How To Win Against Revco Solutions

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If Revco Solutions tries to collect a debt from you, you have options and can fight back. The first thing you should do is have Revco Solutions validate the debt to confirm they have authorization to collect it. Then, verify that the debt is yours and the amount is correct. If you disagree with the debt, you can dispute it. If the debt’s details are correct, you can try to negotiate a settlement for less than what you owe. If Revco Solutions sues you, you can still negotiate the debt, but you must also respond to the summons and complaint. Otherwise, you risk them garnishing your paycheck or bank account.

Written by Curtis Lee, JD. Legally reviewed by Jonathan Petts

Updated May 8, 2025

Table of Contents

- Why Is Revco Solutions Contacting Me?

- Do I Have To Pay Revco Solutions?

- How To Negotiate a Debt Settlement With Revco Solutions in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Revco Solutions in a Debt Lawsuit

- Let’s Summarize…

Why Is Revco Solutions Contacting Me?

Revco Solutions is a third-party debt collection company. If they contact you, it’s probably because they’re trying to collect a debt from you relating to a past-due medical or utility bill.

A hospital, doctor’s office, or utility company most likely hired Revco Solutions to collect on their behalf. To learn more about why Revco Solutions is trying to collect the debt and not the original utility company or healthcare provider, read Upsolve’s How to Deal with Revco Solutions.

Do I Have To Pay Revco Solutions?

Probably, but only if they can validate the debt. To do this, they’ll have to confirm the amount, show that the debt is yours, and prove they have authorization to collect it.

If the debt is valid and you choose not to pay it, you could face serious consequences. Revco could sue you to get a court order to garnish your wages or bank account. Your credit score can also take a hit if you don’t pay the past-due debt.

But there’s good news here: You may not have to pay the debt in full to settle the account. You can try to negotiate a debt settlement to pay less than the full amount.

How To Negotiate a Debt Settlement With Revco Solutions in 3 Steps

If you’re successful in negotiating a debt settlement — yes, this does actually happen — you may only have to pay 40% to 60% of the original amount of your debt.

Negotiation is possible because third-party debt collectors like Revco Solutions get paid by taking a percentage of any money they can collect from you on behalf of their client. In other words, they’re often motivated to settle your account even if it’s not for the full amount. The sooner they settle your debt, the sooner they get paid.

Sometimes a debt collector will offer to settle the debt for less in the first letter they send, but don’t be afraid to start the negotiation process yourself. It’s not too difficult once you know how it works.

Step 1: Make Sure the Debt Is Valid

Before entering negotiations, first confirm the debt is valid. You have the right to do this because of a debt collection rule under the Consumer Financial Protection Bureau (CFPB). It states that third-party debt collectors like Revco Solutions must send you a validation letter and give you 30 days to dispute the debt.

If Revco Solutions sent you a debt validation letter, look it over and confirm all the information is correct. If they never sent you a debt validation letter or if you want to dispute the information in their letter, you can send them a debt verification letter.

It’s important to validate the details of the debt because debt collectors sometimes get information wrong. They may try to collect the wrong amount from you or try to collect a debt that’s not yours. You also want to ensure that Revco Solutions owns the debt or can legally collect the debt on behalf of its client. If you’ve done all this and you agree that you owe the debt, you can move on to the next step.

Step 2: Figure Out What You Can Pay

If you’ve validated the debt and want to negotiate the amount down, you’ll first need to figure out what you can afford to pay. Do this by calculating how much money you have left over each month after you pay your bills, taxes, and other expenses. If you need help, check out the CFPB’s monthly budget worksheet and debt worksheet. You can also look into getting a free consultation with an accredited nonprofit credit counselor who can help you with your personal budget and debt management.

When it comes to your settlement offer, you have two options: pay a lump sum or offer a payment plan. Debt collectors prefer to settle debts with a lump sum. It’s less time-consuming and quicker for them. Perhaps there’s an upcoming tax refund or holiday bonus you can use to pay the lump sum. Or you might have some personal property you can sell.

If you can’t afford a lump-sum payment, you’ll have to get clear on what monthly payment you realistically can afford and time period you feel comfortable with. Think of what else you can do to sweeten the pot: Revco Solutions may be more willing to approve a payment plan if you agree to set up an automatic direct withdrawal from your bank account.

Step 3: Make a Settlement Offer to Revco Solutions

As with any other negotiation, you should start with a number that’s lower than what you can afford. You can go as low as 25% of the original debt. If Revco Solutions accepts your offer, great! If not, don’t worry — some back and forth is normal. The final number you agree on will likely be more than what you initially offered but still a more manageable amount than the full debt.

Whatever agreement you reach with Revco Solutions should be in writing. If you aren’t sure where to start, check out Upsolve’s article Writing a Debt Settlement Offer Letterthat includes a template to get you started.

Don’t Just Negotiate the Amount… Negotiate Everything!

The most important part of the negotiation process is the amount you pay, but there are other things you can negotiate, too. For example, you can ask them to report your account as “paid in full” to the major credit reporting bureaus (Experian, TransUnion, or Equifax). Reporting the account as “paid in full” rather than “partial payment” or “settled” will be the best outcome for your credit score.

Another negotiating point is how much time you have to pay. If Revco isn’t willing to accept a lower amount, they might be open to providing more time to submit your lump-sum payment or a few more months to make monthly payments.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

In most cases, yes. Court cases rarely get to trial because they often settle, and debt collection lawsuits are no different. Plus, most debt collectors like the idea of getting paid without having to spend more time and money in court.

If you’re negotiating with a debt collector during a lawsuit, continue responding to court notices and appear in court when required. Plan to do this until the court closes or dismisses the case.

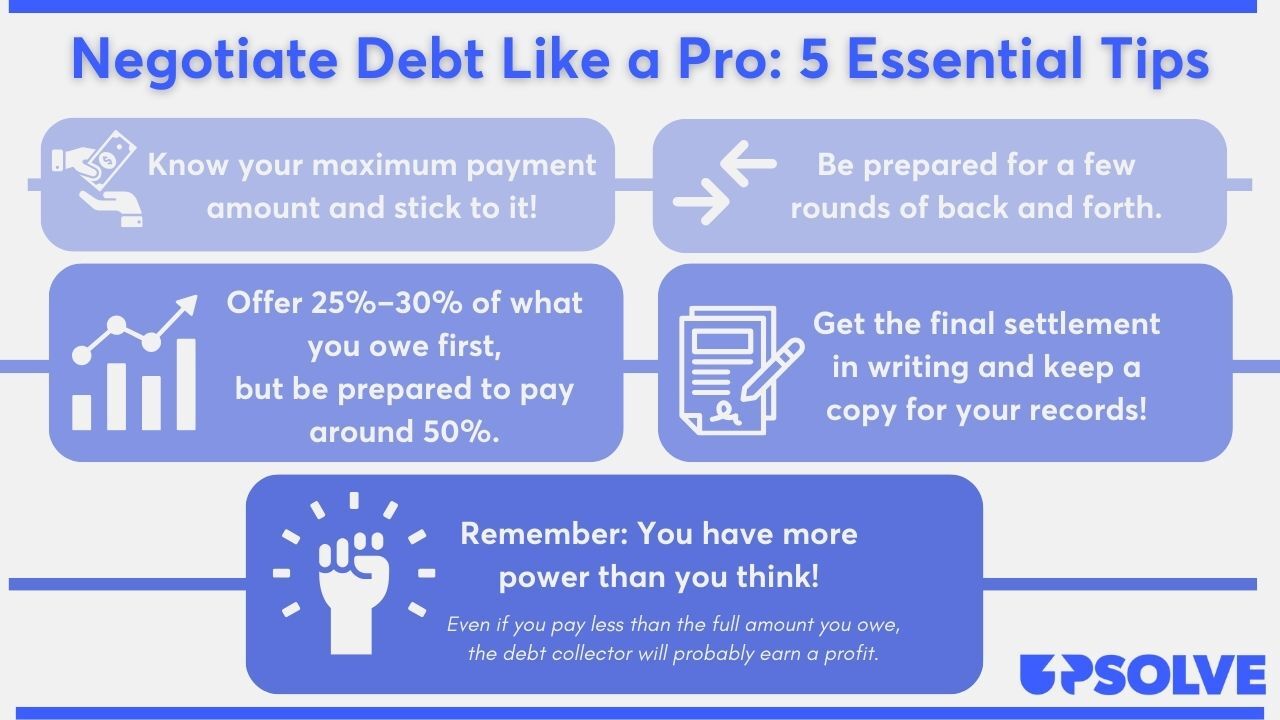

Tips for a Successful Debt Settlement

The following tips will help you make the most of your debt settlement negotiations:

For even more information and advice, read Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Revco Solutions in a Debt Lawsuit

If you get sued by Revco Solutions, you’ll need to respond to the court documents you receive notifying you of the lawsuit. In most cases, these documents will consist of a summons and complaint. Revco Solutions will probably send these documents in the mail or have someone deliver them to you in person.

If you don’t respond to the complaint, the judge will assume you don’t want to defend yourself, and the debt collector will probably win the case. Then, the judge can issue a court order that allows Revco to garnish your paycheck or bank account. Keep in mind that even if there’s a case pending against you, you can still negotiate an agreement to settle the debt.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Preparing and filing a response to a lawsuit may seem intimidating, but it’s often not as hard as you think. Let’s take a look at the basic steps for responding to the complaint.

Step 1: Read the Summons and Complaint Carefully

A summons is a court document that tells you you’re being sued. The exact information contained in the summons varies by court, but most have basic information about the case, including:

The court name and address

The name and contact information of the plaintiff (person suing you) and the defendant (the person being sued; you)

A case or docket number and date the court issued the summons

The signature and seal of the court

The type or nature of the lawsuit

Instructions for the defendant to respond to the lawsuit

A deadline or amount of time to respond to the lawsuit and consequences if this deadline is missed or ignored

The complaint document explains why you’re being sued. Complaints are typically arranged in numbered paragraphs. Each paragraph states a specific fact or claim against you.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

An answer form is your formal response to the plaintiff’s complaint. Many (but not all) courts will have a blank answer form that you can fill out to respond to the complaint. To see if your court has one, do an online search by entering in the court name on the summons and “court forms” or “answer form.”

If you find an answer form, it’ll normally come with some basic instructions. If you need clarification or have a question, the court clerk or employee can usually help. Just remember that while they can’t give you legal advice or tell you what facts or legal arguments to put on the answer, they can explain where to write them on the form.

If the answer form asks you to list your affirmative defenses, it’s important to do so. The court might not be willing to hear them later if the case progresses. You can learn more about defenses in Upsolve’ Article 3 Steps To Take if a Debt Collector Sues You.

You may also be required to complete other forms.These include things like a certificate of service or verification. Sometimes these will be part of the answer template the court provides. You can ask the court clerk or check the court’s website to see if you need to submit other forms alongside your answer form.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

After completing the forms, it’s time to file them with the court and serve copies to the plaintiff (the person suing you). The exact process to file your documents will depend on the court, but you can almost always do so in person at the courthouse. Many courts will also accept filings using other methods, such as e-filing or by mail. You’ll have to check with the court to confirm which methods they accept. This information may also be on the summons.

The process to serve (officially deliver documents to) the plaintiff also varies by court. You may be able to physically hand a copy of the documents to the plaintiff. This is called personal service.

Since this isn’t very convenient for most people, you can usually serve the plaintiff by mail instead. Note that some courts have specific rules for how to do this. For example, you may be required to use certified mail to confirm receipt. As with the filing process, you can get further instructions on how to serve the plaintiff from the court clerk or court website.

Let’s Summarize…

Finding out that Revco Solutions is trying to collect a debt from you can be a scary moment, but you can take action and fight them. Start by having them validate the debt is correct and yours. If the debt is valid, consider negotiating a debt settlement, so you can resolve the debt but pay less than the full amount. If Revco sues you, you can continue to try to settle the debt, but you still need to respond to the lawsuit. The response process varies by court, so check your court’s website or ask the court clerk for more information.