Consequences of Not Paying Student Loans: Explained

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Federal student loan payments are set to resume in October 2023. If you can’t make your student loan payments your credit score, employment opportunities, and emotional well-being can all be affected. This article explains the consequences you may face if you don’t make your student loan payments and proposes some strategies to deal with student loan debt when you can’t make your monthly payment.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated September 23, 2024

Table of Contents

Many agree there is a student loan debt crisis in this country. Over 40 million Americans have student loan debt. About 15% of federal student loan borrowers were in default, and another 15% had loans in forbearance or deferment, according to the U.S. Department of Education.

Without student loan forgiveness or the protections from the pandemic, many student loan borrowers are left wondering what happens if they can’t make their payments and what their options are. The consequences can worsen over time, so let’s start by looking at what happens from the time you miss your first payment onward.

What Happens if You Don't Make Your Student Loan Payments?

What happens when you miss your student loan payments depends on whether you have federal or private loans.

What Happens if You Don’t Make Your Federal Student Loan Payments?

If you have direct subsidized or unsubsidized loans through the federal government, you get a six-month grace period starting after graduation. You don’t have to make payments on your debt during the grace period. If you have Grad PLUS or Parent PLUS loans, you (or the borrower) don’t get a grace period, but you can defer your loans until six months after graduation.

Once the six-month grace period ends, you must start making payments according to the repayment schedule in your loan agreement. By default, you’ll be put on a Standard Repayment Plan, which has a 10-year term (repayment period) with fixed monthly payments. If you don’t make the payment by the due date, you’ll face consequences.

If your payment is late by even one day... Your loan is considered delinquent. The loan will remain delinquent until you pay the past-due loan balance, plus fees.

If your payment is 30 days late... You’ll have to pay a late fee. The late fee may be up to 6% of your late payment amount. Loan servicers charge late fees on payments more than 30 days past due.

If your payment is 90 or more days late... Your loan servicer will report your late payment to the three major credit bureaus, which can hurt your credit score.

If your payment is 270 days late or more... Your loan is considered to be in default.

What Happens if You Don’t Make Your Private Student Loan Payments?

The timeline for repaying private student loans differs from the timeline for federal student loans. Online lenders, banks, and credit unions fund private student loans and have different repayment terms. Private student loans generally use the following payment timeline:

As soon as you graduate... Payment is usually due, but some private loan lenders offer grace periods.

When your payment is one day late... Your lender marks your account delinquent and may report it to the credit bureaus, which can decrease your credit score.

When your payment is 90 days late... The lender considers you in default and may hire a collections agency or sue you in court to collect the debt.

When your payment is 120 days late or more... Lenders usually send the debt to collection (also called charging off the debt). After charging off the debt, the lender often sells it to a collections agency, which then takes over trying to collect the debt.

Student Loan Default: What Are the Consequences?

When student loan payments start up again for federal student loans, if you don’t pay the required monthly amount, your account goes into delinquent status. If you continue not to pay, it will go into default.

Though this trajectory is the same for all types of federal and private student loans, the timeline varies based on the type of loan you have. So will the tools that the lender uses to collect on the debt and the consequences you can face.

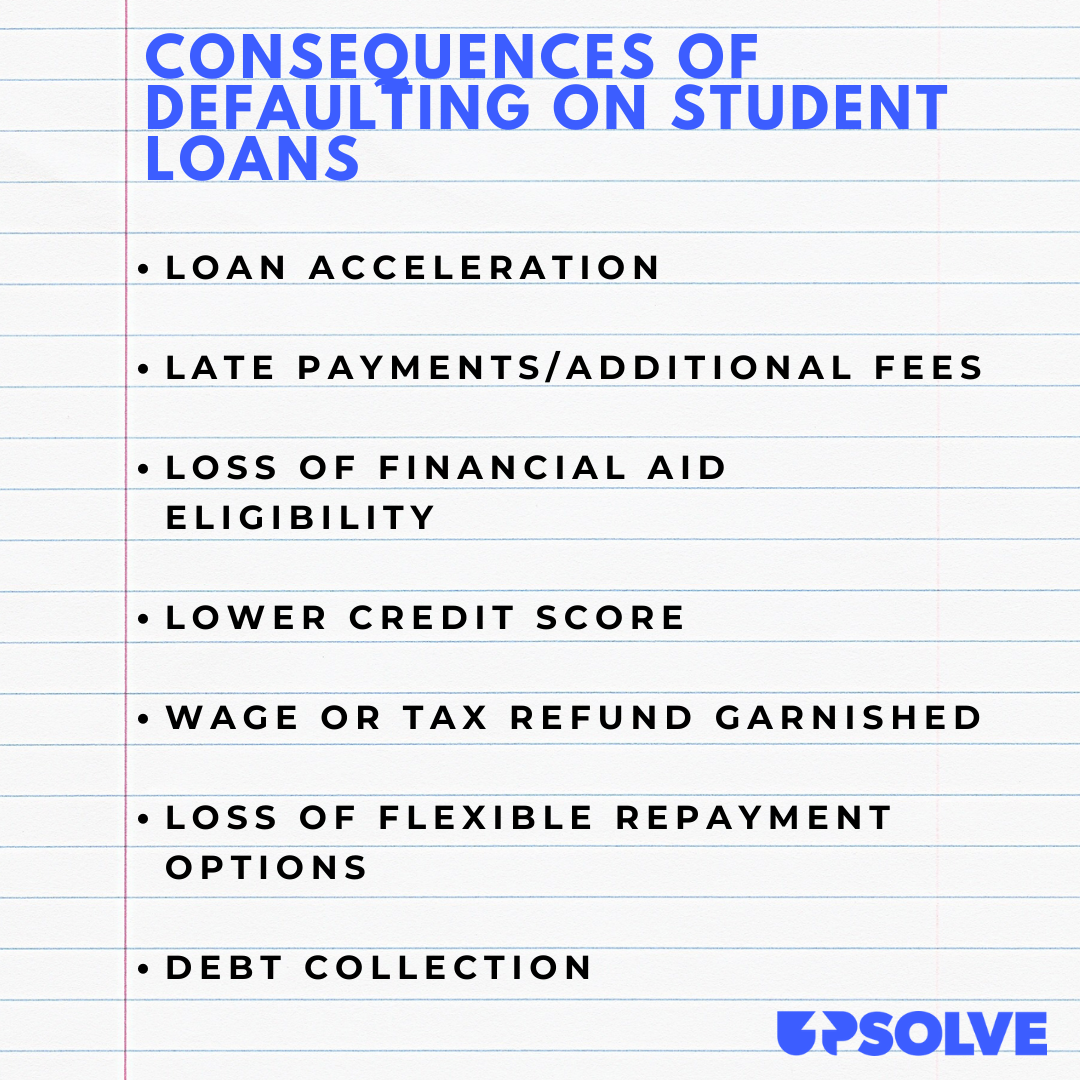

Consequences of Defaulting on Federal Student Loans

Having a federal student loan in default can result in severe consequences. Here’s what could happen:

The lender accelerates your loan: Loan acceleration means the entire outstanding balance of your student loan (not just the missed payments), including accrued interest, becomes due immediately. This can feel particularly frustrating and stressful because you surely can’t pay the entire loan off in one go if you couldn’t make your monthly payment to begin with.

You lose flexibility with repayment options: You can’t apply for federal loan relief programs, such as forbearance, deferment, or income-driven repayment plans.

You lose eligibility for further financial aid and may have your transcript withheld: You’re no longer eligible for more federal student aid, including grants, and your college can withhold your transcripts from you so that you can’t verify your progress or transfer to another school.

Your credit score takes a hit: Once your loan servicer reports your default status to credit agencies, your credit score will drop. This can have financial consequences — making it harder to get loans and being offered higher interest rates. It may a;sp hurt your chances of getting a job or housing.

You can lose wages, tax refunds, or federal benefits: The government can garnish wages from your paycheck or keep your federal tax refund (called a treasury offset) or Social Security payments and apply them to the amount owed.

You may have to deal with collections: The loan servicer may hire a collections agency, which will move aggressively to collect the amount owed. You’ll have to pay collection fees.

You can be sued: The government can sue you in court, and you may have to pay attorney fees and court fees.

Consequences of Defaulting on Private Student Loans

Private student loan lenders can’t use as many of the means to collect on defaulted loans as the federal government. Still, defaulting on private student loans can have very serious consequences, including:

Late fees: Most private lenders charge late fees equalling around 5% of the past-due amount.

Credit reporting: Private lenders will report your default to the credit bureaus, which can seriously harm your credit. This can happen any time after you miss a payment.

Collections: The lender may sell the debt to a collection agency, which will aggressively pursue payment. Your loan agreement may also require you to pay for collection costs, including attorney fees and court costs.

Lawsuits: The private lender can sue you in court. If they win, they may be able to get a court order for your employer to garnish your wages to collect the debt.

What To Do if You Can't Make Your Student Loan Payments

If you can’t afford to pay the payments on your student loan, you need to take action immediately. Ignoring the problem will only make things worse. You may lose options for payment if you wait too long. Once your student loan is in default (at least 270 days late for federal student loans), you may lose some of your options, so be proactive.

Here are the options we’ll cover below:

Contact your loan servicer to discuss your options.

Consider switching to an income-driven repayment plan.

Apply for deferment or forbearance.

Consider consolidating your student loans.

See if you qualify for any student loan forgiveness programs.

Refinance your loans (if you have private student loans).

Contact Your Student Loan Servicer Immediately

As soon as you think you can’t make a payment, contact your loan servicer to discuss your repayment options. Lenders only make money if you pay them, and most lenders lose money if the debt ends up in collections. This means lenders usually want to work with you on your student loan repayment. Tell your lender about your financial situation and see if you can work out an arrangement for repayment.

Sign Up for an Income-Driven Repayment Plan

Federal student loan borrowers are automatically assigned to the Standard Repayment Plan unless they choose a different plan. The Standard Repayment Plan has the shortest repayment period: just 10 years. While this means it’s the fastest way to repay student loan debt, it also has the highest monthly payment.

If you’re enrolled in a standard plan, consider switching to an income-driven repayment (IDR) plan such as:

Pay As You Earn (PAYE): This plan allows borrowers to pay 10% of their discretionary income for 20 years.

Income-Based Repayment (IBR) Plan: This plan allows borrowers to pay 10% of their discretionary income for 20 years if they’re a new borrower (took out Direct Loans on or after July 1, 2014). They pay 15% of their discretionary income for 25 years if they’re not a new borrower.

Income-Contingent Repayment (ICR) Plan: This plan allows borrowers to pay 20% of their discretionary income for 25 years, or they can pay on a 12-year repayment plan adjusted to their income.

Saving on a Valuable Education (SAVE) Plan: This plan allows borrowers to pay 5% (for undergraduate loans) or 10% (for graduate loans) of their discretionary income for 10 years (for low balance borrowers), 20 years (for undergraduate loans), or 25 years (for graduate loans).

Formerly the Repay As You Earn (REPAYE) Plan

Most federal student loan borrowers are eligible for these plans. Monthly payments for these plans are often much less than payments under the Standard Repayment Plan.

When you have paid the maximum number of payments over the repayment period for income-driven plans (either 20 or 25 years), the federal government is meant to forgive the rest of your outstanding debt.

Apply for Loan Deferment or Forbearance

If you’re facing financial hardship, you can apply for a deferment or forbearance on your federal student loan. Either option allows you to temporarily postpone your loan payments.

What’s the difference?

Deferment: During the deferment period, you don’t have to make payments on the loan principal, and interest doesn’t accrue.

Forbearance: With forbearance, you can either stop or reduce your payments for a set period, but interest does accrue, and you’ll eventually have to repay it.

Remember, if your loan is already in default, you’re probably not going to be eligible for deferment or forbearance. In that case, look into loan rehabilitation to access more options.

Get a Direct Consolidation Loan

Even if your federal student loan is in default, you can apply for a direct consolidation loan (DCL). With a DCL, you either agree to repay the consolidation loan under an IDR plan or you must make three consecutive, on-time monthly payments in full before the debt is officially consolidated.

Once consolidated, the loan is no longer in default and you become eligible for other federal loan benefits and protections, such as deferment, forbearance, and loan forgiveness.

Consolidation doesn’t remove the default notice from your credit report. Also, you can only get a Direct Consolidation loan if you have a federal student loan. Private student loans can’t be consolidated this way. However, you can look into refinancing or consolidating your loans through your loan servicer.

Apply for Federal Student Loan Rehabilitation

If your federal student loan is in default, you can also agree in writing to make nine monthly payments (as determined by the loan servicer) within 20 days of their due date. This is known as student loan rehabilitation.

You must make all nine payments within 10 months. Once you make all nine payments, your loans are no longer in default, and the default will be removed from your credit report. However, the late payments that led to the default will stay on your credit report.

Look Into Student Loan Forgiveness Programs

Student loan forgiveness programs usually require you to make loan payments for a specific period before the remaining loan amount is forgiven.

Many of these programs are for people in specific career fields. For example, the Public Service Loan Forgiveness Program is for those employed in public service jobs (either for a government agency or a nonprofit organization). Participants may be eligible for federal debt forgiveness after 10 years on the job and making 10 years of student loan payments.

Consider Refinancing Your Student Loans

You may be able to refinance your student loans. You need to do this before your loans are in default. Once your loans are in default, a lender probably won’t approve you for a refinanced loan.

Refinancing is available for both federal and private student loans, but if you refinance your federal loans, they become private student loans because you’ll refinance through a private lender. After refinancing a federal loan, you won’t be eligible for income-driven repayment plans or for other federal benefits like deferment or forbearance.

What To Do if You Can't Make Your Private Student Loan Payments

You can generally use the strategies discussed above for federal student loans only. Private student loans have their own programs and requirements. Some private lenders may have programs for deferment or forbearance, but few offer programs that correspond to IDR plans. Private loans also don’t have loan forgiveness programs.

As soon as you think you aren’t going to be able to make your payments, contact your loan servicer to find out what options are available.

Tried Everything But Still Can’t Make Your Student Loan Payments?

If you’re saying to yourself: "I’ve already tried all this, but I’m still struggling!" You may have one other option you haven’t considered: filing bankruptcy to erase your student loan debt for good.

You may have heard this isn’t possible, but it can be done! In fact, changes from the federal government (the Department of Justice and Department of Education) in late 2022 make discharging student loans in bankruptcy easier for borrowers who have federal Direct or Direct Consolidation loans.

You can read more about how this works in our article: Yes, You Can File Bankruptcy on Student Loans. Here’s How. If you want to see if you’re eligible for free help from Upsolve discharging your student loans in bankruptcy, use our free screener now.