How To Answer an Oregon Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you’re sued for a debt in Oregon, you’ll receive an official notice from the court. If you’re sued in small claims court, you need to respond to the notice and tell the court if you want a hearing or jury trial. If you’re sued in regular circuit court, you need to respond with an answer form that includes any affirmative defenses you may have. After responding in either situation, you must show up to required court appearances, which could be a hearing, mediation, or arbitration, depending on your case.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated April 23, 2025

Table of Contents

How Do Debt Collection Lawsuits in Oregon Work?

If you get behind on paying your bills, your account may eventually be sent to an in-house or third-party debt collector. Then, you’ll receive phone calls and debt collection letters in the mail. After some time, the debt collector may decide to file a lawsuit against you.

In Oregon, debt collection lawsuits are typically filed in either the small claims division of a circuit court (sometimes called justice court) or they’ll be on the regular circuit court docket. If you’re sued in small claims court, the process will be quicker and simpler than if you’re sued in the regular circuit court. You’ll know which court your case is in when you get official notice of the lawsuit.

How Do You Know You’ve Been Sued?

If you get sued by a debt collector or creditor, you’ll receive official paperwork from the court notifying you of the lawsuit.

If your case is in small claims court (justice court), you’ll receive a Small Claim and Notice of Small Claim form.

If your case is part of the regular circuit court docket, you’ll receive a summons and complaint.

Both the summons and notice of small claim will also list other important information, including:

Instructions about how to respond to the lawsuit

The deadline to respond

What can happen if you don’t respond

The first page of the small claims form looks like this:

The summons for regular circuit court cases will look different from the notice of small claim. It should say “Summons” on the top part of the form and list the plaintiff’s (person suing you) name and address, your name and address (as the defendant), and the court’s name.

The complaint document will be labeled “Complaint” somewhere toward the top of the document. The complaint outlines the plaintiff's claims (in numbered paragraphs), the basis for the lawsuit, and the relief sought from the court. The relief the plaintiff is seeking is a court judgment to collect the debt they believe you owe plus additional court costs or legal fees.

How Long Do You Have To Respond to the Lawsuit?

If you’re sued for a debt in Oregon, you need to file a response or answer form with the court. The deadline to reply depends on which court is hearing your case.

If you’re sued in small claims court and receive a Small Claim and Notice of Small Claim, you must respond within 14 days.

If you’re sued in a regular circuit court and receive a summons and complaint, you must respond within 30 days.

The official court documents you receive notifying you that you’re being sued should include this information and deadline as well.

How Do You Respond to an Oregon Small Claims Notice?

If you receive a Small Claim and Notice of Small Claim, you need to file a Defendant’s Response form within 14 days or you will lose the case automatically.

You can use OJD iForms to draft and submit your response form electronically. This is an online resource provided by the court to help self-represented individuals. You can also download a copy of the form and fill it out by hand.

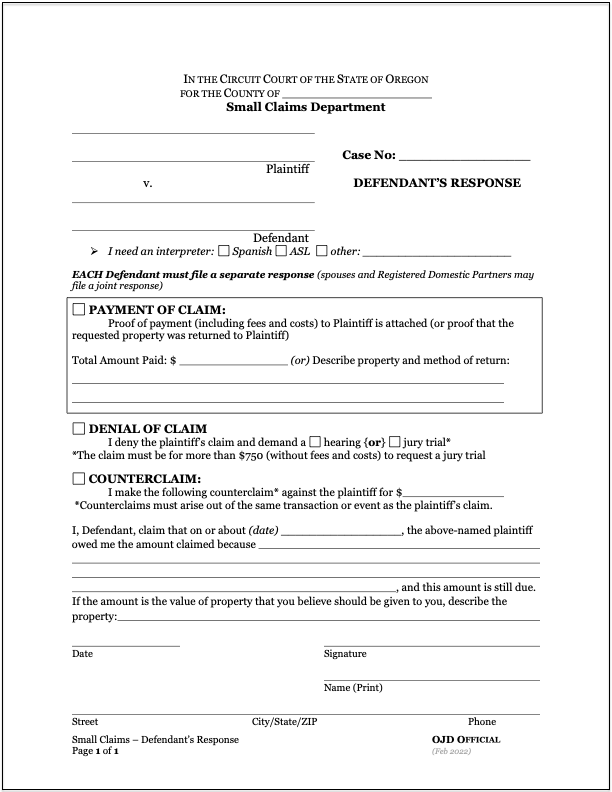

Here’s what the form looks like:

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee, and can make the response process less stressful and quicker!

Step 1: Fill in the Case Information

Using your Notice of Small Claim form for reference, fill out the top of the response form, including:

The county name

The plaintiff’s name and address

The defendant’s name and address

The case number

If you need an interpreter, you can check the appropriate box to let the court know this.

Step 2: Address the Claim

The next three checkboxes read as follows:

Payment of Claim

Denial of Claim

Counterclaim

If you agree that you owe the debt and you have the money to pay it off, you can pay the debt in full, then check the “Payment of Claim” box and attach proof of payment.

If you don’t believe you owe the debt, the debt amount is wrong, or you have any other defense to raise about why you shouldn’t have to pay, you can check “Denial of Claim.”

Then you must check a box to demand either a hearing or a jury trial. While it’s your right to decide between these two, choosing a jury trial may slow down the process. It comes with significant costs and sets out new deadlines and requirements for you. You can learn more about this by reading the court’s instructions for responding to a small claim.

If you check the box for a hearing, the court will set a hearing date, which you should receive formal notice of.

You can also check the box to file a counterclaim if you believe that the plaintiff actually owes you money in the matter related to the lawsuit. You can read more about the counterclaim process in the form instructions. Again, it’s your right to file a counterclaim if you see fit to do so, but it’s often beneficial to hire a lawyer to help with this process as it’s more complicated than a simple response to the lawsuit against you.

Step 3: Attend Mediation and/or the Hearing

If you choose to proceed with a hearing, you need to show up to any scheduled court appearances. The first scheduled appearance may be a mediation session with a trained, neutral third-party mediator. If mediation doesn’t work, a trial will be scheduled.

You should receive official notice from the court of the date, time, and place of any required appearances. The mediation and/or hearing may be in person or virtual.

If you do have to go to trial, rest assured that small claims hearings are more informal than trials in regular court. You’ll need to show up with your defenses prepared and evidence to back them. This could be contracts, account statements, receipts, or other proof of payment. It may be helpful to read the section below about defenses and affirmative defenses to help yourself prepare to dispute the plaintiff’s claims at the hearing.

The plaintiff will tell their side of the story and then you’ll get to tell yours. Be sure to speak respectfully to the judge and everyone else at the hearing. Address the judge as “your honor,” and be sure to be on time.

How Do You Respond to a Debt Lawsuit in Regular Circuit Court?

If you receive a summons and complaint, you need to respond to the lawsuit by filing an answer form. There is no official Oregon answer form for justice court, but you can use a template like this one from Columbia County to guide you.

Your answer should include the name of the court and each of the parties (the plaintiff and defendant) at the top. It should also include the case number, and somewhere it should say “Answer,” so the court knows it’s your answer form.

The answer will also include:

Your response to the plaintiff claims, which may be “admit,” “deny,” or “don’t know/don’t have enough information”

Your affirmative defenses

Proof of service

Step 1: Address Each Complaint/Allegation

It’s important to address every claim from the plaintiff’s complaint form. The claims will be in numbered paragraphs on the complaint form. In your answer, be sure to address every claim by number. Here are your options for addressing claims:

Admit it: This means you believe the information in a given claim is true.

Deny it: This means you don’t believe the information in a given claim is true or you disagree with some aspect of it.

Say you lack sufficient information to admit or deny: This means the plaintiff didn’t provide enough information in their claim for you to know whether it’s true or not.

Using this third option can be powerful because it requires the person suing you to prove their claims against you.

If the plaintiff left important information out of their complaint, you may be able to raise this as an affirmative defense. If you’re successful in doing so, the judge may dismiss the case.

Step 2: Raise Your Defenses

Affirmative defenses are legal arguments you present to the court that, if proven, can defeat the plaintiff's claim, even if the debt itself is valid. It’s like saying, "Yes, there might be a debt, but here are reasons why I shouldn't have to pay it."

Here are some of the most common types of affirmative defenses used in debt collection cases:

Statute of limitations: The debt collector filed the lawsuit too late, exceeding the legal time limit to collect the debt.

Lack of standing: The debt collector can't prove they have the legal right to sue for the debt.

Improper service of process: The defendant wasn't served with the lawsuit papers correctly, which can invalidate the lawsuit.

Payment: The defendant has evidence of making full or partial payments on the debt.

Identity theft or fraud: The debt resulted from identity theft or fraudulent activity.

Settlement or agreement: There's a prior agreement or settlement between the parties that wasn't fulfilled.

Unfair or deceptive practices: The debt collector used unfair, deceptive, or illegal practices in debt collection.

If you believe that any of these apply to your case, you can include this as an affirmative defense in your answer form. It’s best to provide evidence to back up your claim and help the judge see your side. Evidence could be account statements, receipts, proof of payment, police reports (for identity theft), or contracts.

Step 3: File Your Forms With the Court Clerk and Serve the Plaintiff

Now you’re ready for the final step: filing your answer form and delivering a copy to the plaintiff.

In Oregon, most courts allow you to e-file your paperwork. Doing so often expedites the filing process, so consider using the electronic system if that’s available to you. If it’s not or you prefer to file hard copies, make two copies of your completed answer form.

Take or mail the original to the court listed on the summons. Mail one copy to the plaintiff or their attorney. (This info is also listed on the summons.) Keep one copy for your records. When you send any court papers via mail, it’s a good idea to use certified mail so you have proof that the document was sent and when.

What Happens After You Respond to the Lawsuit?

You should receive an official notice from the court about next steps in the lawsuit after you file your answer. This could be preparation for a trial or arbitration. If your case goes to arbitration, you and the plaintiff will each tell your side of the story and present your evidence to the arbitrator. The arbitrator will then decide who wins the case, but their decision can be appealed.

Whether there’s a hearing or arbitration, you should come prepared. Know your defenses and bring your evidence with you. It doesn’t hurt to practice explaining your side of the story beforehand. Also, be sure to be on time for scheduled appearances and speak respectfully to all involved.

What Happens if You Don’t Respond to the Lawsuit?

Responding to a lawsuit is a crucial way to protect your rights and financial well-being. If you don't respond to the lawsuit, the court is likely to issue a default judgment against you. A default judgment means that you automatically lose the case because you didn’t respond to it. Once a default judgment is issued, the creditor can take aggressive actions to collect the debt, such as wage garnishment or a bank levy.

Here’s the good news: You have more power than you think! You can exercise that power just by responding or showing up.

Debt collectors often count on defendants not showing up or responding to the lawsuit. They want an easy victory, and, sadly, they often get it because people don’t defend themselves. Don’t let this happen to you. With a little research and effort, you can win the debt collection lawsuit.

If a default judgment has already been issued against you, you may still be able to get it canceled. To do so, you usually need to file a motion to cancel the judgment or reopen the case. Filing a motion means formally requesting the court's review. To learn more about this process read this article: How Do You Cancel (Vacate) a Court Judgment?

Need Legal Help?

Legal Aid Services of Oregon provides free or low-cost legal help to qualifying individuals.

Oregon Law Help can help you find legal aid services and other legal help near you.

Oregon has a unique legal referral program that provides low-cost legal assistance.