How To Win Against Central Portfolio Control

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If Central Portfolio Control contacts you, they probably bought a debt they believe you owe. Before paying anything, you need to validate the debt to confirm that it’s legitimate. If it is, figure out how much you can pay and begin debt settlement negotiations. If Central Portfolio Control is suing you for unpaid debt, you need to respond — even if you’re in the middle of settling the debt — and follow court procedures.

Written by the Upsolve Team. Legally reviewed by Jonathan Petts

Updated May 1, 2025

Table of Contents

- Why Is Central Portfolio Control Contacting Me?

- Do I Have To Pay Central Portfolio Control?

- How To Negotiate a Debt Settlement With Central Portfolio Control in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Central Portfolio Control in a Debt Lawsuit

- Let’s Summarize…

Why Is Central Portfolio Control Contacting Me?

Central Portfolio Control (CPC) is a third-party debt collection agency focusing on consumer debts. They collect past-due accounts primarily for banks and financial institutions. If CPC is contacting you, they probably bought your debt from your bank.

To learn more about Central Portfolio Control and what to do if they contact you, read our article How To Deal With Central Portfolio Control.

Do I Have To Pay Central Portfolio Control?

The short answer is: It depends. First, be sure that CPC has validated the details of the debt.

If they can’t validate the debt, you shouldn’t have to pay them, and you can ask them to stop contacting you.

If CPC has validated the debt and you agree you owe it, you probably have to pay them or you may risk being sued. If you’re sued and lose, you could face serious consequences like a bank account or wage garnishment. That said, you may not have to pay the debt in full — you can try to negotiate a debt settlement.

You may be able to stop a debt collector from contacting you by sending them a cease and desist letter.

How To Negotiate a Debt Settlement With Central Portfolio Control in 3 Steps

Third-party debt collection companies, like Central Portfolio Control, are a business. Their main objective is to make money. This might not seem like good news for you, but surprisingly, it is.

Debt collectors buy debts from creditors and lenders for pennies on the dollar. This means they are usually open to negotiations because they can still make money even if you don’t pay the full amount. Debt collectors routinely settle debt accounts for 40%–60% of the original amount.

CPC might reach out first with a settlement offer, but you can (and should!) initiate the conversation. You'll feel much more confident once you know the process. Here are the three steps.

Step 1: Make Sure the Debt Is Valid

If you haven't already received a debt validation letter from Central Portfolio Control, ask them for one immediately. If CPC has sent you a debt validation letter, make sure to read it thoroughly and verify all information is accurate.

If CPC hasn’t sent you a validation letter, use Upsolve’s template to write a debt verification letter. You can use the verification letter to request additional information about the debt account. You want to make sure that:

The debt is yours.

Central Portfolio Control legitimately owns it.

The amount is correct.

According to a Consumer Financial Protection Bureau (CFPB) debt collection rule, third-party debt collectors must send a debt validation letter and give you a 30-day period to dispute the debt. You can use your debt verification letter to dispute the debt.

Here’s an infographic explaining the main difference between these two types of letters:

Step 2: Figure Out What You Can Pay

After validating the debt, you need to figure out how much you can pay. Look at your monthly take-home pay, expenses, and existing debt obligations (auto loans, credit cards, mortgage) to get a sense of your financial situation.

The CFPB has a helpful budget worksheet to simplify this process. They also have a debt worksheet that helps you visualize your bills and how much money you owe. If you’re stuck with your budget, you can get a free consultation with an accredited nonprofit credit counselor.

You have some say in how you choose to pay Central Portfolio Control. Debt collectors typically prefer a one-time lump-sum payment rather than a monthly payment plan. If you’re in debt, you probably don’t have a lot of extra cash lying around to offer a lump-sum payment. Think creatively. Can you use an upcoming or recent work bonus or tax return?

If a lump-sum payment doesn't work for your finances, figure out what monthly payment amount and timeline you can confidently agree to and negotiate a payment plan. Some debt collectors may be more open to a payment plan if you agree to set up a direct withdrawal from your bank account.

Step 3: Make a Settlement Offer to Central Portfolio Control

Once you know how much of the debt you can afford to pay, it’s time to make Central Portfolio Control an offer. Make your offer in writing and request CPC’s reply in writing so there’s a record of the agreement. Start lower than what you can afford, and be prepared for some back and forth.

You can use Upsolve’s Debt Settlement Letter template to create your offer letter.

Don’t Just Negotiate the Amount… Negotiate Everything!

Did you know you can also negotiate how you repay your debt and how the collector reports the account to the credit bureaus? The debt collector can report the account as “paid in full,” “partial payment,” or “settled.” Each of these has a different effect on your credit score.

Negotiate for CPC to report your debt as “paid in full.” This will be the most beneficial for your credit score. Resolving the debt account in general should also boost your score over time.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

In many cases, yes, you can still negotiate a debt settlement even if Central Portfolio Control has sued you. But if you’re sued, it’s important to respond to the lawsuit and comply with all court requirements, including appearances, until your written settlement agreement is submitted to the court.

Tips for a Successful Debt Settlement

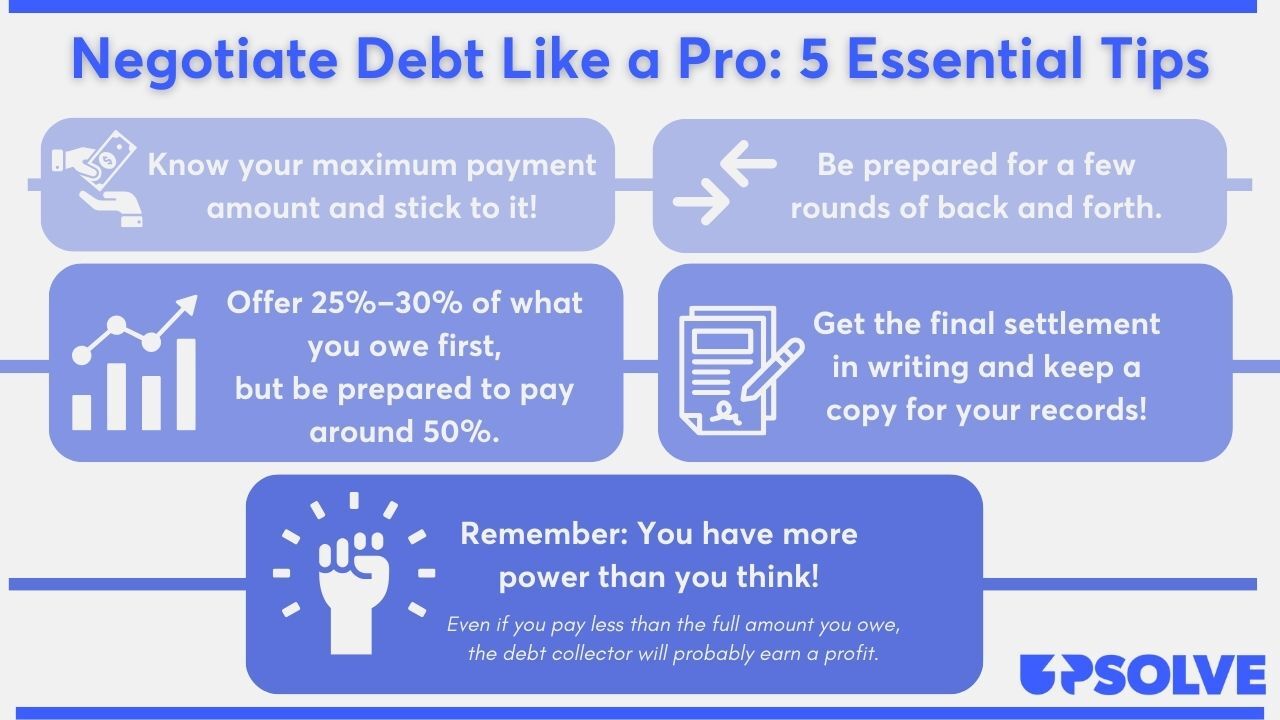

Here are our top tips for negotiating a debt settlement:

For even more tips and info, read Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Central Portfolio Control in a Debt Lawsuit

You’ll know you’ve been sued if you receive a summons and a complaint, which are two official court documents. The most important thing you can do is respond to the lawsuit. This is often as simple as filling out and mailing off some paperwork… and you don’t have to hire an attorney to do it! You can respond on your own.

If you ignore the lawsuit, your circumstances may get worse. Debt collectors sue in hopes of getting a court order to garnish your paycheck or bank account. If you don’t fight back, you’ll probably lose automatically.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Step 1: Read the Summons and Complaint Carefully

A summons is a court document that notifies you that you are being sued. The summons will have important details that you’ll need for your answer form, such as:

The name and address of the court you report to

Information of all parties involved

The case number assigned to your lawsuit

Details of the legal consequences if you fail to respond to the lawsuit

The format and content of a summons varies from court to court, so your document may have more information than what’s listed above. Regardless, it should contain all the key information you need to fill out your response to the court.

A complaint document should accompany your summons form. While the summons alerts you of the lawsuit, the complaint outlines all of the debt collector's claims against you. These are usually laid out in numbered paragraphs.

Here is an example of what a complaint can look like:

Example from the Minnesota Judicial Branch

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

You respond to the lawsuit by filing your response, a document typically referred to as an answer form. Many courts provide blank answer forms and basic instructions. To see if your court has a form you can use, Google “[court name] + answer form.”

If you can’t find the form or don’t understand what you do find, you can ask the court clerk for help. Clerks are court officials who answer questions and help guide people through court proceedings. Clerks can’t give you legal advice, but they can help you better understand legal processes. They may also be able to point you to self-help resources or low-cost legal help.

In the answer form, you get to explain your side of the story and tell the court about any defenses you may have. You can also raise affirmative defenses — information the debt collector didn’t include in the lawsuit that could make them lose the case.

Upsolve’s 3 Steps To Take if a Debt Collector Sues You article further explains debt collection lawsuits and how to navigate them. It also gives examples of common affirmative defenses.

Note: Check with your court to see if they require you to fill out any additional paperwork, like a certificate of service. This is a form to verify that you’ve sent a copy of your response to the debt collector. Your court clerk can help you.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

After filling out your answer form, you need to file it with the court listed on your summons. You can almost always file the form in person at the court, but some courts also allow you to e-file your form or mail it in.

Each court has its own rules, so make sure you check your court’s website or ask the court clerk about your filing options. You might be able to find the information on your summons, as well.

Most courts require you to deliver a copy of your answer form to the person suing you (the debt collector). This can usually be done through the mail, preferably by certified mail, so you have a record of the mailing.

Let’s Summarize…

Central Portfolio Control is a third-party debt collection agency that collects consumer debts, mainly for banks and financial institutions. If CPC contacts you, they probably bought a debt that they believe you owe. Once you’ve validated the debt, figure out how much of the debt you can pay and negotiate a settlement offer with CPC. If they sue you because of unpaid debt, the most important thing you can do is respond to the lawsuit and take action. This is the best way to protect yourself and your finances!