What Debts Can't You Get Rid of in Bankruptcy?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

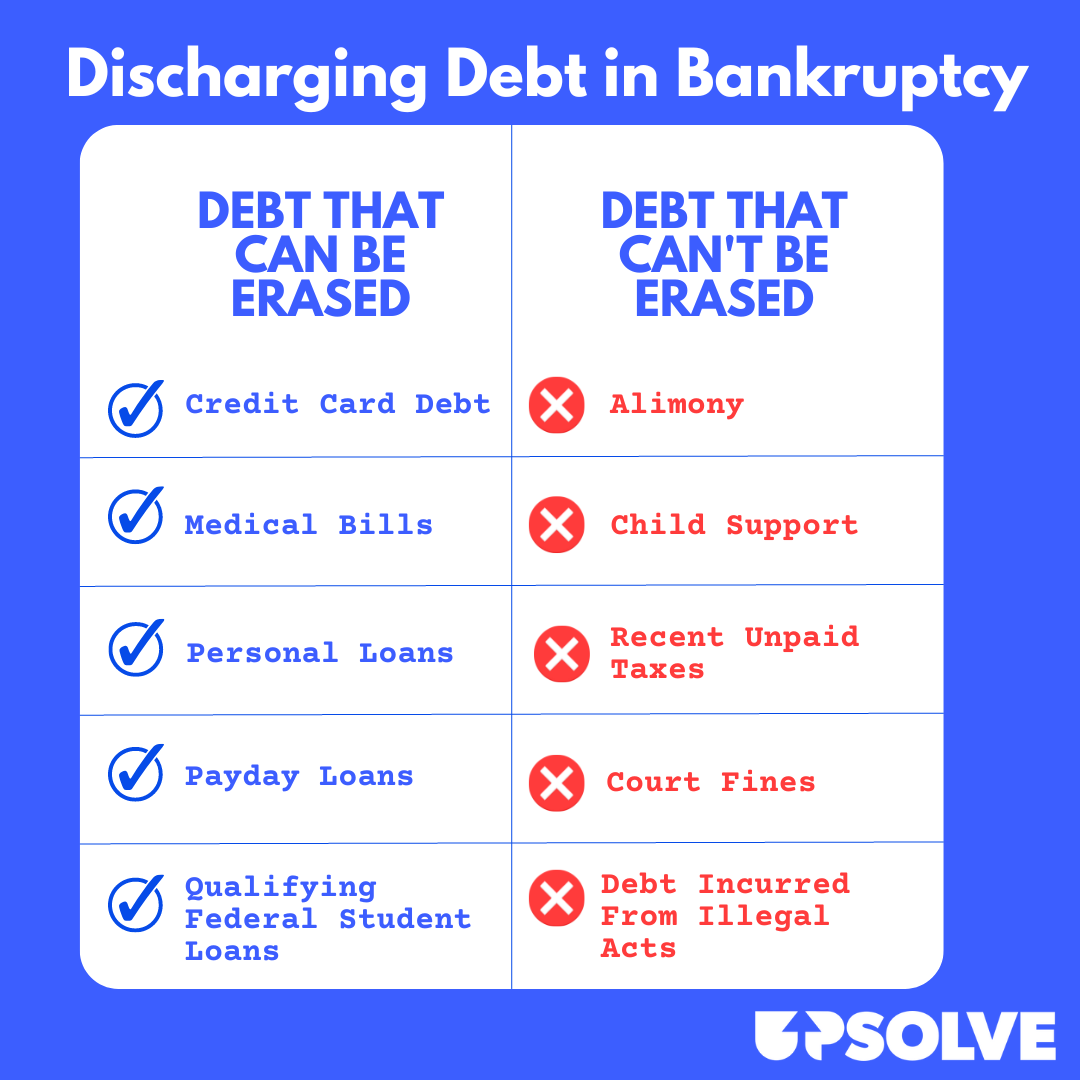

Though bankruptcy provides real debt relief for folks who are struggling to make ends meet, not every debt is treated equally under bankruptcy law. Bankruptcy is a great way to get rid of credit card debt, medical bills, and personal and payday loans. But bankruptcy can’t wipe out recent income tax you owe, alimony, child support, or debt incurred from illegal acts (embezzlement, larceny, etc.) Though there’s a common misconception that student loan debt can’t be erased in bankruptcy, you can discharge, or wipe out, your student loan debt in Chapter 7 or Chapter 13 bankruptcy. You must prove that repaying it is causing undue hardship and that you’ve made good faith efforts to pay in the past.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated May 22, 2025

Table of Contents

A Quick Refresher on Chapter 7 and Chapter 13 Bankruptcy

There are two common types of bankruptcy for individuals and married couples: Chapter 7 and Chapter 13. Both erase credit card debt, medical bills, and personal loans. You’ll hear this type of debt called unsecured debt because no property or collateral backs it up. As soon as you file your bankruptcy petition, all debt collection must stop because of the automatic stay. Debt collectors cannot call you, repossession cannot occur, and no one can garnish your wages or bank account.

Upsolve has a free tool to help you file your Chapter 7 case and has helped get millions of dollars of debt discharged for everyday folks. You’ll also find helpful resources on our site, like our guide: How to File Bankruptcy for Free in 10 Steps.

If your bankruptcy filing is successful, the bankruptcy judge will issue a bankruptcy discharge order wiping out all eligible debt. You don’t have to pay back any debt that’s discharged. Successful Chapter 7 and Chapter 13 cases both end in a bankruptcy discharge and financial fresh start, but each follows a different path:

If you file under Chapter 13, you’ll come up with a 3–5 year repayment plan. You must make a monthly payment to the bankruptcy trustee until the plan ends. The monthly Chapter 13 repayment plan amount is calculated based on your monthly income minus allowable expenses.

If you file Chapter 7 bankruptcy, things will go must faster. Most cases are completed within six months because you don’t have to follow a repayment plan.

Which Type of Bankruptcy Should You File?

You’ll have to evaluate the pros and cons of each type of bankruptcy before you file. But generally speaking, filers who have certain property they want to keep or who have non-dischargeable debts may favor Chapter 13 over Chapter 7 because they can include non-dischargeable debt in the Chapter 13 repayment plan.

Millions of people have used bankruptcy to get much-needed debt relief. While bankruptcy wipes out many debts for good, it’s important to know what debts can’t be erased or discharged through bankruptcy. Let’s start by looking at one of the most confusing types of debt when it comes to bankruptcy: student loan debt.

Can You Get Rid of Student Loan Debt by Filing Bankruptcy?

It’s a pervasive myth that student loan debt can’t be discharged in bankruptcy. Student loans can be discharged in bankruptcy if you meet the eligibility requirements and gather the right kind of evidence to help prove your case.

Student loans are treated differently than other types of unsecured debt (like credit card debt) in bankruptcy proceedings. This means you have to take an additional step to have your student loan debt reviewed. You do this by filing an adversary proceeding, completing an attestation form, and compiling evidence to prove what you say on the attestation form. This is how the court will evaluate whether paying off your student loan debt is causing you “undue hardship.” This is the standard filers must meet to have their loans discharged in bankruptcy.

Proving undue hardship was a somewhat murky process in the past because the standard wasn’t well defined in the Bankruptcy Code. In late 2022, the Department of Justice and the Department of Education released updated guidelines on the bankruptcy discharge process to help clarify this process for bankruptcy judges and bankruptcy filers alike. This guidance is specifically for federal student loans. You can still try to discharge your private student loans in bankruptcy, but the guidance for this hasn’t been updated or simplified, so many filers opt to hire a bankruptcy lawyer to help.

Upsolve may be able to help you get your student loans discharged through Chapter 7 bankruptcy. Check your eligibility now if you’re interested in learning more.

What Debts Won’t Be Discharged in Bankruptcy?

The U.S. Bankruptcy Code outlines a list of non-dischargeable debts. Non-dischargeable debts are debts that will not be erased in bankruptcy. In other words, even if your bankruptcy filing is successful, you must continue to repay non-dischargeable debts during and after the bankruptcy proceeding.

The type of bankruptcy you file matters when it comes to the types of debt you can discharge. The two most common types of personal bankruptcy are Chapter 7 and Chapter 13. Certain debts that can’t be discharged in Chapter 7 bankruptcy can be discharged in Chapter 13.

Can Income Tax Debts Be Erased in Bankruptcy?

If you owe back taxes, this debt may not be erased in your bankruptcy case. It will depend on how old the debt is, though. Income tax debts become dischargeable once a certain period of time passes. You’ll also have to meet other eligibility requirements.

For an income tax debt to be dischargeable, it must meet three criteria:

The tax debt must be at least three years old. The tax return (and any extensions) associated with the tax debt must have been due more than three years before the bankruptcy filing.

The tax return related to the debt must have been filed with the IRS at least two years ago. If the tax return wasn’t filed on time, that tax return must have been filed more than two years before the bankruptcy case filing date.

The IRS must have assessed the tax debt at least 240 days prior to filing bankruptcy. A tax debt is considered “assessed” on the date the tax liability is officially assessed at the IRS Service Center and the applicable form is signed by an IRS official.

If your income tax debt meets all three conditions, then it may be erased in bankruptcy. The exception is if the IRS has filed a tax lien on your property. If this happens, your income tax debt becomes a secured debt and may not be eliminated in bankruptcy.

If this seems confusing, don’t worry! If you use our free app to prepare your Chapter 7 bankruptcy forms, we’ll walk you through each step of the process. If you don’t use our app and need extra help, you can get a free consultation with a bankruptcy attorney.

Can Alimony and Child Support Be Erased in Bankruptcy?

No. Alimony and child support can’t be discharged in Chapter 7 or Chapter 13 bankruptcy. This includes both current and missed alimony and child support payments. Also, while payments on other debts are suspended once you file your bankruptcy case (due to the automatic stay), you’re required to pay any domestic support obligations that are due during and after the bankruptcy process.

Debts from a divorce decree or property settlement agreement that are not characterized as support payments can be discharged in a Chapter 13 bankruptcy.

Are All Credit Card Charges Dischargeable in Bankruptcy?

Since credit card debt is unsecured debt, it’s usually dischargeable through bankruptcy. But be careful with how you use your credit cards in the three months before you file your bankruptcy case. Racking up credit card debt in hopes that it will be forgiven in bankruptcy may be considered bankruptcy fraud, and the debt will not be dischargeable.

That said, many people are using credit cards to pay necessary living expenses. Not all your credit card charges will be flagged as potentially fraudulent. By law (called the Bankruptcy Code), filers are allowed to make credit card charges for necessities. This means that debts you incur for goods or services that can be reasonably considered necessary for you and your dependents can be discharged in bankruptcy.

Keep in mind that charges — especially large ones — you make in the months before filing bankruptcy can be scrutinized. If you pay for something that’s $725 or more, it may be considered a luxury good (or service) and may not be dischargeable, especially if a creditor objects to the charge.

Are Debts From “Bad Acts” Dischargeable in Bankruptcy?

As you can imagine, if you incur debt from certain “bad acts,” you can’t erase them in bankruptcy. These include debts related to the following:

Embezzlement

Larceny

Personal injury caused by driving while intoxicated

Willful and malicious injury to someone or someone’s property (Note: These debts can’t be discharged in Chapter 7, but if you opt to file Chapter 13 bankruptcy, they may be.)

While it’s legal to file bankruptcy more than once in your lifetime, if you have a previous bankruptcy on your record, any debts you intentionally omitted in that prior case won’t be dischargeable in the current case.

Are Secured Debts Like a Mortgage or Car Loan Dischargeable in Bankruptcy?

Secured debt can be confusing when it comes to filing bankruptcy. Some people assume it’s non-dischargeable, but this isn’t technically true. The filer’s personal obligation to pay the secured debt — usually in the form of a car loan or mortgage — is discharged. But the only way to keep the property that is securing the debt is by paying for it.

In other words, you can’t get rid of the debt for the car or home and keep the car or home. But if you want to keep your motor vehicle or home, you may be able to negotiate that as part of your base by signing a reaffirmation agreement and having it approved by the bankruptcy court judge (if needed).