How To Win Against LVNV Funding

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If LVNV Funding reaches out to try to collect a debt, get informed about your rights and learn your options. First, make sure the debt is valid. If it isn’t, dispute it. If it is, figure out what you can pay and draft a settlement offer. Even if LVNV Funding sues you, you can still try to negotiate a settlement to pay less than you owe. Continue to respond to the lawsuit while you work out negotiations.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated May 8, 2025

Table of Contents

- Who Is LVNV Funding LLC and Why Are They Contacting Me?

- Do I Have To Pay LVNV Funding?

- How To Negotiate a Debt Settlement With LVNV Funding in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Collection Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat LVNV Funding in a Debt Lawsuit

- Let’s Summarize…

Who Is LVNV Funding LLC and Why Are They Contacting Me?

LVNV Funding is likely contacting you to request payment on an overdue credit card debt or personal loan. They are a debt collection agency that probably purchased the debt from the lender or original creditor you opened the account with.

The person who contacts you is likely from Resurgent Capital Services. This is the company LVNV Funding outsources its account management to. See our article How To Deal With LVNV Funding to learn more. This article also covers your rights under the Fair Credit Reporting Act and the federal Fair Debt Collection Practices Act.

Do I Have To Pay LVNV Funding?

If LVNV funding validates the debt, you agree that you owe it, and the amount is correct, you probably have to pay them at least a portion of the debt. If you ignore the situation, collection efforts are likely to escalate beyond phone calls and collection letters. In fact, you could end up getting sued and having your wage or bank account garnished.

The good news is that it’s possible to negotiate with LVNC to pay less than the original debt amount and settle the account for good.

How To Negotiate a Debt Settlement With LVNV Funding in 3 Steps

It’s unfortunate, but debt collection is a legal, profit-driven business. Still, you can take advantage of some of its downfalls. For instance, LVNV Funding likely purchased your debt for a fraction of the original amount you owed. This means they may be open to negotiating a settlement where you end up paying 40%–60% of the original amount.

This often means they can turn a profit while closing your account, which allows them to move on to other collection accounts. It is an incentive for them and you.

Sometimes debt collectors will reach out to you with a settlement offer, but there’s no need to wait for that to happen. If you think this is your best option, you can reach out to them. It isn’t a difficult process.

Step 1: Make Sure the Debt Is Valid

To confirm that the debt is valid, compare the information you have about the debt (if any) with the debt validation letter from LVNV Funding. This letter outlines important details about the debt they believe you owe.

Debt collectors like LVNC are legally required by the Consumer Financial Protection Bureau (CFPB) to send you a validation notice before or within five days of contacting you. The validation letter also gives you 30 days to dispute the debt or ask for additional information, which you can do with a verification letter.

If you haven’t received a debt validation letter from LVNV Funding, ask for one! Once you get it, check that:

The debt belongs to you (there are no issues of identity theft or misidentified account holder).

LVNV Funding owns the debt.

The amount of debt they’re claiming you owe is correct.

If you have confirmed that the answer is “yes” to all of those points, the next step is to assess what you can realistically pay.

Step 2: Figure Out What You Can Pay

At this point in the process, you’ll need to have an honest review of your finances. Look at your monthly take-home income, expenses, and existing debt payments to determine how much you can afford to pay without sacrificing your essential needs.

If you get stuck, the CFPB offers a helpful budget and debt worksheet that simplifies this process. If you feel you still need guidance, accredited nonprofit credit counselors are available for free consultations. They can also help you understand other debt relief options if you’re struggling to repay multiple debts.

Lump-Sum Payments vs. Payment Plans: Which Is Better?

As you work through this process, keep in mind that your offer is more likely to be accepted if you pay one lump sum rather than setting up a payment plan. If you anticipate any small windfalls, such as a work bonus or tax return, consider using that money as a one-time payment.

Understandably, coming up with a one-time payment that will satisfy a debt collector is impossible for many people struggling with debt. Not to worry, you can also try to work out a payment plan. There are strategies you can use to make your offer more enticing. For instance, some debt collectors will be more inclined to accept a payment plan if you agree to direct withdrawals from your bank account.

Whatever you do, make sure to suggest a payment amount you are confident you can afford and a timeline you are comfortable with.

Step 3: Make a Settlement Offer to LVNV Funding

Once you know how much you can afford to pay, you’re ready to make an offer. Start lower than where you expect to end up, and be prepared for some back-and-forth while negotiating. You can use Upsolve’s Debt Settlement Letter template to draft your offer letter. Ask LVNV Funding to reply in writing, too. It is important to keep a written record of all agreements with debt collectors.

Don’t Just Negotiate the Amount… Negotiate Everything!

The settlement amount is only one piece of the offer equation. Advocate for yourself by also negotiating how you repay the debt and how the debt collector reports the account to the credit bureaus.

Settled accounts can be reported in several ways. Each impacts your credit score differently. If your credit report shows the debt as “paid in full,” this can help you start to repair damaged credit. They can also report the account as “partial payment,” or “settled.” So, as part of your debt settlement, ask LVNV Funding to report the collection account as “paid in full” to the major credit bureaus.

Can You Still Negotiate a Settlement if There’s a Debt Collection Lawsuit Against You?

Yes, you can usually negotiate a settlement after you’ve been sued, and it’s often a worthwhile option to pursue.

That said, it’s important to respond to the lawsuit and continue to follow court requirements (even while simultaneously working toward a settlement agreement). Treat legal proceedings as valid until the case has been closed or dismissed.

Tips for a Successful Debt Settlement

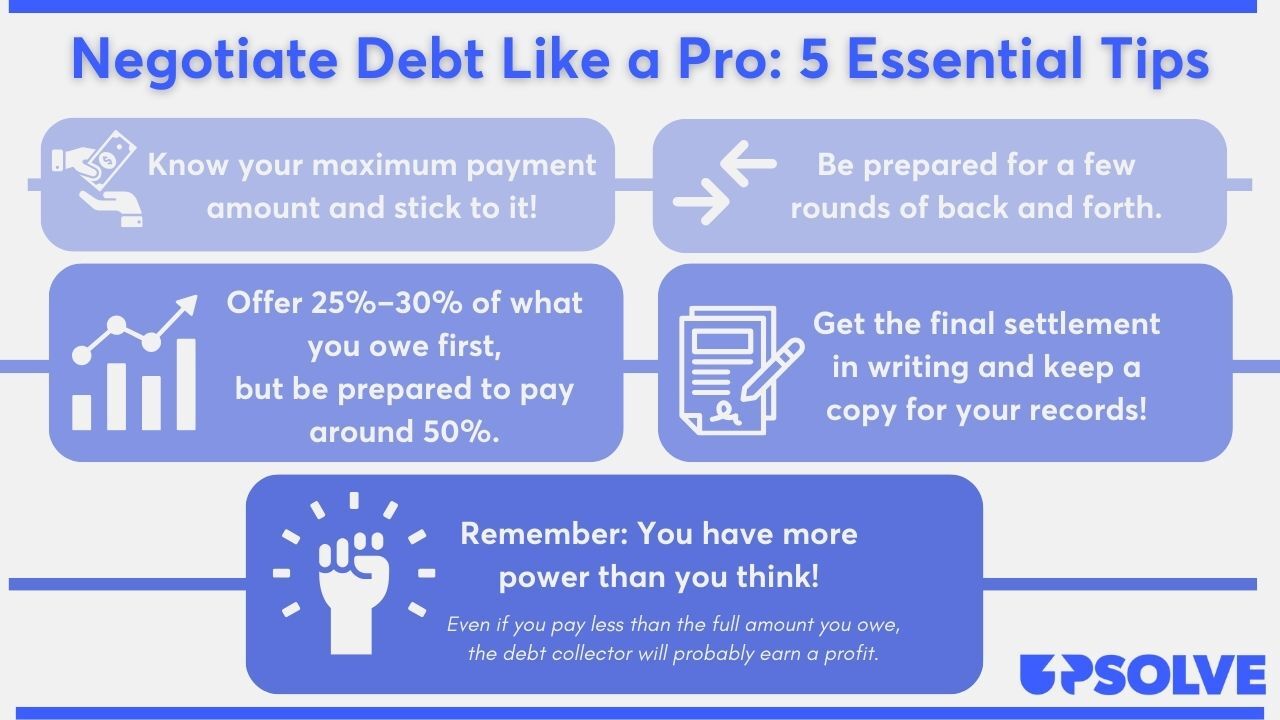

Navigating negotiations can be a daunting experience. Enhance your confidence and improve the likelihood of a successful settlement by following these tips:

For even more tips and info, read Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat LVNV Funding in a Debt Lawsuit

If LVNV Funding hasn’t been successful in collecting payment from you for an outstanding debt, they may eventually decide to take legal action and sue you. You’ll know you’re being sued if you get an official notice from the court. This usually comes in the form of two documents called a summons and a complaint.

The most important thing to do is respond to the summons. If you ignore the lawsuit, the judge is likely to give the debt collector a win and issue what’s called a default judgment. This opens the door to wage garnishment. Participating in the lawsuit reduces their chances of being successful. And it’s easier than you might think!

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter using our partner Solo. They've helped over 280,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Step 1: Read the Summons and Complaint Carefully

A summons is a legal document that notifies you if you are being sued. It also includes additional information, such as:

The court name and address

The names and addresses of the parties involved

The case number

The nature of the lawsuit

There may also be instructions to the defendant (which is you, if you’re being sued) and a disclaimer about the legal consequences if you do not respond to the lawsuit.

Lastly, the summons will inform you of how much time you have to respond to the lawsuit. This may be a specific date or a specified number of days.

A complaint, which accompanies a summons, outlines claims against the defendant, usually in the form of numbered paragraphs.

Many people can successfully respond to debt collection lawsuits without hiring a lawyer. But if you want or need legal help, you can contact a local debt settlement attorney or look for free help through the Legal Services Corporation’s search tool.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

After receiving a summons and complaint, you will need to reply to the lawsuit. Some courts provide blank answer forms that you can fill out to serve as your reply. To find out if your court offers these, Google the court name listed on the summons plus “answer form” or “court forms” and see if there are any results. Court-provided answer forms often contain instructions for filling them out, so read them carefully to guide you.

You can also ask the court clerk to find out if answer forms are available. Court clerks cannot give legal advice, but they are a great resource to answer questions and help you understand the paperwork and processes of the legal system.

Your response to the lawsuit is an opportunity to raise an affirmative defense. An affirmative defense is a reason the debt collector shouldn’t win the lawsuit against you because of information they left out of their complaint. To better understand debt defenses, read 3 Steps To Take if a Debt Collector Sues You.

Keep in mind that many processes vary by court. For example, some courts require additional forms beyond the answer form. A certificate of service is a common one, though it’s often included in the answer form. If you aren’t sure about additional steps or forms, look on the court website for local rules, and don’t hesitate to seek clarification from the court clerk.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

After you’ve filled out the answer form (and any additional required forms) with your reply to the lawsuit, you’re ready to file the paperwork with the court. You can almost always file in person at the courthouse or send your reply in the mail. Though it’s less common, some courts allow you to file your form online or email it to the court clerk. Check the court summons, your specific court’s website, or with the court clerk to find out your options.

You must also deliver a copy of your reply to the plaintiff (the debt collection company that is suing you). Send it via mail to the address listed on the summons or ask the court clerk what your other delivery options are. When you mail court documents, it’s advisable to send them via certified mail, so you have proof of when the documents were sent and delivered.

Let’s Summarize…

If LVNV Funding is contacting you to collect a debt, first make sure the information they have is correct by validating the debt. Send a verification letter if you need additional information or to dispute the debt if it isn’t valid. If you do owe the debt, determine how much you can pay and negotiate a settlement. If LVNV Funding sues you, settling the debt is still a viable option. Just remember to continue meeting the requirements of the lawsuit while you are negotiating. Courts differ somewhat in their processes, so check with the court listed on your summons, and use their website and court clerk as resources to answer your questions.