Can You Get Student Loan Forgiveness if You Drop Out?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Most people go to college with hopes of getting a degree and creating a good life for themselves. Unfortunately, unforeseen hardships — often financial — lead many students to drop out before they finish their degree. If that’s you, know that you have options to deal with your student loan debt! You may still qualify for student loan forgiveness programs like Public Service Loan Forgiveness (PSLF), or loan forgiveness after paying on an income-based repayment plan. If you need a temporary repayment pause while you find work or figure out your next steps, you can apply for forbearance or deferment.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated January 30, 2025

Table of Contents

- What Happens to Your Student Loan Debt if You Drop Out?

- Can a Federal Student Loan Forgiveness Program Help Me With My Student Loan Debt?

- Other Ways To Deal With Student Loan Debt After Dropping Out

- How Can Deferment and Forbearance Help Me With My Federal Student Loan Debt?

- The Dangers of Default: Why You Need To Face Your Student Loan Debt Head On

- I Dropped Out of School and Can't Make My Student Loan Payments. What Can I Do?

Even with financial aid, higher education is expensive! Almost 50 million Americans have student loan debt. Many borrowers take on this debt assuming they’ll finish college and get a degree that will help them net higher earnings. But many people drop out before they receive a college degree.

By some estimates, as many as one-third of all college students drop out. If you find yourself in this position, you may be wondering if you have any special options to deal with student debt or make your monthly payments. Here’s what you need to know.

What Happens to Your Student Loan Debt if You Drop Out?

Unfortunately, when you leave or drop out of college, you don’t leave your student loan debt behind. You’ll be responsible for repaying your federal student loans after a six-month grace period after you leave school (whether you drop out or graduate) or if you drop below half-time enrollment.

If you have private student loans, you may have to begin repayment while you’re still in school. If not, repayment may kick in immediately after you leave school or on some other timeline set by the lender. Private loan agreements can vary widely, so check your loan agreement or ask your lender about when you’re expected to begin repaying your loans after you leave school.

What Is a Grace Period?

Whether you drop out or graduate, leaving school triggers federal student loan repayment. But your payments usually aren’t due right away because most federal student loans have a built-in six-month grace period. The grace period allows you time to get a job and/or get your finances in order before mandatory repayment starts.

For most federal student loans, the grace period is six months. But, there are exceptions. For instance, federal Perkins Loans have a nine-month grace period. Private student loans may or may not offer a grace period. Again, you’ll have to consult with your lender or read your loan agreement to see when repayment begins.

What You Need To Know About Grace Periods and Student Loan Interest

While a grace period gives you time to start earning money, your loan will be accruing interest during that time. Typically, this interest is added to the loan balance. That means that when you start making payments after six or nine months, you’ll owe more than you did when you left school. To save some money in the long run, you can make interest-only payments during the grace period.

Can a Federal Student Loan Forgiveness Program Help Me With My Student Loan Debt?

The Department of Education offers several student loan forgiveness programs. You may qualify for these programs even if you didn’t graduate. The most popular and widely known forgiveness program is the Public Service Loan Forgiveness program, better known by its acronym PSLF.

Even if You Drop Out, You May Qualify for the Public Service Loan Forgiveness Program

Whether you finish college or not, if you work for a qualifying employer and meet the other program requirements, you can get PSLF. Generally, any full-time work with a governmental agency or 501(c)(3) nonprofit qualifies. You may also be able to combine multiple qualifying part-time jobs to meet the full-time requirement.

To qualify for PSLF, you must make 120 qualifying payments (usually over 10 years). You also have to submit documentation along the way.

To learn more, read our Comprehensive Guide to the PSLF Program.

Other Ways To Deal With Student Loan Debt After Dropping Out

Managing student loan debt can be difficult whether you graduate or not. But if you drop out and you’re feeling pinched financially, you may have other challenges to deal with as well. Luckily, you still have options! The important thing is not to ignore your debt or monthly payments. If you do, you risk defaulting on your debt, which can lead to serious consequences, including having your tax refund withheld.

If you can’t afford to pay anything toward your student loans right now: Consider applying for deferment or forbearance. Both programs give borrowers a temporary payment pause (up to one year, but you can apply to extend it).

If you can afford to make a monthly payment: Consider getting on an income-driven repayment plan or do research to see what your best repayment option is.

How Can Deferment and Forbearance Help Me With My Federal Student Loan Debt?

Repayment can be especially difficult for those who leave school without a bachelor’s degree. It can be tough to quickly find a job that pays enough to cover living expenses and student loan payments. If this feels familiar and you’re a federal student loan borrower, check out your deferment and forbearance options.

Student loan deferment and forbearance both give borrowers a temporary reprieve from making monthly payments. Though there is some overlap, eligibility requirements vary a bit between the two. Also, interest is treated differently in deferment vs. forbearance.

Note that deferment and forbearance are federal programs. If you have private student loans, you’ll need to consult with your lender to see if you have any options to help with repayment if you’re struggling.

Deferment vs. Forbearance: Eligibility and Accrued Interest

If you’re experiencing economic hardship, you may qualify for deferment. There are several other qualifying events, too. Check out the full list on StudentAid.gov.

There are two types of forbearance: general and mandatory. This means there are several ways to qualify for forbearance, including financial hardship, loss of income, and medical expenses. General forbearances are discretionary, which means that anything your student loan servicer thinks is a good reason can qualify you.

While either type of temporary reprieve can give you some financial relief, make sure you know how interest works during this time.

If you have subsidized federal student loans, you won’t be responsible for paying the accrued interest during deferment. The federal government will pay it for you.

If your loans aren’t subsidized, you may be responsible for accrued interest during deferment.

If you are granted forbearance, you’ll be responsible for paying the accrued interest regardless of what kind of federal loan you have.

Though you don’t have to make interest payments during deferment or forbearance, doing so can lower the total amount you pay in loans over time.

How To Choose the Best Student Loan Repayment Plan for Your Student Loan Debt

The six-month grace period and a temporary reprieve from deferment or forbearance can give you some breathing room, but you’ll eventually need to start repaying your student loans. Fortunately, you have many repayment options.

Struggling Financially? Look Into Income-Driven Repayment Options

If you’re a low-income borrower who’s already struggling to make ends meet, start by looking at income-driven repayment plans. These plans look at your income and household size to determine your monthly payment. They usually result in a lower monthly payment than the Standard Repayment Plan (SRP). You’ll be put on the SRP by default when you leave school unless you make a different choice.

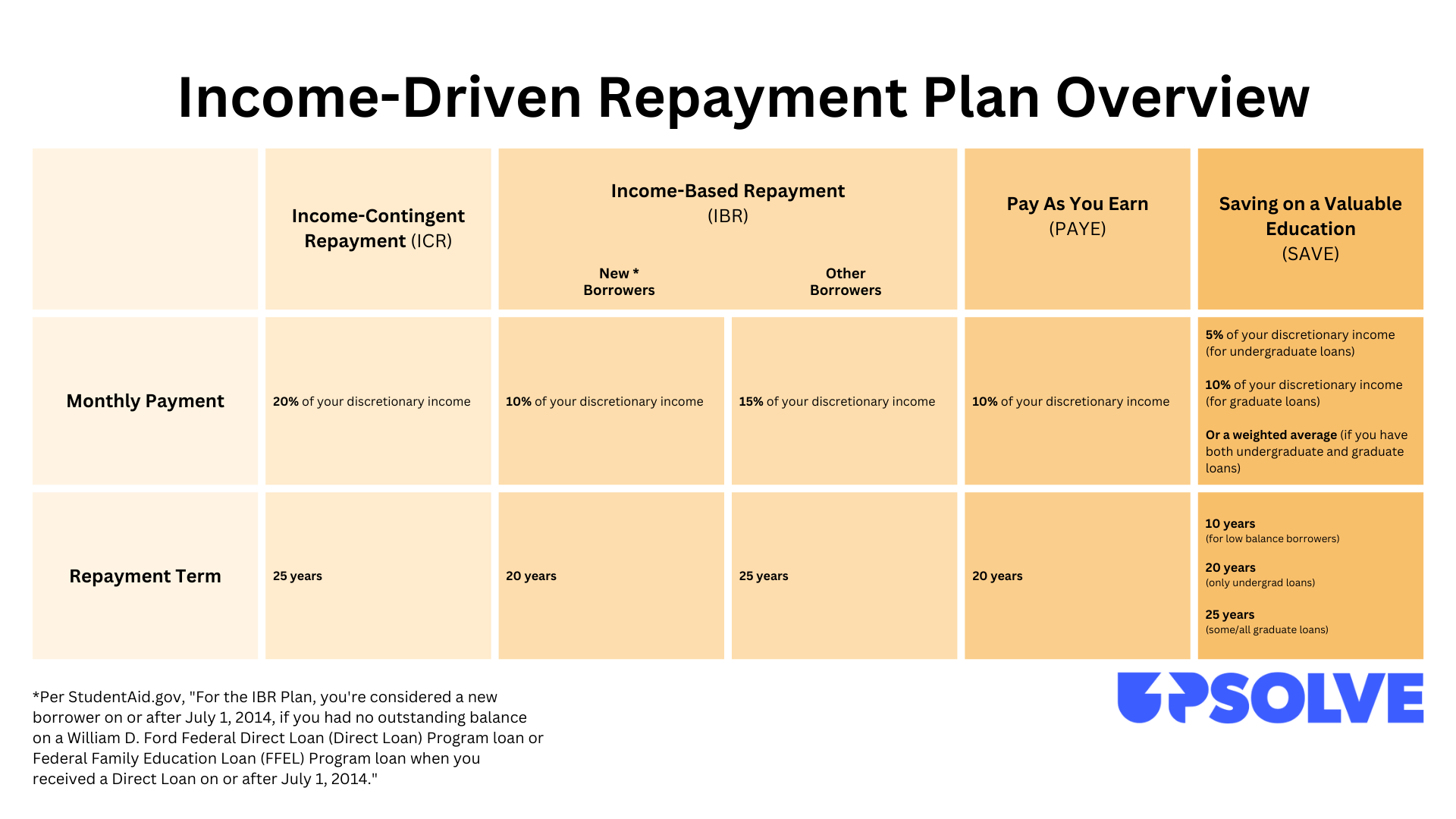

Currently, there are four income-driven options, including:

Income-Based Repayment (IBR)

Pay As You Earn (PAYE)

Income-Contingent Repayment ICR

Saving on a Valuable Education (SAVE)

Formerly the Revised Pay as You Earn Plan (REPAYE)

Here’s a brief overview of how these compare:

If you stay on an income-driven repayment plan for the full repayment term (20–25 years, depending on which plan you choose), you’re eligible for loan cancellation. In other words, if you stick with it and avoid default, the federal government could forgive the remaining balance of your loans.

One disclaimer: This type of student loan forgiveness has been rare, though it, too, is a target in current federal student loan reform. Additionally, the Biden administration is working to reduce the amount of time borrowers need to repay their loans before they qualify for forgiveness.

The Dangers of Default: Why You Need To Face Your Student Loan Debt Head On

Defaulting on a student loan is serious business. Default can cut off options that might have made student debt manageable. Worse, the federal government’s collection powers are significant. The government can garnish your wages, seize your income tax refund, and take other collection action without any court proceedings if you default on your loan(s).

To avoid default, contact your student loan servicer to discuss your options as soon as you run into trouble making your payments.

I Dropped Out of School and Can't Make My Student Loan Payments. What Can I Do?

If you had to drop out of school due to tuition costs, or any reason at all, that is a hard enough situation to navigate. If you’re met with crushing student loan debt after making that decision, you probably feel completely overwhelmed.

If the other options above do not fit your financial situation, you might feel like you’re out of luck, but there’s another option you may not have considered: filing bankruptcy to erase your student loan debt. There previously was a widespread myth that you cannot discharge your student debt through bankruptcy, but you can.

You will have to meet certain eligibility requirements, but bankruptcy is certainly worth looking into if other paths are not available to you. You can take the first step to determining your eligibility by taking our free student loan discharge screener right now! Let us help you receive the fresh start you rightfully deserve.