What Is Debt Settlement?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Debt settlement is a type of debt relief. If a creditor agrees to a debt settlement, you make a lump-sum payment for less than the total debt you owe and they forgive the rest. This can work well if you have a large sum of cash at hand. But many who've fallen behind on paying their debts don’t. If you try to save up money to settle a debt, you'll hurt your credit in the meantime if you stop making your debt payments.

Written by the Upsolve Team. Legally reviewed by Attorney Paige Hooper

Updated May 7, 2025

Table of Contents

Debt settlement is a type of debt relief that may allow you to settle certain debts for less than what you owe. You can negotiate directly with your creditors or hire a debt settlement company to do the work for you. Whether you hire a company or do it yourself, you’ll need a lump sum of money to make an offer. If you hire a company, you’ll likely pay into an account until you’ve saved enough money to make a good settlement offer.

Like any debt relief solution, debt settlement isn’t for everyone. In this article, you’ll learn more about how debt settlement works and what the benefits and risks are.

What Is Debt Settlement?

The concept behind debt settlement is simple: Contact credit card companies and other creditors and offer each a lump-sum payment that’s less than the full amount you owe. The company gets at least partial payment on your debt and you get the rest of the debt forgiven.

You can contact creditors and lenders directly to negotiate your debt or hire a debt settlement company. Each has its pros and cons, which we explore later in this article.

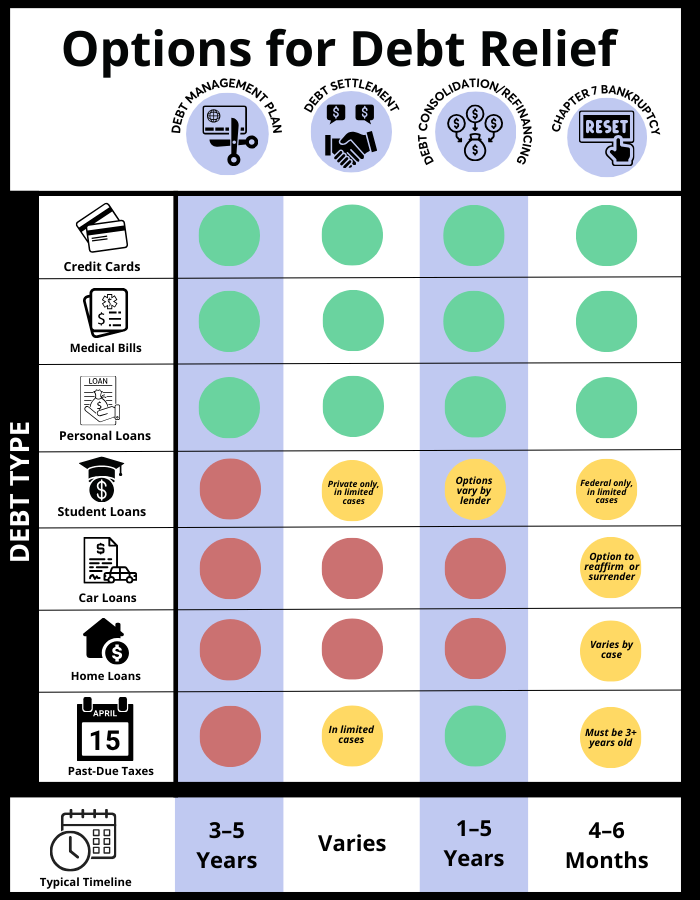

What Types of Debt Can Be Included in a Debt Settlement Plan?

Debt settlement only works with certain types of debt. Generally, this includes unsecured debts like credit card debt. You usually can’t settle secured debt like the loan you took out to buy your house or your car. You can only settle student loan debt in rare cases. To do so, you usually have to negotiate a settlement with your student loan company directly.

How Long Does Debt Settlement Take?

The time frame to settle your debts will depend on your resources. If you have a chunk of cash to devote to settlement, you can start the negotiation process right away. But most people considering debt settlement don’t have ready cash. If you don’t have cash available to start making settlement offers, you’ll need to save up.

If you’re working with a settlement company, you’ll make monthly payments into a special account the company sets up. When there’s enough money in your settlement fund, the debt settlement company will make an offer to one of your creditors. If the creditor accepts, you enter into a settlement agreement with that creditor, make the lump-sum payment, and resolve the debt. Then, it’s on to the next!

Why Are Creditors Willing To Settle Debts?

First off, it’s important to know that not all creditors are open to debt settlement. Creditors that are willing to negotiate do so because they otherwise may not get paid at all. For example, if you chose to file bankruptcy instead, your credit card debt would be wiped out completely and your creditors would likely get nothing.

DIY Debt Settlement vs. Hiring a Debt Settlement Company

You can negotiate debt settlements on your own for free. If you don’t have the time, energy, or confidence to do it yourself, you can hire a debt settlement company to handle the negotiation for you and oversee your debt settlement fund. If you choose to hire a company, it’s crucial to do your research. Some debt settlement companies are reputable and have proven settlement track records. But the Federal Trade Commission (FTC) has also caught some debt settlement companies breaking the law.

Before signing up with a debt settlement company, research the company carefully. You can look at the company history or search for complaints through the Better Business Bureau, the Consumer Financial Protection Bureau (CFPB), the FTC, and your state’s attorney general.

Pros and Cons of Hiring a Debt Settlement Company

There are some advantages to hiring a company to settle your debts for you. For one, it may be less stressful since the company handles the debt negotiation. Also, some debt settlement companies have knowledge of and relationships with major creditors, so they know how to make offers that creditors are likely to accept.

But there are also many downsides. The first is that you’ll have to pay a fee for their services. If the company you hire is really good, you may still save money overall, but this is hard to know when you hire. Another downside is that you’ll need to do careful research before you hire a company to avoid the many debt settlement scams out there. The CFPB warns against working with companies that make specific promises about how much they can reduce your debt. It’s also a red flag if a debt settlement company asks you for upfront payment.

Debt Settlement Risks

Even when you work with a reputable debt relief company, debt settlement has downsides. For most people, the debt settlement plan involves saving up settlement funds for months or years. Often, the debt settlement company will tell you to stop paying your creditors during that time. Partly, that’s so you can use the money you would’ve paid to the creditors to help settle debts. But it’s also partly because creditors are more likely to settle if they’re not getting paid at all.

During this time, there’s nothing to stop creditors from trying to collect the debt or from turning it over to a collection agency. You’ll likely continue to get collection calls and threatening letters. You may even be sued and have your wages or bank account garnished.

In addition to all that, your creditors will likely report every payment you miss to the three major credit bureaus. As these missed payments show up on your credit report, they’ll hurt your credit score. In fact, your payment history is the biggest factor used to calculate your credit score, so several missed payments can cause a lot of damage to your credit.

Debt settlement can also mean higher taxes. Debt that’s written off as part of a settlement agreement may be considered taxable income. Debt settlement companies don’t always warn you about the tax consequences. So you may be in for a big shock when you file your income taxes.

Other Debt Relief Options

When you’re struggling financially, it’s best to learn about multiple options and take the time to choose the best one for you. Bankruptcy, debt consolidation, and debt management plans (DMP) are three common alternatives.

Debt Consolidation

A debt consolidation loan combines multiple debts into one larger loan. You still pay the total amount of your debt, but your monthly payments will be more manageable. Ideally, the new loan will have a lower interest rate, and the single monthly payment will be less than the combined amount you were paying before.

Debt consolidation loans can be hard to get if you’ve already fallen behind on your payments and your credit score is low. It may be easier to get approved for a secured loan, like a home equity loan, to cover the debt you’re having trouble paying. But this can be risky because creditors can take your property if you can’t keep up with the payments.

Debt Management Plans (DMPs)

A debt management plan works a lot like a debt consolidation loan. But instead of taking out a loan, a nonprofit credit counseling agency creates and administers a repayment plan. They also work out payment terms with your creditors. The agency takes your monthly payment and distributes funds to the creditors as agreed. Because you aren’t taking out a loan, you don’t need good credit to get into a DMP, and you don’t have to provide property as collateral.

Bankruptcy

If you have a lot of unsecured debt you can’t pay, Chapter 7 bankruptcy may offer a solution. Many types of unsecured debt, like credit card debt, medical bills, and payday loans can be eliminated in a Chapter 7 bankruptcy. But you can’t eliminate secured debt unless you’re willing to give up the property. Chapter 7 usually works best for people who have mostly unsecured debt and don’t own a lot of property.

Let’s Summarize…

Debt settlement is one of many potential debt relief solutions. If a creditor agrees to a debt settlement, you’ll make a lump-sum payment for less than the total debt you owe and they’ll forgive the rest. Debt settlement can work well if you have a large sum of cash at hand. But many people don’t. In that case, you may hurt your credit by stopping your debt payments and taking time to save up a settlement fund.

If you aren’t sure where to start on your journey to a debt-free life, you can schedule a free consultation with a nonprofit credit counseling agency that can help you better understand your options.