How To Win Against Capio Partners

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If Capio Partners contacts you to try to collect a debt, the best thing you can do is get informed and respond. Before paying anything, validate the debt. If it’s your debt but you can’t afford to pay it, make a settlement offer to pay less than the original amount owed. If it isn’t your debt, dispute it. Capio is unlikely to sue, but if they do, you can probably still negotiate as long as you also meet the requirements of the lawsuit.

Written by the Upsolve Team. Legally reviewed by Jonathan Petts

Updated April 22, 2025

Table of Contents

- Why Is Capio Partners Contacting Me?

- Do I Have To Pay Capio Partners?

- How To Negotiate a Debt Settlement With Capio Partners in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Capio Partners in a Debt Lawsuit

- Let’s Summarize…

Why Is Capio Partners Contacting Me?

Capio Partners is likely contacting you to request payment on a past-due medical debt, such as a hospital or ambulance bill. They are a third-party debt collection agency that purchases debts from hospitals, doctor’s offices, and other healthcare providers. If a medical provider repeatedly tried to get payment from you but was unsuccessful, they may have sold your debt to Capio, who is now taking over collection efforts.

Read Upsolve’s article How To Deal With Capio Partners for more information.

Do I Have To Pay Capio Partners?

You might need to pay Capio Partners, but you have some homework to do before you can answer that. First, make sure that Capio validates the debt (more on this below). If they validate it and you are confident that the debt is yours and the amount is correct, you probably do need to pay them or you risk facing serious consequences. If you haven’t paid because you can’t afford the full amount, you may be able to negotiate a settlement to pay less than the original amount you owed and close the account for good.

If you don’t agree that you owe the debt or you disagree with the amount Capio says you owe, you have the right to file a dispute.

No matter what, it’s important to respond to Capio. If you ignore them, they might intensify their collection efforts. In extreme cases, they could even sue you to get a court order for a wage or bank account garnishment against you.

How To Negotiate a Debt Settlement With Capio Partners in 3 Steps

Unfortunately, debt collection is a for-profit, legal industry in the U.S. While this might seem shady, it does have some benefits for you, the consumer.

Capio Partners likely acquired your medical debt for less than what you owe. And, since they don’t get paid unless you pay them, they’re typically open to negotiating the amount you owe. Many debt collectors are willing to settle for about 50% of the original amount owed.

Capio could reach out to you with a settlement offer first. But if you know you want to go this route, it’s a good idea to initiate the conversation yourself. This is a manageable process when you are familiar with the steps involved, which is what this article is here to teach you!

Step 1: Make Sure the Debt Is Valid

The first step is to confirm the details of the debt validation letter (also called a validation notice) that Capio Partners sent you. If you haven’t received this letter, request one from them. Debt collectors are required to send you a validation letter before or within five days of initially contacting you, according to a Consumer Financial Protection Bureau (CFPB) debt collection rule.

This letter is important because it gives you specific information about the alleged debt to help you determine if it’s legitimate. Specifically, you want to be able to confirm that:

The debt is actually yours, not a case of identity theft or misidentified account holder.

Capio Partners owns or is authorized to collect the medical debt.

The amount of debt is correct.

If Capio doesn’t provide you with all the information you need to answer these questions, send them a debt verification letter with your additional requests. You can also use a verification letter to dispute the debt, which you have a 30-day window to do.

Medical debt can be more confusing than other types of debt. You can learn about how to decipher your medical bills and double-check your debt amount by reading Upsolve’s Guide to Medical Bills.

Step 2: Figure Out What You Can Pay

If Capio Partners validates the debt and you agree that you owe it, your next step is to figure out what you can pay. Make some calculations based on your monthly take-home pay, expenses, and existing debts. Be realistic about what you can afford without sacrificing your essential needs, like housing or food.

To help with this process, the CFPB offers a budget worksheet and debt worksheet. If you are a person who benefits from talking things out with someone knowledgeable, consider getting a free consultation with an accredited nonprofit credit counselor.

Figure Out How You Can Pay

You typically have two options for repaying a debt: a lump-sum payment or a payment plan. You’ll probably get a better deal — and your offer is more likely to be accepted — if you can pay in one lump sum instead of a payment plan. If it makes sense for your situation, think about using a small windfall like a tax return or work bonus as a one-time payment. Many people can’t afford to make a lump-sum payment. If that’s you, don’t worry.

If a payment plan is your only doable option, you can make your offer more enticing to Capio by agreeing to allow direct withdrawal from your bank account. Direct withdrawal could make them feel better about getting paid in installments. The main takeaway is to suggest a payment plan with a monthly payment amount you can afford and a timeline you’re confident you can work with.

Step 3: Make a Settlement Offer to Capio Partners

After you’ve decided on an amount you feel comfortable with, you are ready to make Capio Partners a settlement offer. You can do this on the phone with a representative from Capio. If they don’t agree to a deal that works for you, don’t hesitate to hang up and try again on another call later. If you’re able to come to an agreement, ask the person on the phone to send you a copy of it in writing.

While the process is slower, you can also use Upsolve’s debt settlement letter template to negotiate your settlement offer. Ask for Capio’s reply in writing, too, so there is a record of all exchanges and agreements.

Don’t Just Negotiate the Amount… Negotiate Everything!

To recap, you can negotiate the settlement amount and whether you repay the debt in one lump sum or via a payment plan.

Equally important is negotiating how the debt collector reports the account to the credit bureaus. Their options are: paid in full, partial payment, or settled. Your credit score will benefit the most if the debt is reported as “paid in full,” so ask Capio to report it this way as part of your negotiations.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Yes, even if you have been sued, you can usually still negotiate a settlement. One word of caution: Always respond to the lawsuit and comply with court requirements while you’re in negotiations. Treat the lawsuit as valid unless and until the settlement is in writing and has been submitted to the court or the case is dismissed or closed.

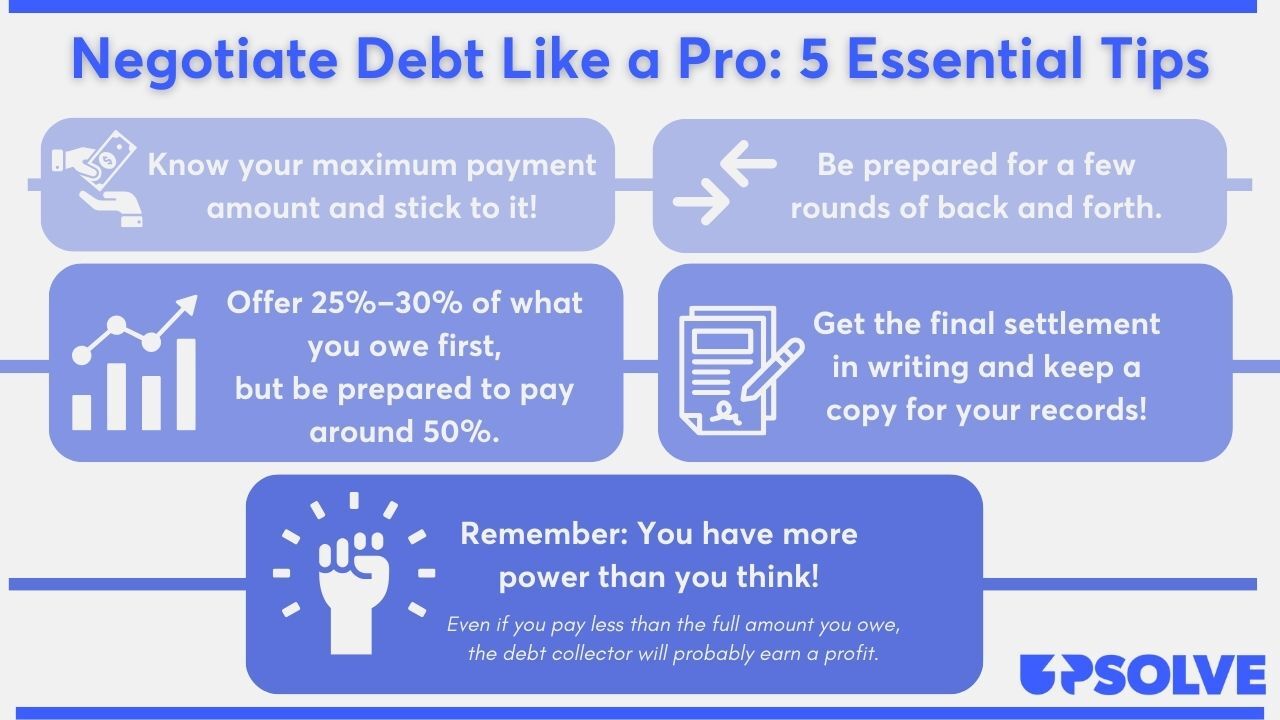

Tips for a Successful Debt Settlement

Negotiating a debt can seem daunting, but empowering yourself with the information in this article will help you navigate the process like a pro.

How To Beat Capio Partners in a Debt Lawsuit

Fortunately, Capio Partners doesn’t have a strong history of suing people, so a lawsuit isn’t likely to be their first strategy. That doesn’t mean they won’t eventually sue you for a debt if they can’t get payment from you, however.

If you receive official court documents called a summons and complaint, Capio Partners is suing you, and it is crucial that you respond. Many debt collectors are banking on you not responding to the lawsuit. If this happens, the court will probably grant them a default win, which allows them to garnish your wages without even proving the validity of the debt.

Simply responding to the lawsuit can increase your chances of a better outcome, and you don’t even need an attorney to answer a summons for a debt. Keep reading to learn more.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Step 1: Read the Summons and Complaint Carefully

A summons is a legal notice to inform you that you’re being sued. Although they vary by court, summons forms include important information about the lawsuit, such as:

The court’s name and address

The names and contact information of the parties involved

The case number

The legal consequences of not responding to the lawsuit

You will need to reference this information when you reply to the lawsuit. Most importantly, a summons gives you a deadline for you to respond to the lawsuit, either as a specific date or a number of days.

A complaint is included with the summons and outlines the specific claims against you, usually in numbered paragraphs. It also tells you who is suing you and how much you’re being sued for.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

The simplest way to respond to the lawsuit is by filling out an answer form, which is provided by most courts. To find out if this is an option for you, Google the court name listed on the summons + “answer form” or “court form.” Additional forms may be included with the answer form, such as a certificate of service, so be sure to fill those out too. And, if there are instructions, follow them carefully when drafting your reply.

Your written response to the lawsuit is an opportunity to have your voice heard and raise any defenses you may have. If Capio left important information out of their complaint that could help you win the lawsuit, you might also have an affirmative defense you can include in your response.

Two valuable resources to keep in mind while addressing the lawsuit are the court clerk and the court’s website. If you are unsure about a form or need help understanding any aspect of the legal process, every court has a court clerk. They can’t give you legal advice, but they can answer your questions about court rules and processes.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

After you’ve completed the answer form, it needs to be filed. Once again, this process varies by court, but filing in person at the courthouse or sending the form in the mail is almost always an option. If you prefer to submit the answer form in another way, check your court summons or the court’s website to find out if there are other options.

The second part of the filing process is to serve the plaintiff. This means you deliver a copy of your answer form to the person suing you — Capio, in this case. Find their address listed on the summons and mail them a copy of your answer form.

Let’s Summarize…

If Capio Partners contacts you, they’re probably trying to collect on a medical debt that they purchased from your original provider. Before you pay them, validate the debt to verify that it’s yours, the amount is correct, and that Capio owns the debt. If the debt or its details are incorrect, dispute it. If you do owe the debt, initiate a settlement offer and negotiate to pay less than the original amount. Even if you are involved in a lawsuit with Capio, you can often still negotiate. Just be sure to comply with all court requirements.