Your Guide to Wisconsin’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

The Wisconsin Consumer Act (WCA) is a state law designed to protect consumers from unfair and deceptive business practices. Its primary purpose is to promote fairness and transparency in consumer transactions and ensure that consumers are not taken advantage of by unscrupulous businesses. Wisconsinites are also protected by the federal Fair Debt Collection Practices Act (FDCPA).

Written by Upsolve Team.

Updated May 22, 2025

Table of Contents

What Are the Debt Collection Laws in Wisconsin?

In Wisconsin, two main laws govern debt collection practices and protect consumers:

The Wisconsin Consumer Act (WCA)

The federal Fair Debt Collection Practices Act (FDCPA)

Some of the WCA’s rules are similar to the FDCPA’s, but in some important ways, it provides further protections.

How Does the Wisconsin Consumer Act (WCA) Protect Consumers in Wisconsin?

The WCA’s purpose is to protect consumers from unfair and deceptive business practices and to promote fairness and transparency in consumer transactions and debt collection practices.

The WCA applies to original creditors and third-party debt collectors (except for healthcare billing companies). This is a broader protection than the FDCPA, which only applies to third-party debt collectors.

Under the WCA (427.104), debt collectors and creditors can’t:

Threaten violence, criminal prosecution, or disclosure of false information intended to harm your reputation

Harass you by calling too frequently or at odd hours

Disclose information about a debt you’ve disputed without including notice that the debt is in dispute

Take part in any behavior that threatens or harasses you or anyone related to you, including using obscene language

Make or use documents that look like official government or court documents by aren’t

How Does the Fair Debt Collection Practices (FDCPA) Act Protect Consumers in Wisconsin?

The FDCPA mirrors many of the provisions in the WCA relating to debt collector harassment, deception, and unfair practices. But the FDCPA only applies to third-party debt collectors, not original creditors.

Here’s an overview of the law:

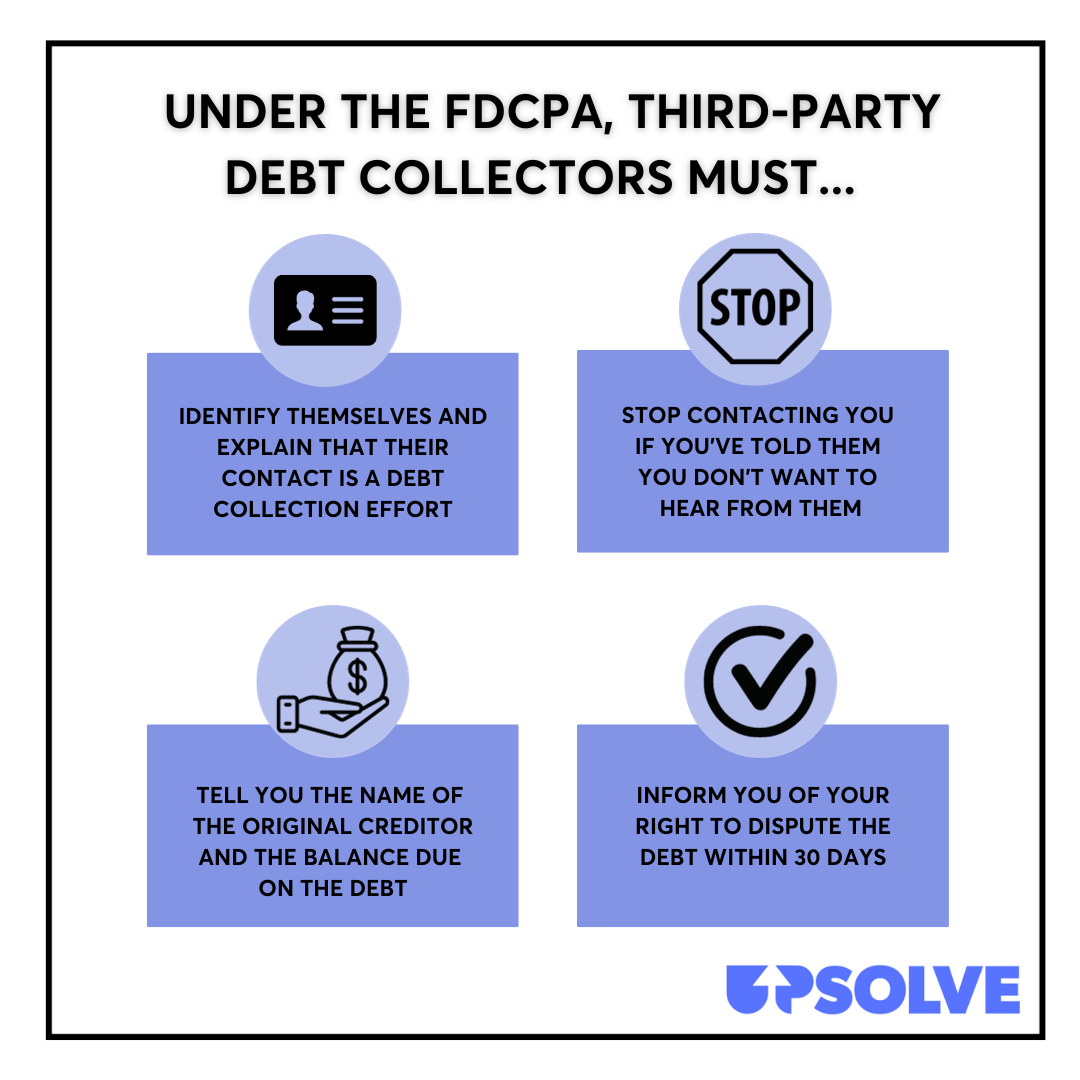

Here are the requirements debt collectors must comply with:

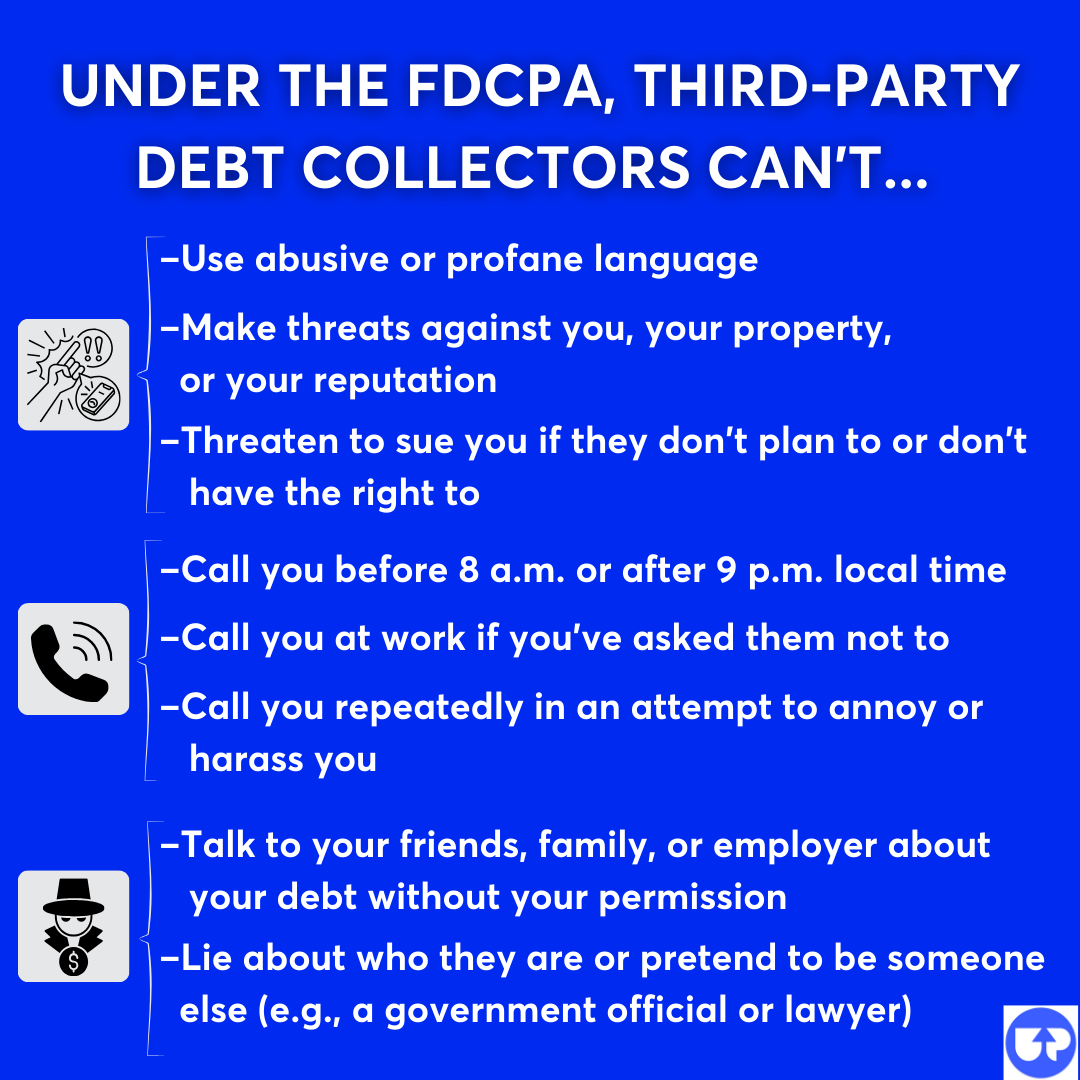

Here’s what debt collectors are prohibited from doing:

To learn more, read Upsolve’s Guide to the FDCPA.

What Can You Do if a Debt Collector Breaks the Law in Wisconsin?

If someone violates either of the laws mentioned above, you can report them or, in some cases, file a lawsuit against them.

Report the Debt Collector by Filing a Complaint

If a debt collector or creditor violates the Wisconsin Consumer Act, you can file a complaint with the Wisconsin Department of Financial Institutions. Some local governments have consumer protection agencies that may also accept complaints. For example, if you live in Adams County, you can file a complaint with the Office of Consumer Protection.

If the debt collector violates the FDCPA, you can also file a complaint with the Consumer Financial Protection Bureau (CFPB). This is a federal agency that helps enforce the FDCPA and impose penalties on violators.

Sue the Debt Collector in Court for Damages

If the debt collector violates the WCA, you can file a lawsuit in state court for damages. Damages are financial compensation for losses or harms you suffered. The amount you can recover depends on whether you sue the original creditor (under 425.301) or a debt collector (under 427.105). To be awarded damages, you’ll have to show the court that the creditor’s or debt collector’s violation was deliberate (not accidental).

If a third-party debt collector violates the FDCPA, you can sue them in federal court for actual damages, plus statutory damages of up to $1,000. To learn more, read Upsolve’s article: Yes, You Can Sue Debt Collectors Who Break the Law.

Upsolve Member Experiences

3,877+ Members OnlineWhat Is the Statute of Limitations for Debt Collection in Wisconsin?

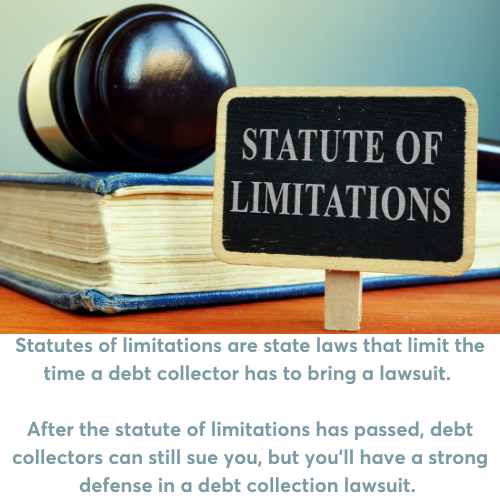

The statute of limitations for credit cards and medical debt — the two most common types of consumer debt — is six years in Wisconsin. The statute of limitations is a state law that puts a time limit on how long a debt collector or creditor can sue you in court for an outstanding debt.

It’s important to note that if you make a payment toward a debt, the timeline can restart. If you’re contacted about a debt that's several years old, be careful about what you say or do. To learn more, read What To Do if You’re Contacted About a Time-Barred Debt.

What Can Debt Collectors Do To Collect Debt in Wisconsin?

If you fall behind on a credit card, medical bill, or other debt payment, your account may fall into default. At this point, you’re likely to get debt collection phone calls and letters. Your debt may be sold to a third-party debt collector or collection agency. Eventually, often after several months, if you don’t pay, you may be sued for the debt.

The number of debt collection lawsuits filed has risen considerably in recent years. This is due, in part, to the tactics debt collectors can use if they win the court case. Having a court order allows for wage garnishment, a bank account levy, or a property lien.

Of these three, wage garnishment orders are the most common. Though this allows the debt collector or creditor to take money from your paycheck, the amount they can take is limited by Wisconsin law.

Note that if you default on an auto loan, you’re at risk of repossession. Creditors do not have to get a court order to repossess your car in Wisconsin.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Need Help With Debt Relief? Here Are Some Options

Consumer debt — especially credit card debt — has been on the rise over the last year. If you’re struggling to keep up with your bills, you aren’t alone. While this can feel incredibly stressful, you can take control of your situation by exploring your debt relief options.

Some popular debt relief options include:

Debt management plans

Debt consolidation

Debt settlement

Bankruptcy

How do you know which option is right for you? One easy way is to schedule a free appointment with a nonprofit credit counselor. These professionals are trained to look at your debt, finances, and goals, and help you come up with a plan to deal with your debt.

If you decide you want to get a fresh start by filing Chapter 7 bankruptcy, Upsolve can help. See if you’re eligible to use our free filing tool. Upsolve is a nonprofit that’s helped 300,000 people erase almost $700 million in debt since we started in 2016. And it’s 100% free.