How To Win Against Halsted Financial Services

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

Dealing with debt collectors like Halsted Financial Services requires assertiveness and action. You can effectively defend yourself by understanding your rights, validating the debt, negotiating a settlement, or seeking legal assistance if necessary. You have options when facing debt collection by Halsted Financial Services, and with the right approach, you can navigate this challenging situation successfully. Continue reading to learn how you can take action to help you win by asserting your consumer rights.

Written by the Upsolve Team. Legally reviewed by Jonathan Petts

Updated May 14, 2025

Table of Contents

- Why Is Halsted Financial Services Contacting Me?

- Do I Have To Pay Halsted Financial Services?

- How To Negotiate a Debt Settlement With Halsted Financial Services in 3 Steps

- Can You Still Negotiate a Settlement if There's a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Halsted Financial Services in a Debt Lawsuit

- Step 1: Read the Summons and Complaint Carefully

- Step 2: Fill Out an Answer Form (and Any Other Required Forms)

- Step 3: File the Answer Form With the Court and Serve on the Plaintiff

- Let's Summarize…

Why Is Halsted Financial Services Contacting Me?

Halsted Financial Services is a third-party debt collection agency that collects debt on behalf of other companies. They may contact you to collect on a past-due credit card, retail, utility, phone, or internet account you have with another company. Alternatively, Halsted might be trying to locate you or someone you know to collect a debt.

If Halsted Financial Services has contacted you but you're unsure of the debt's origin or the original creditor, you can email them or call them at (855) 284-0831 to request additional information.

To learn more about what to do if Halsted contacts you, read Upsolve’s Guide to Halsted Financial Services.

Do I Have To Pay Halsted Financial Services?

If Halsted has validated the debt, and you agree that you owe the amount they say you do, then you’ll likely be required to pay the debt.

Ignoring the debt could lead to severe consequences, like wage or bank account garnishment. However, you still have options if you disagree with the debt or believe the amount is incorrect.

You Can Dispute the Debt

You have the right to dispute the debt with Halsted and the credit reporting bureaus Experian, TransUnion, and Equifax. If you dispute the debt in writing within 30 days of receiving the necessary details from Halsted Financial Services, they must provide documentation of the debt.

You Can Negotiate a Debt Settlement

If you acknowledge the debt but cannot afford to pay it in full, you can negotiate a settlement with Halsted. They may be willing to accept a lesser amount in exchange for paying upfront.

Negotiation can alleviate an enormous financial burden while still responsibly addressing the debt. Remember, it’s important to communicate with Halsted and explore your options rather than ignoring the situation because failing to address the debt could lead to serious consequences.

How To Negotiate a Debt Settlement With Halsted Financial Services in 3 Steps

Navigating debt negotiations with Halsted Financial Services might feel daunting, but understanding the dynamics of debt collection can work in your favor and empower you to take action.

Unfortunately, debt collection has become a lucrative industry. But there's a silver lining: Halsted may be willing to negotiate the amount down, so you might be able to settle the account without paying the total debt amount.

Many debt collectors are open to settling for 40% to 60% of the original debt. While debt collectors sometimes initiate settlement offers, you can start the conversation to get the ball rolling.

The good news is, once you understand the basics, negotiating your debt is easier than you might think. Start by making sure the debt is valid.

Step 1: Make Sure the Debt Is Valid

Third-party debt collectors like Halsted must send you a debt validation letter (also known as a validation notice) that gives you details of the debt account within five days of contacting you. This is required under a Consumer Financial Protection Bureau (CFPB) debt collection rule. The rule also states that the debt collector has to notify you of your right to dispute the debt and give you 30 days to do so.

If you haven’t received a debt validation letter, ask for one. Then read it carefully to make sure that:

The debt belongs to you

Halsted Financial Services is legally allowed to collect the debt

The debt amount on the letter is correct

Unfortunately, sometimes people learn they are victims of identity theft or that the creditor simply has the wrong account holder. Mistakes happen, so ask questions!

If you need more details about the debt account or if the information on the validation letter appears incorrect, you can write a debt verification letter. Here’s the difference between a validation and verification letter:

Step 2: Figure Out What You Can Pay

Once you confirm that the debt is yours and the amount is correct, it’s time to figure out how much you can pay. Review your monthly income and expenses to figure out how much you could put toward your debt repayment. It may help to create a budget to see how your expenses and other debt payments compare to your income. The goal is to determine a realistic payment amount for yourself.

If you need help with this process, consider a free consultation with an accredited nonprofit credit counselor.

Lump Sum Vs. Monthly Payments: Which Is Better?

If you can make a lump-sum payment rather than setting up a monthly payment plan, your settlement offer is more likely to be accepted, and you may be able to negotiate a lower amount. Are you expecting a potential work bonus, tax refund, or some other financial windfall? If so, consider using it to make a lump-sum payment.

If a payment plan is your only option, make sure that the amount you commit to monthly fits your budget. And be sure it also allows you to continue to cover your basic expenses like food and housing without stress. Some companies may be more willing to agree to a payment plan if you authorize direct withdrawal from your bank account.

Step 3: Make a Settlement Offer to Halsted Financial Services

You’re almost at the finish line! After determining what you can comfortably pay via lump sum or monthly payments, it’s time to write up a settlement offer.

Upsolve Tip: Use Upsolve’s Debt Settlement Letter Template to get started. Ask Halsted Financial Services to respond to your letter in writing as well. This ensures you always have a written record of the agreement. Usually, debt collectors send settlement agreements in the mail, so make sure you scan, take a picture of, or retain the original letter for your records.

Don't Just Negotiate the Amount… Negotiate Everything!

In addition to negotiating the settlement amount, you can negotiate how debt collectors report settled accounts. Accounts are usually noted on your credit report as paid in full, partial payment, or settled. In your settlement letter, ask them to report your account as paid in full to the major credit bureaus. This can help improve your credit score.

Can You Still Negotiate a Settlement if There's a Debt Lawsuit Against You?

Yes, you can still pursue a debt settlement even if you've been sued by Halsted Financial Services. However, you still need to respond to the lawsuit and comply with any court requirements, like appearing online or in person.

It’s crucial to pay attention to and respond to the lawsuit until you reach a settlement and it’s submitted to the court or until the court case is dismissed or closed.

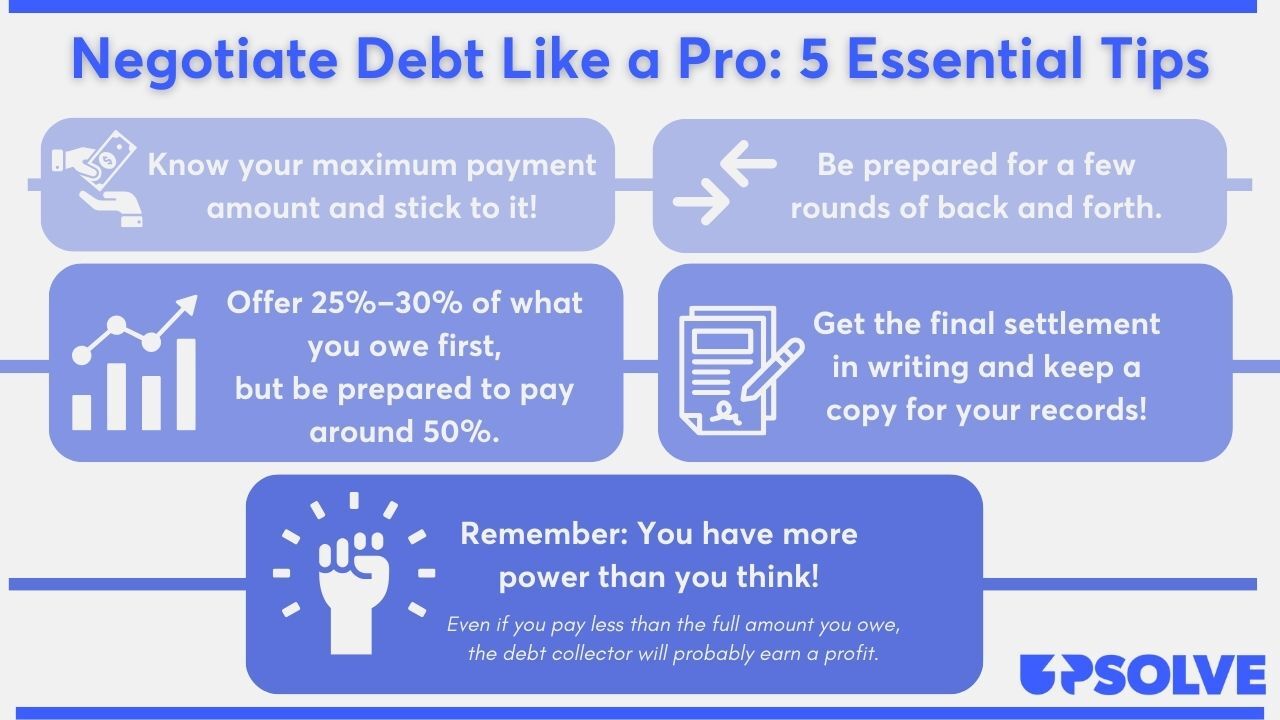

Tips for a Successful Debt Settlement

Settling your debt is easier than you might think. Here are Upsolve’s top tips for a successful settlement.

You can read Upsolves’s article 5 Solid Steps for Negotiating With Debt Collectors to learn even more.

How To Beat Halsted Financial Services in a Debt Lawsuit

If you've received notice of a lawsuit (a summons and complaint), it’s important to respond quickly. If you don’t, you could automatically lose your case. If the debt collector wins, they can get a court order that allows them to garnish your wages.

Responding is simpler than you might think. Many courts provide forms and instructions. The first thing to do is file an answer form or seek legal assistance. Responding protects your rights and allows you to present your defense.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Step 1: Read the Summons and Complaint Carefully

A summons is a court document that notifies you of a lawsuit. It usually contains the following information:

Court name and address

Parties involved (the plaintiff is the person suing; the defendant is the person being sued)

Case number

Instructions to the defendant

Legal consequences if you fail to respond to the lawsuit

The amount of days you have to file your answer

The information in a summons can vary, especially how many days you have to respond, so be sure to read your summons carefully. A complaint is another court document that outlines the plaintiff’s claims against you. You’ll use the information in the complaint when you fill out your answer form.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

Do not ignore a summons and complaint from Halsted Financial Services. Many courts offer blank answer forms, making it easier for you to file an answer. Google the court name on the summons followed by "answer form" or "court forms" to find an answer form.

Carefully read and follow the instructions provided on the documents. If you can’t find an answer form or don’t know how to proceed, contact the court clerk. While they can’t give you legal advice, they can let you know what paperwork you need and where you can find the documents to submit your answer.

The answer form is your chance to raise affirmative defenses, These are legal statements that could defeat or reduce the plaintiff's claims to the court. For more information on affirmative defenses and how to defend yourself against a lawsuit, read Upsolve’s article 3 Steps To Take if a Debt Collector Sues You.

If you deny any allegation or make affirmative defenses, file your supporting documents, such as payment records or communications, with your answer.

Some courts may require additional forms, like a certificate of service. Check the court website or consult the clerk of court to see if you need to include other forms with your answer.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

The process of filing your answer form also varies by court. Typically, you can file in person at the courthouse or send the form via mail. You may also be able to email or e-file the form.

Sometimes, there will be a fee to file your answer. To see if there’s a filing fee or request a waiver, speak with the court clerk.

You usually need to deliver a copy of your answer form to the person suing you. This is called service. You can serve the form via mail using the address listed on the summons. Be sure to comply with any specific delivery instructions provided by the court or outlined in the summons.

Let's Summarize…

It may feel overwhelming at first, but you can use the steps and resources mentioned above to empower yourself to seek additional information from Halsted Financial Services and take action. By disputing your debt or sending a settlement offer, you can potentially resolve your debt with Halsted Financial Services quickly and for less than what you owed originally.

If Halsted Financial Services has sued you, act swiftly to prevent further consequences. Review the lawsuit documents and prepare a comprehensive answer. Unfortunately, by failing to respond, many people lose their lawsuits by default. You don’t have to let lawsuits and debt collection overwhelm you. By taking assertive baby steps and knowing your rights, you can win against Halsted Financial Services.

For more detailed guidance, refer to our article 3 Steps To Take if a Debt Collector Sues You.