What Happens if I Don’t Pay an Unsecured Loan?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Unsecured debt is any debt that isn’t backed by collateral. The most common types of unsecured debt are credit card debt, student loans, personal loans, cash advances, medical debt, retail store accounts, and money borrowed from family or friends. If you default on unsecured debts, the lender can send your account to a collection agency, which can lead to stressful phone calls and notices, a lowered credit score, and more difficulty getting new credit in the future.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated May 22, 2025

Table of Contents

Unsecured Loans vs. Secured Loans: What’s the Difference?

Most loans fall into two categories: unsecured loans and secured loans.

An unsecured loan is a loan that is not secured by other funds or property and typically relies heavily on your credit score for approval. In most instances, the only thing backing the loan is your pledge to pay it back.

A secured loan is a loan that is backed by assets or property, which guarantees repayment. The asset or property is known as collateral.

The most common type of unsecured loans are:

Credit cards

Student loans*

Some business loans

Personal loans (including debt consolidation loans)

The most common types of secured loans are mortgages and auto loans. A mortgage is secured by the home that was purchased with the loan. A car loan is secured by the car that was purchased with the loan. If you fail to repay your mortgage, the lender can repossess the real estate you purchased with the mortgage loan as repayment. This process is called foreclosure. With a car, this process is called repossession.

*Student loans are unsecured loans, but they have features similar to secured loans. When you take out a student loan, you sign a promissory note, which acts as a promise to repay the loan, much like how a check ensures you pay for the items you buy with it. This note gives lenders a stronger legal footing to enforce repayment, even though there isn’t physical collateral. If you don't repay a student loan, the lender can use the promissory note to take legal action against you, which can include wage garnishment or withholding tax refunds

What Happens if You Don’t Pay an Unsecured Loan?

If you don’t pay an unsecured loan, you can face serious consequences both in the short and long term. Missing payments can negatively impact your credit score, making it harder to obtain future loans. Plus, creditors will charge late fees on missed payments and late payments, which add up quickly and increase your debt. You can check your credit card or loan agreement to see if your lender provides a grace period. A grace period is a set amount of time after your payment due date during which you can make a payment without incurring late fees or other penalties.

If you set up automatic payments and don’t have enough money in your account, your bank might charge overdraft fees, worsening your financial situation. For business loans, late fees and other charges can be even higher because these loans aren’t usually covered by consumer protection laws.

The consequences for missing unsecured loan payments often get worse as you miss multiple payments. That’s why it’s useful to understand the difference between delinquency and default.

Delinquency occurs when you miss a loan payment.

Default happens if you fail to make payments for an extended period, usually several months.

Responding to Debt Collectors When Your Loan Is in Default

When your loan goes into default, the lender will likely turn it over to an internal or third-party debt collection agency. Debt collectors typically call and send collection letters asking for payment. They aren’t supposed to harass you or tell friends or family about your debt, but some debt collectors violate the law. It’s important to know your rights if your debt goes into collections!

Debt Collection Lawsuits

If their initial tactics don’t work, collection agencies might send your debt to a law firm, which may try to settle the account or collect payment. They aren’t legally required to do either, but they must send you notice that they now own the debt. They might also send you notice of a debt lawsuit.

It’s important to respond to the debt lawsuit, or you’ll likely lose by default! You don’t have to hire a lawyer to reply to the lawsuit. You can respond on your own or use a service like SoloSuit to reply for a small fee. SoloSuit has helped over 280,000 respond to debt lawsuits, and they have a money-back guarantee if the court doesn't accept your filing.

If the creditor wins the lawsuit, the court will issue a judgment against you, making the debt legally enforceable. This means your creditor can garnish your wages or levy your bank account. The judgment can stay on your credit report for up to 10 years and will hurt your credit score. This, along with other negative marks that remain for up to seven years, will make it harder to get credit in the future and lead to higher interest rates.

What Should You Do if You Default on an Unsecured Debt?

Since there can be serious consequences for not paying unsecured debt, it’s not a good idea to ignore the debt even if you can’t afford the payment. You can take steps with a few options to address the default and potentially eliminate the debt legally.

Contact the Lender Directly

A great first move is to contact your lender directly. Explain your situation and ask if they can help. Some lenders will let you skip one or more payments if you’re experiencing financial hardship. You can also ask if it’s possible to lower the monthly payment, waive late fees, or temporarily reduce interest rates.

Get a Free Consultation With a Nonprofit Credit Counselor

If you can't reach an agreement with your lender, you might want to contact a nonprofit credit counseling agency. Creditor counselors can go over your financial situation and help you make a personalized plan. They may suggest a debt management plan, which allows you to combine all your monthly unsecured debt payments into one easier payment. They can usually help you get lower interest rates and waived fees.

Refinance Your Loan or Get a New Loan

If a debt management plan doesn’t feel like the right move, you can also explore refinancing options or getting a new loan to repay existing unsecured debt. This is sometimes called debt consolidation.

Refinancing or consolidating your unsecured debt can help you get a lower interest rate, better repayment terms, and sometimes a lower monthly payment. This can be especially helpful if you have a lot of high interest credit card debt.

You can use a few different types of loans to consolidate your debts, including a personal loan, a home equity line of credit, and a credit card balance transfer. Be aware, though, that if you do a home equity line of credit, you’re essentially turning an unsecured debt into a secured debt by putting your house up as collateral. This can be very risky if you aren’t able to repay the loan.

File Bankruptcy

If you have to borrow money to make the payments on loans you already have, that may be a sign of more significant financial problems. If you feel like your debt is overwhelming and you can’t get a handle on it, you may want to consider filing bankruptcy.

Bankruptcy is a legal process that allows eligible individuals to discharge most kinds of unsecured debts including credit card debt, medical bills, past-due utility bills, payday loans, personal loans, and more.

When you file bankruptcy, you also get immediate relief from debt collector phone calls or debt lawsuits against you. This is thanks to the automatic stay. If you’re thinking of filing Chapter 7 bankruptcy, take our two-minute screener to see if you qualify to use our free filing tool.

Why Does Your Credit Score Matter for Unsecured Loans?

Having a good credit score will help you get approved for unsecured loans and get lower interest rates. You may also be eligible for a higher loan amount if you have a good credit history. Since there’s no collateral involved with unsecured loans, creditors often rely on your credit score to tell them how well you handle debt compared to other borrowers. They get this information by doing a credit check.

If you make your monthly debt payments on time, don’t use too much of your available credit, and have long standing credit accounts, you probably have a pretty good credit score. Having a good credit score reassures lenders and can help you secure more favorable loan terms, such as lower interest rates.

On the other hand, if you miss payments or default on your loans, your credit score will drop. Lenders often see bad credit as a warning sign that you might not repay future loans, which makes them less likely to lend you money. A lower credit score can lead to higher interest rates or even loan denials.

Where Does Your Credit Score Come From?

Three major credit bureaus — Experian, Equifax, and TransUnion — track your credit card and loan activity and payment history. They use this information to create a record of your financial behavior called a credit report and to generate your credit score. A credit report is like a school transcript, whereas a credit score is like a grade or grade point average.

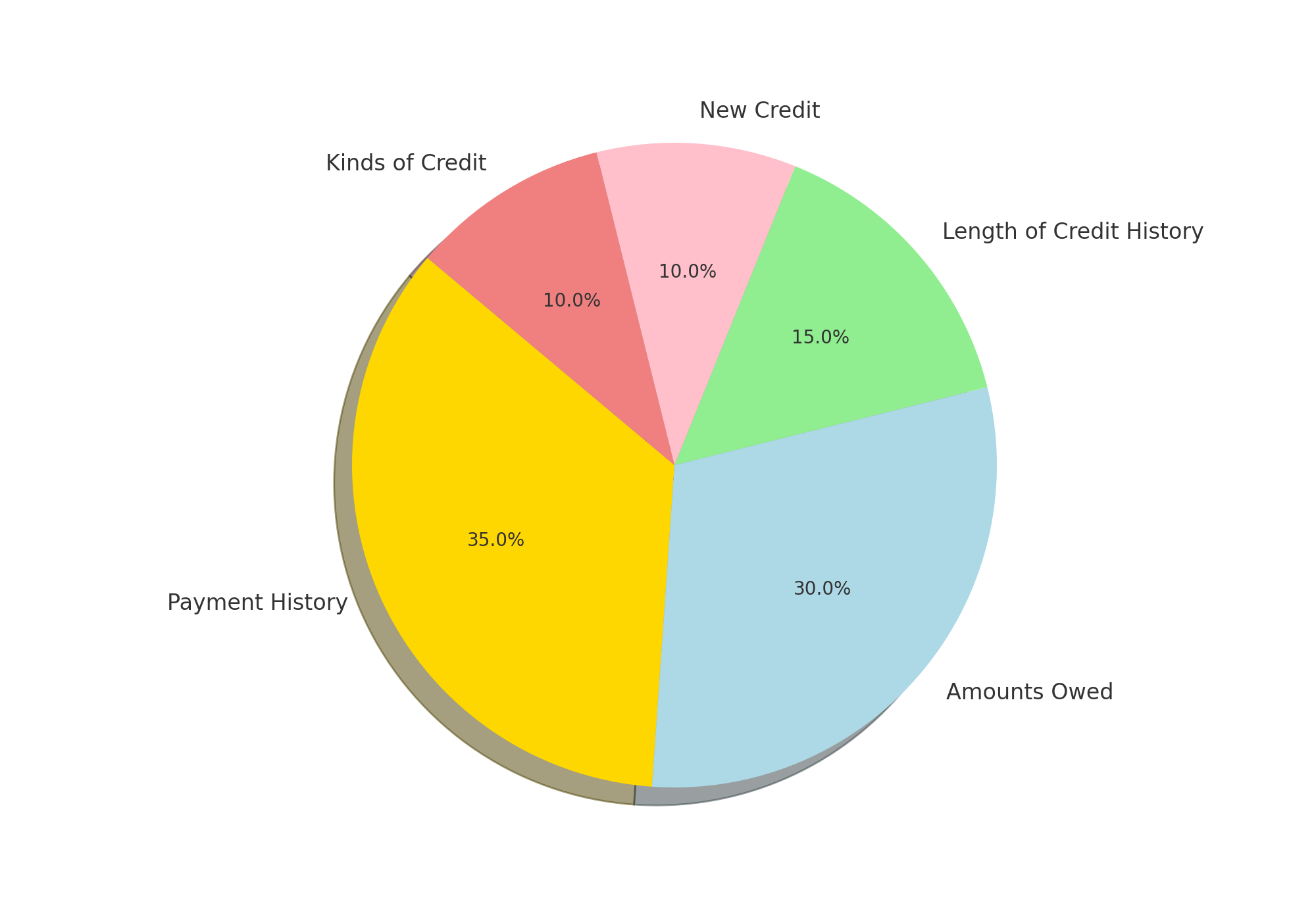

There are five major elements of a credit score and how much each contributes to your overall score:

You can get a free copy of your credit report from each of the three credit bureaus once a week. If you want to boost your credit score to get approved for a credit card or an unsecured loan, it’s important to check your credit report to make sure all the information on there is correct.

Let’s Summarize…

If you don’t pay an unsecured loan, you might face late fees and higher interest rates, and your credit score could drop. Debt collectors might call you and send letters. If you still don’t pay, the debt could go to a law firm, and they might sue you. If they win, the court could issue a judgment against you, allowing the creditor to garnish your wages or take money from your bank account. To avoid these issues, try to work out a payment plan with your lender or get help from a nonprofit credit counseling agency.