Affordable Student Loan Repayment: Your Guide to Income-Driven Plans

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

In an income-driven repayment (IDR) plan, your monthly federal student loan payment is calculated based on your income and family size. Since IDR plans are tied to your income, the monthly payments tend to be more affordable for borrowers than other repayment plans like the Standard Repayment Plan. Sometimes the monthly payment is as low as $0. The federal government has promised student loan forgiveness after 20–25 years of repayment under an IDR, but recent evidence has shown this forgiveness is hard to get. President Biden has proposed new IDR rules to change this. The rules are subject to public comment and review before they can be implemented. This article explains how income-driven repayment plans work. It also details the four different types of income-driven repayment plans, how to choose the right plan for you, and how to apply for the income-driven repayment program.

Written by Attorney Paige Hooper.

Updated May 8, 2025

Table of Contents

- How Do Income-Driven Repayment Plans Work?

- What Are the 4 Types of Income-Driven Repayment Plans?

- What Loans Are Eligible for Income-Driven Repayment Plans?

- How Is Discretionary Income Calculated Under Income-Driven Repayment Plans?

- Which IDR Plan Is Best for You?

- Do IDR Plans Have Any Disadvantages?

- How Do You Get an Income-Driven Repayment Plan?

- What if You Can’t Afford IDR Plan Payments?

If you’re struggling to make your federal student loan payment each month, an income-driven repayment plan could be the solution. The federal government offers these plans to help make student loan payments more affordable.

In traditional repayment plans, your monthly payment amount is based on paying the loan in full by a certain date. But in an income-driven plan, your monthly loan payments are based on your income and family size, which helps ensure you can afford your loan payment each month.

How Do Income-Driven Repayment Plans Work?

Income-driven repayment (IDR) plans are federal student loan repayment programs that link the amount of your monthly student loan payment to your income. Your family size, the type of loan(s) you have, and the state where you live also help determine your payment amount under these plans.

IDR plans make your monthly student loan payments more affordable, which can help you avoid defaulting on your loans.

These plans are often especially helpful for borrowers who:

Have high student loan debt relative to their income

Have a low income or are unemployed

Qualify for Public Service Loan Forgiveness (PSLF)

IDR plans are only available to federal student loan borrowers. Private student loans aren’t eligible for income-driven repayment. This includes federal loans that have been refinanced into private loans.

Currently, the U.S. Department of Education offers four types of income-driven repayment programs. President Biden has also proposed a new income-driven repayment plan that would simplify the repayment process and help IDR participants get loan forgiveness.

What Are the 4 Types of Income-Driven Repayment Plans?

Eligible borrowers can choose from four IDR plans:

Income-Contingent Repayment (ICR)

Income-Based Repayment (IBR)

Pay As You Earn (PAYE)

Saving on a Valuable Education (SAVE)

Formerly the Revised Pay As You Earn (REPAYE) Plan

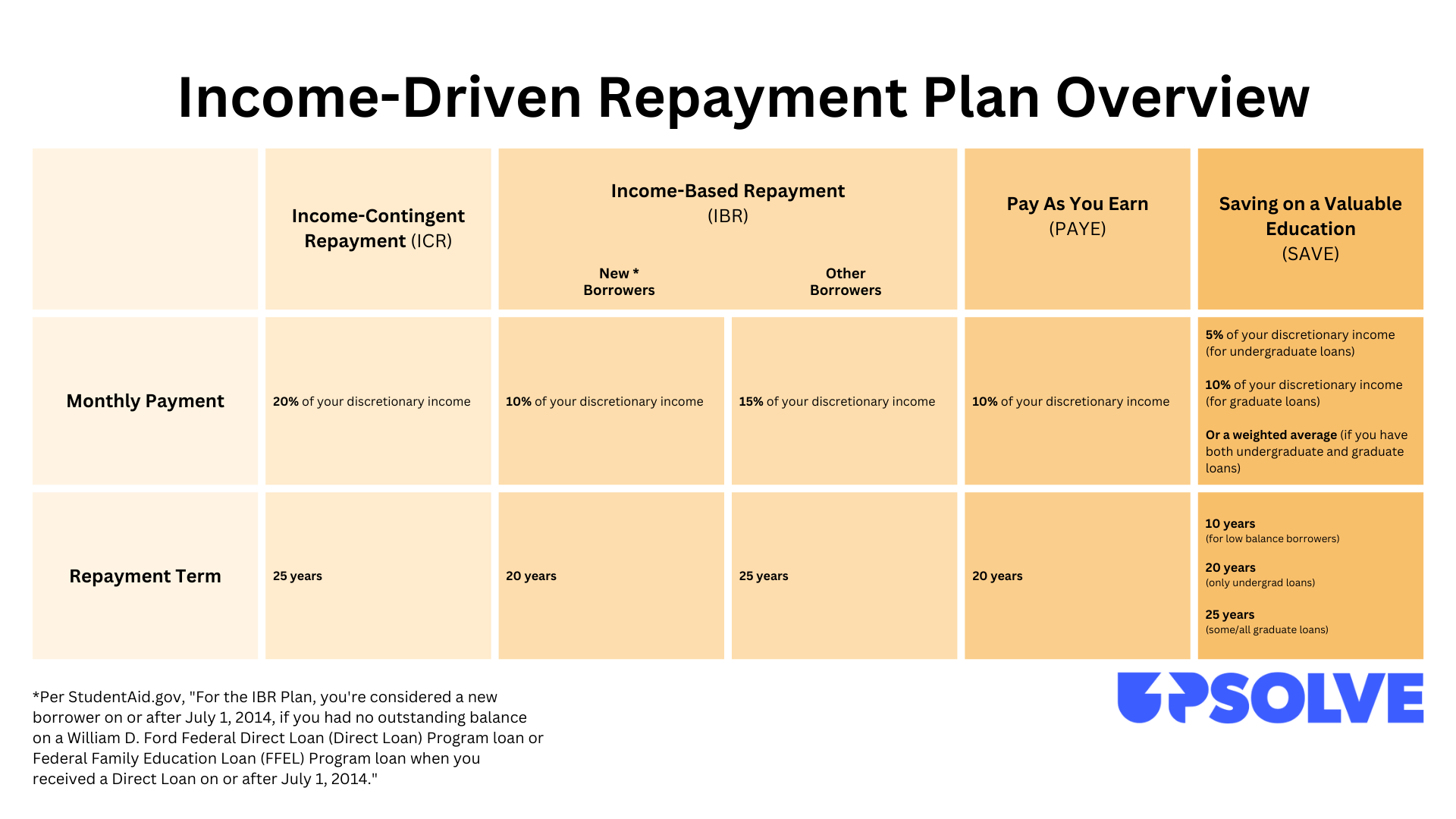

Three main characteristics differentiate each plan:

The percentage of your discretionary income that determines your monthly payment

Ranges between 10% and 20% (5% and 10% for the SAVE Plan)

The length of the repayment term

Ranges from 20 to 25 years

Other eligibility requirements

This includes whether you’re a new borrower and what your payments are under the Standard Repayment Plan

Regardless of which income-driven repayment plan you choose, you’ll usually have a lower monthly loan payment than you would if you stay enrolled in the default Standard Repayment Plan. Depending on your income, your payment could be significantly lower — as low as $0 per month.

All income-driven plans come with a big promise: Any remaining balance on your loan will be forgiven — meaning you don’t have to pay it back — once your repayment term is up. Frustratingly, recent data from the National Consumer Law Center shows that only 32 borrowers have received such forgiveness since the program began in 1995. The federal government is also now aware of the dysfunction of this program, and President Biden has proposed a new income-driven repayment plan (an updated version of the current REPAYE Plan) to address it.

Check out the table above to see a quick comparison of the four plans. Here are some of the more nuanced details of each plan.

What Is the Income-Contingent Repayment (ICR) Plan and Who Qualifies?

Any borrower with qualifying federal student loans can apply for the ICR Plan. Under the plan, you’ll pay 20% of your discretionary income for 25 years, with one caveat: If your monthly payment would be lower under an adjusted 12-year Standard Repayment Plan, then you pay that lower monthly payment amount. The plan term is still 25 years, though, not 12 years.

To learn more, check out our complete guide to ICR Plans.

What Is the Income-Based Repayment (IBR) Plan and Who Qualifies?

The Income-Based Repayment Plan has two tracks: one for “new borrowers” and one for people who don’t qualify as new borrowers.

According to StudentAid.gov, you’re a new borrower if you don’t have an "outstanding balance on a Direct Loan or Federal Family Education Loan (FFEL) Program loan when he or she receives a Direct Loan or FFEL Program loan on or after” July 1, 2014.

If you qualify as a new borrower, you’ll pay 10% of your discretionary income for 20 years under the IBR Plan.

If you don’t qualify as a new borrower, you’ll pay 15% of your discretionary income for 25 years.

To qualify, your monthly payment under the IBR Plan must be less than your monthly payment would be under a 10-year Standard Repayment Plan. If your student loan debt is high relative to your annual income, you’ll likely qualify.

What Is the Pay As You Earn (PAYE) Plan and Who Qualifies?

Under the Pay As You Earn Plan, your monthly student loan payment will be 10% of your discretionary income, and you’ll repay the loan for 20 years. To qualify, your monthly payment under the PAYE Plan must be less than your monthly payment would be under the 10-year Standard Repayment Plan, and you must qualify as a new borrower under the federal two-part test described above.

To learn more, read our complete guide to PAYE Plans.

What is the Saving on a Valuable Education Plan (SAVE) and Who Qualifies?

With the SAVE Plan (formerly the REPAYE Plan), the income exemption jumps from 150% to 225% of the poverty line.

Your monthly payment under a SAVE Plan is either 5% of your discretionary income (for undergraduate loans), 10% (for graduate loans), or a weighted average (if you have both undergraduate and graduate loans).

The forgiveness timeline for the SAVE Plan is 10 years (for low balance borrowers*), 20 years (for undergraduate loans), and 25 years (for graduate loans).

* low balance borrowers are borrowers who owe less than $12,000 in federal student loans.

If you are married and file your taxes separately from your partner, The SAVE Plan excludes spousal income.

What Loans Are Eligible for Income-Driven Repayment Plans?

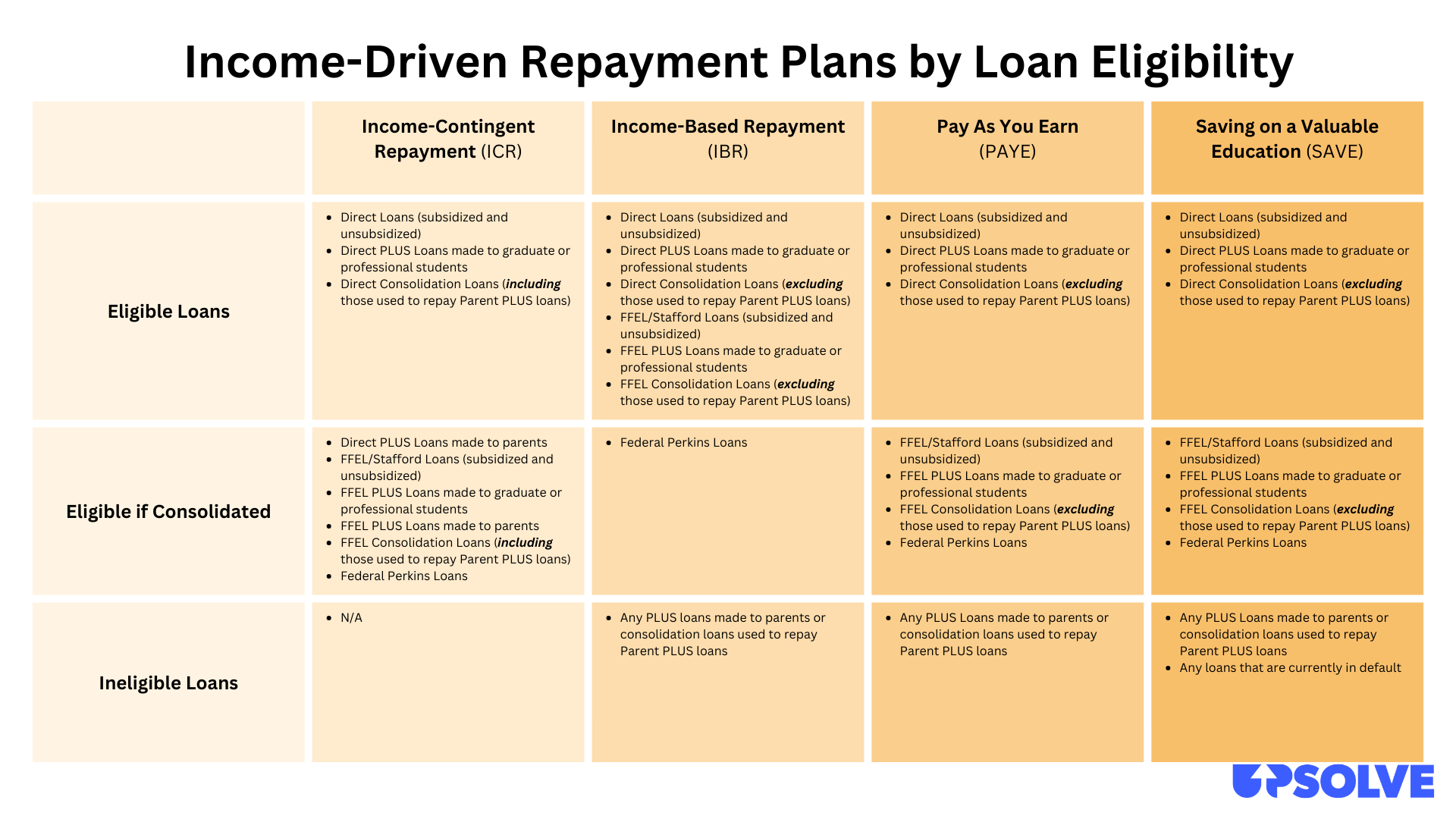

Generally speaking, if you have federal Direct Loans, you’ll have your pick of IDR plans. The group of borrowers who will find themselves most constricted is parents who took out PLUS Loans or Direct Consolidation Loans to repay a PLUS Loan. PLUS Loans are only eligible for the Income-Contingent Repayment Plan.

If you’re confused about all these different kinds of federal student loans, you aren’t alone! Luckily, there’s an easy way to identify which kind of federal student loan(s) you have: Run a report on the National Student Loan Data System (NSLDS). (It’s an official government site run by StudentAid.gov.)

Here’s the complete picture of loan eligibility by repayment plan type:

How Is Discretionary Income Calculated Under Income-Driven Repayment Plans?

The U.S. Department of Education’s calculation for discretionary income for IBR, PAYE, and SAVE plans is “the difference between your annual income and 150 percent of the poverty line for your family size and state of residence.” (Note: the SAVE Plan uses 225% of the poverty line to calculate your total.)

Discretionary income is calculated differently under ICR Plans. Here it’s defined as your Adjusted Gross Income (AGI), which you can find on your tax return, minus 100% of the federal poverty guideline for your location and family size.

Which IDR Plan Is Best for You?

All four IDR plans offer monthly payments that are based on your income, so they’re good student loan repayment plan options for those experiencing financial hardship or those whose student loan debt is much greater than their annual income.

All plans offer forgiveness of any remaining loan balance after you complete the plan, but each has different rules and eligibility requirements. Some plans require you to pass the two-part “new borrower” test, and some plans are limited to certain types of federal student loans.

So, an easy place to start is to ask yourself, “Which plan am I eligible for based on the type of loans I have?” If you aren’t sure what loan(s) you have, check your loan type by logging into the National Student Loan Data System (NSLDS). Then, you can refer to the chart above to see which plan(s) you’re eligible for.

If you’re confused about which student loan forgiveness options you qualify for, check out free online resources like Savi. Savi’s free online tool helps you compare plans, see your estimated payments under each one, and enroll in just a few clicks.

Which Plan Will Give You the Lowest Monthly Payment?

In addition to eligibility, it’s also important to consider which plan type is best for your financial situation and goals. The Department of Education’s Federal Student Aid Office has an online loan simulator that lets you compare different repayment plans based on your loan information. If you’re still not sure which IDR plan to choose, your loan servicer can enroll you in the plan that will give you the lowest monthly payment.

IMPORTANT: If you qualify for Public Service Loan Forgiveness (PSLF), all payments made under an IDR plan count toward your 10-year repayment term. Choosing the plan with the lowest monthly payments will help you maximize the benefits of the PSLF program.

Do IDR Plans Have Any Disadvantages?

There are some potential downsides to using an IDR plan. It could take longer to pay off your loans, so you could end up paying more in interest overall. This is because IDR plans have longer repayment periods — typically 20 to 25 years — compared to the Standard Repayment Plan, which typically has a 10-year repayment term.

Another downside is that, if you’re married, your spouse’s income could affect your eligibility and payment calculations. If you and your spouse file your income taxes jointly, your discretionary income and monthly payment amount will be based on your joint income. This is true for all IDR plan types. If you file income taxes separately, then SAVE, PAYE, IBR, and ICR plans will only consider your income.

Finally, one of the great things about IDR plans is that any remaining loan balance is forgiven at the end of the plan term. But there are few drawbacks to this as well: First, recent data from the NCLC shows that these plans haven’t proven to be effective forgiveness programs. The federal government is working on addressing this. And if more borrowers get forgiveness after their 20–25 years of repayment, they’ll face one final downside: The forgiven amount may be taxable. This doesn’t apply to loan balances forgiven under the PSLF program.

How Do You Get an Income-Driven Repayment Plan?

To apply for an IDR plan, you must fill out an application called the Income-Driven Repayment Plan Request and submit it to your loan servicer. You can complete and submit your application on StudentAid.gov, or you can complete a paper copy and mail it to your student loan servicer. You can apply to change your repayment plan at any time — there aren’t any special enrollment periods.

Provide Income Information & Proof of Income

IDR plans are based on how much money you make, so you’ll need to provide proof of your current income with your application. If you’ve filed your federal income tax returns for the past two years and your current income is about the same as last year, you can use the AGI from your most recent tax return. If you’re applying online, you can use the online IRS Data Retrieval Tool within the plan application website to transfer your AGI data. If you’re using a paper application, include a copy of your most recent tax return or tax transcript.

If you haven’t filed tax returns for the past two years or if your income is significantly different from what’s shown on your most recent tax return, you can submit pay stubs or other proof of your current income. If you don’t have any taxable income, you can indicate that on the application.

Let the Servicer Process Your Application

It can take your loan servicer several weeks or more to process your application. Online applications are generally processed faster than paper applications. Your loan servicer may put your loans into forbearance while your application is being processed, which pauses your monthly payments. If this happens, you won’t have to make loan payments while your application is being processed. But interest may still accrue on the loans during the forbearance.

Recertify Your Information Every Year

Income, family size, and location can all change from year to year. As a result, you must recertify your income and other information each year to stay in your IDR plan. If your family size changes or your income changes substantially, your loan payment amount will likely also change.

You’re only required to recertify once per year. If your income increases significantly during the year — you get a big raise, for example — you don’t have to change your payment until it’s time to recertify. But if your family size changes or you have a big drop in income, you don’t have to wait until your annual recertification date to lower your payments.

You have to recertify your information by the deadline each year, even if your information hasn’t changed. If you don’t recertify by your deadline, you’ll either be placed on a different repayment plan (usually with higher payments) or your monthly payment will be changed to match your payment under a Standard Repayment Plan. Also, any unpaid interest that accrued while you were in the IDR plan may be added to your principal loan balance.

If you miss the recertification deadline, you can re-enroll in the IDR program, but your repayment term may start over again.

The bottom line: You can submit updated documents and ask your loan servicer to recalculate your payments at any time. If you don’t recertify by the annual deadline, you can be placed on a different payment plan and your monthly payments may increase.

What if You Can’t Afford IDR Plan Payments?

If your estimated payments under an IDR plan are too high for you to afford because of your loan type, your spouse’s income, or other factors, don’t get discouraged. You have other repayment options that may help:.

Consider an extended repayment or graduated repayment plans.

Pros: These plans aren’t income-based, but they could result in lower monthly payments.

Cons: You could end up paying more interest under these plans, and they aren’t eligible for loan forgiveness.

Consider refinancing your student loans.

Pros: This may lower your monthly payments or provide you with better loan terms.

Cons: The federal government doesn’t refinance student loans, so when you refinance, your loans lose their federal status. That means your loan becomes a private loan, so you give up your eligibility for federal programs like loan deferment, forbearance, and student loan forgiveness.

Consider filing Chapter 7 bankruptcy to get rid of your loans without paying.

Pros: You get a fresh start! Under Chapter 7, all qualifying debt will be erased for good without you having to pay. This includes eligible student loan debt and other debts like credit card bills, medical bills, etc. If you file under Chapter 13, you’ll repay some of your debt over 3–5 years, and then the remainder will be forgiven.

Cons: Only federal Direct Loans and Direct Consolidation Loans are eligible to be discharged in bankruptcy. Also, filing bankruptcy can cause your credit score to drop, which can affect your ability to take out credit (including loans and credit cards) and may be considered in housing and employment situations.

If you’re considering bankruptcy as an option, Upsolve may be able to help! Use our screener now to see if you’re eligible to discharge your student loan debt for free.