Your Guide to Michigan’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

Michigan residents are protected by two state laws that regulate debt collection activities. One law applies to third-party debt collection agencies and the other applies to original creditors. Both laws mirror the federal Fair Debt Collection Practices Act (FDCPA), which prohibits harassment, deception, misrepresentation, and abuse in the debt collection process.

The statute of limitations for credit card and medical debt in Michigan is six years.

Written by Upsolve Team.

Updated September 16, 2025

Table of Contents

What Are the Debt Collection Laws in Michigan?

Michigan’s debt collection laws don’t have fancy names or acronyms, but they provide important protections. These laws can be found in Section 339.915 and 445.251 of the Michigan Occupational Code.

Section 339.915 regulates third-party debt collectors, and Section 445.251 regulates original creditors.

According to Michigan law, third-party debt collectors and original creditors trying to collect a debt can’t:

Mislead or deceive people to collect a debt

Make or use forms that mimic official legal forms

Misrepresent your rights

Tell you that you’ll be arrested or go to jail for not paying a debt

Tell your employer about your debt

Use or threaten to use violence against you

Use profane language or harass you

Under state law, third-party collection agencies must also be licensed with the state.

As you’ll see, these laws are similar to the federal Fair Debt Collection Practices Act (FDCPA).

How Does the FDCPA Protect Michigan Residents?

The FDCPA is an important federal law that regulates third-party debt collection practices. This is nicely supplemented by Michigan’s state laws, which also apply to original creditors.

Here’s an overview of the FDCPA:

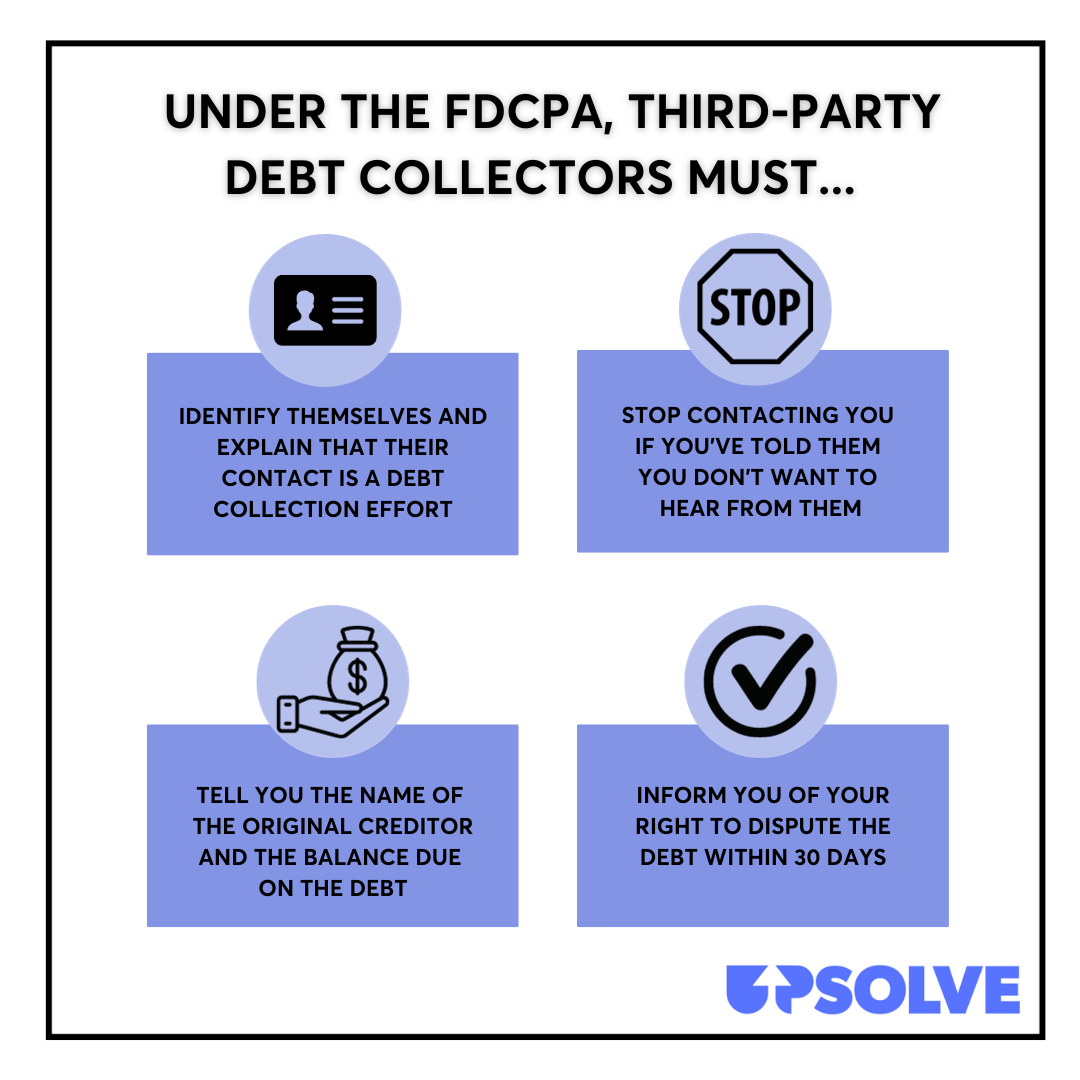

Here’s what the FDCPA requires debt collectors to do:

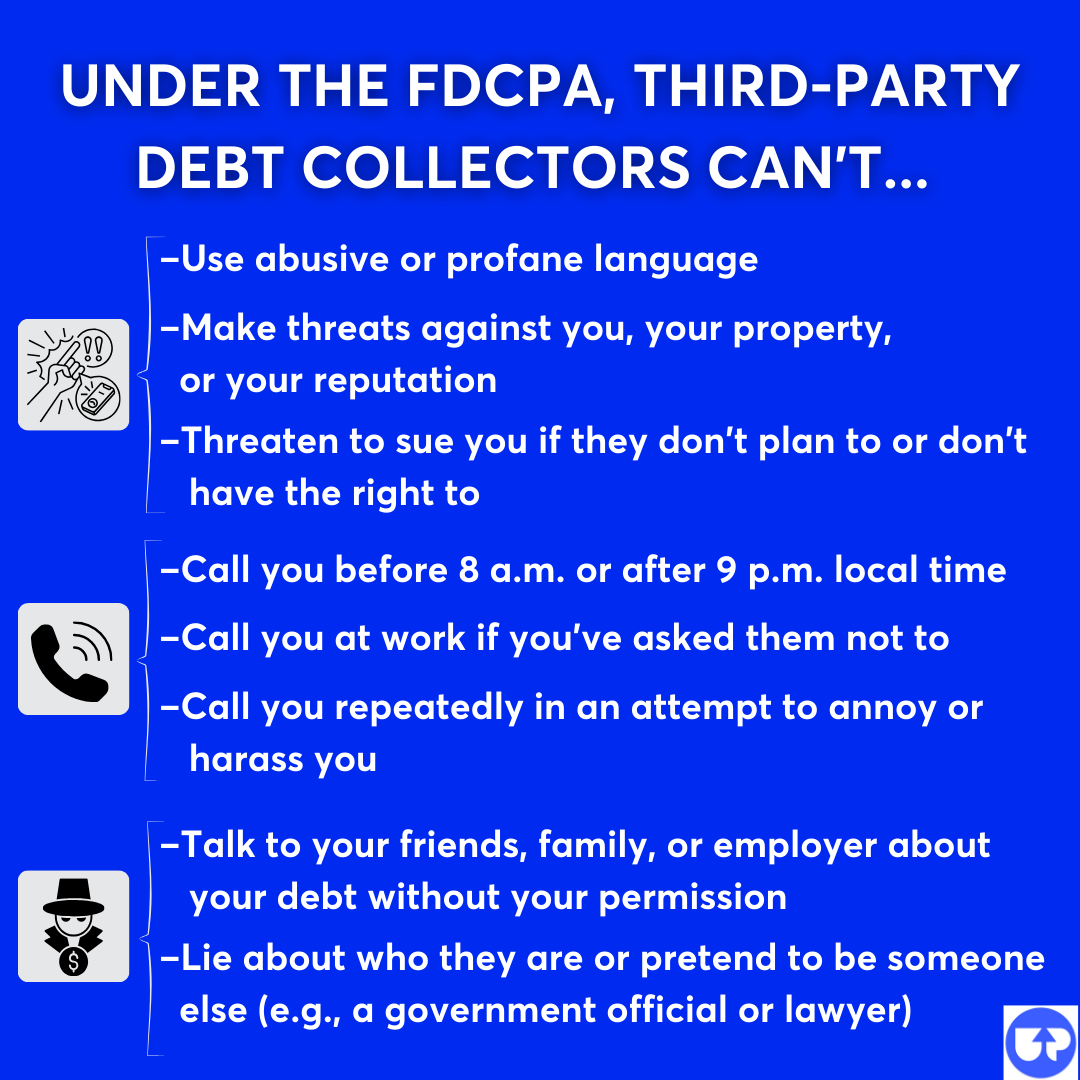

Here’s what debt collectors can’t do under the FDCPA:

If you want to learn more about this federal law, you can read Upsolve’s Guide to the FDCPA.

What Can You Do if a Debt Collector Breaks the Law in Michigan?

If a debt collector breaks any of Michigan’s laws when trying to collect a debt from you, you can file a complaint or sue them.

File a Complaint

You can report bad debt collection behavior to the Michigan Attorney General’s office using the Consumer Complaint Form. If you’re dealing with a third-party debt collector who won’t give you their license number or doesn’t have one, you can file a complaint with the Bureau of Professional Licensing.

Because you’re also protected by the FDCPA, you can file a complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB is the main federal agency that oversees the FDCPA and investigates consumer complaints against debt collection agencies.

File a Lawsuit Against the Debt Collector

If a debt collector has broken the law, you can sue them for damages. Damages is a legal term that means compensation. You can sue a debt collector in a local or state court for breaking state laws.

If you win, you may be awarded actual damages (money you lost as a result of the debt collector’s behavior) or $50, whichever is greater. If there’s proof that the violation was willful, you may be eligible for three times your actual damages or $150, whichever is greater. Your attorney fees and court costs are also usually covered if you win the court case.

You can also bring a lawsuit in federal court against third-party debt collectors who violate the FDCPA. If you win the case, the judge may award you actual damages and up to $1,000 in statutory damages (plus attorney and court fees).

Upsolve Member Experiences

4,642+ Members OnlineWhat Is the Statute of Limitations for Debt Collection in Michigan?

In Michigan, the statute of limitations for most consumer debts is six years. This includes credit card debt, medical debt, and debt backed by an oral or written contract.

The statute of limitations is a state law that ensures that you can’t be sued for an old debt forever. It puts a limit on the time a debt collector has to bring a lawsuit against you.

If you are sued for a debt that you believe is beyond the statute of limitations, you may be able to use this as a defense in the lawsuit. But be aware that this can get tricky. Some actions — such as making a partial debt payment — may restart the clock on the statute of limitations.

If you’re contacted by a debt collector out of the blue about an old debt, be careful what you say to them. Ask them to validate the debt before you give any information. Read What Is the Statute of Limitations for Debt? to learn more.

What Can Debt Collectors Do To Collect Debt in Michigan?

There are limits to what a debt collector can legally do to try to get you to pay a debt. Despite these limitations, they still have a lot of options.

Contact You or Repossess Your Car

If you’re past due on a credit card or medical bill payment, you’ll probably get debt collection phone calls and notices in the mail or online. If you’re behind on a car payment, you’ll probably hear from the lender first, but you’ll also be at risk of having your car repossessed. Lenders and debt collectors do not need a court order to repossess your car if you’ve defaulted on the auto loan.

Sue You in Court

Debt collectors commonly take people to court to try to get a wage garnishment order. This allows them to take money directly from your paycheck. However, Michigan law limits how much they can take. If you aren’t working, they may try to get a court order for a bank levy or property lien.

You may think you’re powerless to fight a debt collector in court, but that’s not true. You can fight a debt collection lawsuit on your own, without a lawyer. When a debt collector brings a case against you, they are responsible for proving that you actually owe the debt and that they are allowed to collect it from you. But if you don’t contest the case, you’ll probably lose by default.

That’s why the most important thing you can do is respond to the lawsuit if you get sued. Responding is as simple as filing some paperwork with the court. There’s even a free online tool you can use to help you generate your forms.

📌 If you want help responding, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Need Help With Debt Relief? Here Are Some Options

A quarter of all Michigan residents have a debt in collections. This isn’t surprising given that consumer debt like credit card debt has been on the rise in 2023. Unfortunately, it’s all too easy for the average person to get behind on bills, and this causes a lot of stress. But don’t lose hope. There is always a path forward.

If you aren’t sure about the best way to deal with your debt or get your finances in order, consider getting free guidance from an accredited credit counselor. They can help you understand your debt relief options and may recommend a debt management plan, debt consolidation, or bankruptcy.

Upsolve has helped 300,000 people discharge over $700 million in debt through Chapter 7 bankruptcy. We’re a nonprofit organization, and our help is always free. See if you’re eligible to use our free filing tool for your case.