Your Guide to Oklahoma’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you live in Oklahoma, your best line of protection against unfair debt collectors is the Fair Debt Collection Practices Act (FDCPA). This is a federal consumer protection law. Oklahoma hasn’t passed any state-specific debt collection laws to protect its residents. The statute of limitations for written debt contracts — including medical debt and credit card debt — is four years in Oklahoma.

Written by Jonathan Petts. Legally reviewed by Ben Jackson

Updated May 22, 2025

Table of Contents

What Are the Debt Collection Laws in Oklahoma?

Oklahoma doesn’t have any state laws regulating third-party debt collectors or original creditors. However, Oklahoma residents are still protected by the federal Fair Debt Collection Practices Act (FDCPA) and related regulations.

The FDCPA is the best protection against unfair debt collectors for Oklahoma residents. This federal law protects consumers from harassment and abusive debt collection practices. Everyone in Oklahoma is protected under the FDCPA.

Here’s an overview of the law:

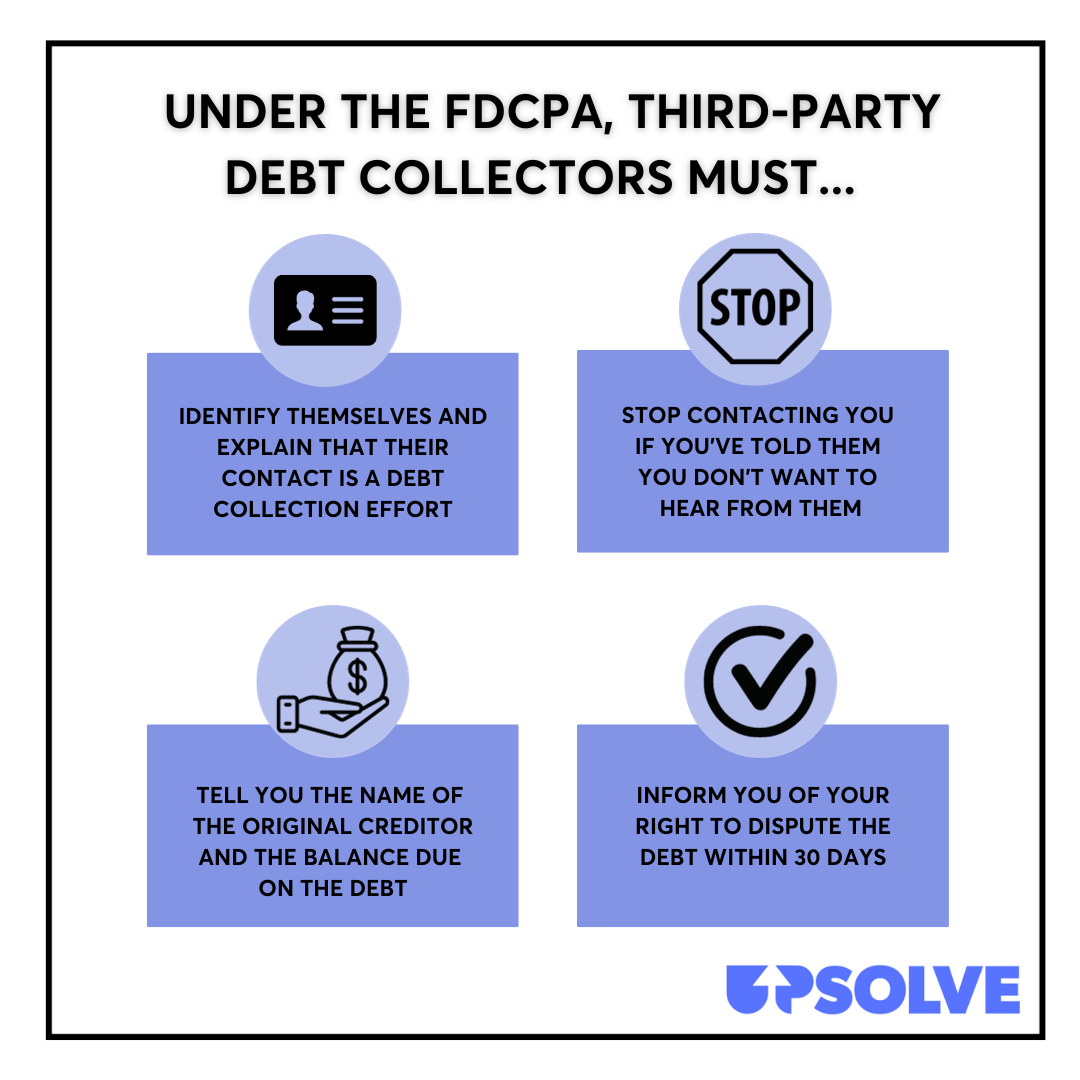

The main purpose of the FDCPA is to protect consumers against third-party debt collectors. It also outlines certain responsibilities debt collectors have to you, including:

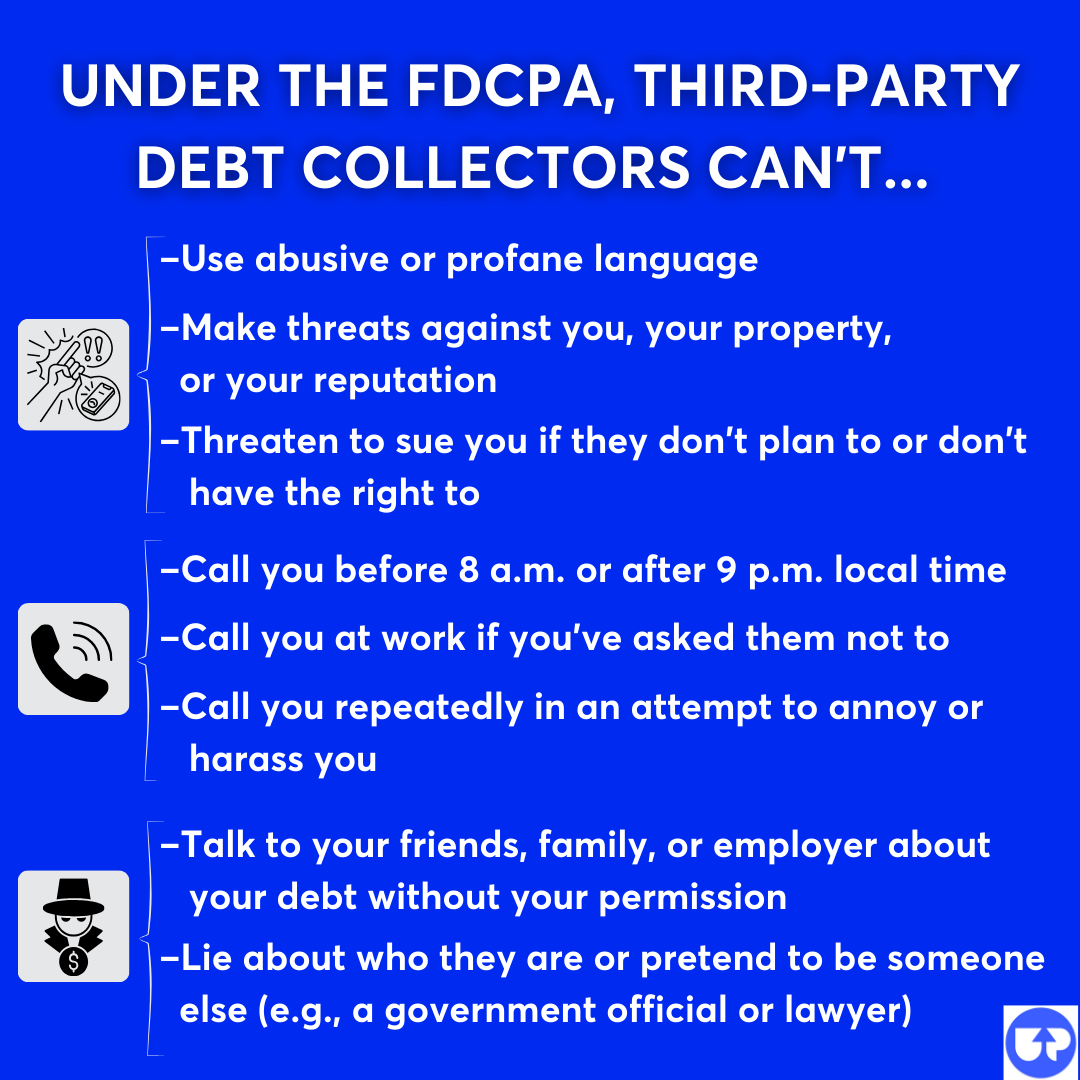

The FDCPA also outlines what third-party debt collectors can’t do:

What Can You Do if a Debt Collector Breaks the Law in Oklahoma?

If you think a debt collector has violated the FDCPA, you can report them to the Federal Trade Commission (FTC) or the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal government agency that protects you by helping to enforce the FDCPA and penalize debt collectors who break the law by using unfair collection practices.

You can also contact the Oklahoma state attorney general if you believe a debt collector has broken the law.

Also, you can sue debt collectors for FDCPA violations. Instead of filing in state or local court, you file your lawsuit in a federal court. If you win the lawsuit, the collector could be required to pay actual damages (the amount of money you’ve lost).

What Is the Statute of Limitations for Debt Collection in Oklahoma?

The statute of limitations for written debt contracts in Oklahoma is four years. This includes installment contracts, medical debt, and open-ended accounts like credit cards and contracts for secured debts. The statute of limitations for unwritten, oral, or implied contracts in Oklahoma is three years.

In most cases, the statute of limitations “clock” starts on the date of the last payment made on the debt in question. Making a payment — or a written promise to pay — can restart the statute of limitations, so be careful about what you say to debt collectors who are calling or writing about older debts. To learn more, read Upsolve’s article What To Do if You’re Contacted About an Old Debt.

What Can Debt Collectors Do To Collect Debt in Oklahoma?

It’s important to know what debt collectors legally can do so you can protect yourself. Debt collectors will start with phone calls and written notices and escalate their efforts over time. Eventually, you may be sued in court, which opens up routes to serious collection measures. For example, in Oklahoma debt collectors can eventually garnish your wages and repossess your property (typically your car).

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped over 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Debt Collectors Can Garnish Your Wages (With a Court Order)

Debt collectors can take you to court for an unpaid debt. If you get sued by a collection agency and lose, the judge will issue a court order called a judgment to the collector. This allows the debt collector to get an order for wage garnishment, a bank levy, or a property lien. Of these, wage garnishment orders are the most common. Oklahoma state law does limit how much a debt collector or creditor can take from your paycheck.

Debt Collectors Can Repossess Your Car

If you don’t make your car payments on time, the lender can legally repossess the vehicle, and they aren’t required to give you prior notice. They also don’t need a court order to take your vehicle. If you default on your auto loan, you’re at risk of repossession. This could happen after only one missed payment, so it’s important to review your auto loan contract to understand your terms.

Need Help With Debt Relief? Here Are Some Options

If you are in debt, you may feel like it’s an uphill climb to get your finances back on track. It can be hard to know where to start in this stressful situation. Please know it’s completely normal to feel overwhelmed. If you’re not sure where to start, you may want to consider scheduling a free consumer credit counseling session.

Meeting with an accredited nonprofit credit counselor can give you personalized insight into how to tackle your debt and where to start your journey. A counselor might suggest a debt management plan, debt consolidation, or even bankruptcy.

Bankruptcy is a powerful legal tool that gives you the power to reclaim your finances. If your debt has become unmanageable and you’re looking for a fresh start, filing bankruptcy might be the right option for you. Filing bankruptcy also stops all collection efforts immediately, including any wage garnishment orders against you.

If you decide to file Chapter 7 bankruptcy, you can see if you’re eligible to use Upsolve’s free online filing tool. It walks you through the Chapter 7 process so you can empower yourself and file on your own, with our guidance.

Looking for Legal Help?

If you’re dealing with a debt collection lawsuit or you just want to learn more about the debt collection laws in your state, the resources below can help you! Here are a few Oklahoma-specific legal organizations working to cater to OK residents facing legal issues:

Legal Aid Services of Oklahoma provides free legal services to eligible low-income OK residents.

OKLegalConnect.org is an online hub with links to legal aid programs and organizations across the state.

OKLaw.org has self-help guides and resources online.

Oklahoma Bar Association Legal Resources has lists of online resources, clinics, and low- or no-cost legal assistance providers across the state.

Community Action Agency of Oklahoma City provides legal assistance to low-income residents of Oklahoma City as well as Canadian and Oklahoma Counties.