Your Guide to Oregon’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Oregon’s Unlawful Debt Collection Practices Act aims to prevent debt collectors and debt buyers from engaging in unfair practices. It prohibits harassment and deception and requires transparency in the debt collection process. Oregonians are also protected by the federal Fair Debt Collection Practices Act (FDCPA). Both of these laws apply to third-party debt collectors and debt buyers, not to original creditors.

Written by Upsolve Team.

Updated May 22, 2025

Table of Contents

What Are the Debt Collection Laws in Oregon?

The Unlawful Debt Collection Practices Act (UDCPA) is a state law that protects Oregonians against unfair debt collection practices. Oregon residents are also protected by the federal Fair Debt Collection Practices Act (FDCPA).

How Does the Oregon Unlawful Debt Collection Practices Act (UDCPA) Protect You?

Oregon’s Unlawful Debt Collection Practices Act (UDCPA) is an important state law regulating third-party debt collectors and buyers. It aims to ensure debt collection practices are fair, legal, and not harmful to consumers. In addition to preventing harassment, abuse, and deception, the law also aims to increase transparency in debt collectors’ communications with consumers.

Under the UDCPA, debt collectors in Oregon can’t:

Threaten or use violence to harm you, your family, or property

Threaten to arrest you

Threaten to take your property

Speak to you or your family using obscene or abusive language

Call repeatedly or at inconvenient times

Publicize your debt or threaten to do so

Make empty threats to sue you or take other actions they can’t actually take

Use letterhead or send documents that look like official government or legal documents

Under the same law, debt collectors must:

Tell you their name and the name of the company they’re collecting on behalf of (if applicable) in their first written communication with you

Tell you who they are and what their purpose is within 30 seconds if they call you

Debt collectors are also required to be licensed.

How Does the Federal Fair Debt Collection Practices Act (FDCPA) Protect You?

The FDCPA is a federal law that works similarly to Oregon’s UDCPA. Both laws were passed to prevent debt collectors from harassing, abusing, deceiving, or misleading consumers.

Here’s a basic overview of the FDCPA:

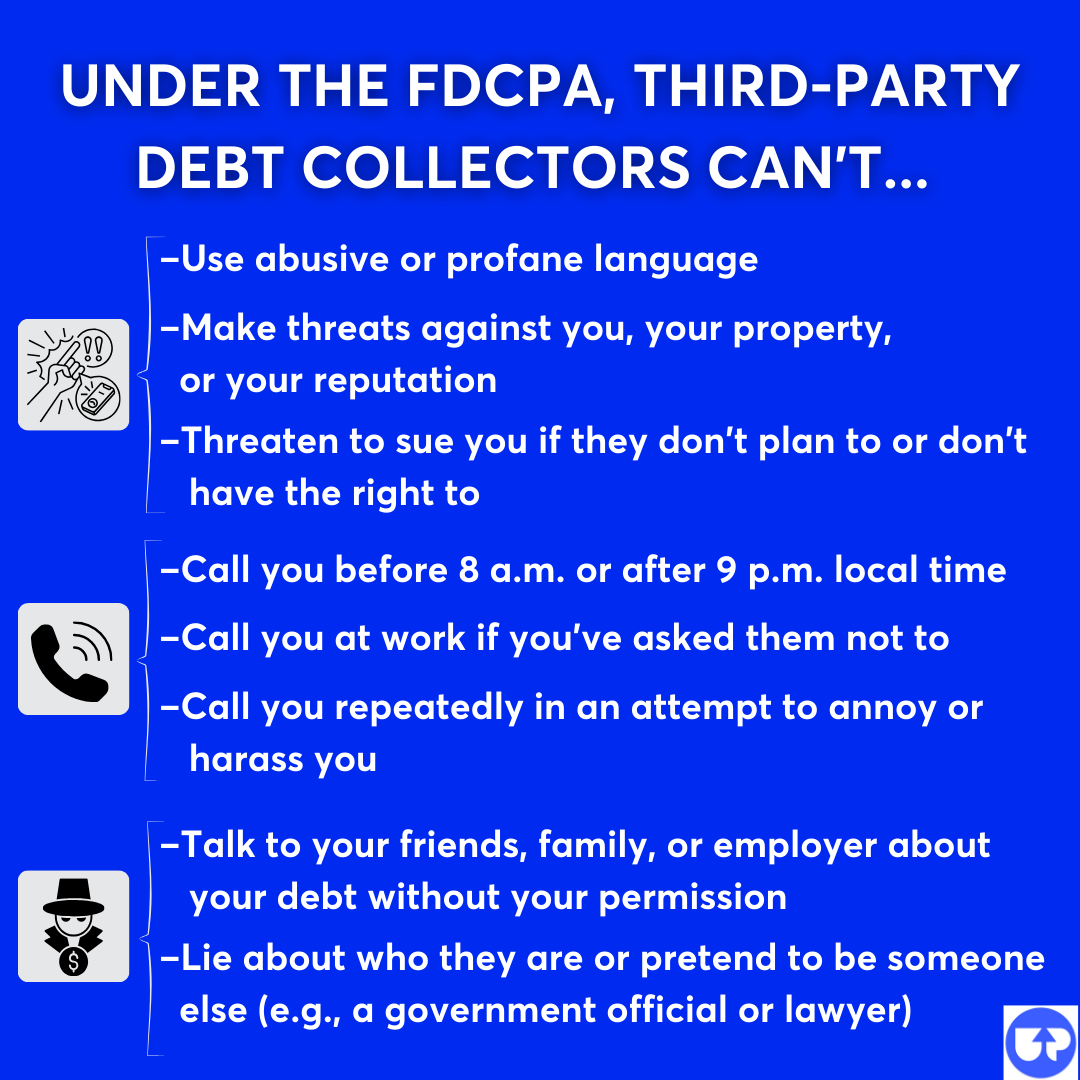

Like the UDCPA, the FDCPA spells out prohibitions against bad behavior, including:

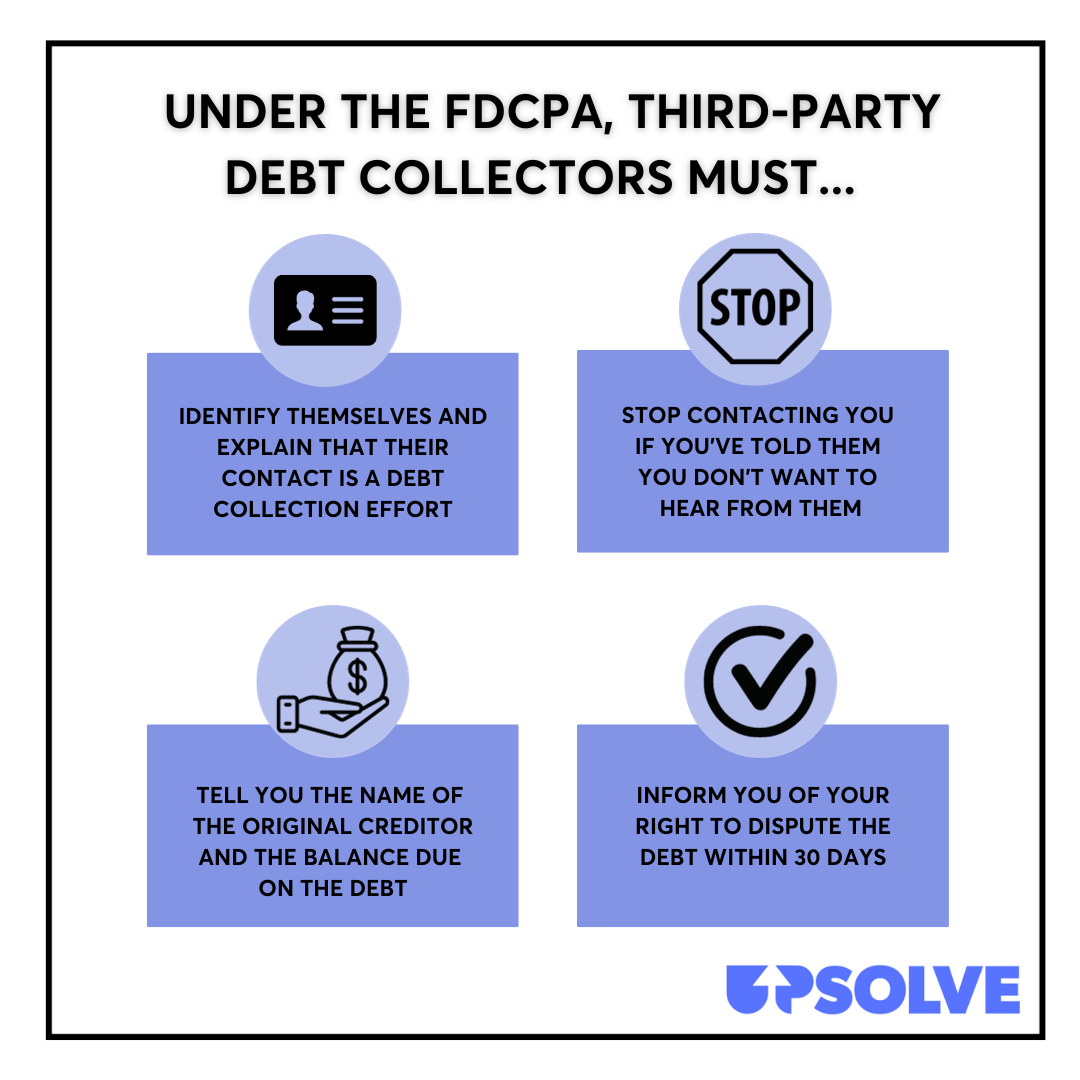

The FDCPA also sets some requirements for debt collectors, including:

What Can You Do if a Debt Collector Breaks the Law in Oregon?

If you believe a debt collector has violated the Oregon Unlawful Debt Collection Practices Act, you can file a complaint with the Oregon Attorney General’s office. The attorney general’s office helps enforce the UDCPA by investigating complaints and taking legal action against debt collectors who violate the law.

You can also file a civil lawsuit under the Oregon Unlawful Debt Collection Practices Act. You must bring a lawsuit within one year of the violation. If you win the case, you can recover actual and punitive damages. Actual damages are compensation for monetary losses or harm incurred. Punitive damages are further compensation to punish the company for the violation.

Upsolve Member Experiences

3,804+ Members OnlineWhat Is the Statute of Limitations for Debt Collection in Oregon?

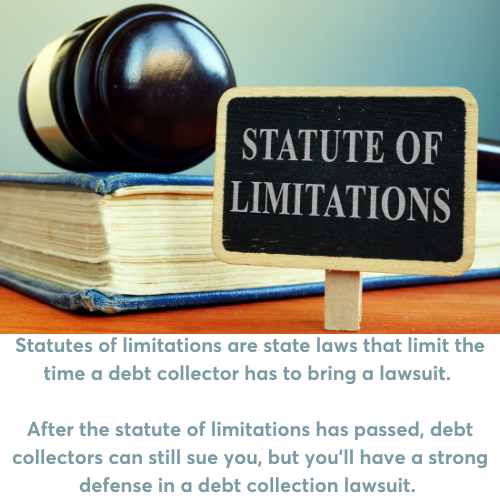

The statute of limitations puts a time limit on how long you can be sued for a debt. The timeline varies by what type of debt you have.

The statute of limitations for debts based on a contract is six years. This includes:

Medical bills

Credit cards

Car loans

Other contractual debts like personal loans

Mortgage loans and court judgments have a 10-year statute of limitations.

The clock usually starts ticking when you default on a debt, but be aware that if you make a payment on the debt, you may restart the clock.

If you get contacted about or sued for an old debt (near or over six years old), be careful about what you say to the debt collector. Don’t take any action toward the debt until you have it verified in writing. To learn more, read What To Do if You’re Contacted About a Time-Barred Debt.

What Can Debt Collectors Do To Collect Debt in Oregon?

State and federal laws are in place to help regulate debt collectors’ behaviors and practices. But there’s still plenty they can do to try to collect a debt from you.

Calling you is the most common tactic. You’ll also receive written notices and may even be contacted on social media. If you’re behind on an auto loan, your car can be repossessed.

Unfortunately, ignoring the debt collectors won’t make them go away. At some point, they may choose to take you to court for the debt. It’s scary to receive a formal notice of a lawsuit. You may think you don’t stand a chance against a debt collector without a lawyer, and who can afford that?

But the truth is, all it takes to respond to the lawsuit is filling out some paperwork. Then it’s on the debt collector to prove you actually owe the debt and that they’re legally allowed to collect it. If you don’t respond, though, the debt collector doesn’t have to prove anything, and you can lose by default.

Losing puts you at risk of wage garnishment. This is the most popular tactic debt collectors use to take money directly from you. In this case, from your paycheck. However, Oregon law limits how much they can take.

If you aren’t working, the debt collector can try other tactics like a bank account levy or a property lien.

The bottom line is, if you get sued, you should respond to the lawsuit.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Need Help With Debt Relief? Here Are Some Options

16% of all Oregonians have a debt in collections. And far more are struggling with overwhelming debt. If this is you, consider getting some help to take control of your finances and make a plan for your debt.

Not sure where to start? Schedule a free appointment with a nonprofit credit counselor. These financial professionals work with everyday people to help them sort out their finances and make a plan to pay down debt. They may even be able to help save you money in the process.

A credit counselor may suggest a debt management plan, debt consolidation, or bankruptcy, depending on your situation. To learn more about credit counseling, read Upsolve’s Guide. If you want to do the work on your own or do some research beforehand, read Debt Relief: What Are the Options & How Do They Work?

If you decide you want to get a fresh start by filing Chapter 7, see if you’re eligible to use Upsolve’s free filing tool. Upsolve has helped over 300,00 people get rid of $700 million in debt… and it’s completely free.