How To Win Against Resurgent Capital Services

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If Resurgent Capital Services is reaching out to you, they’re likely trying to collect a debt. Before taking action or paying anything, make sure the debt they’re claiming you owe is valid. If it is, and you can’t afford to pay it, you can negotiate a debt settlement to pay less than you owe and settle the account for good. If Resurgent Capital Services sues you, respond immediately by filing an answer form. Read this article to learn how to win against a debt collector like Resurgent Capital Services.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated October 13, 2025

Table of Contents

- Why Is Resurgent Capital Services Contacting Me?

- Do I Have To Pay Resurgent Capital Services?

- How To Negotiate a Debt Settlement With Resurgent Capital Services in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Resurgent Capital Services in a Debt Lawsuit

- Let’s Summarize…

Why Is Resurgent Capital Services Contacting Me?

Resurgent Capital Services is a third-party debt collection agency that buys consumer debt from credit card companies, medical providers, banks, and others. If they are reaching out to you, they likely think you owe a debt to one of these companies and are looking to collect that debt.

Learn more about Resurgent Capital Services and what to do if they contact you by reading How to Deal With Resurgent Capital Services.

Do I Have To Pay Resurgent Capital Services?

If Resurgent Capital Services can validate your debt and the amount they’re claiming is accurate, you likely have to pay them. If the debt is legitimate and you don’t pay, you could face serious legal consequences like wage garnishment or a bank levy.

Even if you do have to pay Resurgent Capital Services, you may not have to pay the full debt amount if you can’t afford it. How? You can negotiate the debt and settle the account for less than the full amount.

How To Negotiate a Debt Settlement With Resurgent Capital Services in 3 Steps

Debt collection agencies, like Resurgent Capital Services, are businesses. Like any business, they want to make money. This drive for profit actually has an upside for you.

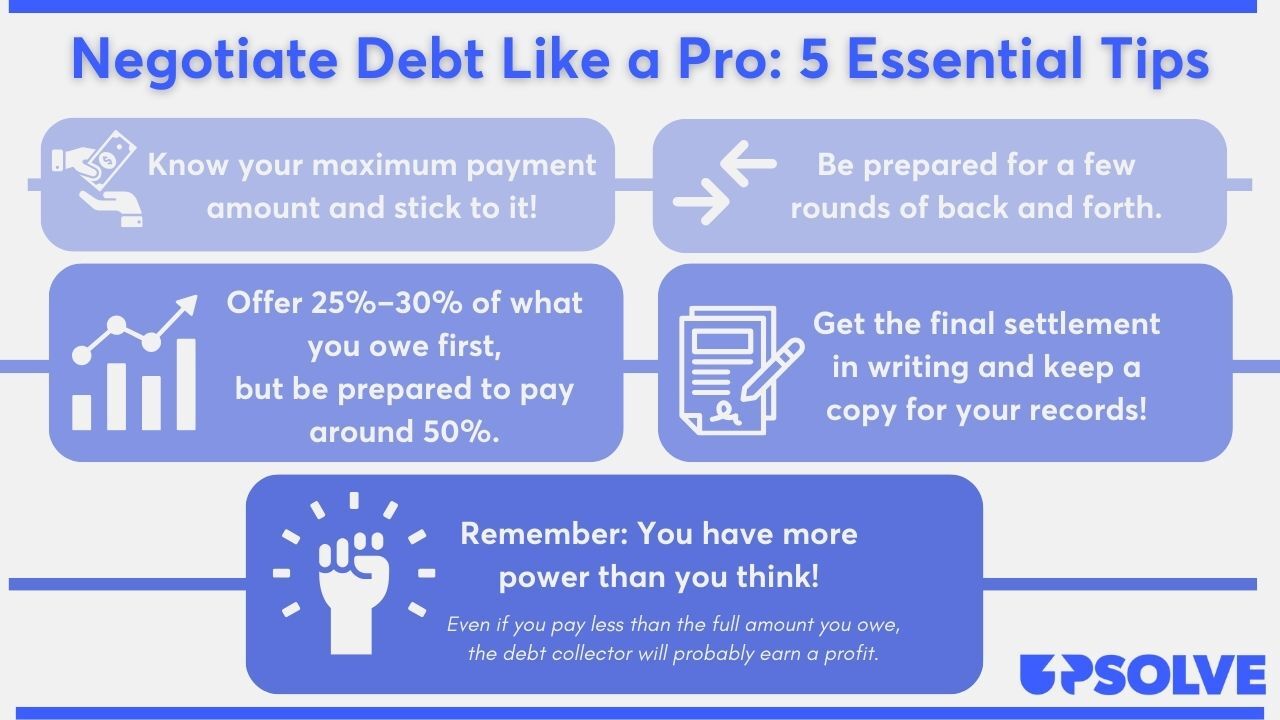

Since collectors buy debts for significantly less than they’re worth, they still make a profit even if they accept a lower amount than you owe. This is why it’s smart to start negotiations low, even as low as 25%, and be prepared for some back and forth. Debt collectors are typically willing to settle for 40%–60% of the original debt total.

Some debt collectors may approach you with a settlement offer, but you can also start the conversation. Don’t worry, debt settlements aren’t as intimidating as they may seem!

Let’s take a look at our three-step debt settlement negotiation process so you can learn to negotiate like a pro.

Step 1: Make Sure the Debt Is Valid

Thanks to a Consumer Financial Protection Bureau (CFPB) rule, debt collectors have to send you a debt validation letter before or within five days of first contacting you. They must also give you 30 days to dispute the debt.

Your debt validation letter needs to verify that:

The debt belongs to you

Resurgent Capital Services legitimately owns the debt or has authorization to collect it

The debt amount is accurate

If Resurgent Capital Services hasn’t sent you a debt validation letter, ask them for one right away. If they have sent one, read it thoroughly and verify all of the information with your own records. You may need to ask them for additional information if there is anything missing from your validation letter.

You can send a debt verification letter to request more information from Resurgent Capital Services.

Debt validation letters and debt verification letters may sound similar, but each has a distinct purpose.

Step 2: Figure Out What You Can Pay

If you’re not able to pay the entire debt (a lot of people can’t), figure out how much of the debt you can pay. To do this, take a look at your monthly expenses and your monthly take-home pay.

The CFPB has a great debt worksheet that can help you visualize your monthly expenses and debt obligations, like loans and mortgages. They also have a budgeting worksheet that can help you craft your new budget. If you need help with this process, you can get a free consultation with an accredited nonprofit credit counselor.

When repaying a debt collector, you basically have two options: a lump-sum payment and a payment plan.

Lump-Sum Payment vs Payment Plan: Which Is Better?

Debt collectors usually prefer a one-time lump-sum payment. You’ll probably get the best deal in a settlement if you can pay with a lump sum. This could be a good option for you if you're expecting a boost in income from a work bonus or tax return or if you have some savings you’re able to part with.

Many people don’t have extra money available, though. If that’s you, you can negotiate with Resurgent to repay the debt on a monthly payment plan. Try suggesting a plan with monthly payments you feel comfortable with and a timeline you feel confident in. To get a better deal, consider offering to set up an automatic withdrawal from your bank account for the monthly payments. This could also help persuade the debt collector to accept your payment plan offer!

Step 3: Make a Settlement Offer to Resurgent Capital Services

Now that you know how much of the debt you can pay, it’s time to make Resurgent Capital Services an offer. Don’t worry, making a settlement offer isn’t as scary as you might think!

You can make your offer in writing and ask for their reply in writing too, but it’s often best to do this over the phone. If you need help creating an offer letter, Upsolve’s Debt Settlement Letter template can guide you through the process.

Don’t Just Negotiate the Amount… Negotiate Everything!

You can negotiate more than just the debt amount! You can also negotiate how you repay the debt (lump-sum payment or a payment plan) and how Resurgent Capital Services reports your account to the credit bureaus.

Debt collectors can report your account to the major credit bureaus in one of three ways: “Paid in full,” “partial payment,” or “settled.” As part of the negotiation, ask Resurgent to report the account as “paid in full.” This can help boost your credit score.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Yes, most of the time, you can still negotiate a settlement even if you’re involved in a debt lawsuit. It’s still important to participate in the lawsuit by responding to the case and showing up for court appearances until the settlement is completed or the lawsuit is closed.

Tips for a Successful Debt Settlement

We know the negotiation process can feel really overwhelming. Let’s take a look at Upsolve’s top tips for negotiating a debt settlement:

For more tips on negotiating like a total pro, check out Upsovle’s 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Resurgent Capital Services in a Debt Lawsuit

It probably won’t be their first move, but Resurgent Capital Services can file a lawsuit against you. If they do sue you, you’ll know when you receive two official court documents called a summons and a complaint.

The most important thing you can do if you are sued is to respond to the lawsuit quickly. Otherwise, Resurgent Capital Services could garnish your wages or freeze your bank account.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped over 300,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

Try not to stress, responding to a lawsuit isn’t as complicated as you may think!

Step 1: Read the Summons and Complaint Carefully

Summons and complaints serve different purposes. A summons is a document that tells you you’re being sued and outlines the basics of the lawsuit. The information on your summons varies depending on your court, but typically a summons will include:

The court name and address

Your case number

The deadline for your response

The nature of the lawsuit

Information on all parties involved in the case

Most courts also send a complaint alongside a summons. A complaint lists the specific claims Resurgent Capital Services is making against you. It’s important for you to know the information in both the summons and complaint to fill out your answer form.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

Most courts have a blank answer form template you can use to respond to your lawsuit. Not every court provides one of these templates, but you can check your court’s website or Google your court’s name and the phrase “answer form” or “court forms.”

Even if they don’t provide an answer template, most courts detail at least brief instructions for filling out and filing an answer form on their website. They should also note any additional paperwork requirements on their website or on the answer form (if they provide one).

The answer form is your opportunity to bring up any reason why Resurgent Capital Services should not win the debt lawsuit. These reasons are called defenses or affirmative defenses.

If you’re confused about any aspect of the lawsuit process, you can always reach out to the court clerk and ask questions. A court clerk can’t give you legal advice, but they can help guide you through your filing.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

The answer form filing process varies by court. Most of the time, you can file in person at your courthouse, but some courts let you file online or even by mail. Your filing option should be outlined on your summons, but you can always check with your court.

You usually have to deliver a copy of your answer form to Resurgent Capital Services — this is called “serving” or “service of process.” You can almost always do this through the mail. Sending your copy via certified mail is a good move because you will get a receipt for your records.

Let’s Summarize…

If Resurgent Capital Services contacts you about a debt, first check that the debt is valid and real. If it is, you can start debt settlement negotiations. You’ll need to figure out how much of the debt you can pay and how you can pay (lump-sum payment or payment plan) before you start negotiations. Be ready for some back and forth. If Resurgent Capital Services files a lawsuit against you, respond by filing an answer form as soon as possible. Follow the requirements of the lawsuit, even if you’re negotiating a settlement, until your case is closed.