How To Answer a Wisconsin Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you get a summons and complaint notifying you of a debt collection lawsuit against you in Wisconsin, your case will be heard in small claims court if it’s for $10,000 or less. If you want to dispute the claims against you, you need to respond to the lawsuit. In some counties, this means filing a written answer using a court-provided form. In other counties, it means showing up at a court hearing. Even if you aren’t required to file a written answer, reading this article can help you understand how to read court paperwork and prepare to present your side of the story.

Written by Upsolve Team.

Updated April 24, 2025

Table of Contents

- How Do Debt Collection Lawsuits in Wisconsin Work?

- How Do You Respond to a Wisconsin Court Summons for Debt Collection?

- Cheat Sheet for Answer Requirements in Wisconsin’s 6 Largest Counties

- How Do You Fill Out an Answer Form?

- What Happens After You Respond to the Lawsuit?

- What Happens if You Don’t Respond to the Lawsuit?

- Need Legal Help?

How Do Debt Collection Lawsuits in Wisconsin Work?

Debt collection lawsuits are usually a creditor’s or debt collector’s last attempt to collect on a debt they believe you owe. You don’t usually get sued right after missing a payment. It often comes months after other collection efforts like phone calls and written notices have failed.

If you get sued for a debt in Wisconsin, you’ll get a summons and complaint. Most debt collection lawsuits are filed in the small claims division of a Wisconsin Circuit Court. These courts hear cases that are for $10,000 or less. This article focuses on the process for small claims debt lawsuits in Wisconsin. If you’re sued for more than $10,000, your case will be part of the regular docket in a circuit court, and the rules may be different.

What Is a Summons and Complaint?

A court summons is an official document that notifies you that you’re being sued and who is suing you. In Wisconsin, the summons also tells you what you need to do to dispute the lawsuit.

A complaint is an official court document that tells you why you’re being sued and what you’re being sued for.

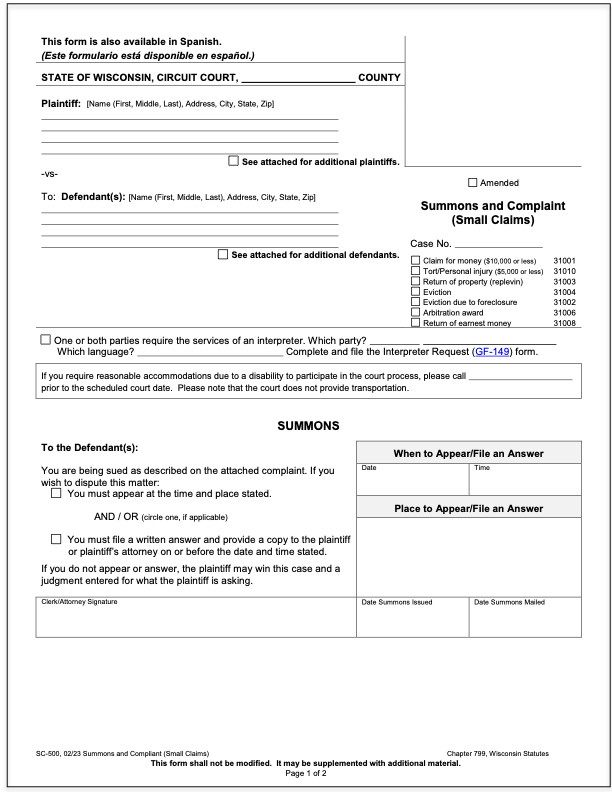

In Wisconsin, the small claims court provides an official summons and complaint document. This is a two-page document. The first page is the summons, and the second page is the complaint.

How Do You Read a Wisconsin Small Claims Summons?

Here’s what the summons looks like:

The summons tells you:

The court’s name — the court will usually be in the county you live in

The plaintiff’s name — the plaintiff is the debt collector who is suing you

The defendant’s name — the person being sued (you)

What to do to dispute the lawsuit — pay special attention to this!

When (the deadline) and where to appear for the hearing or file your answer

⚠️ The process to dispute the lawsuit varies by county in Wisconsin, so it’s important to read the section on this carefully and comply with it. If you don’t, you will lose the lawsuit and the plaintiff will get whatever they’ve asked for in the complaint. ⚠️

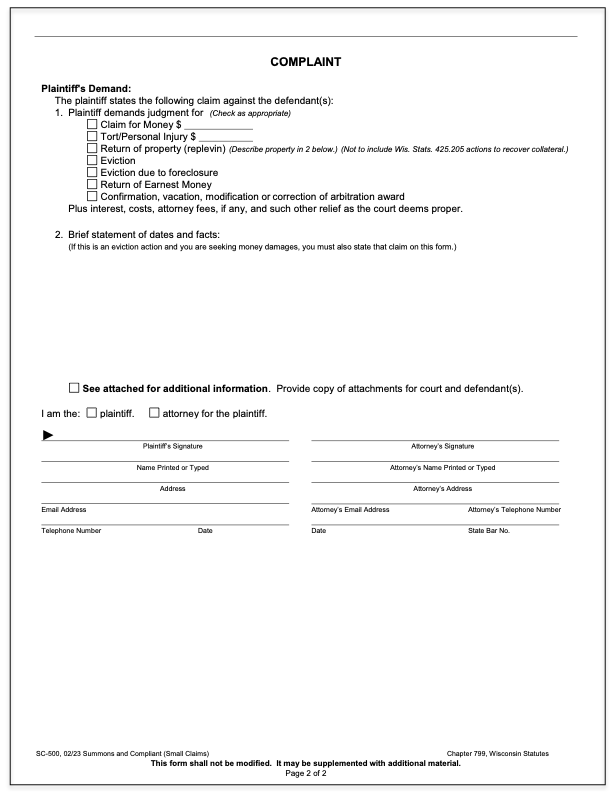

How Do You Read a Wisconsin Small Claims Complaint?

When you get the summons, you’ll also get the complaint on the second page.

This is what the official small claims complaint form looks like in Wisconsin:

The complaint tells you:

The plaintiff’s demand

A statement of dates and facts

The plaintiff’s (and their lawyer’s) name and contact information

The plaintiff’s demand is what the person who’s suing you is hoping to get if they win the case. In debt collection cases, the first box “Claim for money” will be checked and the debt collector will write in the amount they believe you owe.

The next section will tell you why the plaintiff believes you owe this money. In addition to writing out dates and facts, the plaintiff or their lawyer may also include other documents with the complaint to help prove these facts to you and the court.

The final section will come in handy if you need to file a written answer form with the court and deliver a copy to the plaintiff. If this is required in the county you’re sued in, you usually need to deliver your answer in person or via mail, so you’ll need the plaintiff’s address.

If you don’t recognize the name of the company suing you, your debt was probably sold to a third-party collector or debt buyer. In this case, you’ll want to make sure they provide evidence that they own and can legally collect the debt from you. If this information isn’t included with the complaint, you may be able to use this as a defense later in the case.

How Do You Respond to a Wisconsin Court Summons for Debt Collection?

The process to respond to a court summons for small claims debt collection cases varies by county in Wisconsin. In most counties, you’ll either be required to file an answer form with the court and serve (deliver) a copy on the plaintiff or simply show up to the court on the date listed on the summons.

It’s crucial to understand and follow the court process in the county you’re sued in. If you don’t, you can lose the court case and put yourself at risk of wage garnishment. The summons itself should tell you what to do to dispute the lawsuit.

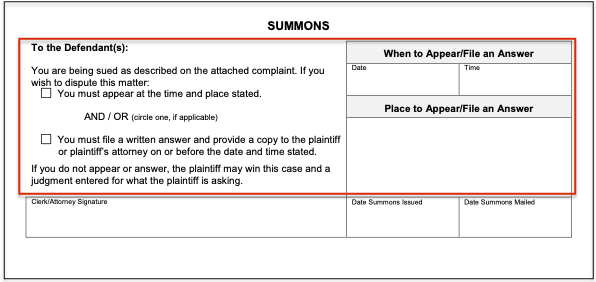

Look at this portion of the form:

If you want more information, you can find your local court’s rules by searching the Wisconsin Circuit Court Rules page. Once you pull up your county, you can use the find shortcut (CTRL+ F on a PC or Command + F on a Mac) to search “small claims.” From there, look for information about how to answer the lawsuit.

You can also contact the county court clerk and ask them questions to clarify any court processes. The clerk can’t give you legal advice, but they’re very knowledgeable about court requirements and rules. Find your court clerk using the court’s directory.

Upsolve Member Experiences

4,312+ Members OnlineCheat Sheet for Answer Requirements in Wisconsin’s 6 Largest Counties

There are 72 counties in Wisconsin, and each has similar but slightly different rules for answering (responding to) small claims debt lawsuits. Here’s a quick cheat sheet for the small claims requirements in Wisconsin’s six most populous counties:

| County | Local Rule for Responding to Small Claims Lawsuit |

|---|---|

| Milwaukee County | 👥 If you reside in Milwaukee County, you must answer by appearing in person at the court on the date on the summons. 👥📝 If you reside outside the county, you can appear in person or file and serve a written answer. |

| Dane County | 📝 You may file a written answer (and serve the plaintiff) on or before the return date listed on the summons. If you file a written answer, you don’t have to appear in person on the return date. |

| Waukesha County | 📝 You must file and serve a written answer on the plaintiff. |

| Brown County | 👥You must appear in person at the courthouse on the date listed on the summons to contest the lawsuit. |

| Racine County | 👥📝 You have the choice to file and serve a written answer prior to the deadline on the summons or show up at the courthouse on the date on the summons. |

| Rock County | 👥📝 You have the choice to file and serve a written answer prior to the deadline on the summons or show up at the courthouse on the date on the summons. |

If you have the choice to write an answer or just show up to the hearing, it’s generally advisable to file a written answer. This allows you the chance to gather your thoughts, research your defenses, and write a compelling version of your story. This can also show the plaintiff suing you that you’re taking full advantage of your legal rights and intend to fight the lawsuit.

How Do You Fill Out an Answer Form?

If you’re required or allowed to provide a written answer, you should. This is your opportunity to respond to the claims in the complaint. Wisconsin court provides a blank answer form you can download and use to write up your answer. It also has space to include a counterclaim if you want to file one.

The form is two pages long. Along the left side of the form are court-provided instructions.

Here’s what the first page of the answer form looks like:

Step 1: Address Each Complaint/Allegation

If you don’t agree with the claim(s) against you (as listed in the complaint), place a checkmark next to “2. This matter IS contested” on the answer form.

Then, you have space to explain your reasons or defenses. If you say that the claim(s) against you is untruthful and that’s why you deny it, that’s a general defense. You can also raise affirmative defenses here and in court.

Step 2: Raise Your Defenses and Counterclaims

A general defense says, “The plaintiff’s claim is untrue.” An affirmative defense says, “The plaintiff shouldn’t win the case regardless of whether their claims are true.” Affirmative defenses can be useful if you have information the plaintiff didn’t present in their complaint.

Here are some of the most common affirmative defenses defendants use in debt collection lawsuits:

The debt is too old to collect because it’s past the statute of limitations. In Wisconsin, collectors for credit card bills and medical debts must bring a lawsuit within six years of you defaulting on the account.

The debt collector didn’t follow the law when trying to collect the debt. If the debt collector violated the Wisconsin Consumer Act or the Fair Debt Collection Practices Act, you can raise this as a defense in your case.

The summons and complaint weren’t properly served. Again, you’ll need to reference the small claims court rules for your county to see what the service requirements are.

You don’t owe the debt because you were a victim of identity theft or fraud.

You already paid off the debt.

To learn more, you can read Upsolve’s article How Do You Answer a Summons for Debt Without an Attorney?

If you want to bring a counterclaim against the person suing you, you must do so on the second page of the answer form. Bringing a counterclaim can get complicated because you’ll need to prove that the claim is true. (By contrast, in the lawsuit against you, the plaintiff is responsible for proving their claims are true.) This can be difficult without legal knowledge, so it’s a good idea to consult with a lawyer.

Step 3: Sign and Certify the Answer Form

If your county’s court requires you to file a written answer with the court, you’ll also need to deliver a copy to the plaintiff. In any legal matter, when you submit paperwork or information to the court that’s related to the case, you also have to give the opposing party a copy. This ensures everyone is operating with the same information.

When you sign the answer form, you are certifying that you have sent (or will soon send) a copy of the form (and any form attachments) to the plaintiff at the address listed on the complaint form.

Step 4: Serve a Copy of the Answer on the Plaintiff

In legal terms, serving a copy of a form means you deliver it according to the court’s rule. In Wisconsin, this usually means sending the form to the plaintiff at the address listed on the complaint. If they have a lawyer representing them (this is common), you’ll send a copy of your answer forms to the lawyer. It’s wise to send this via certified mail so you can show the court proof that you sent it on time.

Before you send off any forms, make at least two copies! You’ll need one for yourself, the court, and the plaintiff.

You usually have to send a copy of the answer form (and file it with the court) by the deadline listed in the summons.

Be sure to check your local court’s service requirements and follow them. Again, if any part of this is confusing, contact the court clerk to get clarification on that court’s rules.

Note: Steps 4 and 5 can be done in any order so long as you meet the court’s deadline set out in the summons.

Step 5: File Your Forms With the Court Clerk by the Date Listed on the Summons

If you’re required to file a written answer, you’ll do so at the courthouse by the date listed on the summons. You can almost always file your forms in person, but some counties may also allow you to mail the forms to the court or file electronically. Again, you need to check your local court’s rules or contact the court clerk to find out.

What Happens After You Respond to the Lawsuit?

If you’re required to file a written answer, you’ll likely receive a court notice about what happens next. This could be a scheduled hearing (trial) or mediation. If a mediation session is scheduled, you’ll have the opportunity to try to resolve the situation with the debt collector (or their attorney) before you go to trial. Mediation is facilitated by a neutral third party.

If you aren’t required to file a written answer prior to showing up at the courthouse on the date listed on the summons, your first appearance in court probably won’t be a formal trial. This first appearance is your opportunity to tell the judge that you disagree with the plaintiff’s claims and you want to dispute them. The judge will tell you what happens from here. Likely, they will schedule a mediation or trial.

How To Prepare for Court Appearances

The Wisconsin court system provides helpful information about how to prepare for court appearances.

Here are a few of the top tips:

Dress professionally in neat and clean attire and be well groomed.

Always address the judge as “Your Honor.”

Be respectful and speak respectfully to everyone in court, including the staff, judge, and the plaintiff.

Speak when it’s your turn to speak. Don’t argue or interrupt others when they’re speaking.

Be early! Make sure you arrive early enough to park and find the room you’re supposed to be in at the court.

To sum it up, “Always remember the four Ps: Professionalism - Punctuality - Politeness - Preparation.”

What Happens if You Don’t Respond to the Lawsuit?

If you’re served with a summons and complaint and you don’t respond to the lawsuit by the deadline listed in the summons (or you don’t show up for scheduled hearings later in the process), you will likely lose the lawsuit by default. If this happens, the judge will issue a default judgment, which gives the debt collector access to tools like wage garnishment or a bank account levy.

Part of the reason debt collectors sue is that they want an easy win. They have legal representation and know that most people are intimidated or scared when they receive legal papers. Further, if you’re being sued for debt, you probably don’t have the money to hire a lawyer. Luckily, you don’t have to hire a lawyer to fight the lawsuit against you. You may even be able to win it on your own. It just takes some confidence, knowledge, and willingness. Reading this article is a great start!

If the court has already issued a default judgment against you, you may be able to file a motion to vacate (cancel) it, but this can get complicated. To learn more, read How Do You Cancel (Vacate) a Court Judgment?

Need Legal Help?

The Wisconsin State Law Library has a directory of legal aid organizations by county. You can use this directory to find free or low-cost legal services in your community.

The State Bar of Wisconsin’s Lawyer Referral and Information Service is a low-cost ($20–$30) public service that helps consumers deal with legal problems. You may be referred to an attorney or another organization that can help you with your legal matter.

The Wisconsin State Law Library also has helpful information on learning when you need to hire a lawyer and when you can represent yourself in court.