How To Answer an Alabama Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Answering a debt lawsuit is easier than you might think! You simply need to fill out an official court answer form, tell the court why you disagree with the lawsuit, and file the paperwork with the court. Then, you have to send a copy of your answer form to the person suing you. Finally, wait to get notice from the court about next steps. If you contest the lawsuit, the court will schedule a hearing date to hear both sides of the story.

Written by Jonathan Petts. Legally reviewed by Ben Jackson

Updated April 23, 2025

Table of Contents

- How Do Debt Collection Lawsuits in Alabama Work?

- How Long Do You Have To Respond to an Alabama Court Summons for Debt Collection?

- How Do You Fill Out an Answer Form for a Small Claims Case in Alabama?

- What Happens After You Respond to the Lawsuit?

- How Do You Fill Out an Answer Form for Debt Lawsuits in an Alabama District Court?

- What Happens if You Don’t Respond to the Lawsuit?

- Need Legal Help?

How Do Debt Collection Lawsuits in Alabama Work?

If you get behind on your bills, your debt may eventually be sent to an in-house or third-party debt collector. The debt collector will call you and send written notices for a while, but if this isn’t successful, they may eventually decide to sue you to collect the debt.

If the debt collector claims you owe $6,000 or less, your case will be heard in a small claims court. If the claim is for more than $6,000 (but less than $20,000), your case will be heard in a district court. Most credit card and medical debt collection lawsuits are for $3,000 or less, so many cases will end up in small claims.

How Do You Know if You’ve Been Sued for Debt in Alabama?

If you’re sued by a debt collector, you’ll receive an official notice of the lawsuit from the court. This is called a summons. You’ll also receive a copy of the plaintiff’s (the person suing you) claims against you. In Alabama, this is called a statement of claim or a complaint.

What Is a Court Summons?

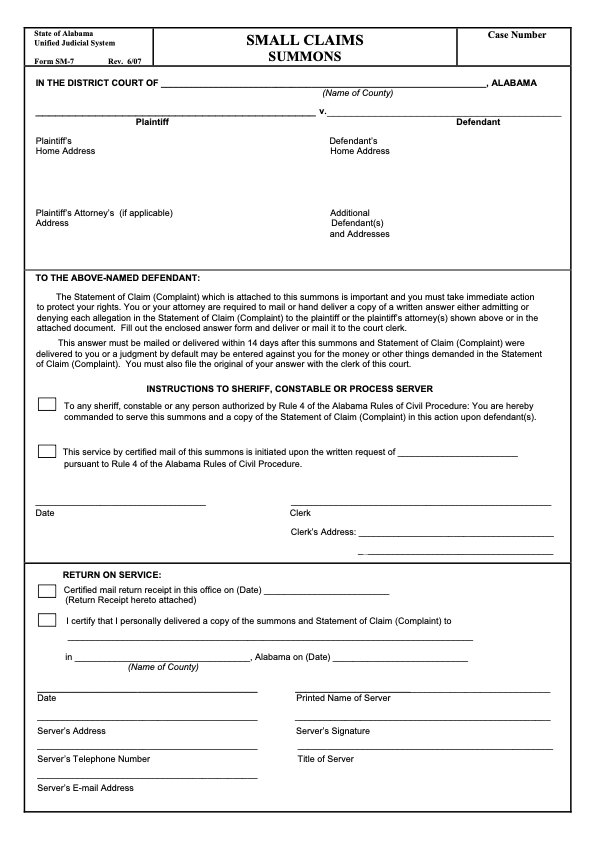

As mentioned, the summons is the official notice from the court that you’ve been sued. The summons contains important information including:

The name of the court hearing your case

The plaintiff’s name and address (the plaintiff is the person suing you)

The defendant’s name and address (if you’re being sued, this is your information)

The amount of time you have to respond to the lawsuit

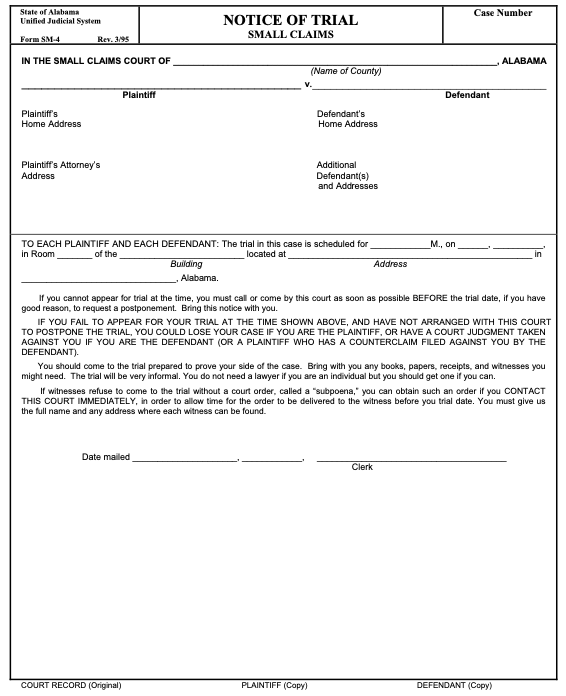

Here’s what a small claims summons form looks like:

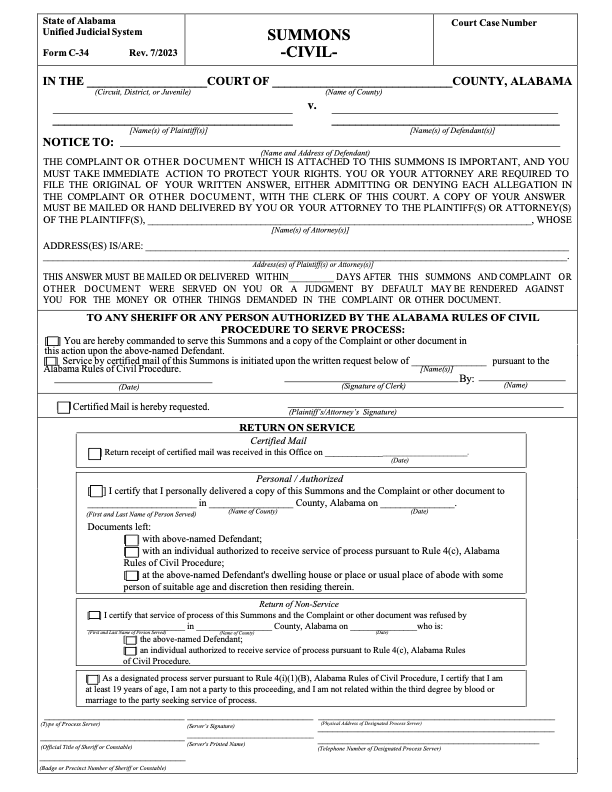

If you’re sued in Alabama District Court, you’ll receive a civil summons that looks like this:

What Is a Statement of Claim?

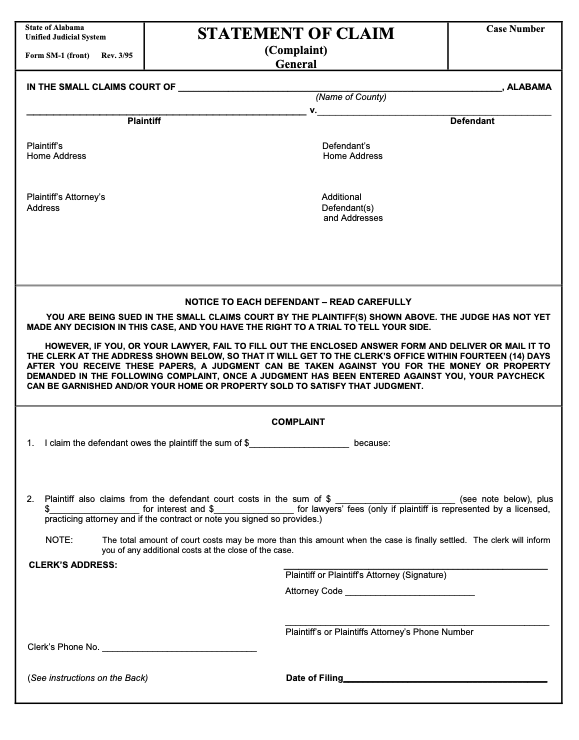

The statement of claim (also called a complaint) is the official court document that outlines the plaintiff’s claims against you. This includes how much they believe you owe them, which can include the debt amount plus interest, legal fees, and court costs. The statement of claim also says why the person suing you believes you owe the debt. Be sure to read this part carefully, as it may help you decide how to defend yourself against the debt collector in court.

Here’s what a statement of claim for Alabama Small Claims Court looks like:

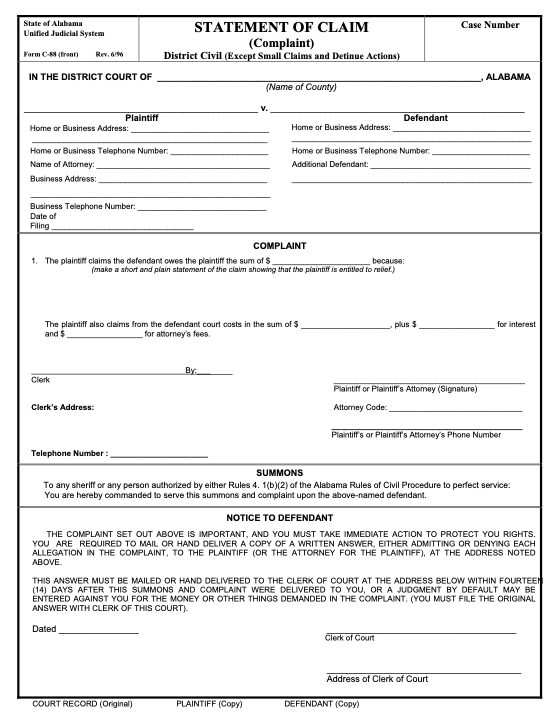

If you’re sued for a larger amount in a district court, you’ll get a statement of claim that looks like this:

As you can see, it contains all the same information as the small claims complaint form, telling you how much you’re being sued for and why.

How Long Do You Have To Respond to an Alabama Court Summons for Debt Collection?

Alabama doesn’t give you much time to reply to debt collection lawsuits filed in small claims or district courts. You only have 14 days to respond to the lawsuit by filing an answer form with the court listed on the summons.

📌 If you want help responding to the debt lawsuit but you can't afford a lawyer, consider using SoloSuit, a trusted Upsolve partner. SoloSuit has helped 280,000 respond to debt lawsuits and settle debts for less. They have a 100% money-back guarantee.

How Do You Fill Out an Answer Form for a Small Claims Case in Alabama?

To reply to the lawsuit, simply fill out a court-provided answer form. Most courts include an answer form for you to fill out with the summons and complaint you receive. If you receive an answer form, it may have some information (such as the case number, court name, and clerk’s name and address) already filled in. If not, you should fill it in yourself.

You can also download the form from the court’s website. It’s a pretty simple one-page form that has three main parts.

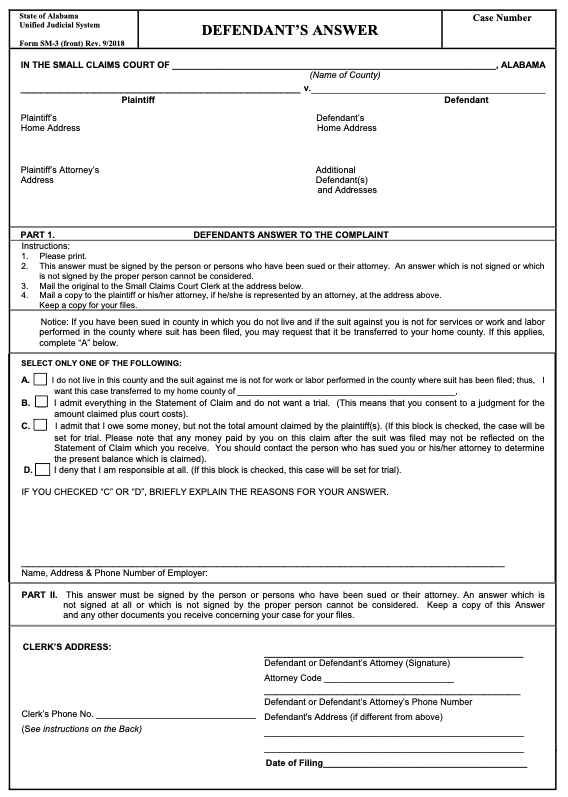

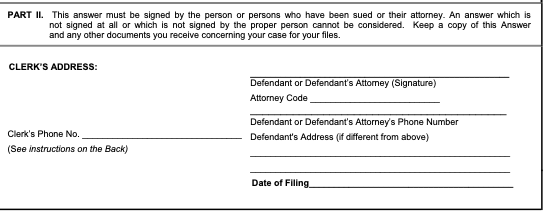

The small claims answer form looks like this:

After you download the form, you can type your answers directly into the PDF or you can print the form off and write your answers in by hand.

Step 1: Fill Out the Court Information

The top part of the form should be easy to fill out if you have the summons and complaint forms handy.

As you can see, you simply need to fill in the following information:

The case number

The name of the county court hearing your case

The plaintiff's name and address

The defendant’s (your) name and address

Step 2: Fill Out Part 1 of the Answer Form

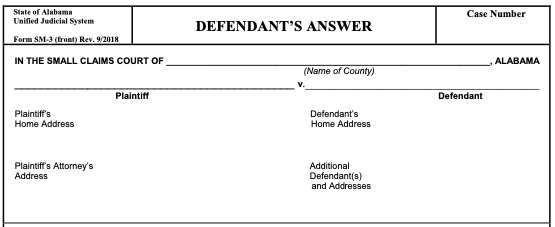

The next section of the answer form, Part 1, looks like this:

First, the court provides brief instructions on filling out the form. Then you’ll enter your response to the case by checking one of four boxes.

Check the first box (A.) if the lawsuit wasn’t filed in the county you live or work in and you want the case transferred to a local court.

Check the second box (B.) if you agree you owe the debt, don’t want to contest it in court, and admit that what the debt collector said in the statement of claim is true. (This means you’ll have to pay the debt.)

Check the third box (C.) if you believe you owe part, but not all, of the debt

Check the fourth box (D.) to deny that you owe the debt.

As you can see, if you check box C or D, you need to add a brief explanation in the blank space below. This is where you can include any defenses or affirmative defenses you have.

What Are Affirmative Defenses?

A basic denial is a defense. If what the debt collector said in their complaint isn’t true, you can deny the complaint and show any evidence you have that supports your position.

Because many debt collectors get information wrong, you may also have an affirmative defense you can raise to win the lawsuit or get it dismissed by the court. An affirmative defense is a reason the plaintiff shouldn’t win based on information they didn’t include (or got wrong) in their complaint.

Some of the most common affirmative defenses in debt collection cases are:

The debt is past the statute of limitations. If your credit card or medical debt is more than six years old, it may be past the state’s statute of limitations. If true, this is a strong affirmative defense. (Note that the statute of limitations for credit card debt in Alabama has been interpreted differently by different courts. In some cases, it’s been determined to be as short as three years.)

You already paid the debt. If the debt was yours but you’ve already paid it off (either because you paid the original creditor or the debt collector), you can raise this as an affirmative defense. You’ll need to show proof of payment as evidence.

The debt isn’t yours. When debt gets sold to third-party agencies and buyers, information can get lost or miscommunicated. If the debt isn’t yours (look at the name, account number, and other personal identifying information on the debt), raise this as an affirmative defense.

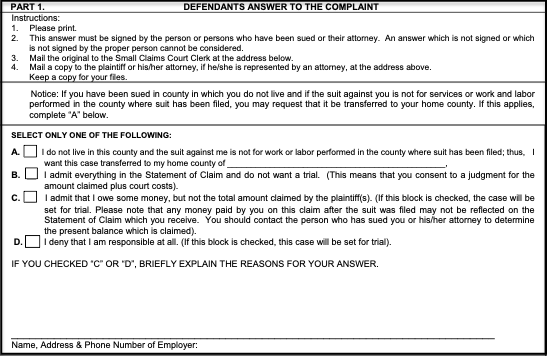

Step 3: Fill Out Part 2 of the Form and Make Copies

This last part is pretty easy, simply sign the form where it says “Defendant.” If the answer form came with your summons and complaint, the clerk’s information will probably already be filled in. The address is provided so you know where to send the completed form if you choose to file by mail.

Keep the clerk’s phone number handy. If you have questions about what happens next or you need to reschedule future hearings, you can call the clerk.

After the form is complete, make two copies. Keep one for yourself. File the original with the court, and send the final copy to the plaintiff.

Step 4: File the Form With the Court and Send the Plaintiff a Copy

You can file your small claims answer form with the court via mail or by going in person to the courthouse. Since you only have 14 days to respond to the case, it’s advisable to get the form in the mail as soon as possible or, if you’re able to, file in person so you know the clerk received the form. If you mail your forms, the court advises you to call the clerk after a few days to ensure they received your answer form.

If the clerk doesn’t have the form in hand within 14 days of you getting the summons, the judge will assume you aren’t contesting the debt and you may lose the case automatically.

What Happens After You Respond to the Lawsuit?

After you respond to the lawsuit, you’ll get a notice of trial from the court. This tells you when and where your hearing will be. It also includes instructions for preparing for trial and a strongly worded reminder that you’ll lose the case if you don’t show up for trial.

The notice of trial looks like this:

Prepare your case well before your trial date. Be prepared to tell the judge and debt collector you want to see proof that the debt collector actually owns and can legally collect on the debt. Also, gather any evidence you have that supports your affirmative defenses. This may be receipts, bank or credit card statements, a call log with notes from debt collection calls you received, or other documents that back up your case.

How Do You Fill Out an Answer Form for Debt Lawsuits in an Alabama District Court?

If you’re not sued in small claims, your case will likely be heard in district court. The process to respond is very similar to the small claims process, so read the instructions above. You may not receive an answer form with the summons and complaint if you’re sued in district court. You can download one from the court, or you may be able to simplify the process by e-filing your form.

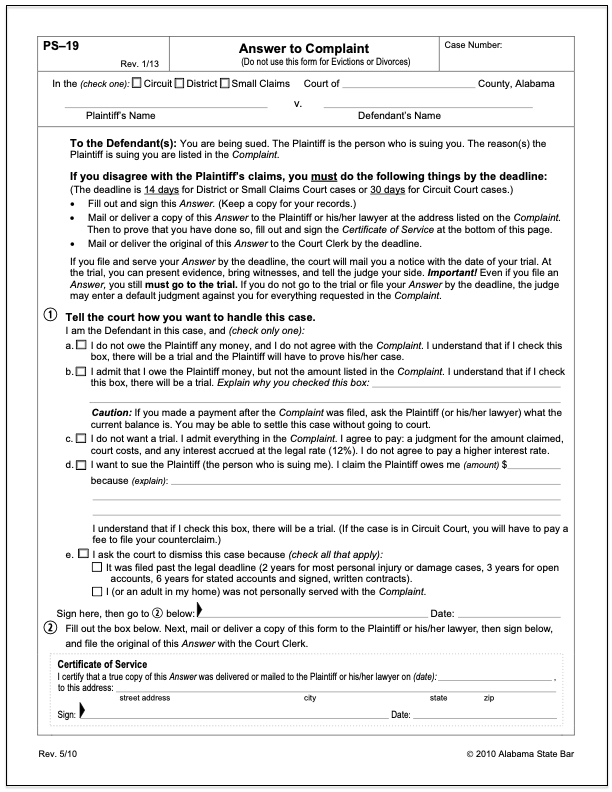

The answer form in district court looks like this:

As you can see, the form itself has easy-to-follow instructions. To complete the form, fill in the court and case information on the top portion and then check the lettered box that best fits your response:

Box A says that you don’t believe you owe the plaintiff any money and you want them to prove their case.

Box B says you admit you owe the plaintiff some money, but they got the amount wrong.

Box C says you admit to owing what the plaintiff said you owe in the complaint and you agree to pay the debt and any accrued interest at a 12% rate.

Box D is how you tell the court you want to file a counterclaim.

Box E is a request to the court to dismiss the case. You can request dismissal for two reasons:

The debt account is too old (past the statute of limitations of three years).

The plaintiff didn’t properly serve the complaint.

Check the relevant box and add a brief explanation if needed. Then make two copies of the form. File the original with the court (electronically via the court’s e-file system, by mail, or in person). Keep a copy for yourself. Mail or personally deliver the other copy to the plaintiff or their lawyer at the address listed on the summons. When you sign and date the answer form, you are attesting that you have served (delivered) the paperwork to the plaintiff.

What Happens if You Don’t Respond to the Lawsuit?

Facing a debt collection lawsuit can be daunting, but responding is easier than most people think. And it’s well worth doing because if you don’t, the court may issue a default judgment against you. A default judgment is a court order that authorizes the debt collector to take your money via a wage garnishment or a bank levy.

Debt collectors often count on defendants not responding, as it makes their job easier. But you can shift the balance by taking the step to respond to the lawsuit. It signals that you're prepared to challenge the claim. If the debt collector knows they can’t prove the debt in court, they may drop the case or contact you to settle the debt for far less than the total you owe.

It’s fine to negotiate a debt settlement agreement with a debt collector after you’re served with a summons. Just be sure you continue to follow all court deadlines and procedures. Send in your answer on time and show up to scheduled hearings if you haven’t sent a copy of the agreement to the court yet. If you don’t, again, you can lose the lawsuit, even if you’re negotiating in good faith with the creditor.

What if There’s Already a Default Judgment Against Me?

If the judge has already issued a default judgment against you, you may still be able to act to get it removed by filing a motion to vacate (cancel) the judgment. Filing a motion is just more paperwork. A motion is a formal request to the court. This process can get complicated and often comes with strict deadlines. If you want to learn more, contact the court clerk, tell them a default judgment was issued against you, and ask them if you can do anything to have it canceled.

Speak to the court clerk, tell them your situation, and ask about your options. They can’t give legal advice, but they will be able to tell you if there’s a process in place to contest the judgment.

Need Legal Help?

Legal Services Alabama provides free or low-cost legal help for qualified individuals.

The Alabama State Law Library has resources for individuals representing themselves in court. Law librarians can also help you access legal resources and provide guidance on legal research methods and resources. They can’t give you legal advice though.

The Alabama State Bar lists legal clinics, which are programs that offer free or low-cost legal services, advice, and representation to individuals.