How To Answer a Tennessee Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Generally speaking, to respond to a debt collection lawsuit in Tennessee, you should fill out and file an answer form, sometimes called a sworn denial form, with the court. The deadline to file this form will be listed in the court summons that notifies you of the lawsuit. You usually have 30 days to respond. Rules vary by court in Tennessee, so it’s important to visit the local court website or speak with the court clerk to verify the forms you need to submit and what the court’s processes are for debt collection lawsuits.

Written by Upsolve Team.

Updated April 18, 2025

Table of Contents

How Do Debt Collection Lawsuits in Tennessee Work?

If a debt collector or creditor has been contacting you about a debt they think you owe for a while, your case may eventually end up in court. Debt collection lawsuits are an increasingly common collection tactic. In Tennessee, these kinds of lawsuits are typically filed in General Sessions courts.

If you’re being sued for a debt, you’ll receive a summons and complaint. These are official court documents.

What Is a Summons and Complaint?

A summons is a court document that tells you you’re being sued. A complaint is a court document that explains why you’re being sued.

The summons usually includes:

The case docket number

The name of the court overseeing the case

The name and address of the person suing you (called the plaintiff) and the attorney representing them if they’ve hired one

Notice that you have 30 days to respond to the lawsuit

Further instructions on what you need to do next

The complaint will list the claims against you in numbered paragraphs. It will also tell you what the plaintiff is asking the court for, usually a money judgment. A judgment is a court order to collect the debt amount on the complaint plus any attorney or court fees.

It’s important for the person suing you to follow the court’s service requirements when delivering these forms to you. Service requirements are the court’s rules for how the paperwork gets delivered to ensure you’ve received the paperwork and are aware of the case against you. You may be served in person or the documents may be sent by certified mail.

How Do You Respond to a Tennessee Court Summons for Debt Collection?

The process to respond to a court summon varies by court in Tennessee. We’ll cover a general overview of the steps below, but be sure to double-check what your local court requires. You can do this by looking at the court summons, checking your county’s website for local rules, and/or calling the clerk of court.

The court clerk is there to help you understand court processes, rules, and forms. They can’t give you legal advice, but they can help guide you through the process. You can find your court clerk here.

Step 1: Get an Answer or Sworn Denial Form

In legal terms, a response to a lawsuit is called an answer. You answer the lawsuit by filling out an answer form and filing it with the court clerk. In some Tennessee courts, this is called a sworn denial form. Here’s a template of the sworn denial form you can download and use.

Here’s what the first page of the sworn denial form looks like:

Some courts have blank answer forms. You may be able to find this on the court website or by going in person to the courthouse and asking the clerk for a copy. Most forms will ask for similar information, including:

The plaintiff’s name (the person suing you)

The defendant’s name (your name)

The case or docket number

Your signature

Your response to the claims in the complaint

In some cases, the clerk may tell you that you don’t need to file a written answer form; you can just show up to the scheduled hearing for your case.

Even if you aren’t required to file an answer, it’s usually still a good idea. It will help you to look carefully at the claims against you and consider your defenses. Sending a copy of the answer to the person suing you also shows them you’re taking this seriously and plan to assert your rights.

Step 2: Write Out Your Response

Your answer is your chance to respond to the claims in the complaint form. You can:

Deny any/all claims

Admit any/all claims

Deny any/all claims due to a lack of knowledge

The last one is like saying you don’t know or don’t have enough information. Note that you can only use this response in Tennessee if you’ve actually tried to find out the information. Court rules call this making a “reasonable inquiry.”

If you want to deny all the claims outright or deny them for lack of knowledge, you can write that on the response form. You could also address each claim individually by paragraph number. You can include defenses in your answer form.

Raise Your Defenses and Counterclaims

Defenses — also called affirmative defenses — are reasons the debt collector shouldn’t win the lawsuit. They’re often based on information the debt collector didn’t mention in the complaint. For example, the debt might be past the statute of limitations, or maybe it was discharged in a recent bankruptcy case.

Many different kinds of affirmative defenses can be used in debt collection cases. Some of the most common ones include:

The debt is too old.

The debt was already paid.

The debt doesn’t belong to you (because of identity theft or misidentification by the collector).

The debt was discharged in bankruptcy.

If the debt collector violated any debt collection laws when trying to collect the debt, you can also mention that as an affirmative defense or consider countersuing them for the violation. You may want to hire an attorney if you plan to countersue because this is more complicated than simply filing an answer form. Some attorneys offer free consultations, which can help you decide if a countersuit is viable and worth your while.

Step 3: Complete Any Other Required Forms

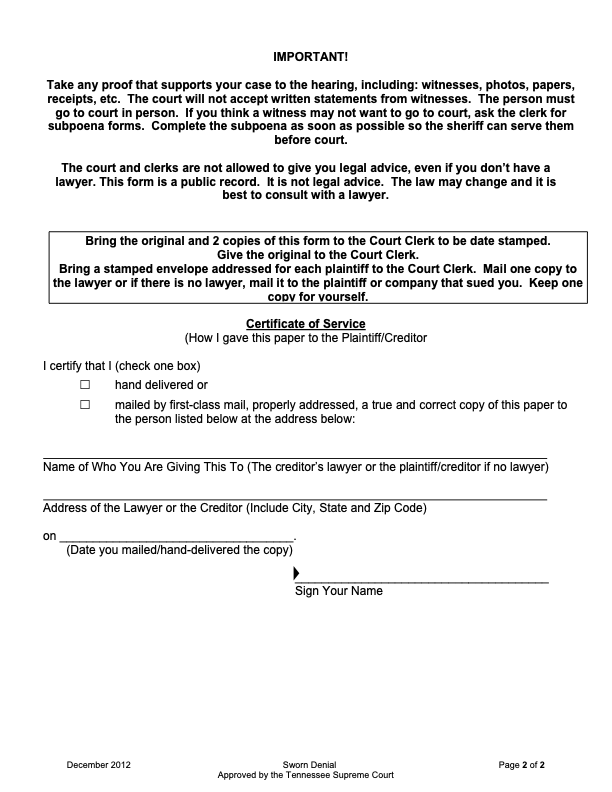

Since the process to answer a debt collection lawsuit varies by court in Tennessee, it’s a good idea to look at the court’s website or contact the court clerk to ask if you’re required to fill out or file any forms to accompany your answer form. Many states require people to fill out and sign a certificate of service form. This is used to verify that you’ve properly delivered a copy of your answer form to the plaintiff.

On the sworn denial form, the certificate of service is included at the bottom of the second page.

Ask About Service Requirements

When either side in a lawsuit files papers with the court, they’re usually required to send a copy to the other side. This ensures everyone is aware of where the case stands and what each side is doing.

Courts commonly require defendants to send a copy of their answer form to the person suing them and to certify they’ve done so by signing a form. This process varies by court in Tennessee. In some cases, the court clerk may serve the form for you. Make sure you know what the service requirements are in the court your case was filed in and that you follow them.

In most cases, you can send the answer form via mail or deliver it in person to the plaintiff.

Step 4: File Your Forms With the Court Clerk Within 30 Days

Finally, you need to file your answer form with the court clerk at the courthouse listed on the summons within 30 days. Some courts allow you to file in person, file electronically, or mail the forms in. Inquire with the court clerk to learn about your options. No matter how you file your forms, be sure to do it within the 30-day deadline. If you don’t, you’re essentially telling the court that you don’t want to contest the case, and you’re likely to lose by default.

Upsolve Member Experiences

3,804+ Members OnlineWhat Happens After You Respond to the Lawsuit?

After you file your answer, pat yourself on the back. You’ve done something many people are too intimidated to do! The court will contact you to tell you what happens next. Often, you’ll receive written notice by mail indicating a hearing date and time. In some cases, the notice of the hearing date and time may be included on the summons you received when you were notified of the lawsuit.

Read every document you get from the court carefully. If you can’t attend a scheduled hearing, call the court clerk and ask them what you need to do to reschedule.

If you want to know what to expect at a general session court hearing, you can watch the Tennessee Access to Justice Commission’s videos to help you prepare.

What Happens if You Don’t Respond to the Lawsuit?

Getting sued for a debt you may or may not owe is very stressful, but it’s crucial that you don’t ignore the lawsuit. If you do, the most likely outcome is that you’ll lose. In this case, the judge will issue a default judgment to the person suing you. This is a court order that opens the way for them to take money from your paycheck or your bank account or potentially take and sell your personal belongings.

Sadly, most people lose these kinds of cases because they don’t respond to the lawsuit. The debt collector is hoping to get a default judgment and avoid having to prove you really own the debt and they can legally collect it. Don’t get them that chance. If you have a good defense and you answer the lawsuit, you may even win it and get the case dismissed.

What if the Judge Already Issued a Default Judgment?

If you didn’t respond to the lawsuit or you missed the court hearing and the judge entered a default judgment against you, you may still be able to act to cancel the judgment. This is typically done by filing a motion within 10 days of the judgment being entered. A motion is a formal request to the court.

Again, your local court clerk will be your best resource here. You can ask if there is a motion template you can use to file this motion. You may also want to seek legal help as this process can be difficult. See the resources listed in the next section for free or low-cost legal help.

If your money or belongings are at risk because of a default judgment, you can protect them by filing a Protected Income and Assets form with the court (and serving a copy to the plaintiff). The Legal Aid Society of Middle Tennessee and the Cumberland has a helpful brochure explaining how to do this. It also includes a form template you can use.

Need Legal Help?

You do not have to hire a lawyer to respond to a debt collection lawsuit. You can file the answer form on your own and represent yourself at the hearing. But if you want legal advice or feel you need assistance, you may be able to get free or low-cost legal help from:

Legal Aid Society of Middle Tennessee and the Cumberlands: Phone number: (800) 238-1443, Website: Legal Aid Society

Legal Aid of East Tennessee: Phone number: (865) 637-0484, Website: Legal Aid of East TN

West TN Legal Services, Inc.: Phone number: (731) 423-0616, Website: West Tennessee Legal Services

Memphis Area Legal Services, Inc.: Phone number: (901) 523-8822, Website: Memphis Area Legal Services