Your Guide to Tennessee Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

When it comes to debt collection, Tennesseans are primarily protected by the federal Fair Debt Collection Practices Act (FDCPA). That said, Tennessee’s Consumer Protection Act does provide some consumer protections against misconduct that aren’t specifically outlined in the FDCPA. The Tennessee Consumer Protection Act also requires third-party debt collectors and debt buyers to register with the Tennessee Collection Service Board. The statute of limitations for medical debt and credit card debt is six years in Tennessee.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated May 22, 2025

Table of Contents

What Are the Debt Collection Laws in Tennessee?

Tennessee doesn’t have a specific debt collection law. However, the Tennessee Consumer Protection Act (TCPA) is a general consumer protection statute that can be applied to debt collection since it prohibits acts or practices that are deceptive to consumers. If you live in Tennessee, you’re also protected by the federal Fair Debt Collection Practices Act (FDCPA).

How does the TCPA Protect People in Tennessee?

The TCPA protects consumers against misconduct that isn’t specifically addressed in federal laws. It also requires third-party debt collectors and debt buyers to register with the state.

The TCPA may apply to original creditors and third-party collectors. To be protected by this act in a debt collection lawsuit, the collection activity must prove to be unfair or deceptive, and it must be based on a consumer transaction.

Under the TCPA, third-party debt collectors and debt buyers have to register with the Tennessee Collection Services Board. This requirement doesn’t apply to collection attorneys, “passive” debt buyers, or original creditors — unless the original creditor attempts to collect from you under a fake name.

You can go to the Tennessee Collection Service Board’s website to verify whether a debt collector is properly licensed. If a debt collector is not properly licensed, you can file a complaint with the state Collection Services Board.

How Does the FDCPA Help Tennesseans?

This Tennessee act works alongside the Fair Debt Collection Practices Act (FDCPA). The FDCPA is a federal law that protects consumers from harassment and abusive debt collection practices. Every citizen in Tennessee is protected under the FDCPA.

Here’s an overview of the law:

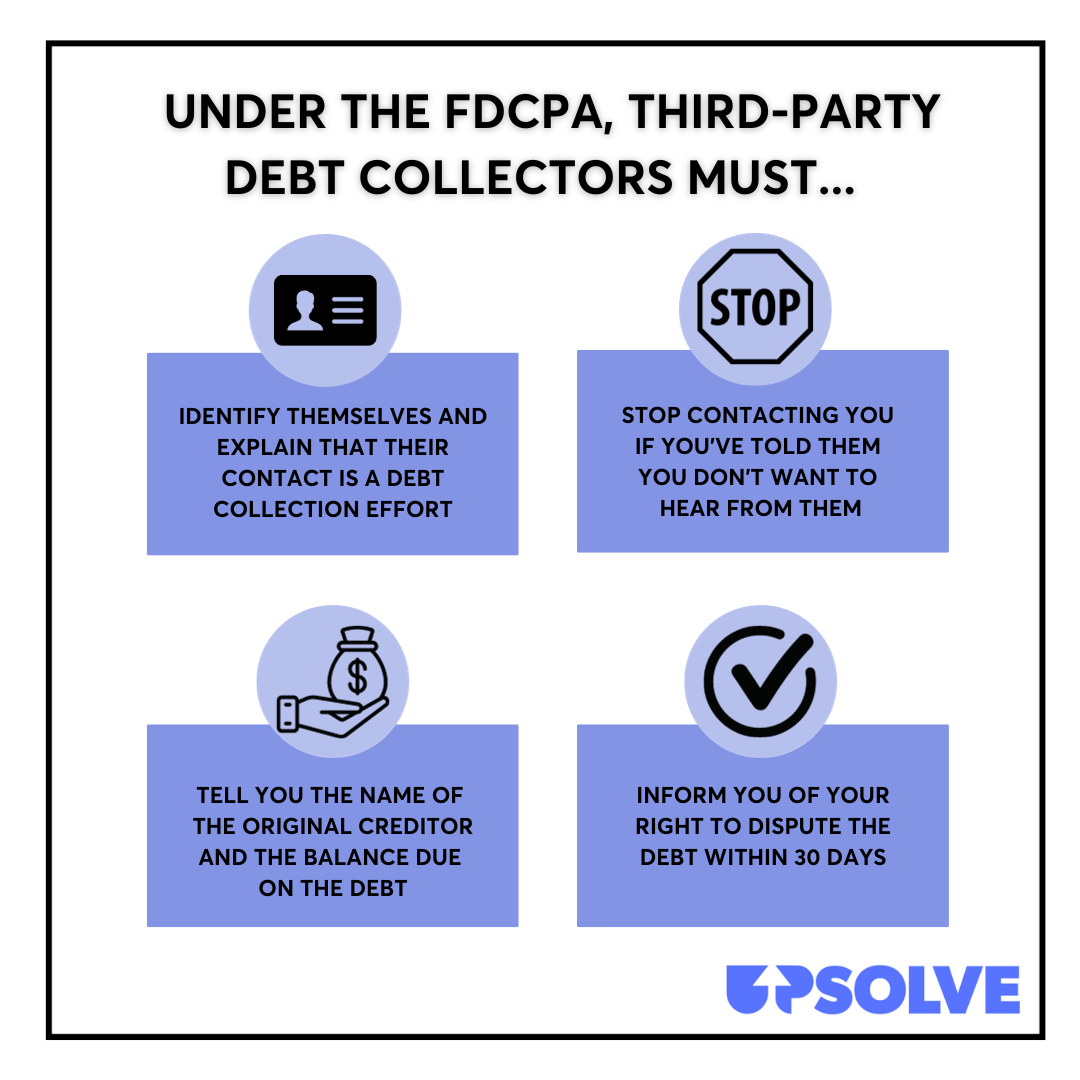

The main purpose of the FDCPA is to protect consumers against third-party debt collectors. It also outlines certain responsibilities debt collectors have to you, including:

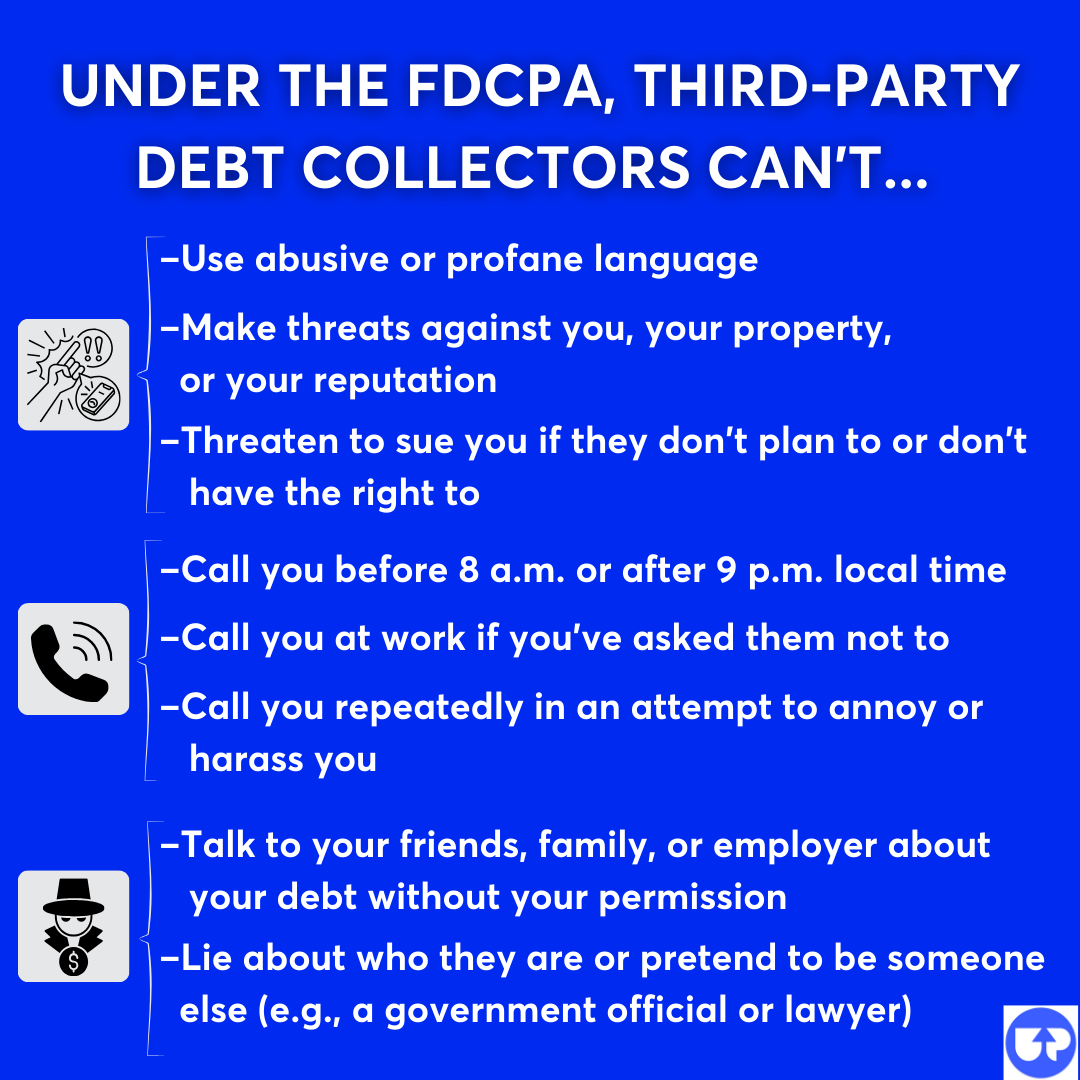

The FDCPA also outlines what third-party debt collectors can’t do:

What Can You Do if a Debt Collector Breaks the Law in Tennessee?

If you believe a debt collector has violated the Tennessee Consumer Protection Act, you can file a complaint with the Tennessee Attorney General. You can also sue debt collectors in state court. To sue, the debt collector must have knowingly deceived you. If you win the lawsuit, you’re eligible for up to three times your actual damages (financial harm or loss you incurred). You can also be awarded court costs and attorney fees.

If you think a debt collector has violated the FDCPA, you can report them to the Consumer Financial Protection Bureau (CFPB). You can also sue debt collectors in federal court for FDCPA violations. If you win, you may receive actual damages plus up to $1,000, in addition to court costs and attorney fees.

What Is the Statute of Limitations for Debt Collection in Tennessee?

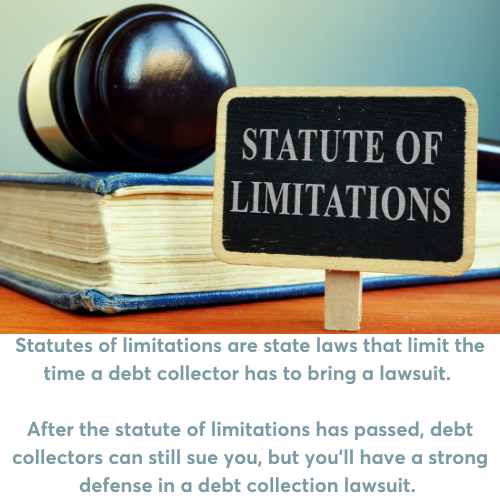

The statute of limitations for oral and written contracts in Tennessee is six years. This includes medical debt and open accounts like credit cards.

In most cases, the statute of limitations “clock” starts on the date of the last payment made on the debt. For installment notes — such as fixed loans — the “clock” starts on the due date of the installment, not when payment is missed. This means each installment payment has its own statute of limitations that starts running on the installment due date.

Be careful about what you say to debt collectors who are calling about older debts. To learn more, read Upsolve’s article What To Do if You’re Contacted About an Old Debt.

What Can Debt Collectors Do To Collect Debt in Tennessee?

It’s important to know what debt collectors legally can do so you can protect yourself. Debt collectors will start with phone calls and written notices and escalate their efforts from there. Eventually, you may be sued in court, which opens up routes to serious collection measures. In Tennessee, debt collectors can eventually garnish your wages and repossess your property (typically your car).

If you do get sued, don't panic. You may be able to respond on your own and avoid wage garnishment. SoloSuit, an Upsolve partner, helps you draft and file a response to the lawsuit and has helped over 280,000 people handle debt lawsuits. They offer a money-back guarantee if your documents aren’t accepted by the court.

Debt Collectors Can Garnish Your Wages (With a Court Order)

Debt collectors can take you to court for an unpaid debt. If you get sued by a collection agency and lose, the debt collector can get a court order for wage garnishment, a bank levy, or a property lien. Of these, wage garnishment orders are the most common. Tennessee state law does limit how much a debt collector or creditor can take from your paycheck.

Debt Collectors Can Repossess Your Car

If you don’t make your car payments on time, the lender can legally repossess the vehicle. They don’t need to give you prior notice or get a court order to take your vehicle. If you default on your auto loan, you’re at risk of repossession. This could happen after only one missed payment. Review your auto loan contract to make sure you understand the terms of your specific contract.

Need Help With Debt Relief? Here Are Some Options

Being in debt is stressful. Sometimes it can feel hard to find the time or energy to get back on track. In this case, consider getting some (free) help. A good place to start is by scheduling a free consumer credit counseling session.

Meeting with an accredited nonprofit credit counselor can give you personalized insight into how to tackle your debt. A counselor might suggest a debt management plan, debt consolidation, or even bankruptcy.

Bankruptcy is a powerful legal tool that gives you a fresh start. If your debt has become unmanageable and you don’t see a way out, see if filing bankruptcy is the right option for you. One advantage of bankruptcy is that as soon as you file, all collection efforts against you must stop. This includes wage garnishment orders against you.

If you decide to file Chapter 7 bankruptcy, you can see if you’re eligible to use Upsolve’s free online filing tool.

Looking for Legal Help?

If you’re dealing with a debt collection lawsuit, or you just want to learn more about the debt collection laws in your state, the resources below can help you! Here are a few Tennessee-specific legal organizations working to cater to Tennessee residents facing legal issues:

Help4TN has online self-help guides and a toll-free telephone hotline at 888-HELP4TN (888-395-9297).

TN Free Legal Answers is a virtual legal clinic where volunteer attorneys answer your legal questions via email or chat.

Tennessee Access to Justice Initiative has online self-help resources and referrals to local legal aid providers across the state.

Memphis Area Legal Services has online resources and referrals serving residents of Shelby, Tipton, Fayette, and Lauderdale counties.

West Tennessee Legal Services has online resources and referrals serving 17 counties in West Tennessee.

Legal Aid Society of Middle Tennessee & the Cumberlands has online resources and referrals serving 48 counties across Middle Tennessee.

Legal Aid of East Tennessee has online resources and referrals serving 26 counties in East Tennessee.