How To Win Against Cavalry SPV I LLC

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If Cavalry SPV I LLC (Cavalry Portfolio Services LLC) contacts you, the most important thing you can do is to take action. You need to validate the debt and decide what you want to do next. You can either dispute the debt (if there are inaccuracies or if you disagree with the debt) or negotiate a debt settlement and pay less than the total debt amount. Unfortunately, if you ignore Cavalry and their collection efforts, they can file a lawsuit against you. If Cavalry files a lawsuit against you, you need to respond quickly. Read this article to find out how.

Written by the Upsolve Team. Legally reviewed by Jonathan Petts

Updated April 22, 2025

Table of Contents

- Why Is Cavalry SPV I LLC Contacting Me?

- Do I Have To Pay Cavalry SPV I LLC?

- How To Negotiate a Debt Settlement With Cavalry SPV I LLC in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Cavalry SPV I LLC in a Debt Lawsuit

- Let’s Summarize…

Why Is Cavalry SPV I LLC Contacting Me?

Cavalry SPV I LLC (Cavalry Portfolio Services LLC) is a third-party debt collection agency that buys debt from original creditors. Cavalry focuses on consumer debts, like credit cards, medical bills, utility bills, etc.

If Cavalry is contacting you, a creditor has charged off (sold) your debt to them, and they are taking over collection efforts. Any time a debt collector contacts you, you must first validate the debt before paying. To validate a debt means to verify that the debt is real and yours. (More on this below.)

Once you verify that the debt belongs to you, you can either dispute the debt — if the information is incorrect or you disagree with the debt — or negotiate a settlement and pay less than the total amount you owe.

To learn more about Cavalry and how to respond to them, read our article: How To Deal With Cavalry SPV I LLC.

Do I Have To Pay Cavalry SPV I LLC?

Whether you’re required to pay Cavalry depends on a few factors. First, you need to figure out if the debt is valid. If the debt is not valid, you don’t have to pay Cavalry, as it’s not your debt. If the debt is valid, you need to determine if you agree with the details of the debt, particularly the amount owed.

It’s important to note that even if you disagree with a validated debt, you need to respond to the debt collector and take action. Ignoring them could open you up to more problems. Cavalry could win a wage or bank account garnishment and legally take your money.

If the debt is valid and you do have to pay Cavalry, you might not have to pay the entire amount you owe. Debt collectors are typically open to negotiating since they can make a profit even if they are paid less than the total amount owed.

How To Negotiate a Debt Settlement With Cavalry SPV I LLC in 3 Steps

Dealing with a debt collector can feel intimidating. However, it’s important to remember that you still have some control in this situation. Debt collection has, unfortunately, become its own kind of business, and while collectors would like you to believe they hold all of the power, you hold a lot too.

When a debt collector buys your debt from a creditor, they usually buy it for pennies on the dollar, so even if they settle for a lower amount, they still make a profit. This is where negotiations come in.

Most debt collectors will settle for 40%–60% of the original amount you owe; they just don’t want you to know that. Some debt collectors may start negotiations with you, but more often, you need to be the one to initiate the settlement negotiation.

It might seem scary, but once you know the process, you’ll get the confidence boost you need to take on Cavalry.

Step 1: Make Sure the Debt Is Valid

If Cavalry hasn’t already sent you a debt validation letter (also called a validation notice), request one from them. Make sure you thoroughly read and verify the information in the validation letter. You can also create and send your own debt verification letter.

Use the validation letter to make sure that:

The debt is real and actually belongs to you.

Cavalry truly owns the debt.

The amount they’re claiming is correct.

According to a Consumer Financial Protection Bureau (CFPB) debt collection rule, third-party debt collectors are required to send you a debt validation letter before or within five days of first contacting you. They also have to give you a 30-day window to dispute the debt, which you can do with a debt verification letter.

Take a look at our graphic below to understand the differences between a validation and verification letter:

Step 2: Figure Out What You Can Pay

Once you confirm the debt is legitimate and yours, figure out how much of it you can pay. Take a look at your monthly take-home pay, monthly expenses, and any existing debt obligations to determine an amount you can realistically pay.

The CFPB has a helpful budget worksheet that can walk you through this process. They also have a debt worksheet that helps you visualize your monthly expenses. If you need additional support, consider getting a free consultation with an accredited nonprofit credit counselor.

While you can usually work out a payment plan with a debt collector, they’re more likely to accept an offer if you pay in one lump sum. If you’re expecting a small windfall, like a tax return or work bonus, you can plan to use that money.

If a lump-sum payment isn’t a good option for you — it might not be for most people — suggest a monthly repayment plan. Make sure you choose an amount you feel comfortable with and a timeline you know works for you and your finances. You can even suggest setting up an auto-pay direct deposit for your payments to help sway the collector into accepting this offer.

Step 3: Make a Settlement Offer to Cavalry SPV I LLC

Once you’ve figured out how much you can afford to pay Cavalry, you are ready to make a settlement offer. It’s best to make this offer in writing so you have a record. Ask the debt collector for their reply in writing as well.

If you’ve never drafted a settlement offer letter before, use Upsolve’s Debt Settlement Letter template as your guide.

Don’t Just Negotiate the Amount… Negotiate Everything!

Negotiations don’t have to start and stop with the settlement amount. You can also negotiate how you repay the debt and how Cavalry reports your account to the major credit bureaus (“paid in full,” “partial payment,” “settled”). Negotiations are crucial here because having the settlement recorded as “paid in full” is the most beneficial to your credit score.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

In most cases, even if a debt collector has sued you, it’s not too late to negotiate a debt settlement. If you have been sued, the most important thing you can do is respond to the lawsuit and follow court requirements. Even if you’re in negotiations, do not ignore a lawsuit, as that will only cause greater problems.

Participating in the lawsuit — responding to the lawsuit, showing up for appearances, etc. — is necessary until your settlement is in writing and the debt collector has accepted the settlement offer.

Tips for a Successful Debt Settlement

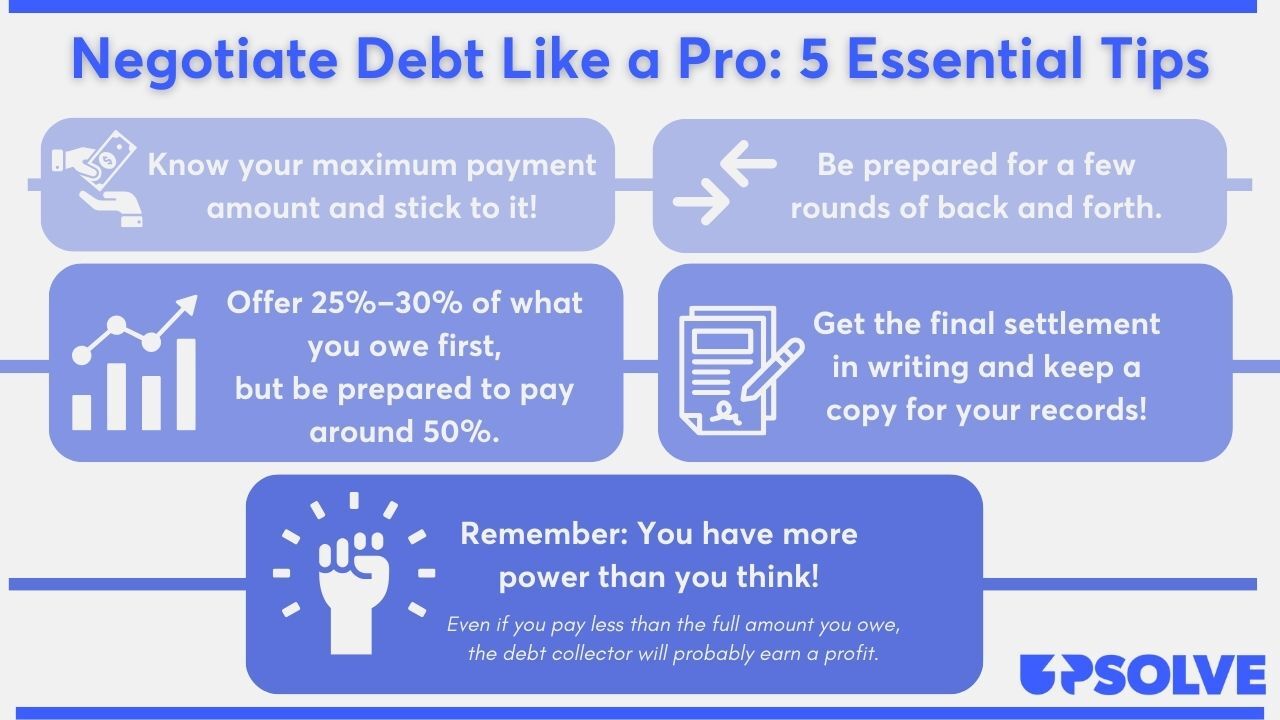

Going into a debt settlement may feel overwhelming. That’s completely understandable! Here are some essential tips for negotiating a debt settlement:

For even more tips and info on negotiating with a debt collector, read 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Cavalry SPV I LLC in a Debt Lawsuit

You may be wondering: “How do I know if I’m involved in a lawsuit?” If Cavalry has sued you, you’ll be notified of the lawsuit when you receive a summons and a complaint, usually in person or by mail. These official court documents notify you that a lawsuit has been filed against you and contain the case details.

Responding to a summons is the most important thing you can do if you’re involved in a lawsuit. If you ignore a lawsuit, hoping the issues disappear, you risk the debt collector receiving a default judgment to garnish your wages and bank account(s).

It sounds intimidating, but responding to a lawsuit is usually easier than you may think.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Step 1: Read the Summons and Complaint Carefully

A summons is a court document that outlines the details of the lawsuit. It’s best to read your summons thoroughly since it contains important information you need to fill out your answer form (more on this below).

Your summons most likely contains:

The name and address of the court you report to

Information about all parties involved

Your case number

The description code that categorizes your lawsuit (the “Nature of the Suit”)

An outline of the possible legal consequences if you fail to respond to the lawsuit

Summons forms vary by state, so there may be additional information depending where you live. Overall, summons documents contain all of the key information you need to respond to your lawsuit.

A complaint details the specific claims the debt collector is filing against the defendant (this is you, the person being sued). The information is usually laid out in numbered paragraphs, so it should be easy to follow along.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

After you receive your summons and complaint, you need to answer (respond to) the lawsuit. You do this by filling out and filing an answer form. Many courts provide blank templates for you to fill out. To find these forms, you can Google: “[court name] + answer form.”

If the court provides an answer form template, they’ll also have instructions on how and where to file the form. Read those instructions carefully. If you need help with your forms, every court has a court clerk, a person who works for the court and performs clerical tasks, who can be a great point of contact. Note: Court clerks don’t provide legal guidance, only administrative help.

When filling out your answer, this is your opportunity to raise any affirmative defenses you have. Affirmative defenses are reasons that the debt collector should not win the lawsuit against you. This is your chance to explain your side of the lawsuit and provide details the collector may have left off of the complaint.

You can learn more about how to respond to a debt collection lawsuit in our article: 3 Steps To Take if a Debt Collector Sues You.

Bottom line: Procedures vary from court to court, so it’s best to look up the court’s website and read as much as possible to prepare yourself. You can always contact the court clerk to ask for help as well.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

After you fill out your answer form, you submit it to the court (detailed on your summons) and deliver a copy of the finalized form to the plaintiff (the debt collector).

The filing process, like everything else, varies by court. Some courts offer an e-filing option or allow you to file by certified mail, but almost every court allows you to file in person at the courthouse. It’s always best to check with your court to know your options.

After filing, deliver a copy to Cavalry. This is called serving and can be done through the mail. Sending through certified mail is a good idea so there’s a record of the mailing.

Let’s Summarize…

If Cavalry SPV I LLC (Cavalry Portfolio Services LLC) contacts you about a debt, you first must validate the debt. If the debt is accurate, you can dispute the amount or negotiate a debt settlement. The most important thing is to respond and take action. Otherwise, they can file a lawsuit against you to garnish your wages and your bank account.