How To Win Against MBA Law

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If MBA Law contacts you to collect a debt or tries to sue you for a debt, you have rights and can fight back. To start, have them validate the debt. If they can validate the debt but you disagree with it, you can dispute it. If the debt is valid and you agree that you owe it, you can pay it off in full or try to settle the account for less than what you owe. These negotiations are common with debt collectors like MBA Law. If MBA Law sues you, it’s best to respond quickly, or you risk losing the lawsuit and potentially having your paycheck garnished.

Written by Curtis Lee, JD. Legally reviewed by Jonathan Petts

Updated April 21, 2025

Table of Contents

Why Is MBA Law Contacting Me?

If MBA Law contacts you, it’s probably because they’re trying to collect a medical debt they believe you owe on behalf of the original creditor or lender.

MBA Law, also known as The Law Offices of Mitchell D. Bluhm and Associates, is a third-party debt collector that collects past-due medical bills. Unlike other third-party agencies, MBA Law doesn’t usually buy and own the debt account. A medical provider likely sold your debt to a debt collector, who then hired MBA Law to help them collect it.

To learn more, read Upsolve’s article How to Deal with MBA Law.

Do I Have To Pay MBA Law?

Maybe. This depends on whether MBA Law can validate the debt and if you can successfully dispute it. If MBA Law validates the debt, you recognize that you owe it, and it’s in the correct amount, you probably have to pay it. If you don’t pay a valid debt, your credit score is likely to drop and you risk being sued. If you lose the lawsuit, you risk having your wages or bank account garnished.

If you want to pay the debt to get MBA Law off your back but you can’t afford to pay the full amount, you can try negotiating with MBA Law to settle the debt for less than the full amount.

How To Negotiate a Debt Settlement With MBA Law in 3 Steps

The debt collection business is just that — a business. MBA Law wants you to pay them so they can get paid for successfully collecting the past-due account from you. This desire to get paid and close your account is why they may be willing to negotiate the debt.

MBA Law might reach out to you with a settlement offer, but you can act first, too. Going up against a debt collector may feel intimidating, but you’ll see it’s not as hard as you think once you know how it works.

Step 1: Make Sure the Debt Is Valid

Before you start negotiations, you need to validate the debt to confirm:

The debt is yours.

MBA Law has authorization to collect it.

The debt amount is correct.

Third-party debt collectors like MBA Law are required to send debt validation letters when they try to collect on a new account. The letter should notify you of your right to dispute the debt within 30 days, as well as explain how to dispute the debt. This is all according to a debt collection rule from the Consumer Financial Protection Bureau (CFPB), a federal agency that helps enforce consumer protection law.

Why do you need to validate a debt? When third-party debt agencies collect on behalf of another company, they sometimes get account information wrong or try to collect debts that have already been paid. Simply put, you don’t want to pay a debt you don’t actually owe. Validating ensures you don’t.

If MBA Law hasn’t sent you a debt validation letter or you want more information about the account, you can write and send them a debt verification letter.

Step 2: Figure Out What You Can Pay

If you’ve confirmed that the debt is valid, you can start to figure out how to pay it. Medical bills can be very expensive. If you’re struggling to pay your medical debt in full, you aren’t alone. Luckily, you can offer a debt settlement and try to negotiate down your medical bills.

But first, you need to calculate how much you can pay. Start by looking at your monthly paycheck and any other income sources. Then, subtract your regular expenses, like utility bills, housing payments, groceries, and other debt payments. This can give you a sense of how much you can realistically afford to pay toward the medical debt each month.

If you want help with this process, you can use the CFPB’s budget worksheet and debt worksheet. If this feels overwhelming, consider scheduling a free consultation with an accredited nonprofit credit counselor. They can help you with the budgeting process and explain all your debt-relief options.

Payment Plans vs. Lump-Sum Debt Repayment: Which Is Better?

The best debt repayment option is the one you can follow through on! That said, many debt collectors prefer a lump-sum payment and may be willing to negotiate your debt amount down further if you can pay it all off in one go. If this feels impossible, consider whether you’ll have extra income coming in through a tax return or work bonus. Or you could consider selling some items to try to earn some cash.

If it’s simply not possible for you to come up with a lump-sum payment, don’t fret. You can ask MBA Law to set up a monthly payment plan. They may be more willing to agree to this if you set up a direct withdrawal from your bank account. If you agree to go on a payment plan, make sure you can afford the monthly amount and that the repayment timeline feels reasonable to you.

Step 3: Make a Settlement Offer to MBA Law

Now that you know what you can afford to pay, it’s time to make an offer. As with any negotiation, your initial offer should be lower than what you ultimately hope to pay. Don’t be surprised if MBA Law counters your initial offer with a higher number. If it seems reasonable, you may want to accept it. If not, you can make a counter offer.

Though you can negotiate over the phone, it’s best to write these things down so you have a record of the agreement. Plus, negotiating in real-time on the phone can feel intimidating. Give yourself time to plan and think. You can use Upsolve’s sample debt settlement letter to get started.

Don’t Just Negotiate the Amount… Negotiate Everything!

Negotiating the settlement amount is key, but you can also negotiate other things.

As mentioned earlier, you can negotiate whether you pay off the debt in one lump sum or over time with a payment plan. You can also negotiate when the payments are due and how long the payment plan is.

Another important term you can negotiate is how MBA Law reports your account to the credit bureaus. By default, settled debts are often reported as “partial payment” or “settled.” But you can ask MBA Law to report the account as “paid in full.” This can help boost your credit score.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Yes, you can still negotiate a debt settlement even if you get sued. If you find yourself in this position, be sure not to ignore the lawsuit, though. You should still attend any court hearings and respond to any court filings until the case is officially closed or dismissed by the judge.

Tips for a Successful Debt Settlement

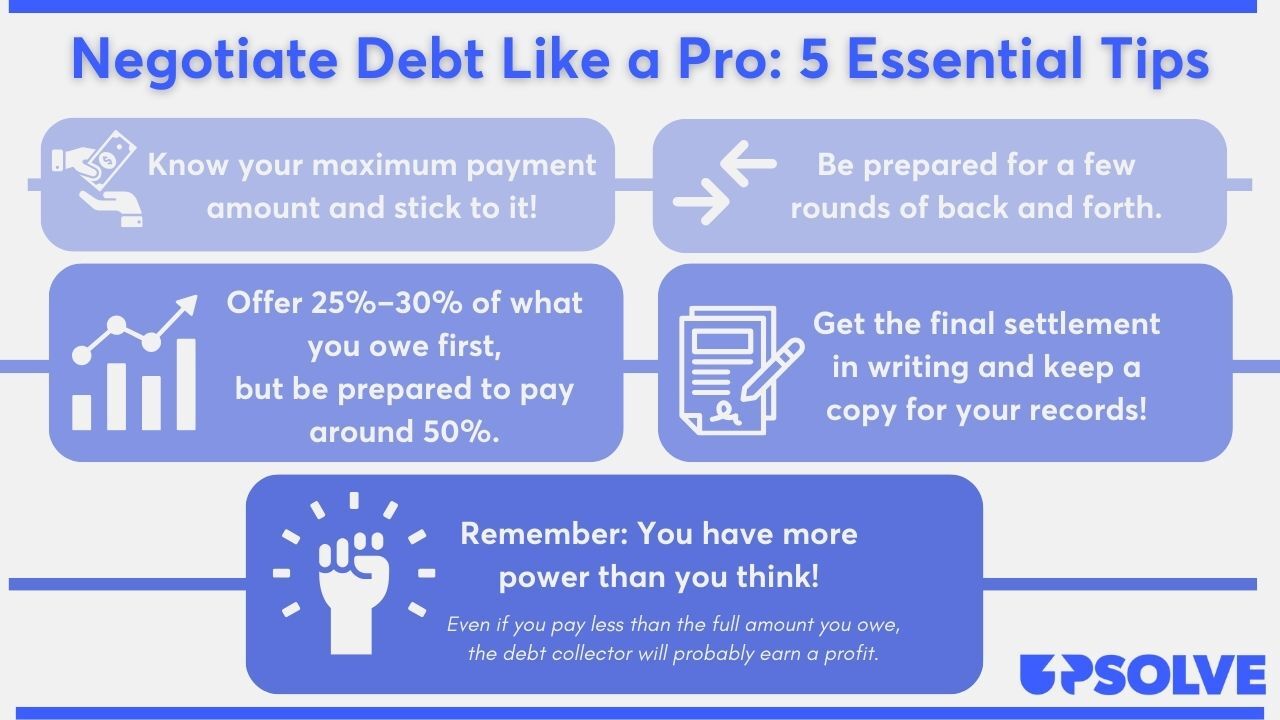

Here are some tips to help increase your chances of succeeding with your debt settlement negotiations and give you extra confidence during that process.

You can learn more tips and information about the negotiation process by reading Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat MBA Law in a Debt Lawsuit

Since MBA Law collects on behalf of other creditors, they’re unlikely to sue you. But the original company or another debt collection agency might.

If you get sued, you should be notified with two official documents: a summons and complaint. It’s important to respond to the summons. If you don’t respond to the lawsuit, you’ll probably lose. If this happens, the person suing you can get a court order to garnish your paycheck or freeze your bank account.

You don’t have to hire an attorney to respond to a lawsuit. Here are the basic steps to follow.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Step 1: Read the Summons and Complaint Carefully

If you get sued, you should receive a summons or a similar document notifying you of the lawsuit. Though these documents can vary a bit by court, they typically tell you:

The court’s name and address

The name and contact information of the plaintiff (the person suing you) and the defendant (you, or the person being sued)

A case or docket number

The date the court issued the summons

The date by which you need to respond or how many days you have to respond

The consequences if you don’t respond to the case

The summons is usually accompanied by a complaint form, which explains why you’re being sued. These reasons are usually listed as claims in numbered paragraphs. You’ll need this information to fill out your answer form, which is how you respond to the lawsuit.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

Many courts offer templated answers you can use if you are representing yourself (instead of hiring an attorney). You can usually find the form by going to the courthouse in person or looking online. To see if your court has a templated answer form you can use, Google “court forms” or “answer form” plus the court’s name. (You can find this on the summons.)

Many answer forms come with basic instructions, but if you still have questions, a court clerk can help. They can’t give you legal advice or tell you what you should write on the form, but they can explain what the form is asking and what the rules are for filing it.

You may need to explain your defenses in your answer form. To learn more about common defenses in debt collection lawsuits, read Upsolve’s article 3 Steps To Take if a Debt Collector Sues You.

Finally, some courts will require you to submit other forms, such as a certificate of service, alongside your answer form. The exact requirements depend on the court. For instance, some courts will include the certificate of service on the answer form. Read the court’s website or talk to a court clerk if you aren’t sure whether you need to fill out other forms.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

To respond to the lawsuit, you have to file your answer form with the court and serve or deliver a copy to the person suing you. Filing rules vary by court, but you can almost always file in person at the courthouse or send your answer via mail. It’s best to use certified mail if you mail your form.

It’s becoming more common for courts to accept forms via email or an efiling system on the court’s website. Don’t hesitate to ask the court clerk if you need help understanding your filing options.

Your final step is making sure the person suing you gets a copy of the answer form, too. This is typically called “service” or “process of service.” Often, you’ll have the choice to serve the forms by mail or deliver them in person to whoever is listed on the summons. Though it’s less common, some courts allow you to serve forms via email.

Let’s Summarize…

If MBA Law contacts you, they’re probably trying to collect a medical debt. If they haven’t already done so, ask them to validate the debt. It’s your right to file a dispute if you disagree with the debt validation details. If the debt is valid and you agree that you owe it, you can likely negotiate a debt settlement to pay less than the original debt amount. If you get sued, you can probably still negotiate a debt settlement, but it’s best to also respond to the lawsuit unless and until the court dismisses or closes the case.