Can I Walk Away From a Mortgage?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you’re struggling financially and can’t make payments on your mortgage loan, you may be wondering what to do. If you owe more on your house than what it's worth, it could make sense to quit making payments and walk away from your mortgage, but it's good to keep in mind that there are consequences to walking away from a mortgage. There are also other options available to you for making your mortgage payment more manageable. Read on to learn about what you can do if you're upside down on your mortgage loan.

Written by Lawyer John Coble. Legally reviewed by Jonathan Petts

Updated May 8, 2025

Table of Contents

If you’re struggling financially and can’t make payments on your mortgage loan, you may be wondering what to do. In some cases, it makes sense to quit making payments and walk away from your mortgage. This article will discuss your options for dealing with a mortgage that's "underwater" as well as the consequences and sometimes the benefits of walking away from a mortgage.

What Is An Underwater Mortgage?

A mortgage is underwater if you owe more than the home is worth. "Upside down" is another term used for underwater. To figure out if your mortgage is underwater, you have to figure out what the value of your home is. The first place to look for this is by looking at your local tax assessor's appraisal. In the past, tax assessor appraisals were much lower than the market value for most homes. In recent years, some states have begun to annually reappraise homes to bring these valuations closer to market value. Some websites like Zillow may give you a more accurate estimate of your home’s value. You could also contact a local real estate agent.

The following example shows an easy way to calculate if your mortgage is underwater.

| Underwater Mortgage Example | |

|---|---|

| Your Home Value | $ 150,000.00 |

| Your Mortgage Balance | $ 180,000.00 |

| Underwater Amount | $ (30,000.00) |

Who wants to pay $30,000 more for a property than it's worth? Though this calculation looks simple, the housing market fluctuates a lot, which means your home’s value can change too.

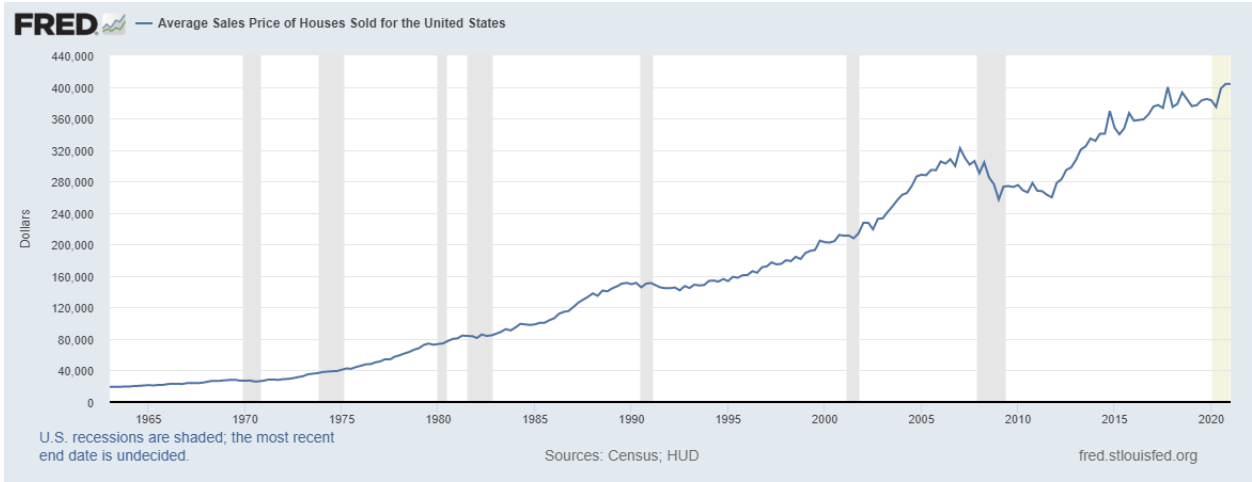

An interactive version of this graph is available on the Federal Reserve Economic Database (FRED).

Just because you’re underwater now doesn’t mean you’ll be underwater in the near future. The graph above shows that in early 2007, when there was a housing bubble, the average sales price for a home in the U.S. was $322,100. That number fell to $257,000 in early 2009 because of the housing crisis. That's a drop of about 20% in 2 years. At the end of 2011, home values had barely changed. But just three years later in 2014, the average home value was up 42% to $369,400.

If the owners of the home in the example above decided to stay in their home in 2011, by 2014 their home value could have increased from $150,000 to $213,000. Even if the principal on the mortgage balance stayed the same, this $63,000 increase in value would take the homeowners from being underwater by $30,000 to having more than $33,000 in equity. In the real world, your principal balance will usually decrease over time as you make payments. That means your equity would be more than $33,000.

Some people like to think of their home as an investment. Yet, this stock market type of analysis only takes you so far when you're talking about your necessary shelter. If you want to get out of your mortgage and the value of your home is greater than your mortgage debt, you're fine. You can sell the house, pay off the mortgage, and buy a new home. But if you're underwater and you want to sell your house, you’ll have an issue. At this point, you'll have to decide if you want to walk away from the mortgage or try to keep paying it.

What Happens When You Walk Away From an Underwater Mortgage?

It's important to understand your state's laws before you decide to walk away from a mortgage. It's usually a good idea to consult with a local attorney before attempting one of these strategic defaults. Don’t take defaulting on your mortgage lightly. If you live in a recourse state and you stop making mortgage payments, the lender will foreclose on your home. If the proceeds from the foreclosure auction aren’t enough to pay off your debt, the mortgage lender may then sue you for the balance. This is called a deficiency lawsuit.

If you live in a non-recourse state, the lender will foreclose on your home but won't be able to sue you for the deficiency. Non-recourse states include the following 12 states: Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North Carolina, North Dakota, Oregon, Texas, Utah, and Washington.

Even in the 38 recourse states, there are laws limiting a mortgage company's right to pursue a deficiency judgment. For example, in Georgia, courts are required to approve the deficiency lawsuit within 30 days of the sale. In Hawaii, deficiency judgments are only allowed if there has been a judicial foreclosure. That means there can be no deficiency lawsuit if there's been a non-judicial foreclosure. Other states, like Arkansas, require the homeowner to receive credit for the foreclosure sale price or the fair market value of the property, whichever is greater. This prevents the homeowner from being liable for a greater deficiency where the home sells for less than fair market value. If you're in a state that has no limitations on deficiency lawsuits, you may still be able to avoid the deficiency if you have a non-recourse mortgage.

What Are the Consequences of Walking Away From a Mortgage?

It doesn't matter if you're in a recourse or non-recourse state, walking away from a mortgage will harm your credit score. Because of the negative impact on your credit report, you'll probably have difficulty getting a mortgage to buy a new home. You may even have a difficult time finding a rental house or apartment.

If you're sued for a deficiency, you could be subjected to post-judgment collections procedures. These include wage garnishments, bank account levies, and other seizures. There are few things worse than getting a much smaller paycheck than expected because your wages have been garnished or finding less money in your bank account due to an account levy.

Even if you have a non-recourse mortgage and your deficiency is forgiven by your lender, there may still be tax consequences. The amount that is forgiven by the lender will be considered taxable income by the IRS. This means, while you may not have to pay the deficiency to the lender, you might have to pay more in taxes.

What Are Other Options if I Don’t Want To Walk Away From the Mortgage?

For most people, there are better options than just walking away from a mortgage. In rare cases, it's a good idea. The example below illustrates a case in which the homeowner probably should walk away from their mortgage.

The homeowner has a home with a $1 million mortgage balance. The home's value has dropped to $600,000, so the homeowner is $400,000 underwater. The homeowner lives in California, a non-recourse state, and has over $1 million in liquid investments. The homeowner also has a second home that they wouldn't mind living in that has no mortgages against it. This homeowner usually pays cash for everything.

In this case, the homeowner can and probably should walk away. The homeowner gets rid of $1 million in debt by giving up the $600,000 property. The homeowner doesn't care about bad credit because they usually use cash and have plenty of it. In 7 years, their credit issue will go anyway. The homeowner has plenty of investments they can quickly turn to cash if they need money. This homeowner doesn't have to worry about a deficiency lawsuit because they live in a non-recourse state.

HUD-Approved Housing Counselors

If you’re feeling overwhelmed with your mortgage payment and are trying to figure out the best next move, contacting a HUD-approved housing counselor is a good place to start. They can explain what options you have to save your home and make your payments more affordable. You can find a HUD-approved housing counselor by using this tool on the Department of Housing and Urban Development's (HUD) website or by calling the HOPE Hotline at (888) 995-HOPE (4673).

Loan Modification

A loan modification is a good solution for some homeowners who are struggling financially. Freddie Mac and Fannie Mae offer modification programs for their conventional loans. Government-backed Federal Housing Administration (FHA) and Veterans Affairs (VA) loans also offer modification options for borrowers.

Freddie Mac and Fannie Mae’s loan modification program can help you reduce your monthly mortgage payments by up to 20%. FHA’s programs help borrowers reduce their mortgage rate and extend the term of their loan. Note that any past-due amount or missed payments will be added to the loan balance. VA borrowers can have the past-due amount added to the loan balance and their loans can be extended. Housing counselors can inform you about many other private programs for homeowners threatened with foreclosure proceedings.

The following example shows how a loan modification could help you.

| Fannie Mae Flex Loan Modification Example | ||

|---|---|---|

| Before Modification | After Modification | |

| Monthly payment | $1,000.00 | |

| Monthly payment after 20% reduction | $800.00 | |

| Arrearage for 3 months behind | $3,000.00 | |

| Arrearage after the modification | $0.00 |

Loan Refinancing

Whereas a loan modification makes favorable changes to an existing loan, a loan refinance replaces an existing loan with a new, more favorable loan. Some existing programs include: Fannie Mae’s High Loan to Value (LTV) Refinance Program, Freddie Mac’s Enhanced Relief Refinance Program, the FHA Streamline Program, the VA’s Interest Rate Reduction Refinance Loan Program (IRRRL), and the United States Department of Agriculture’s (USDA) Streamline Refinance Program. Each of these programs can help you get a new loan at better terms than your old loan.

The following example shows how a mortgage refinance could help you.

| The Effect of a Mortgage Refinance | ||

|---|---|---|

| Before Refinance | After Refinance | |

| Interest Rate | 7.00% | 4.00% |

| Balance Remaining | $300,000.00 | $300,000.00 |

| Years Remaining | 25 | 25 |

| Monthly Payment | $2,120.00 | $1,584.00 |

Foreclosure Alternatives

Even if none of the many programs designed to help people pay their mortgage will help you, you still have better alternatives than just walking away.

You may be able to persuade the lender to allow you to sell the house for less than the loan balance. This is called a short sale. The best short sale agreements allow the lender to take the proceeds of the sale as full satisfaction of the amount you owe. You may have to agree to partial responsibility for the outstanding balance.

A deed in lieu of foreclosure is also an option. This can reduce the foreclosure cost, meaning the lender will try to collect less money from you. In the long run, this is less expensive than just walking away from the mortgage unless you have a non-recourse loan.

Bankruptcy is another option. Chapter 7 bankruptcy, erases any deficiencies since you no longer have the collateral (the home). In a Chapter 13 bankruptcy, you may be able to catch up on the arrearage through a Chapter 13 plan. Upsolve has a free tool that can help you file your Chapter 7 bankruptcy without an attorney if your case is simple and straightforward.

Let’s Summarize…

In non-recourse states, there are some situations when it makes mathematical sense to walk away from your mortgage. Be careful and make sure you understand all the risks to this strategy. It may be a good idea to consult with a local attorney before walking away. Some attorneys offer free consultations or free legal help for low-income individuals.

It would be prudent to consult with a HUD-approved housing counselor and/or local real estate agents before walking away from a mortgage. Because these professionals have a feel for your local real estate market, they'll have a better sense of whether you should walk away from your mortgage. Home values are unpredictable. What’s underwater today could be very valuable in a couple of years.