Your Guide to Alabama’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you live in Alabama, the federal Fair Debt Collection Practices Act (FDCPA) is your strongest protection against bad behavior by third-party debt collectors. This law prohibits harassment, deception, and other unfair practices during the debt collection process. The statute of limitations for credit card and medical debt is three years in Alabama.

Written by Jonathan Petts.

Updated May 22, 2025

Table of Contents

What Are the Debt Collection Laws in Alabama?

Alabama doesn’t have a dedicated state law that addresses debt collection practices. But thankfully, Alabama residents aren’t without rights and protections. These rights and protections come primarily from the federal Fair Debt Collection Practices Act (FDCPA).

Here’s an overview of the FDCPA:

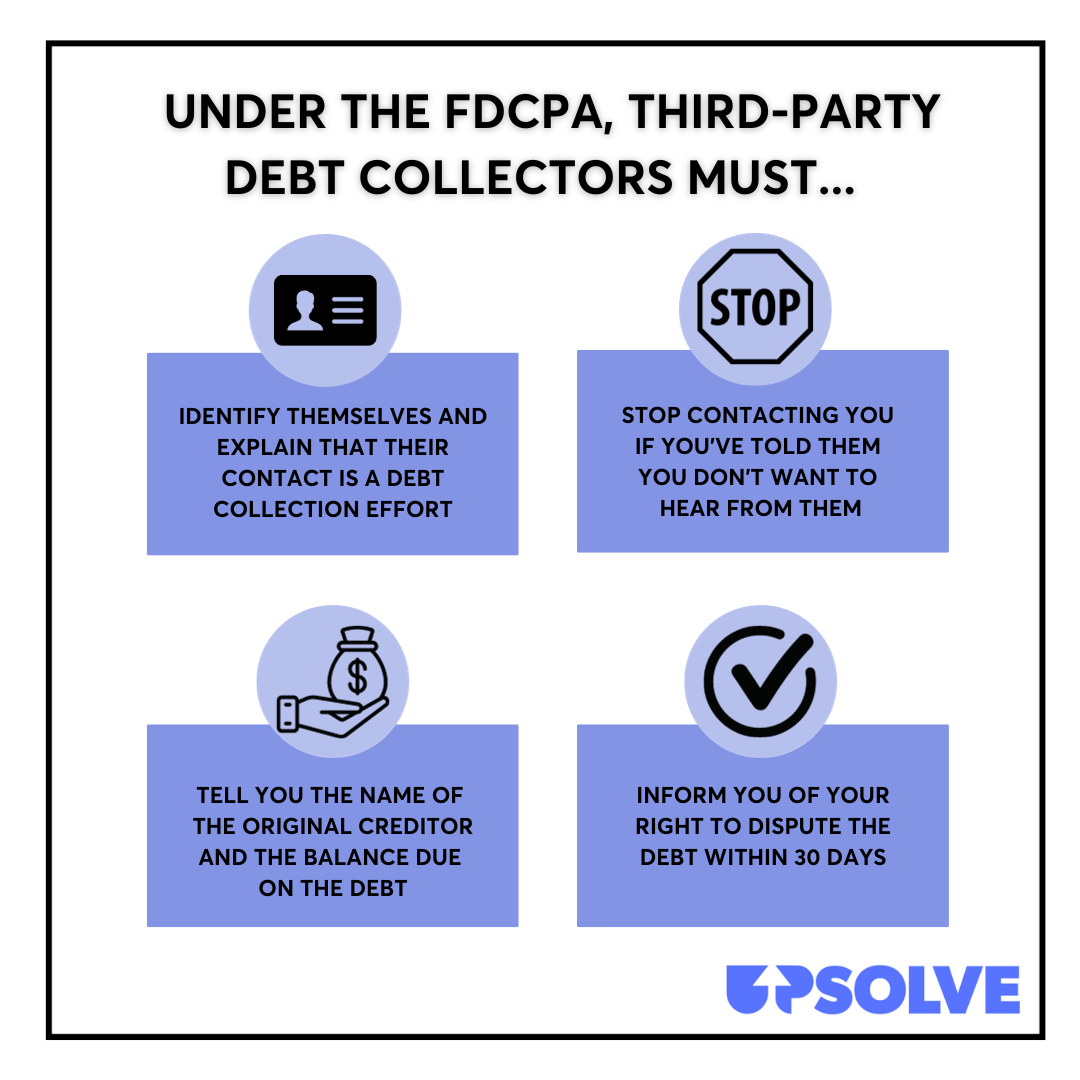

The FDCPA outlines certain responsibilities for debt collectors, which include the following:

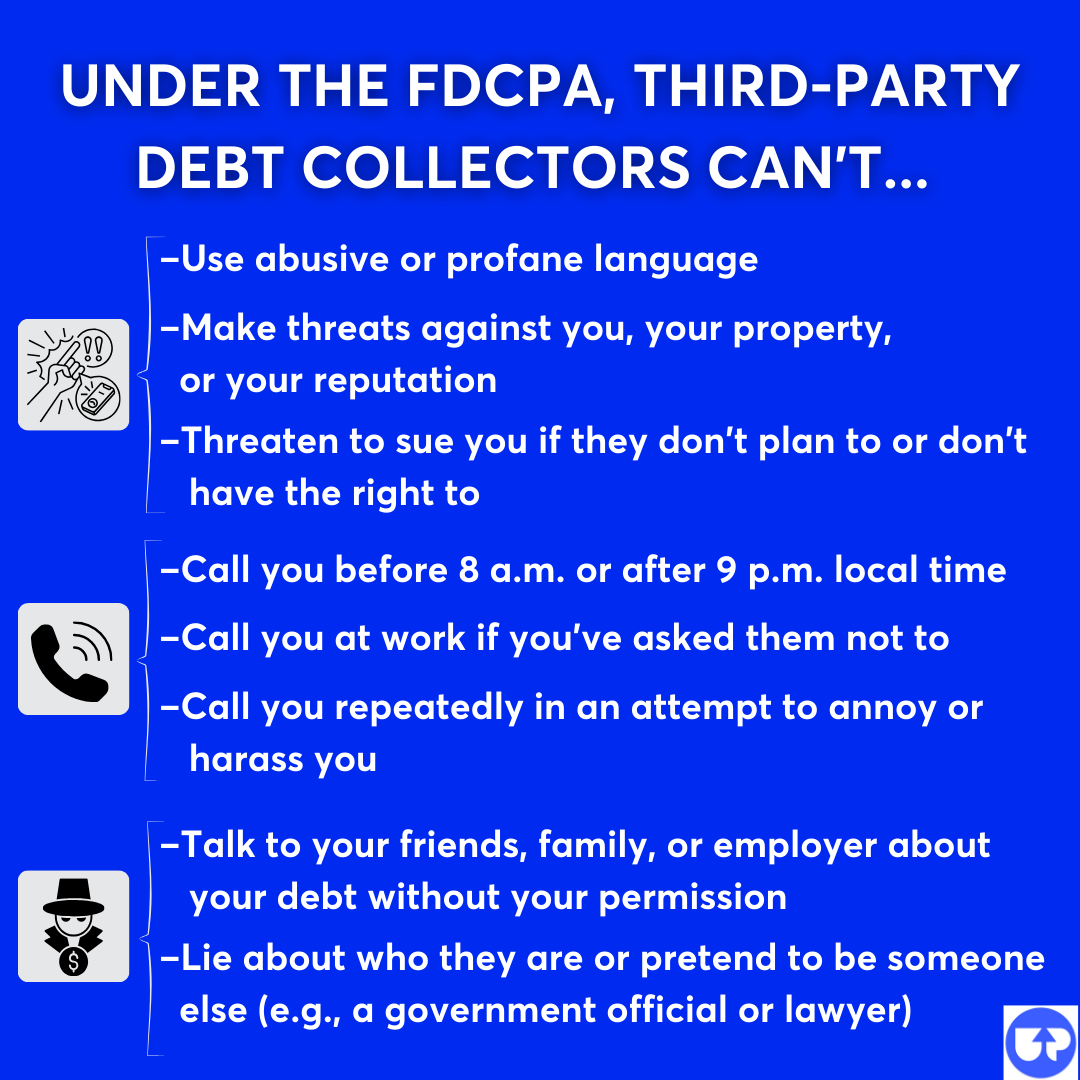

The FDCPA also prohibits certain practices, including the following:

What Can You Do if a Debt Collector Breaks the Law in Alabama?

If you’re the target of debt collector harassment or other bad behavior, report it. You can also sue third-party debt collectors who violate the FDCPA.

To report a debt collection agency, file a complaint online with the Consumer Financial Protection Bureau (CFPB). The CFPB is the federal agency that helps enforce the FDCPA and punish those who violate it.

You can also sue third-party debt collectors in federal court. If you win the lawsuit, you may be compensated for any real financial loss or harm that happened as a result of the debt collector’s behavior. These are called actual damages. You may also qualify for up to $1,000 in statutory damages.

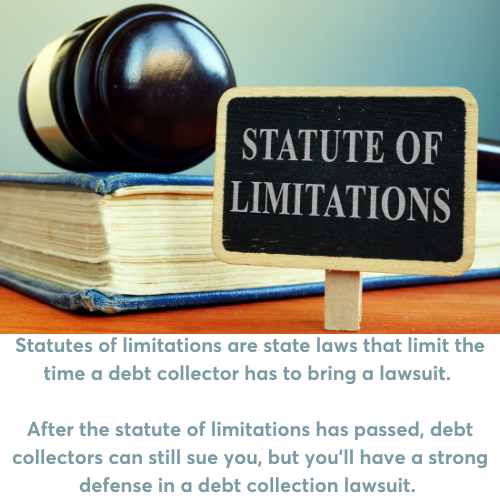

What Is the Statute of Limitations for Debt Collection in Alabama?

The statute of limitations is an important state law that limits how long you can be sued for debts. The timeline varies by the type of debt. Credit card debt and medical debt are two of the most common types of consumer debts in collections. Alabama state courts have interpreted the statute of limitations for credit card differently in different cases. It may be as little as three years or as much as six years. The statute of limitations for medical debt is usually three years.

Here’s a rundown of the statute of limitations for other types of debt in Alabama:

| Type of Debt | Statute of Limitations |

|---|---|

| Open Accounts (medical bills) | 3 years |

| State Tax | 3 years |

| Breach of Contract | 4 years |

| Oral Contracts | 6 years |

| Written Contracts | 6 years |

| Credit Cards* | 3-6 years |

What Can Debt Collectors Do To Collect Debt in Alabama?

Debt collectors aren’t allowed to harass or mislead you in their attempts to collect a debt from you, but they still have a lot of options to try to get your money. If typical collection calls and letters fail, they may eventually decide to take you to court.

Debt collection lawsuits have increased quite a bit in recent years as debt collectors find that many people don’t respond, so the collector can get an easy win. If they do win, they can get access to collection measures like wage garnishment, bank levies, and property liens.

If this all sounds scary, take a deep breath and rest assured that you can fight back if you get sued. You’ll need to do some paperwork and learn a little about the process, but it’s possible to do this without hiring an expensive lawyer to help. To learn more, read Upsolve’s article on responding to a debt lawsuit in Alabama.

If you do get sued, don't panic. You may be able to respond on your own and avoid wage garnishment. SoloSuit, an Upsolve partner, helps you draft and file a response to the lawsuit and has helped over 280,000 people handle debt lawsuits. They offer a money-back guarantee if your documents aren’t accepted by the court.

Need Help With Debt Relief? Here Are Some Options

Dealing with debt is stressful. Getting support can help you reduce stress and gain the confidence to get your finances on track.

Don’t know where to start? Try a free appointment with an accredited, nonprofit credit counselor. Credit counselors help individuals manage their debts and financial challenges by providing guidance on budgeting, debt repayment, and financial education. They can go over your debt relief options and help you decide the best way to tackle your debt.

If you have a lot of debt and can’t see a way out, the credit counselor may recommend looking into Chapter 7 bankruptcy so you can get a fresh start. If this is the route you decide to take, Upsolve can help. See if you qualify to use our free filing tool. Upsolve has helped 300,000 people get rid of $7 million of debt and counting. And our services are completely free.