The Complete Guide To Understanding Chapter 7 Bankruptcy

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Chapter 7 bankruptcy is a legal tool that helps people erase certain debts they can’t afford to pay, like credit card balances and medical bills. It’s the most common type of bankruptcy and can offer fast relief, often wrapping up in about 4–6 months. To qualify, you’ll need to meet income guidelines and complete two short courses. While not all debts can be wiped out, many people keep all of their property and feel immediate relief from collection efforts.

Written by Kristin Turner, Harvard Law Grad. Legally reviewed by Attorney Andrea Wimmer

Updated June 23, 2025

Table of Contents

- Key Takeaways

- What Is Chapter 7 Bankruptcy?

- Does Chapter 7 Bankruptcy Clear All Debt?

- Who Is Eligible To File Chapter 7 Bankruptcy?

- How Much Debt Do You Need To File Chapter 7?

- What Does It Cost To File Chapter 7 Bankruptcy?

- How Long Does Chapter 7 Bankruptcy Take?

- How Does Bankruptcy Affect Your Credit?

- What Are the Benefits and Drawbacks of Filing Chapter 7?

- What Happens to Your Property in Chapter 7 Bankruptcy?

- Should You File Chapter 7 Bankruptcy?

- Chapter 7 vs Chapter 13: Which Is Better?

- What Are Some Alternatives to Chapter 7 Bankruptcy?

- Frequently Asked Questions About Filing Chapter 7 Bankruptcy

Key Takeaways

✅ Chapter 7 clears most unsecured debts like credit cards, payday loans, and medical bills. But it doesn’t usually erase child support, recent taxes, and certain student loans.

✅ Eligibility depends on your income through the means test, which compares your earnings to your state’s median income level.

✅ You can usually keep your property, like your car or home, as long as it's protected by exemptions and you're current on payments.

✅ The process is quick and affordable. Most cases take just 4–6 months, and Chapter 7 costs less than most other debt relief options, especially if you qualify for fee waivers.

✅ Filing triggers an automatic stay. This legal protection stops most collections, lawsuits, and wage garnishments immediately, giving you space to breathe while your case moves forward.

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is the most common type of bankruptcy that individuals file in the United States.

👉 At its core, Chapter 7 bankruptcy is a legal process that allows you to eliminate certain debts you can’t repay like credit card bills, medical bills, payday loans, and more.

Here’s how it usually works:

📃 To file, you fill out the required bankruptcy forms and submit them to the bankruptcy court that serves your area. These forms tell the bankruptcy court what you earn, spend, own, and owe. You’ll also submit recent tax returns and pay stubs if you’re employed, and you’ll pay the required filing fee or submit a fee waiver application.

A bankruptcy trustee then reviews your forms and documents. They'll hold your 341 meeting of creditors, where they’ll ask you basic questions about your financial situation.

💡 The trustee is a court-appointed person who reviews your forms and makes sure everything is accurate and fair during the bankruptcy process.

You’re also required to take two courses: a credit counseling course and a financial management course.

If all goes as planned, after a few months, the court will mail you a notice of your bankruptcy discharge. This is an official document that tells you that your case was successful and your eligible debts were eliminated.

🎯 The success rate for Chapter 7 bankruptcy is high. As long as you fill out your forms honestly and completely and follow all the required steps, the court will likely accept your bankruptcy petition and agree to erase your debts.

Does Chapter 7 Bankruptcy Clear All Debt?

Chapter 7 won’t fix everything, but for many people, it clears out the most stressful debts and creates space to rebuild. That said, there are some debts the law says can’t usually be erased.

Debts You Can Eliminate in Chapter 7

Chapter 7 can erase:

✅ Credit card debt

✅ Medical bills

✅ Personal loans

✅ Payday loans

✅ Utility bills

💡 These debts are called unsecured debts because they aren’t backed or “secured” by collateral.

Debts You Can’t Eliminate in Chapter 7

Some debts usually can’t be discharged in Chapter 7, such as:

❌ Child support and alimony

❌ Debts from fraud or court judgments for certain lawsuits

❌ Traffic tickets or criminal fines

With a few exceptions, these debts generally stick around even after your case is over.

It’s also worth noting that secured debts, like car loans and mortgages, work a little differently. If you want to keep the property tied to the loan, like your car or home, you usually need to keep making payments, even after you file. If you stop paying, the lender may still be able to take the property back.

Can You Get Rid of Student Loans in Bankruptcy?

Yes, you can get rid of certain federal student loans in bankruptcy. But it’s not automatic, and it takes extra work.

💡 While student loans are technically unsecured debt — just like credit cards or medical bills — they don’t work the same way in bankruptcy. Student loans aren’t discharged (erased) through a standard Chapter 7 filing.

To have your student loans wiped out, you need to file your regular bankruptcy case and then submit additional paperwork called an attestation form.

This starts a separate court process called an adversary proceeding, where the court decides if repaying your loans would cause undue hardship.

How To Prove Undue Hardship for Student Loan Bankruptcy

To prove undue hardship, you usually need to show three things:

You can’t afford to repay your loans and maintain a basic standard of living.

Your financial situation isn’t likely to improve soon.

You’ve made a good-faith effort to pay your loans in the past.

These three points are part of what’s known as the Brunner test, which many courts use to decide if someone qualifies to discharge student loan debt.

While this may sound complex, the good news is that the process is slowly becoming more accessible. In 2022, the U.S. Department of Justice issued new guidance to help make decisions more consistent and fair across the country. Because of this, some filers are starting to see better outcomes when they clearly meet the hardship requirements.

How Are Secured Debts (Like Car Loans or Mortgages) Handled in Chapter 7?

Secured debts are loans tied to specific property, like your car or home. If you don’t make the payments, the lender can take the property back. In Chapter 7 bankruptcy, you have a few options when it comes to secured debts.

What happens depends on whether:

✅ You want to keep the property

✅ You can stay current on the loan

If you want to keep your car or house:

You’ll usually need to keep making payments on time, just like before.

You may need to reaffirm the loan, which means you agree to keep the debt and continue paying it after your bankruptcy case is over.

The property needs to be protected by an exemption, or else the trustee could try to sell it.

If you can’t afford the payments or don’t want to keep the item: You can choose to surrender the property. That means giving it back to the lender. If you surrender the property, any remaining balance on the loan will be wiped out as part of your bankruptcy discharge.

Chapter 7 doesn’t erase the lien (the lender’s right to take the property if you don’t pay), so if you stop paying on a secured loan — even after a successful bankruptcy case — you could still lose the property. That’s why it’s important to decide whether the loan and the property still make sense for your budget.

Who Is Eligible To File Chapter 7 Bankruptcy?

Eligibility for Chapter 7 is pretty simple:

✅ You must meet income requirements.

✅ You must complete the required credit counseling course in the 180 days (six months) prior to submitting your case.

✅ If you’ve filed bankruptcy before, you usually need to wait a certain amount of time before filing again.

Here’s a deeper look into the income and waiting period requirements.

Chapter 7 Income Eligibility: The Means Test

To be eligible for Chapter 7, your income has to fall below a certain level based on your household size and where you live.

💡 This is known as the means test. It’s a formula the bankruptcy court uses to see if you can afford to repay any of your debtsThe means test has two main steps:

First, it compares your income to the median income for your state and household size. If you’re below that line, you qualify automatically. Many filers find that they qualify based on their income alone.

If your income is above the median, you move to the second step. This part looks at your monthly income and expenses to figure out if you have any money left over to repay your debts. If your remaining income is too low to make meaningful payments, you may still qualify to file Chapter 7.

✨ You can use Upsolve’s free two-minute screener to see if you meet income eligibility requirements for Chapter 7. If you do, you may be eligible to use our free filing tool to prepare your case.

Can You File Chapter 7 Bankruptcy Twice?

Yes. You can file Chapter 7 multiple times in your life, but if you’ve filed bankruptcy before, you usually need to wait a certain amount of time before you can file again. The waiting period depends on the type of bankruptcy you filed last time and what type you want to file now.

🗓️ For Chapter 7, you have to wait:

Eight years between Chapter 7 filings

Six years between a Chapter 13 and a new Chapter 7 (unless you paid most of your debts in your Chapter 13 case)

💡 These time limits are based on when your previous case was filed, not when it was completed.

How Much Debt Do You Need To File Chapter 7?

There’s no minimum amount of debt required to file Chapter 7 bankruptcy. There’s also no maximum amount of debt you can have in Chapter 7.

👉 When it comes to figuring out if you have “enough debt” to file bankruptcy, what really matters is whether your debt feels unmanageable based on your income, expenses, and overall financial situation.

Some people file Chapter 7 with tens of thousands of dollars in debt. Others file with much less because even a smaller amount has become impossible to keep up with due to job loss, medical issues, or other life changes. Bankruptcy is meant to help people who can’t realistically repay what they owe, regardless of the exact amount.

📌 If you’re overwhelmed by bills and can’t see a clear way out, it may be worth exploring whether Chapter 7 could give you a fresh start. If you have at least $10,000 in debt, you may be eligible to file for free using Upsolve’s online filing app.

What Does It Cost To File Chapter 7 Bankruptcy?

Filing Chapter 7 bankruptcy comes with some costs, but it’s often much more affordable than trying to pay off debt you can’t manage. Also, many people qualify for fee waivers.

💸 The total cost to file Chapter 7 depends on whether you hire a lawyer and whether you qualify for any fee waivers.

Here are the main expenses to expect:

A $338 court filing fee (though many people qualify for a filing fee waiver)

Course fees for the two required bankruptcy courses, which range from $10–$50 each, but many people qualify for a course fee waiver

Attorney fees, if you choose to hire a lawyer

What Is the Court Filing Fee?

There is a standard $338 filing fee for Chapter 7. You’ll be required to pay this to the bankruptcy court when you file your case or submit an application for a filing fee waiver or fee installment plan.

💸 If you’re granted a filing fee waiver, you won’t have to pay anything to file your case. If you aren’t granted a waiver, you can apply to pay the fee in increments called installments. This is like a payment plan, usually with four payments. One payment is usually due on the day you file your case, and the others will be due on a strict timeline the court will outline for you.

✨ If you prepare your bankruptcy forms using Upsolve’s free filing app, it will create the filing fee waiver for you to submit to the court.

How Much Do Bankruptcy Attorneys Charge?

💰 In general, you can expect to spend $1,000–$3,000 if you hire a Chapter 7 bankruptcy attorney. That said, fees can vary depending on your location and the complexity of your case.

You don’t have to hire a bankruptcy lawyer to be successful with your bankruptcy filing. Many people with simple cases file on their own or with the help of Upsolve’s free filing tool and get a bankruptcy discharge with no problems.

But people in certain situations can benefit from hiring a lawyer. For example, people who own their home, have valuable property that’s non-exempt, or are involved in a more complex legal matter — like a personal injury lawsuit or business ownership — often choose to hire a lawyer to protect themselves and their property.

Can You File Chapter 7 for Free?

Yes! Many people are able to file Chapter for free by filing on their own and getting fee waivers to help cover the filing fee and bankruptcy course fees.

You can learn more in our comprehensive 10-step guide to filing Chapter 7 for free.

How Long Does Chapter 7 Bankruptcy Take?

⌛ Most Chapter 7 cases take about 4–6 months from start to finish.

Here are some key milestones you can expect:

Once you file your case with the court, a legal protection called the automatic stay goes into effect right away. This temporarily stops most collection actions, like calls, garnishments, or lawsuits.

About a month after you file, you’ll attend a short meeting with the bankruptcy trustee called the 341 meeting.

If everything is in order and no one objects, the court will send you a discharge notice about 2–3 months after your 341 meeting. This notice officially wipes out your eligible debts.

While delays can happen — especially if you’re missing documents or if the trustee has questions — most Chapter 7 cases move along quickly and don’t require any court appearances or meetings beyond the 341 meeting.

How Does Bankruptcy Affect Your Credit?

If you file Chapter 7, it will stay on your credit report for 10 years. While this sounds like a long time, here’s the good news: The negative credit impact of the filing lessens over time.

💪 Plus, many people who file are able to rebuild their credit more quickly and successfully once their unpayable accounts are wiped out.

Bankruptcy and Your Credit Score

When it comes to your credit score, bankruptcy’s impact can vary widely depending on what your current score and credit history look like.

📉 The truth is that most people who file bankruptcy have already seen serious damage to their credit score through missed or late payments or having accounts in default or collections. That often does far more damage to your credit than filing bankruptcy.

However, if you do have a good credit score — 600 or more — you can expect it to take a hit when you file bankruptcy. But you can always rebuild and bounce back. We see most of our users in a better place with their credit within six months to a year after filing.

💡 You can expedite the credit-recovery process by taking out a secured credit card and self-reporting your rent or utility payments.

What Are the Benefits and Drawbacks of Filing Chapter 7?

Every decision has its pros and cons. Chapter 7 is no exception.

Since the downsides of Chapter 7 are usually pretty well known and people sometimes overlook the upsides, let’s start with the pros.

The Benefits of Filing Chapter 7

Filing Chapter 7 can give you fast, powerful relief from overwhelming debt. Here are some of its biggest benefits:

Debt collection stops immediately. As soon as you file, most collection calls, lawsuits, and wage garnishments are put on hold thanks to the automatic stay.

It’s fast. Most people receive a discharge in 4–6 months that wipes out credit card debt, medical bills, payday loans, and more. This is much faster than most other types of debt relief, including debt management plans or Chapter 13 bankruptcy. (More on this below.)

Most people don’t lose anything but their debt. Over 95% of filers keep everything they own, including personal belongings and vehicles, thanks to bankruptcy exemptions.

You can start rebuilding credit. Many people see their credit improve after bankruptcy and begin receiving credit offers within a year of filing.

💬 Bonus benefit: Less stress and better mental health. Many Upsolve users say they feel tremendous relief upon filing their case and that they wish they’d filed sooner.

Even with these great benefits, it’s important to also consider the drawbacks of a bankruptcy filing.

The Downsides of Filing Chapter 7

Chapter 7 bankruptcy can be a powerful tool for debt relief, but like any option, it comes with some trade-offs. Here are a few potential downsides to consider:

Not everyone qualifies. To file Chapter 7, you have to pass the means test, which looks at your income and expenses. If your income is too high, you may not be eligible.

It doesn’t erase all types of debt. Certain debts — like child support, alimony, and recent tax debt — usually can’t be wiped out in Chapter 7. Only certain federal student loans can be discharged, and that’s only in limited cases.

You could lose non-exempt property. While most filers keep everything they own, the bankruptcy trustee can sell valuable property that isn’t protected by exemptions.

Your credit score may dip temporarily. If your score is high going into bankruptcy, you might see a drop. But for many people, credit scores begin to recover soon after the discharge.

Co-signers aren’t protected. Chapter 7 only erases your personal responsibility for a debt. If someone co-signed a loan with you, they’re still on the hook to repay it.

Chapter 7 works well for many people — especially those with low income, few assets, and lots of unsecured debt. But it’s helpful to understand the limits before deciding it’s the right path forward.

What Happens to Your Property in Chapter 7 Bankruptcy?

Many people worry that filing Chapter 7 means they’ll lose everything they own. But in reality, most people who file keep all of their property, including their home, car, and personal belongings.

This is thanks to bankruptcy exemptions, which protect essential property during the process.

Chapter 7 is sometimes called a “liquidation bankruptcy,” but that doesn’t mean the court takes everything you have. In fact, it’s rare for anything to be sold at all.

If you do own valuable property that isn’t protected by an exemption, the bankruptcy trustee assigned to your case may have the option to sell it and use the money to repay creditors. But for the vast majority of filers, that doesn’t happen.

Below, we’ll look at when you can keep your home, car, and other belongings; how exemptions work; and what the trustee’s role is in all of this.

Can You Keep Your Home, Car, and Belongings?

In most cases, yes. More than 95% of Chapter 7 filers keep everything they own.

Whether you can keep specific property depends on two main things:

Whether the property is protected by an exemption

Whether you’re current on any loans tied to the property (like a mortgage or car loan)

🏠 If the equity you have in your home or car is fully protected by an exemption and you’re current on your payments, you’ll likely be able to keep it.

💡 To figure out your equity in a piece of property, take the current fair market value of the item and subtract any loans you still owe on it. If the item is paid off, your equity is equal to the current market value.

If you're behind on payments and want to keep the item, it may be harder under Chapter 7 — but you may have other options, like filing Chapter 13 instead.

🛋️ Personal items like clothing, furniture, kitchen appliances, or tools for work are almost always protected.

What Are Bankruptcy Exemptions?

Exemptions are laws that protect certain types of property during bankruptcy. Each exemption has a dollar limit. If the value of your item falls under that limit, you can keep it.

Every state, as well as the federal government, has its own set of exemption rules, and some let you choose between state and federal exemptions.

Exemptions commonly protect the following items up to a certain amount:

Equity in your home or car

Clothing and household goods

Tools or equipment you need for work

Some money in bank accounts

Public benefits or retirement savings

If you own something that’s worth more than the exemption allows, it may be considered non-exempt. In that case, the trustee could sell the item to pay back creditors. But again, this is rare.

What Does the Bankruptcy Trustee Do?

The bankruptcy trustee is a court-appointed official who manages your case. Their job is to:

👀 Review your bankruptcy paperwork

🤝 Lead your 341 meeting of creditors (a short meeting where they ask you basic questions)

🏡 Determine whether you have any non-exempt property

If everything checks out and all your property is protected, the trustee usually files a “report of no distribution,” which means there’s no non-exempt property to sell and creditors won’t receive any payment through the case.

In the rare case that there is non-exempt property, the trustee may decide to sell it and distribute the proceeds to creditors.

Should You File Chapter 7 Bankruptcy?

Chapter 7 bankruptcy has helped hundreds of thousands of people get a fresh start financially. But it’s not the right choice for everyone.

Ask yourself this: Do I have more debt than I’ll ever be able to pay back, given my current income and property? If the answer is "yes," then Chapter 7 bankruptcy may be the right option.

Here are some signs that you may be a good fit for filing bankruptcy now:

You have more than $10,000 of dischargeable debt.

Your credit score is already low (below 600).

You don’t own expensive property.

You can’t make ends meet each month and keep up with your debt payments.

You’re worried about wage garnishment or being sued for your debt.

You pass the means test.

You don’t have hope or a plan to pay back your debt over the next five years.

If these apply, right now may be the right time to file for bankruptcy. If you aren’t sure, you can always schedule a free appointment with an accredited nonprofit credit counselor. These financial pros can help you explore all your debt relief options and decide if bankruptcy is right for you right now.

When To Wait To File Chapter 7 Bankruptcy

With Chapter 7, timing matters. If any of the following situations apply to you, it may be best to wait on filing your case.

If you're still using credit cards to make ends meet or you've made large purchases in the last six months, most bankruptcy pros will advise you to wait to file your case.

If you’ve paid back or transferred property to a family member or friend in the last year, it’s also best to wait to file, if you can. You have to disclose these activities in your bankruptcy paperwork, and your trustee will ask you about them.

If you're suing someone or planning to sue someone, then it’s best to hold off on filing bankruptcy until you know the final outcome of that case, if possible. People often delay Chapter 7 bankruptcy if they’re expecting a personal injury settlement.

If you owe your landlord money and you don't plan to move, try to catch up on missed rent payments before filing. The same generally goes for car loans, if you want to keep the car.

If you expect your financial situation to get worse, then you may want to delay your filing. You can only file Chapter 7 bankruptcy once in an eight-year period, so you don’t want to file if you know that you’re going to fall into more debt.

Again, a free consultation with a credit counselor can help you sort out your options and timing. Upsolve can connect you with an NFCC-accredited nonprofit credit counseling agency for a free consultation.

If you want bankruptcy-specific help, you can also schedule a free consultation with a qualified bankruptcy attorney or look into free legal aid services in your area.

Chapter 7 vs Chapter 13: Which Is Better?

Both Chapter 7 and Chapter 13 are legal tools that help people get out of debt — but they work in different ways, and one may be a better fit depending on your situation.

Chapter 7 is usually best for people who:

Have mostly unsecured debts like credit cards or medical bills

Don’t own valuable property they’re at risk of losing

Have low or no income and can’t afford to repay their debts

Chapter 13 is often better for people who:

Have a steady income and can afford a monthly payment

Want to catch up on missed mortgage or car payments

Have non-exempt property they want to keep

Chapter 7 is a much faster option because Chapter 13 bankruptcy requires a 3–5-year repayment plan. Chapter 13 is quite complex compared to Chapter 7, too. Most people who file Chapter 13 work with an attorney. And most Chapter 13 cases filed without an attorney aren’t successful.

Because Chapter 13 takes a long time and requires attorney help, it’s usually much more expensive than Chapter 7.

What Are Some Alternatives to Chapter 7 Bankruptcy?

Bankruptcy isn’t the only way to get the fresh start you need. You have several debt relief options to help you take control of your debt and improve your financial situation.

The most common debt relief tools are:

Debt settlement

Debt management plans (DMPs)

Debt consolidation

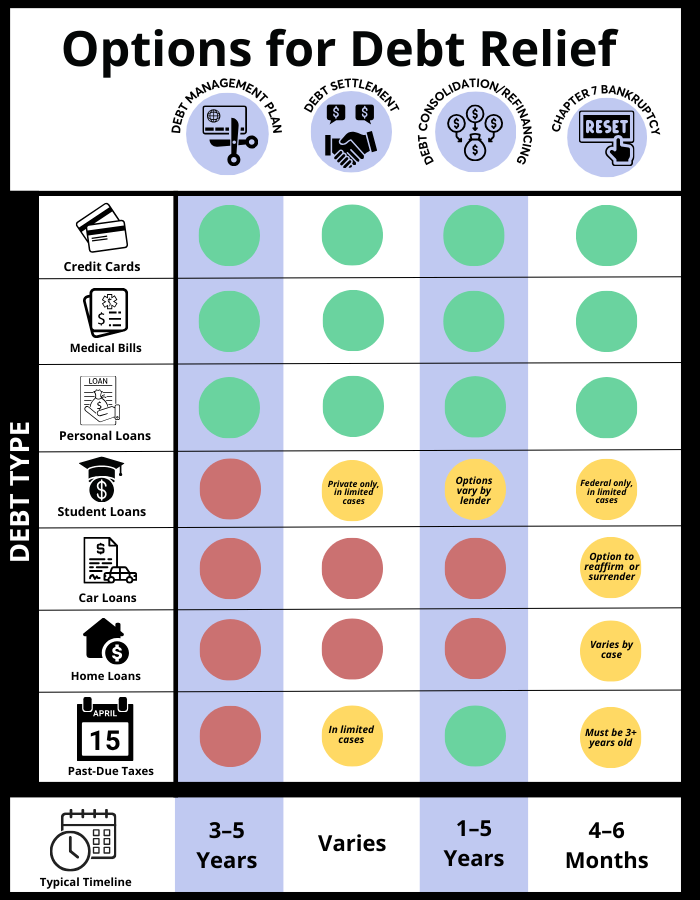

Here’s a quick visual overview of your options and which debts they can help with.

Let's go over each option.

What Is Debt Settlement?

You can negotiate with your creditors. If you've fallen behind on payments or are about to, you can contact your creditor to discuss the issue. You may be able to work out an affordable payment plan or negotiate a debt settlement for less than the full amount owed.

This is especially true with credit card debt. Typically, a settlement needs to be paid in a lump sum. Learn more about how to start this process in our article on debt settlement offer letters.

What Is a Debt Management Plan?

Entering into a debt management plan with a nonprofit credit counseling agency is another option. Unlike in debt settlement, a debt management plan involves paying back your debt over 3–5 years.

The credit counselor will negotiate a lower interest rate and try to have late fees waived. You’ll just make one payment each month to the counselor who administers the plan. Typically only unsecured debts can be included in a debt management plan. Learn more in our guide to debt management plans.

What Is Debt Consolidation?

Taking out a debt consolidation loan to pay off your debts is another debt relief option. You would then have only one monthly payment to make to the new creditor. These loans often offer lower interest rates than what you're already paying. If you’re considering debt consolidation, check out this guide to consolidating your debt.

Frequently Asked Questions About Filing Chapter 7 Bankruptcy

Filing bankruptcy often feels like a big decision, so it’s a good idea to do your research and make sure you get any questions you have about the process answered.

Here are some of the most common questions we hear from our users.

What Happens to Your Federal Tax Refund in Chapter 7 Bankruptcy?

Your tax refund might be considered part of your bankruptcy case, depending on when you earned it, whether it’s protected by an exemption, and what you do with it before filing.

If the refund is based on income you earned before you file, it becomes part of your bankruptcy estate. This is true even if you haven’t received it yet. The trustee can take the refund and use it to pay your creditors unless it’s protected by a state or federal exemption.

Many filers are able to keep their refund by either:

Using it on necessary expenses before filing (like rent, utilities, food, or medical bills)

Protecting it with an available exemption, such as a wildcard exemption

If you receive your refund after you file and it isn’t protected, the trustee may ask you to turn over part or all of it. That’s why it’s important to list your refund in your paperwork and talk to a legal expert if you’re unsure how exemptions work in your state.

What if Someone Sues You or Is Garnishing Your Wages?

If you're being sued for unpaid debt or already have wages being garnished, filing Chapter 7 bankruptcy can help right away.

✋ As soon as you file, the court puts an automatic stay in place. This is a legal order that immediately stops most debt collection lawsuits, wage garnishments, and other collection actions.

In most cases, if the debt qualifies for discharge — like credit cards, medical bills, or personal loans — filing Chapter 7 will permanently stop the lawsuit or garnishment once your case is complete.

If the lawsuit is about something like child support or recent taxes, the rules may be different. These types of debts aren’t usually wiped out in Chapter 7, and the automatic stay may only provide temporary relief.

Can Chapter 7 Bankruptcy Clear Tax Debts?

Some tax debts can be erased in Chapter 7 bankruptcy, but only if they meet specific rules. Most income tax debts must meet all of the following conditions to qualify for discharge:

The tax debt is at least three years old.

You filed the tax return at least two years ago.

The IRS assessed the debt at least 240 days before you filed for bankruptcy.

The debt isn’t tied to fraud or tax evasion.

If your tax debt meets all these criteria, Chapter 7 may be able to wipe it out. But if the debt is newer, involves penalties, or wasn’t properly filed, it usually won’t be discharged and you’ll still be responsible for paying it after your case ends.

🧹 Even if your tax debt isn’t dischargeable, filing Chapter 7 may still help by clearing away other debts and making it easier to manage what you still owe.

Is Bankruptcy Public Record?

Yes, bankruptcy is a matter of public record. That means information about your case will be legally accessible to the public, and it will appear in official court records.

However, unless someone is specifically searching for your case in the federal court system (PACER), it’s unlikely that the average person will come across it. Bankruptcy records aren’t published in newspapers or shared on social media platforms.

Will My Friends, Family, Boss, or Landlord Find Out I Filed for Bankruptcy?

Most people won’t find out you filed for bankruptcy unless you tell them. The court doesn’t send notices to your friends, employer, or landlord. The only people who will be officially notified are your creditors and the bankruptcy court.

If someone pulls your credit report — for example, a future landlord or lender — they may see the bankruptcy listed. But filing is a personal legal process, and many people go through it quietly without anyone in their life ever knowing.