Your Guide to Arizona’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

In Arizona, most debt collectors must follow regulations set out in state and federal law. These laws were designed to increase transparency and fairness in the debt collection process. Arizona state law mirrors the many protections set out in the federal Fair Debt Collection Practices Act (FDCPA), which prohibits third-party debt collectors from harassing or deceiving you. If debt collectors violate the law, you can report them and sometimes even sue them for damages. The statute of limitations for credit card debt and medical debt is six years in Arizona.

Written by Ben Jackson. Legally reviewed by Jonathan Petts

Updated December 17, 2025

Table of Contents

What Are the Debt Collection Laws in Arizona?

In Arizona, third-party debt collectors are regulated by state law as well as the federal Fair Debt Collection Practices Act. State laws can be found in Title 32, Chapter 9 of the Arizona Revised Statutes.

How Does Arizona State Law Protect You Against Debt Collectors?

Arizona law requires most collection agencies and debt collectors to be licensed and bonded (for exceptions, see 32-1004) and to follow certain rules.

The law aims to ensure that debt collectors’ practices are transparent and fair. This means that debt collectors can’t engage in unfair or misleading practices, including misrepresenting who they are or how much you owe.

For example, they can’t pose as a lawyer if they aren’t one or pretend to be a government official. They also can’t send communications that are meant to look like legal documents but aren’t. Finally, debt collectors can’t threaten to charge you additional fees, such as a service or investigation fee, if they aren’t legally allowed to charge such a fee.

Arizona law mirrors the main federal law that regulates third-party debt collectors: the Fair Debt Collection Practices Act (FDCPA).

How Does the Federal Fair Debt Collection Practices Act (FDCPA) Protect You?

The FDCPA is a federal law that was designed to stop debt collectors from harassing, deceiving, and misleading people during the debt collection process. Though it doesn’t lay out licensing requirements, it otherwise mirrors and expands on Arizona state law.

Here’s an overview of the FDCPA:

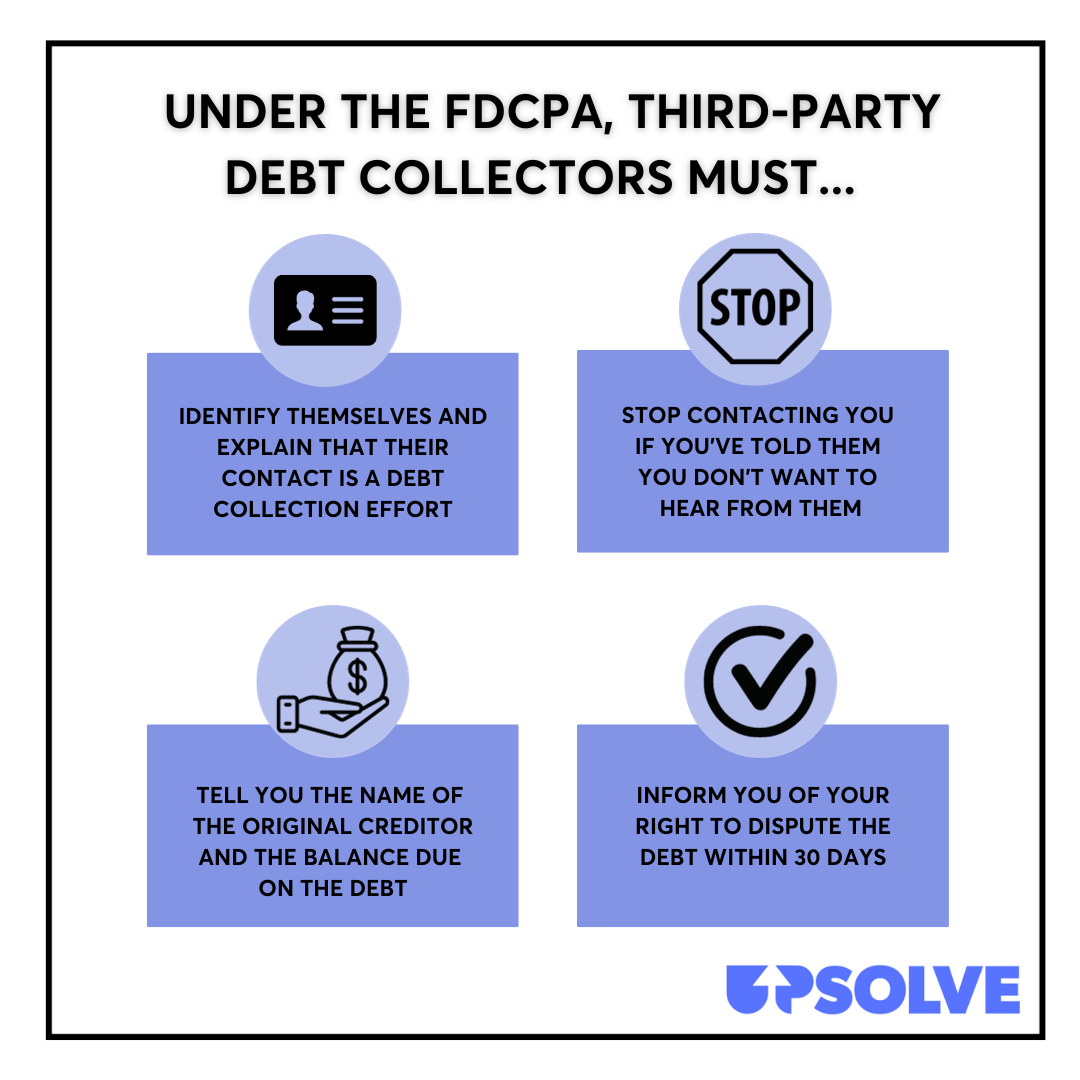

The FDCPA sets out certain requirements for debt collectors, including:

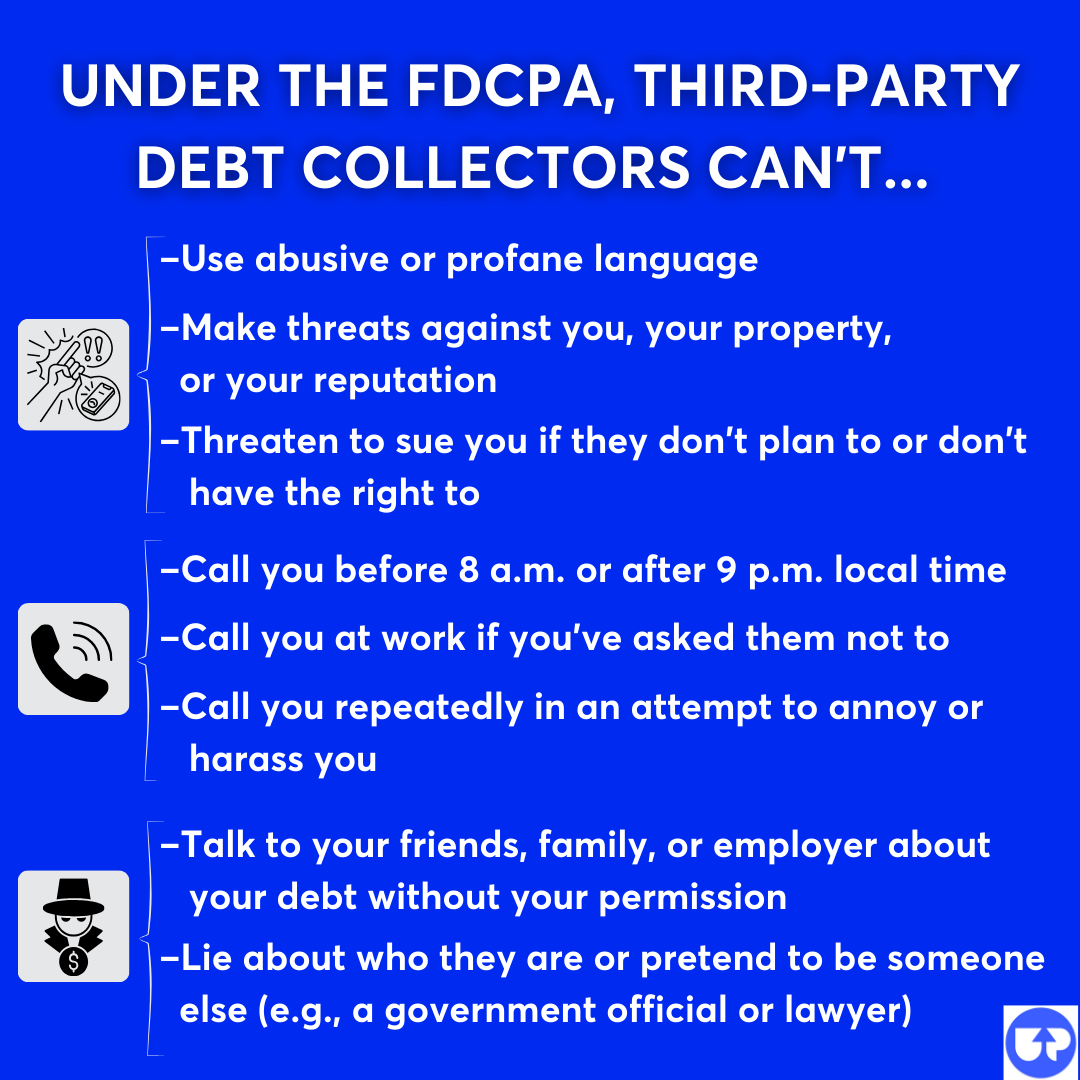

The FDCPA also prohibits certain practices, including:

What Can You Do if a Debt Collector Breaks the Law in Arizona?

If a debt collector violates a state or federal law in the collection process, you can report them. You may even be able to sue them for damages.

How To Report a Debt Collector

Violating Arizona’s debt collection statute is a criminal act. It’s easy to report agencies that violate state law. You simply file a complaint with the Arizona attorney general, who will investigate the matter and determine the consequences, which could include jail time, fines, loss of licensure, and years of probation.

Most state law violations will also be federal FDCPA violations. You can report these violations to the Consumer Financial Protection Bureau (CFPB). This federal agency helps enforce the FDCPA and protect your consumer rights.

How To Sue a Debt Collector for FDCPA Violations

You can also sue debt collectors who violate the FDCPA. Since this is a violation of a federal law, you’d bring the lawsuit in federal court. If you win the case, you can get compensation in the form of actual damages (money for losses or harm) and statutory damages of up to $1,000 (compensation set by law).

Individuals can’t bring lawsuits against debt collectors in state court for state law violations. This is because breaking Arizona’s debt collection law is considered a criminal offense. Your best recourse is to report the debt collector to the state attorney general, who can bring a lawsuit against the collection agency.

What Is the Statute of Limitations for Debt Collection in Arizona?

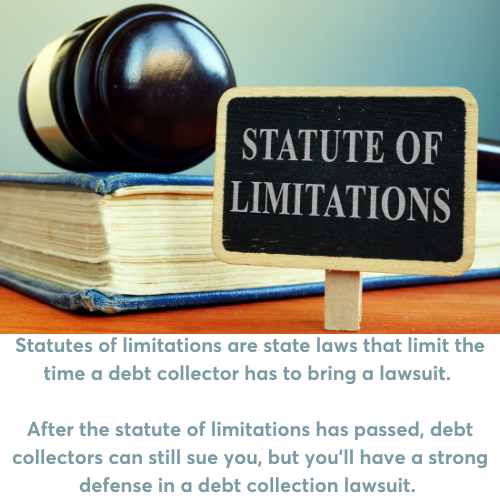

Arizona law also defines the statute of limitations for different types of debt. The statute of limitations is the time a debt collector legally has to sue you to collect a debt.

| Type of Debt | Statute of Limitations |

|---|---|

| Credit Card | 6 years |

| Car Loans | 4 years |

| Medical Debt | 6 years |

| Mortgage Debt | 6 years |

| State Tax Debt | 10 years |

Once a debt is past the statute of limitations, the debt collector isn’t legally allowed to sue you for the debt. However, debt collectors often do bring lawsuits against people for old debts.

So beware if you get a court summons for an older debt! If this happens to you, you should answer the lawsuit and tell the judge the debt is past the statute of limitations. This is a strong defense that helps most people get these cases dismissed. Here’s a step-by-step guide to dealing with a debt lawsuit in Arizona.

What Can Debt Collectors Do To Collect Debt in Arizona?

Collectors in Arizona have to follow state and federal laws during the debt collection process, but they can use several legitimate avenues to get their money back. If phone calls and collection letters don’t get the debt collector what they want, they may eventually decide to take you to court.

If this happens, you’ll be notified with official court papers called a summons and complaint. It’s crucial that you respond to court by the deadline (or within the time frame) listed on the summons. If you don’t, the most likely outcome is that you’ll lose.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft an answer letter for a small fee using SoloSuit. They've helped over 300,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

What Happen if You Lose a Debt Lawsuit?

If you do lose the case, this opens you up to new collection measures including:

Most debt collectors will opt for wage garnishment. This is when they get a court order to take money directly from your paycheck. Arizona law limits how much they can take, but wage garnishment is very hard on most people. You may be able to avoid this by responding to the debt lawsuit and raising your defenses.

If the debt you’re being pursued for is related to a car loan, you also want to be aware of the possibility of having your car repossessed. Lenders in Arizona don’t have to get a court order to repossess your vehicle if you’ve defaulted on the loan.

Need Help With Debt Relief? Here Are Some Options

Getting into debt can happen quickly, and getting out can feel difficult. But you have options. If you aren’t sure where to start, consider scheduling a free session with a nonprofit credit counselor. Credit counseling was designed to help everyday people understand their finances and debt relief options. Credit counselors may recommend a debt management plan, debt consolidation, bankruptcy, or other options.

Bankruptcy can help you get a financial fresh start. It isn’t right for everyone, but if you decide this is the best choice for you, Upsolve may be able to help. See if you’re eligible to use our free filing tool for your Chapter 7 case. Upsolve has helped over 20,000 people erase over $950 million in debt... and our services are completely free.