Should I File For Bankruptcy or Try Debt Relief?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

When you’re trying to figure out the best debt relief option, first consider how much debt you have, whether you want to call in outside help or support, how quickly you’re hoping to repay the debt, and how important your credit score is to you right now. You have several debt-relief strategies available to you, and each has its pros and cons.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated October 13, 2025

Table of Contents

Bankruptcy vs. Debt Relief: What’s the Difference?

Debt relief is a broad term that includes a lot of different strategies, such as:

Budgeting and DIY payoff strategies like the debt snowball method or debt avalanche method

Debt consolidation or refinancing

Debt management plans

Debt settlement

Personal bankruptcy (usually Chapter 7 or Chapter 13)

As you can see, bankruptcy is itself a debt relief option. Many people think of bankruptcy as a last resort or the most extreme debt relief option, but bankruptcy is a powerful legal process created to give people in crippling debt a financial fresh start. That being said, it’s not the right solution for everyone. Let’s take a closer look at your debt relief options.

Where Are You on the Debt Relief Continuum?

It can be helpful to think of the debt relief options listed above as a set of tools, each designed for a different level of financial challenges.

Here’s how you can figure out which tool might be best for you: If you don't have a lot of debt and/or you have some disposable income, you might start with self-help methods. Budgeting and DIY repayment strategies like the debt snowball method can give you a bit more control over your finances.

But if you find yourself overwhelmed with high-interest debts like credit card bills or unexpected, large medical expenses and you're struggling to make monthly payments, it might be time to reach for a different tool. At this point, consider seeking guidance from a credit counselor to see if a debt management plan or debt consolidation loan can get you on track.

And if you feel completely stuck and unsure of how to proceed, more comprehensive solutions like debt settlement or personal bankruptcy are available to help you manage your debt effectively.

If you really aren’t sure where to start, it’s hard to go wrong with getting a free consultation with a nonprofit credit counselor. Their job is to learn about your specific financial situation and goals and suggest a tailored plan to help you effectively deal with your debt.

Upsolve can connect you with an NFCC-accredited nonprofit credit counseling agency for a free consultation.

Understanding Your Debt Relief Options

When most people talk about debt relief options, they are referring to budgeting and DIY payoff strategies, debt consolidation or refinancing, debt management plans, and debt settlement.

Here’s a brief overview of each strategy, along with its pros and cons.

Budgeting

Most people are familiar with the idea of budgeting. It involves looking at your income and expenses and seeing how much (if any) money you have left over each month to put toward debt repayment. If you don’t have any money left over, you may need to consider increasing your income, cutting expenses, or trying a debt relief program if neither of these is possible for you right now.

Pros of budgeting:

Increases financial control and awareness

Can help you avoid new debts by optimizing spending

Cons of budgeting:

Requires discipline and time to see results

Might not be enough to pay down high debt loads

Debt Consolidation and Refinancing

People look to debt consolidation and refinancing for the same reason: They want a lower interest rate on their debt and a more affordable monthly payment. Each strategy only works for a certain kind of debt.

If you have unsecured debts like credit cards bills, medical bills, or student loans, you may be able to use debt consolidation to get control of your debt payments and save money over time.

If you have secured debts like a home loan or car loan, you probably need to consider refinancing if you’re struggling to make your monthly payments. You can also speak to the lender or bank directly and ask if it’s possible to lower your interest rate.

You usually need to have a good credit score to consolidate your debt or refinance an existing loan.

Pros of debt consolidation and refinancing:

Simplifies multiple debts into one payment

Often reduces the interest rate and monthly payments

Cons of debt consolidation and refinancing:

Might extend the debt period, which could lead to paying more over time

Requires good credit for the best terms

Debt Management Plans (DMP)

A debt management plan (DMP) is a 3–5-year structured repayment plan to deal with large debts from high-interest credit cards, medical bills, and personal loans. This isn’t a DIY option. Instead, a credit counselor will create and manage the plan for you. As part of this, they work to lower your interest rates and often get extra fees like late charges dropped.

A DMP can help you streamline your debt repayment, reduce your monthly payment amount, and ultimately pay less money overall. Instead of dealing with several payments to different creditors at various times, you'll make one monthly payment to the counseling agency, which may add a small fee for their services.

Pros of a debt management plan:

Organizes your debt with help from financial experts

Creditors may lower interest rates and waive fees

Cons of a debt management plan:

May involve a one-time setup fee and a recurring monthly fee

May take longer to pay off your debts than other debt relief methods

Debt Settlement

Debt settlement involves negotiating with your creditor to pay a lump sum that's less than your total debt. If the creditor agrees to your offer, they'll cancel the remaining debt. Debt settlement doesn’t always work; not every creditor is willing to negotiate.

Also, it can be difficult to settle a debt unless you are quite behind on the payments already and the creditor thinks they might not get paid at all. If you have missed several payments on a credit card bill or medical bill, you may be able to negotiate a debt settlement. But if you’re up to date on your debt accounts, this approach is unlikely to work.

Pros of debt settlement:

Can save you money by reducing the total amount you owe

Allows you to clear debt faster than if you used most other debt relief options

Cons of debt settlement:

Works best if you have a lump-sum payment to offer

The creditor may decide to take legal action after several months of missed payments

You may have to pay taxes on the forgiven amount

Exploring Bankruptcy as a Debt Relief Option

Chapter 7 bankruptcy allows people overwhelmed with debt to get a fresh start financially. The most common type of personal bankruptcy is Chapter 7.

Some individuals don’t qualify to file Chapter 7 because their income is too high or they own certain assets they don’t want to lose (usually a home). These individuals may choose to file Chapter 13 bankruptcy instead. This is the second most common type of bankruptcy.

Let’s explore the ins and outs of Chapter 7, since it’s the most common.

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is a legal process designed to help individuals or businesses eliminate or wipe out their debts when they can no longer pay them.

It's often referred to as a "liquidation" bankruptcy because it can involve selling off some of your property to pay creditors, though this is very rare. Most property, including basic household furnishings, clothes, and sometimes your car, can be kept if they fall under exemptions that protect them from sale.

As soon as you file your case, there's an immediate pause on most debt collection actions against you, including calls, letters, and lawsuits. This pause is known as an "automatic stay."

The bankruptcy court will appoint a trustee to oversee your case and review your finances. If you own any non-exempt property, they’ll also manage the sale of that. (Again, this is extremely rare.)

When your case is approved, your remaining unsecured debts (like credit card bills, medical expenses, and personal loans) are discharged. This means you're no longer legally required to pay them.

Benefits of Filing Chapter 7 Bankruptcy

Some people consider bankruptcy a last resort. But if you're really struggling financially and don't see a way out, it can be a great way to get a fresh start. Chapter 7 bankruptcy has the following advantages:

✅ It usually only takes 4–6 months. Chapter 7 can eliminate most of your debts within 4–6 months; no lengthy payment plan is required.

✅ It stops creditors' collection efforts. Creditors must obey bankruptcy laws. They can’t continue collection efforts after you file your Chapter 7 petition without court approval. This means all the phone calls have to stop!

✅ After the bankruptcy discharge, collections and harassment will stop permanently. Creditors aren't permitted to try to collect discharged debts. They can face severe penalties for violating the discharge order.

✅ It stops wage garnishment. A Chapter 7 bankruptcy case stops wage garnishment, debt collection lawsuits, and other forms of debt collection.

✅ It erases deficiency judgments. If you choose to surrender your car or house because you can't afford the payments, a creditor can't get a deficiency judgment against you. And if you already have a deficiency judgment against you, the Chapter 7 case discharges the debt.

✅ It doesn’t have to be expensive. Your costs for filing a Chapter 7 case may be very low if you’re eligible to use Upsolve’s free bankruptcy filing tool and file bankruptcy without a lawyer.

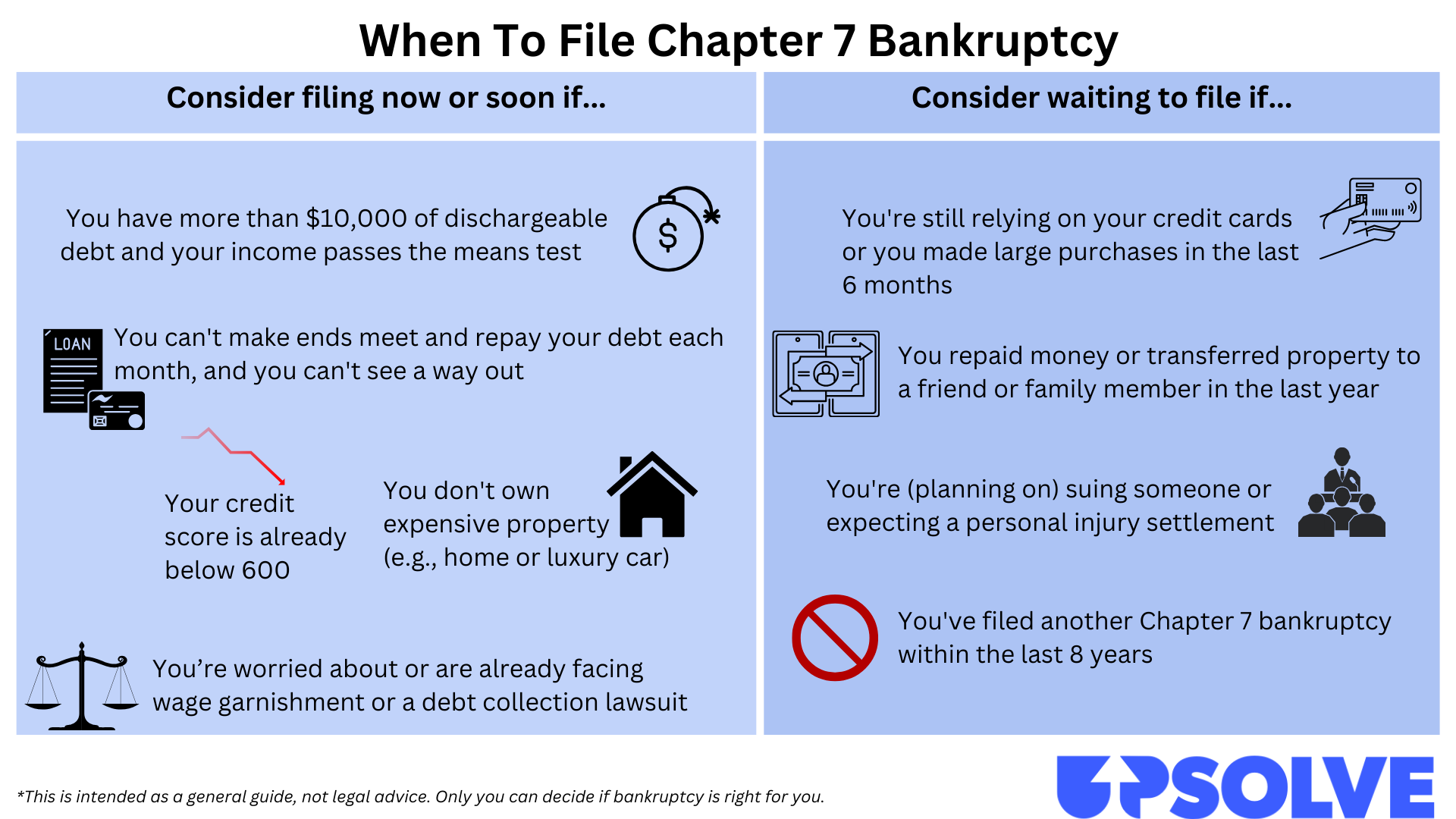

Trying to figure out the best timing for a Chapter 7 filing? This can help:

Drawbacks of Filing Chapter 7 Bankruptcy

While Chapter 7 bankruptcy offers a path to debt relief and a fresh start, it's important to understand the potential downsides before deciding if it's the right choice for you. Here are some of the key disadvantages:

❌ It affects your credit score. If you have good credit, filing for Chapter 7 bankruptcy will hurt your credit score. The bankruptcy will stay on your credit report for up to 10 years, which can make it harder to get new credit accounts or good interest rates.

❌ You may lose non-exempt property. Although most individuals keep all their essential property, if you have any non-exempt assets, the trustee can sell them to pay off creditors.

❌Not all debts are dischargeable. Chapter 7 bankruptcy can eliminate many types of unsecured debt, but certain obligations (called priority unsecured debts), such as child support, alimony, and certain tax debts, typically cannot be discharged. You'll still be responsible for these debts even after the bankruptcy process.

❌ It can be stressful and time-consuming. The process of filing for Chapter 7 bankruptcy involves a lot of paperwork and legal procedures. You'll need to gather extensive financial documentation, attend credit counseling sessions, and possibly go to court. This can be both time-consuming and emotionally taxing.

Can You Get Rid of Student Loans in Bankruptcy?

Sometime. To have your student loans discharged, you'll have to file an adversary proceeding (AP) after you file your bankruptcy petition. During the AP, you must prove that you meet what's called an undue hardship standard.

The Department of Justice released new guidance for bankruptcy courts in late 2022 that helps judges interpret the undue hardship standard more uniformly. Since then it's gotten easier to discharge some student loans — specifically federal student loans. You can try to get your private student loans discharged, too, but the AP process will be more complicated.

Some unsecured debts aren't eligible for a discharge though. For example, student loans aren't dischargeable unless the debtor qualifies for a hardship discharge of the student loans. Most income taxes, as well as alimony, and child support payments also aren't dischargeable. You can’t get out of paying your domestic support payments by filing a Chapter 7 bankruptcy case.

Comparing Debt Relief and Bankruptcy

Debt relief and bankruptcy work in different ways. This section will compare these options to help you decide which one might be best for you.

When To Consider Debt Relief Over Bankruptcy

Debt relief might be better than bankruptcy in some cases. Here are a few situations where debt relief could be more helpful:

You have a manageable amount of debt. If you think you can repay your debt with a good plan and some time, you might want to try debt relief before you file for bankruptcy.

You want to protect your credit score. If you have a good credit score and you want to keep it, debt relief might be a better choice.

You’re confident you can address your debt and stick to a plan with a timeline. Most debt relief options require some patience and persistence. If you have both, debt relief can be a good choice.

When To Consider Bankruptcy Over Debt Relief

Bankruptcy might be the better option in some cases. Here are a few situations where filing for bankruptcy could help more:

You have overwhelming debt. If your debt is way more than you can repay, even with a plan, bankruptcy can give you a fresh start. Chapter 7 bankruptcy can erase most unsecured debts, like credit cards and medical bills.

You want to stop debt collectors in their tracks. Bankruptcy stops all collection actions right away, including calls, letters, and lawsuits. If creditors are bothering you a lot, this immediate relief can be a big help. Bankruptcy can also help protect you from being sued or having your wages garnished.

Other debt relief options haven’t worked. If you’ve tried debt relief options but they don’t work for your situation, bankruptcy might be the only choice. This is often true for people with a lot of medical bills, credit card debt, or personal loans.

How To Choose the Best Option for Your Financial Situation

First, ask yourself: Can I repay this debt without harming my essential living expenses and financial stability?

If your answer is "yes," even if it takes a few years and some outside help, you should look into debt settlement, consolidation, a debt management plan, or a combination of these. A free session with a nonprofit credit counselor can be very helpful here.

If your honest answer is "no," Chapter 7 bankruptcy might be your best choice. Many people, despite their best efforts, can't cover basic needs and pay off their debt. This often happens because of high credit card interest rates, expensive medical bills, large student loans, stagnant wages, life emergencies, or bad luck.

You’ll also want to answer these questions when you’re deciding what’s right for you:

What is the total amount and type of debt you have?

How much will each option cost? Can you do it yourself, or do you need help?

How long will each option take? Can you stick with it?

How flexible does your repayment plan need to be?

How important is your credit score right now? Will this option help you meet your financial goals?

Are you worried about lawsuits or wage garnishment if you don't address your debt soon?