How To Answer a South Carolina Debt Collection Court Summons

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If you’re sued for a debt in South Carolina, the most important thing you can do is respond! Here are the basic steps: 1. Fill out an answer form. 2. Note your defenses. 3. File your forms with the court within 30 days of receiving the summons. 4. Deliver a copy of your answer form to the person suing you.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated April 24, 2025

Table of Contents

How Do Debt Collection Lawsuits in South Carolina Work?

Having a debt in collections usually leads to phone calls and written notices, but if the matter isn’t resolved, debt collectors may eventually decide to bring a debt collection lawsuit against you.

If you’re sued for debt in South Carolina, your case will end up in either circuit court or magistrate court.

Circuit court is the trial court of general jurisdiction in South Carolina. It’s divided into civil and criminal sections — debt collection lawsuits are civil cases. The civil division is sometimes called the Court of Common Pleas, and the criminal division is sometimes called the Court of General Sessions.

Magistrate court (sometimes referred to as summary court) hears civil court cases for claims up to $7,500. Magistrate court is essentially a small claims court in South Carolina.

If you get sued, you’ll be notified with a summons and complaint.

What Is a Summons and Complaint?

A summons and complaint are official court documents.

The summons notifies you that a lawsuit has been filed against you. The summons tells you the deadline to respond to the complaint, which court will hear your case, and who is suing you.

The complaint outlines the allegations, or claims, that the plaintiff is making against you. The plaintiff is the legal term for the person who’s suing you. The defendant is you or the person being sued. In debt collection lawsuits, the complaint lists claims about your debt, such as how much the collector thinks you owe and why they believe you owe it.

The complaint will also explain what the debt collector wants if they win the lawsuit. This is usually a money judgment against you — a court order for you to pay the debt. The judgment amount could include the debt the collector believes you owe, any interest that has accrued since your last payment, and any other costs the plaintiff thinks you should cover as a part of the lawsuit, such as legal costs.

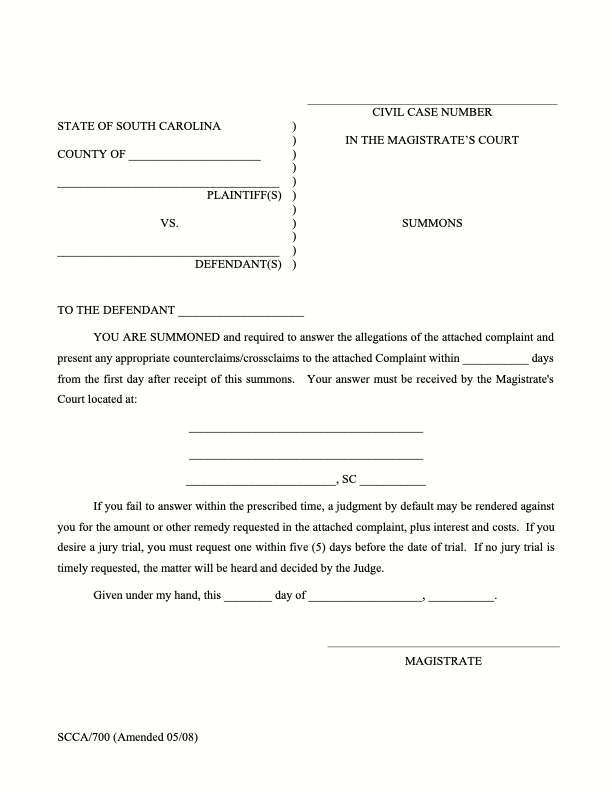

Here’s an example of a South Carolina summons:

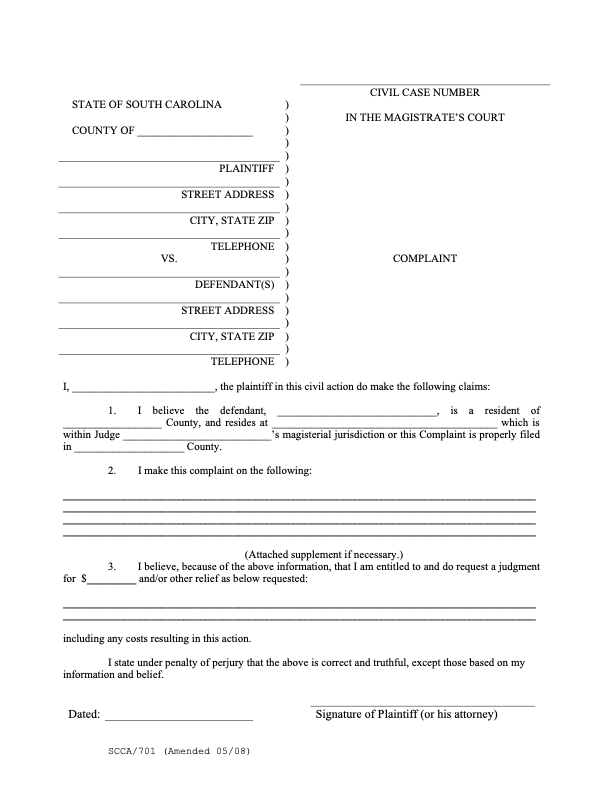

Here’s an example of a South Carolina complaint form:

How Do You Respond to a South Carolina Court Summons for Debt Collection?

Whether your case is being heard in circuit court or magistrate court, you need to file an answer with the court listed on your summons or you risk losing the lawsuit automatically. An answer is how you acknowledge the lawsuit and get the chance to explain your side (or defenses) to the judge.

If your case is in magistrate court, you can file an answer or show up to the hearing to respond with your answer orally. However, it’s advisable to file a written answer for a few reasons: It gives you a chance to formulate your defenses, thoughtfully respond to the complaints, and gather any documents that support your story.

You don't have to hire a lawyer to respond to the lawsuit successfully. You can respond on your own or use a service like SoloSuit to draft and send your answer form. SoloSuit has helped over 280,000 people respond to debt lawsuits and settle debts for less. They also have a money-back guarantee.

How Do You Fill Out an Answer Form?

To file an answer form with both the circuit court and magistrate court, you can download the forms from the South Carolina court website.

The South Carolina Bar website also has a great guide on how to fill out and file your answer form in magistrate court.

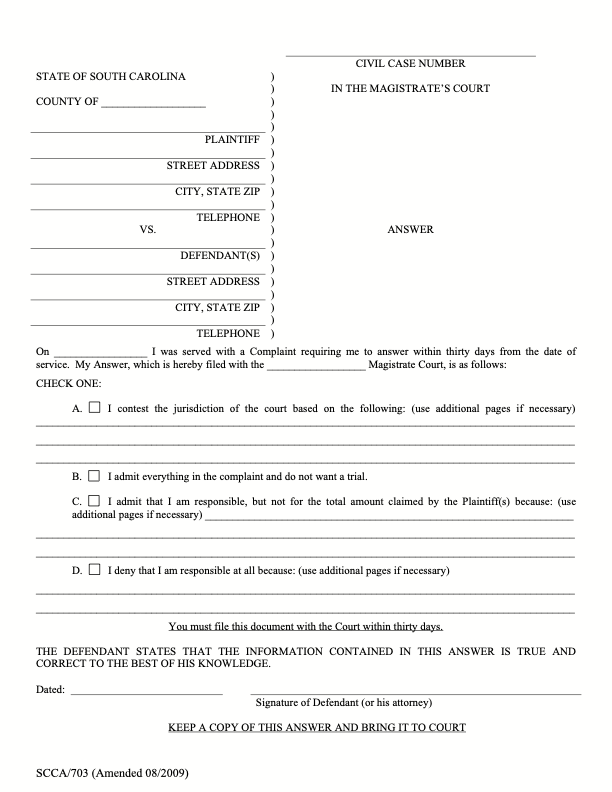

Here is an example of what the magistrate court answer form looks like:

Step 1: Address Each Complaint/Allegation

On the complaint you receive, the plaintiff will outline their claims against you in numbered paragraphs. When you fill out your answer form, be sure to address every one of these allegations by number.

You can respond by either:

Admitting it, which means you agree with the statement

Denying it, which means you disagree with the statement

Claiming a lack of knowledge of the truth, which means you don’t know if the statement is true or not or you need more information

In South Carolina, you can also admit partial responsibility for a plaintiff’s claim, which may be useful if a claim in the complaint includes multiple facts, some that you admit and some you deny.

You can also contest the jurisdiction of the court in your answer. The most common reason people contest the jurisdiction is that they were sued in a court that’s not near where they live or work.

Step 2: Prepare Your Defenses and Counterclaims

While the magistrate court answer form doesn’t provide space for you to write out your defenses, it’s good to think about which might apply to your case before you go to court.

The circuit court (court of common pleas) provides space for you to write your affirmative defenses directly on the answer form.

An affirmative defense is a reason you shouldn’t have to pay the debt. These defenses are usually based on information that the plaintiff didn’t include in their complaint. Common affirmative defenses include:

The debt collector violated the FDCPA by engaging in fraud or misrepresentation.

The statute of limitations has run out, so the debt collector doesn’t have the right to sue you for the debt.

The debt was discharged in bankruptcy.

The debt isn’t yours or you already paid it.

At this point, you can also file a counterclaim if you want to make a claim against the plaintiff. This process can get quite complicated. If you want to countersue, consider getting legal help. Free and low-cost resources are listed at the end of this article.

Step 3: File Your Forms With the Court Clerk Within 30 Days

Regardless of which court is hearing your case, you need to file your answer within 30 days of receiving the summons and complaint.

Make two copies of your answer form. File the original with the court clerk. Serve (deliver) a copy to the plaintiff (more on this in the next step), and keep a copy for your records

You can file your answer in person or contact the court clerk to ask if other filing options are available.

Step 4: Serve a Copy of the Answer to the Plaintiff

You will then serve the plaintiff (or their lawyer). In legal terms, to “serve” means to formally and properly deliver. You’re required to serve your answer form (and counterclaims) on the plaintiff at the address listed on the court summons. Often, but not always, this will be an attorney representing the creditor or debt collector.

You can serve a copy of your answer to the plaintiff (or their lawyer) in person or by mail. If you choose to send it by mail, it’s advisable to use certified mail with a return receipt so you have proof that you sent the form when you said you did.

What Happens After You Respond to the Lawsuit?

If you or the plaintiff request a jury trial, the court may order mediation. If you do want to request a jury trial, you need to make your request five days before the scheduled trial date.

How To Prepare for Court Appearances

Going to court may feel a little intimidating. If you’ve never been before, you might not know what to expect. Many people find their confidence increases by spending a little time preparing and following some simple best practices.

To have a successful court experience, it’s best to:

Arrive early for your hearing.

Speak respectfully to the judge and other people in the courtroom.

Dress professionally.

Be organized and bring copies of relevant documents to support your defenses.

Upsolve’s article on What Happens In Small Claims Court has other helpful tips.

What Happens if You Don’t Respond to the Lawsuit?

The most important thing you can do in a debt lawsuit is acknowledge it and take action. If you ignore the lawsuit, it won’t just go away. Instead, you’re likely to lose the case and have a default judgment issued against you.

This allows the person or company suing you to request a court order for wage garnishment, a bank account levy, or a property lien.

Debt collectors count on you not showing up to court or responding to the lawsuit. If you take action and respond to the lawsuit, you give yourself a fighting chance to win the debt collection lawsuit.

What Do I Do if the Court Already Issued a Default Judgment Against Me?

If a default judgment has already been ordered against you, you can file a motion to vacate the judgment. To vacate means to cancel the judgment ordered.

You may be able to vacate a judgment if you can prove a mistake was made, new evidence was discovered, there was fraud on the plaintiff’s part, etc.

Need Legal Help?

If you need legal help, or general legal guidance, here are a few resources for South Carolina-specific legal issues:

LawHelp.org/SC has legal guides and legal help resources for South Carolina residents.

South Carolina Legal Services is a legal service project that provides legal services and assistance to South Carolina residents.

South Carolina Bar's Guide to Magistrate’s Court is a detailed guide on how to navigate magistrate court in South Carolina.

SC Judicial Branch Court Forms is a directory of downloadable South Carolina court forms.