Can a Married Person File Taxes Without Their Spouse?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

A married couple filing income tax returns can choose to do so married filing jointly or married filing separately. In the past, the primary reason for filing separate tax returns was to shield one spouse from the tax liability of the other spouse. Couples filing separate returns paid much more in income taxes than couples filing joint returns. Today, with tax law changes, there are situations where filing separately can result in a lower combined tax burden.

Written by Lawyer John Coble. Legally reviewed by Jonathan Petts

Updated April 24, 2025

Table of Contents

A married couple filing income tax returns can choose to do so married filing jointly or married filing separately. To be considered married for tax purposes, the taxpayer's marital status must be married on the last day of the tax year, not the entire year. Single filers who have a qualifying person such as a dependent child can use head of household filing status. In the past, the primary reason for filing separate tax returns was to shield one spouse from the tax liability of the other spouse. Couples filing separate returns paid much more in income taxes than couples filing joint returns. Today, with tax law changes, there are situations where filing separately can result in a lower combined tax burden. Ben Franklin is credited with being the first person to say, "the only thing that's certain is death and taxes." He was wrong. With the way technology is changing, in a few decades death might not be certain. And, taxes change so often, they have never been certain. The one certainty is that you will always experience changes. A few months ago, could you have imagined a world where everyone wears face masks? With the calculations later in this article, a slight change in the tax law could render these calculations obsolete.

What Is "Married Filing Separately?"

When filing separately, the couple files two separate tax returns. A spouse puts their income, expenses, and deductions on one federal return. The other spouse puts their information on a completely different tax filing. When filing separately, if one spouse itemizes their deductions, the other spouse must do the same. This prevents the spouse that would prefer not to itemize from benefiting from a higher standard deduction. It is possible that, by filing separately, both spouses will be in lower tax brackets, thereby keeping their tax rates lower.

Why File Separately?

Some people file separately to insulate themselves from the potential tax liability of their spouse. Others file separate returns as opposed to filing joint returns because in rare cases, the amount of taxes due can be lower when filing separately.

Filing Separately to Avoid the Tax Liability of the Other Spouse

You may want to file separately from your spouse to protect yourself from the tax liability of your spouse. Small businesses and independent contractors are much more likely to fall behind on taxes than regular employees. If you work for a corporation that gives you a paycheck with your taxes already deducted, it's unlikely you will have significant problems with the tax authorities. Business owners and independent contractors have to pay the taxes themselves. A business owner may do this partly by paying themselves a regular tax deducted paycheck. Still, both business owners and independent contractors often need to pay estimated taxes. These people do not have someone else doing it for them. They have to do it themselves. When operating your own business, there isn't always enough money to pay all the bills on time. This tempts business owners to pay the tax authorities later. If the business fails, this leaves the business with a large tax liability. As a general rule, it's a good idea to file separately if you work in a stable job, but your spouse is trying to start a new business. Another situation where it's a good idea to file separately is if your spouse has a history of unpaid back taxes. You do not want to become entangled in your spouse’s tax problems.

Special Considerations in the Community Property States

Using married filing separately to protect you from your spouse's tax liabilities works well in the forty-one states that are common law states. The situation is different in the community property states. Federal law determines how property is taxed, but state law determines whether, and to what extent, a taxpayer has "property" or "rights to property" subject to taxation. Aquilino v. United States, 363 U.S. 509 (1960); Morgan v. Commissioner, 309 U.S. 78 (1940). So, federal taxes are assessed and collected based on your state-created rights and interests in property.

The nine community property states are Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin. Even within these states, there are some variations in how each state determines the property rights of married couples. As a general rule, any property, income, or debts incurred after the marriage is joint marital property and debts. For these reasons, liability protection by filing separately doesn't work well in community property states.

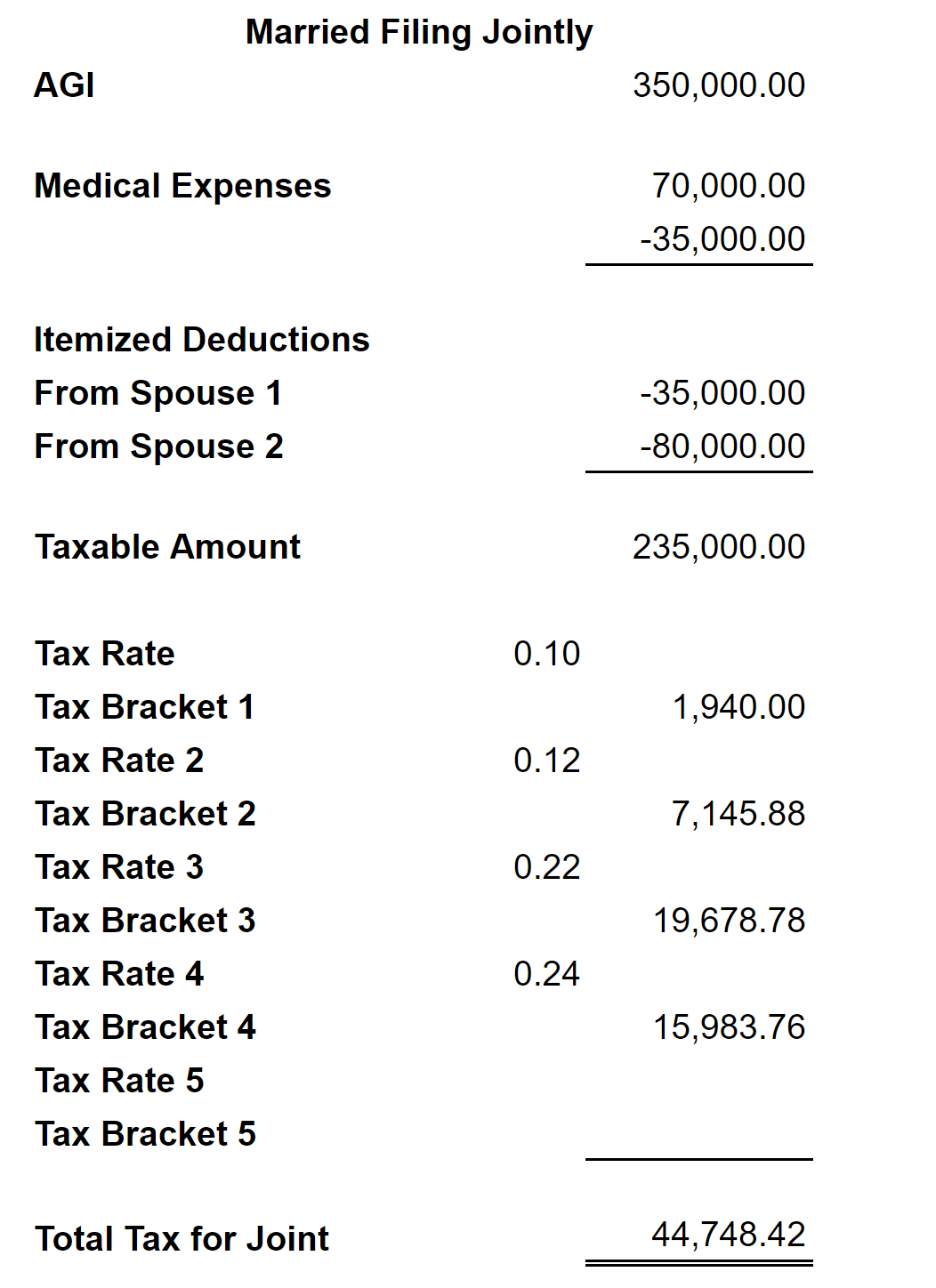

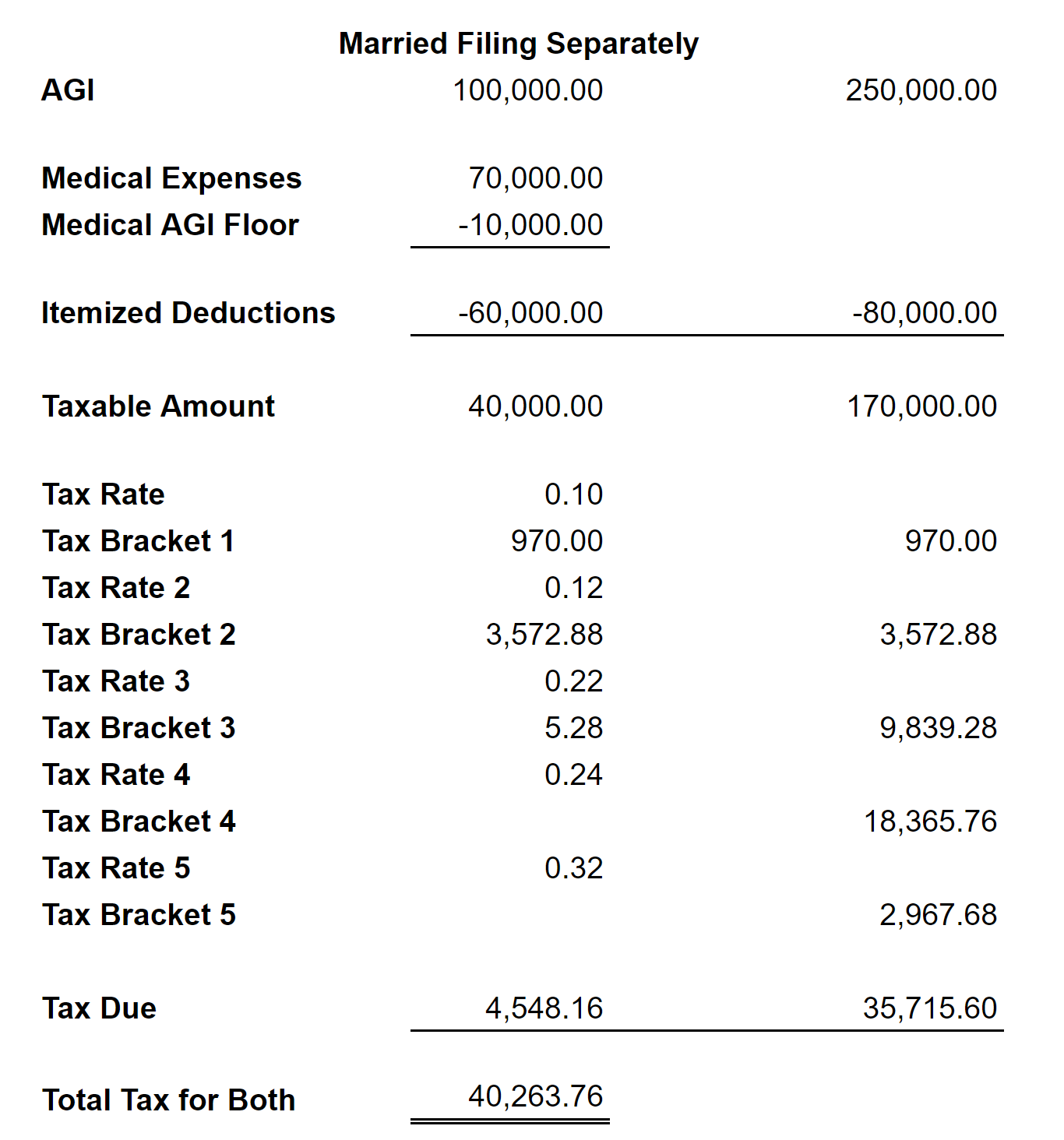

Situations Where the Tax Calculation Is Better if Filing Separately

Medical expenses and charitable deductions are the two main deductions that are limited by Adjusted Gross Income (AGI). For medical expenses, you're only able to deduct to the extent the expenses exceed 10% of your AGI. In the example below, consider a situation where one spouse has an AGI of $100,000.00 with medical expenses of $70,000.00. The other spouse has an AGI of $250,000.00 with total itemized deductions of $80,000.00. Remember if one spouse itemized, the other spouse may not take the standard deduction. The examples below show the spouse's taxes due for married filing separately compared to married filing jointly filing status.

As you can see, here, the spouses had tax savings due to filing separately. This is a rare case. Usually, the spouses would have done better by filing a joint return. In this case, the higher itemized deductions due to Spouse 1 filing separately was enough to tilt in favor of married filing separately. Even with high medical deductions available filing separately, the married filing jointly side was able to stay in a lower tax bracket. This is not always the case. You have to run the calculations on a case by case basis to see which method is better.

If you're using an income-based repayment plan to repay your student loans, it may be a good idea to use married filing separately. Your income for the determination of what your monthly payment will be is determined by your AGI on your tax return. You should have a lower AGI if you're filing separately as opposed to filing a joint tax return. A factor to consider when choosing an income-based repayment plan based on married filing separately AGI is that you will be paying much less over time. As a consequence, the amount of forgiveness for your loan will be higher when you complete the plan term. The amount of forgiven debt is income under the tax law. There is no exception for the forgiveness of debt from an income-based repayment plan for federally backed student loans. That is the law today. There's a good chance that by the time you complete an income-based repayment plan, that law will have changed. Again, one thing you can be certain of in life and especially in tax law, is that things will change.

The Bad Effects of Filing Separately

Usually, a couple will pay more in taxes by filing separately. One reason is the way the tax brackets are set when filing separately, it's much easier for one spouse to reach the higher tax brackets. Another problem is that if you choose married filing separately status is that you lose or limit a lot of potential tax breaks such as tax deductions, credits, or exclusions. These include the child tax credit, the adoption credit which covers adoption expenses, the Earned Income Tax Credit, tax-free exclusion of U.S. bond interest, tax-free exclusion of Social Security benefits, the credit for the elderly and disabled, the deduction for college tuition expenses, the student loan interest deduction, the American Opportunity Credit and Lifetime Learning Credit for higher education expenses (now includes the HOPE Credit), the deduction of net capital losses, traditional IRA deductions, and Roth IRA contributions. Losing these tax benefits is very hard on most taxpayers. While your ability to contribute to IRAs isn't completely lost, it is severely curtailed - especially with Roth IRAs.

Losing some of these credits is not something to take lightly. The Child and Dependent Care Credit is up to $6,000.00 for married filing jointly taxpayers. It's $0.00 if you file separately. The American Opportunity Tax Credit (AOTC) allows a maximum annual credit of $2,500 per eligible student. If you are married filing separately and have eligible dependents or would be eligible yourself, your credit is $0.00. On top of that, the AOTC is a refundable tax credit. This means, if the credit drops your tax liability down to zero, the IRS will send you money. This paid refund is limited to $1,000.00 though. Another refundable tax credit that doesn't have this $1,000.00 limitation is the Earned Income Credit. Married filing separately status bars you from claiming the Earned Income Credit.

Conclusion

You lose a lot when you choose married filing separately when filing your tax return. Yet, in some rare situations, it is the best choice. In some cases, the federal income tax isn't the only issue to consider when filing taxes. There may be aspects of your state's tax law that could tip the balance in favor of or against married filing separately. To file separately or jointly, you must be married on the last day of the tax year. If you do not meet this requirement, you still may be able to benefit from filing as head of household. Determining which filing status to choose requires careful consideration. Often, due to the changing nature of tax law along with the complexity of tax law, it's a good idea to consult with a tax professional. Their full-time job is to keep up with the tax law. Most often, this will be a Certified Public Accountant (CPA). In the most complex cases where there are large amounts of money involved, it may be a good idea to consult with a tax attorney. Many tax attorneys have a second law degree in taxation and are also CPAs. In situations where tax troubles have already arisen due to failure to pay taxes by a spouse, it's a good idea to contact an attorney specializing in tax resolution or an enrolled agent to negotiate with the IRS. Last, there are cases where taxes can be discharged in bankruptcy. Consult with an experienced bankruptcy attorney if this looks like a good option.