Bankruptcy Amendments: How To Correct or Update Your Forms

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you make a mistake or accidentally leave information out of your bankruptcy forms, you can almost always amend them after you file. The trustee in your bankruptcy case may also ask you to file an amendment after meeting with you in your 341 meeting. Be sure to fill out the amended forms carefully with the correct information and follow any local court rules to submit the amended forms. Most amended forms don't require a filing fee.

Written by Attorney Jenni Klock Morel. Legally reviewed by Jonathan Petts

Updated July 17, 2025

Table of Contents

If you accidentally forgot information or made a mistake on one of your bankruptcy forms, you can almost always amend the form after filing your case.

Filing an amendment is usually pretty straightforward. This article explains why some people need to file amendments to their bankruptcy paperwork and how to do it.

What Is a Bankruptcy Amendment?

If you find a mistake on your bankruptcy forms, it’s important to correct it. You do this by filing an amendment with the court, which is a way to officially tell the court you’ve made a change.

💡Amending your forms means changing or updating the information you already submitted.

Filing an amendment usually involves:

1️⃣ Filling out the corrected form

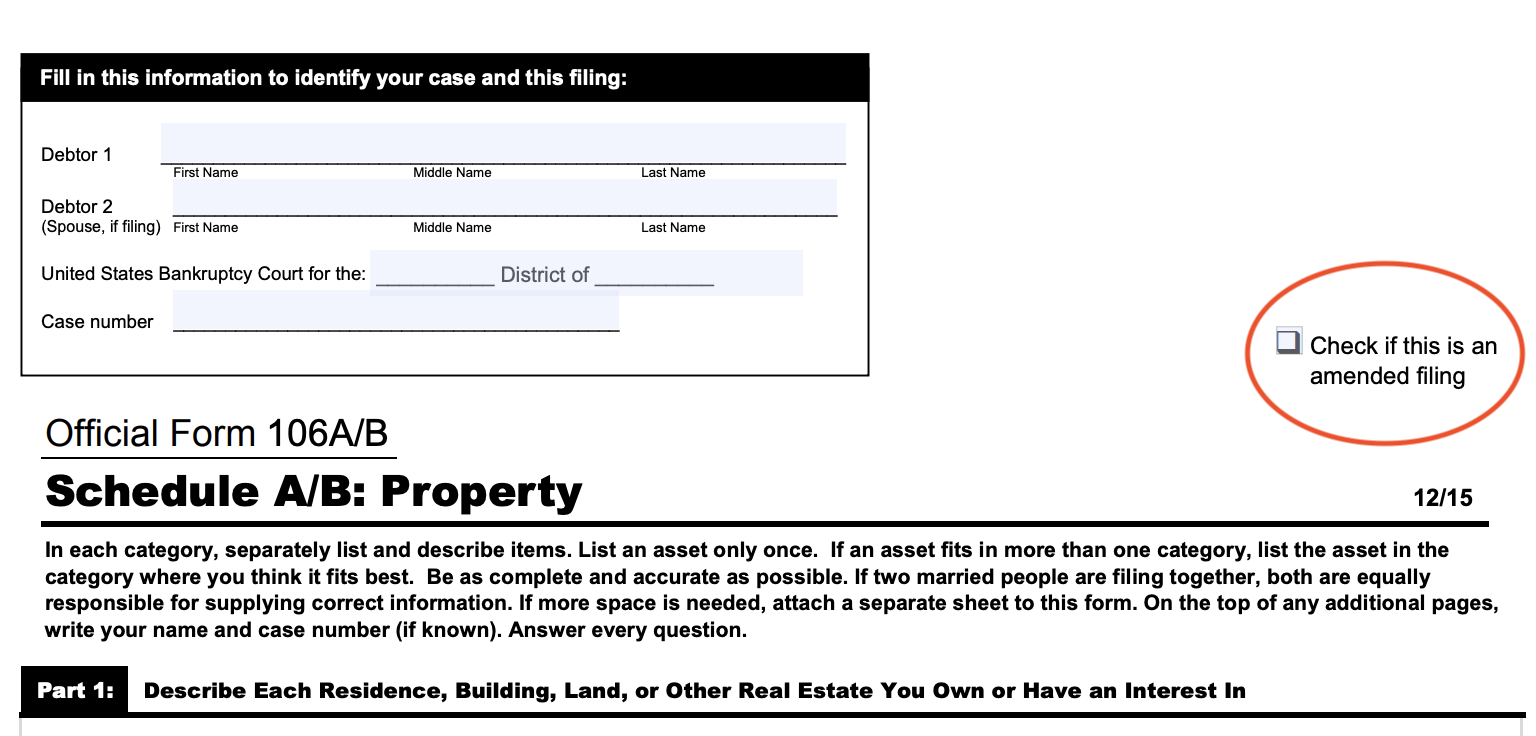

2️⃣ Checking the box that says it's an amended version

3️⃣ Submitting the form to the court

You may also need to include a cover sheet or follow other local rules.

In some cases, there’s a small filing fee — especially if you're adding new creditors. You may also need to send copies to your trustee and any creditors affected by the change.

When Do You Need To Amend Your Bankruptcy Forms?

There are several reasons people file amendments during a bankruptcy case. Some of the most common reasons include:

You made a mistake on your original paperwork. This could be a wrong address, an incorrect debt amount, or a typo in your income or asset listings.

You left out something important. You might have forgotten to list a creditor, skipped a bank account, or left out a source of income.

Your life or financial situation changed after you filed your case. If you move, get a new job, lose income, inherit money, or buy/sell something valuable after filing, it may be necessary to update your forms.

The bankruptcy trustee asks you to fix or clarify part of your paperwork. This is relatively rare, but we cover it more in depth below.

💡 It’s completely normal to make a mistake or forget something on your bankruptcy forms. Many people end up filing an amendment as part of their bankruptcy process.

Why It’s Important To Fix Mistakes, Correct Omissions, and Report Life Changes

Bankruptcy forms are filed under penalty of perjury, which means you’re swearing that everything you’ve included is true and complete to the best of your knowledge. So if you realize that something is wrong or missing, it’s important to fix it.

Filing an amendment shows the court that you’re doing your best to be honest and transparent. In fact, correcting mistakes is a normal part of the process for many people.

How To Respond When the Bankruptcy Trustee Asks You To File an Amendment

Sometimes, the bankruptcy trustee assigned to your case may ask you to file an amendment to your forms. This often happens after your 341 meeting.

💡The 341 meeting of creditors is a court-required hearing where the trustee asks questions about your finances and verifies your identity and information.

At the meeting, the trustee may ask if anything has changed since you filed or bring up something that needs clarification. You might also remember something you forgot to include, like a bank account, a creditor, or a recent payment. If the missing or updated information is important, the trustee will likely ask you to amend your paperwork.

This kind of request isn’t very common, but if your trustee asks you to file an amendment, it doesn’t mean anything is wrong.

How To Amend a Bankruptcy Form

To file an amendment, you'll use the same form you originally filed. But this time, you'll mark it as amended. Most forms have a checkbox or space to indicate that you're submitting an updated version.

Here’s an example of what that looks like:

Just like your original bankruptcy forms, you’ll sign your amended form under penalty of perjury. This means you're swearing that the updated information is true and complete to the best of your knowledge.

🏛️ Many bankruptcy courts have local rules for filing amendments, too. For example, some courts require a cover sheet, while others might ask you to label the document a certain way.

You can check your local court’s requirements on its website. Use the Federal Court Finder to locate your court’s page. If you’re unsure about a local rule, it’s okay to call the clerk’s office — their contact info is on the court’s website.

Once your forms are ready, here’s what typically happens next:

File the amended form with the bankruptcy court.

Send a copy of the amendment to the trustee assigned to your case and to any creditors affected by the changes.

File a certificate of service (sometimes called proof of service) with the court.

💡 A certificate of service is a simple form that tells the court who you sent the amendment to and when. It helps the court confirm that everyone who needs to know about the update has been properly notified.

Do You Have To Pay To Amend Bankruptcy Forms?

💰 If you are filing an amendment to your schedule of creditors (Schedule D or Schedule E/F) or list of creditors, there is a $34 filing fee. You need to pay the fee when you file the amendment with the court.

If you can't afford the additional fee, you can request a fee waiver. Your local bankruptcy court may have a form that can be used to request an amendment fee waiver.

✨ There is no filing fee to amend most other bankruptcy forms.

Can Upsolve Help You File an Amendment?

If you used Upsolve’s free filing tool to generate your original bankruptcy paperwork, you can use the Amendment Editor in your my.upsolve.org account to generate amendment paperwork for:

Schedule A/B, which covers your assets and property

Schedule C, which covers property exemptions

Schedule E/F, which covers your debts

When Is Filing an Amendment Not Allowed?

In most cases, you can file an amendment to your bankruptcy forms at any time before your case is closed. But there are a few exceptions.

You can't file an amendment in bad faith. This means you’re not allowed to use an amendment to try to fix something you deliberately left out to hide it from the court — like an asset you hoped no one would find.

✋ If the court believes you intentionally withheld information, you could face serious consequences, including having your case dismissed.

The bankruptcy rules generally allow amendments any time before your discharge is entered.

💡 A bankruptcy discharge is the court order that wipes out your eligible debts.

If you realize you need to make a change after your discharge, you’ll have to ask the court for permission to file an amendment. And if your case has already been closed (which usually happens shortly after the discharge), you’ll also need to ask the court to reopen your case first.

That said, these situations are rare. Most people know they need to file an amendment well before their case is closed.

Let’s Summarize…

Filing for bankruptcy involves a lot of paperwork, and it’s completely normal to make a mistake or forget something along the way. Amending your forms is a common part of the process and usually nothing to worry about.

🔑 The key is to make sure you’re updating the right forms, following your local court’s rules, and being as accurate and honest as possible so your case can keep moving toward a successful discharge.