How To Win Against United Collection Bureau

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

United Collection Bureau (UCB) is a debt collection agency. If UCB is reaching out to you, you may owe a debt that belongs to them. After confirming you owe the debt, you can negotiate a debt settlement for less than what you owe overall. If UCB files a lawsuit against you, respond immediately by filing an answer form and following all court procedures.

Written by the Upsolve Team. Legally reviewed by Jonathan Petts

Updated April 21, 2025

Table of Contents

- Why Is United Collection Bureau Contacting Me?

- Do I Have To Pay United Collection Bureau?

- How To Negotiate a Debt Settlement With United Collection Bureau in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat United Collection Bureau in a Debt Lawsuit

- Let’s Summarize…

Why Is United Collection Bureau Contacting Me?

United Collection Bureau (UCB), sometimes known as UCB Collections, is a debt collection agency that collects consumer debts, like credit card, medical, and utility debt. UCB is likely contacting you because they bought a debt of yours and want to collect it. Before you pay, make sure that you really owe the debt and that the amount is correct. This is called validating a debt.

Upsolve’s article How to Deal With United Collection Bureau goes into more detail about UCB and what to do if they contact you.

Do I Have To Pay United Collection Bureau?

You might have to pay United Collection Bureau if they validate the debt. Validating a debt means they prove the debt is yours and that the total amount is correct. You shouldn’t have to pay if they cannot validate the debt.

If UCB proves the debt is accurate and you agree but choose not to pay it, there will likely be consequences. They could get a court order for wage garnishment or bank account garnishment and take your income to pay off the debt.

Even if you do have to pay UCB, you may not have to pay the full amount. You can negotiate a debt settlement to only pay a portion of the debt.

Negotiate like a pro by following our three-step negotiation plan.

How To Negotiate a Debt Settlement With United Collection Bureau in 3 Steps

Debt collection agencies are businesses with their own objectives and are known to use intimidation to reach their goals. This sounds scary, but you have an advantage you can use in negotiations.

You may not know that collectors buy your debt for significantly less than it’s worth. This means they still make a profit even if you settle for less than your original debt amount. Many times, they are open to settling for 40%–60% of the total amount. Keep this in mind during your settlement negotiations!

UCB may reach out with a settlement offer, but it’s best practice for you to initiate the settlement. This gives you the upper hand and helps you in negotiations.

If you don’t think you’re ready for negotiations, let’s go through the steps together.

Step 1: Make Sure the Debt Is Valid

A Consumer Financial Protection Bureau (CFPB) debt collection rule states that debt collectors must send you a validation letter within five days of contacting you, and they must give you 30 days to dispute the debt.

Debt collection agencies have to send you a debt validation letter when collecting from you. A debt validation letter contains important details of your debt, so if UCB has not sent you a letter, ask for one.

If they do send you a validation letter but you need more information, you can craft and send a debt verification letter requesting more information. You can also use a validation letter to dispute the debt.

If a debt collector is claiming you owe them for a debt, you need to confirm:

The debt belongs to you

The debt collector owns your debt

The debt amount is correct

Even though they sound similar, debt validation and debt verification letters are quite different. Check out our infographic for a short breakdown of the difference between the two letters.

Step 2: Figure Out What You Can Pay

You need to determine how much you can comfortably pay United Collection Bureau before you make your settlement offer. Take note of your monthly take-home pay, expenses, and debt obligations, like mortgages and loans.

If you need help with this process, the CFPB has a budget worksheet and helpful debt worksheet. If you need further assistance, consider getting a free consultation with an accredited nonprofit credit counselor.

Once you know how much you can afford to pay, you can choose what type of payment to make to UCB. You can either pay a one-time lump-sum payment or through a monthly payment plan.

Debt collectors typically prefer a lump-sum payment. It is a good option if you have a sudden bump in income from a tax return or a work bonus. But a payment plan may be a better option if you don’t have any windfalls on the horizon.

Create a payment plan with monthly installments that work for your budget and on a timeline you feel good about. You can set up a direct withdrawal system that automatically pays the collector every month. This could help persuade the debt collector to accept this option!

Step 3: Make a Settlement Offer to United Collection Bureau

Making a settlement offer isn’t as overwhelming as it seems. Use Upsolve’s Debt Settlement Letter template as a guide when crafting your offer. It’s smart to make your settlement in writing so there is a record of your offer. Make sure UCB’s reply is in writing, too.

Don’t Just Negotiate the Amount… Negotiate Everything!

You can follow our negotiation procedure for more than just the debt settlement amount. Negotiate how you repay the debt (lump sum vs. payment plan) and how UCB reports your collections account to the credit bureaus.

How a collector reports your account is particularly important to your credit score. They can report you as paid in full, paid partially, or settled. It’s best for your credit report if they report you as paid in full, so fight for this option!

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Often, yes! Even if you are being sued, it’s not too late to negotiate a debt settlement. However, even if you’re working towards a debt settlement, do not ignore your lawsuit. You still need to follow all procedures and court requirements, like court appearances, until your settlement is in writing and your lawsuit is dismissed or closed.

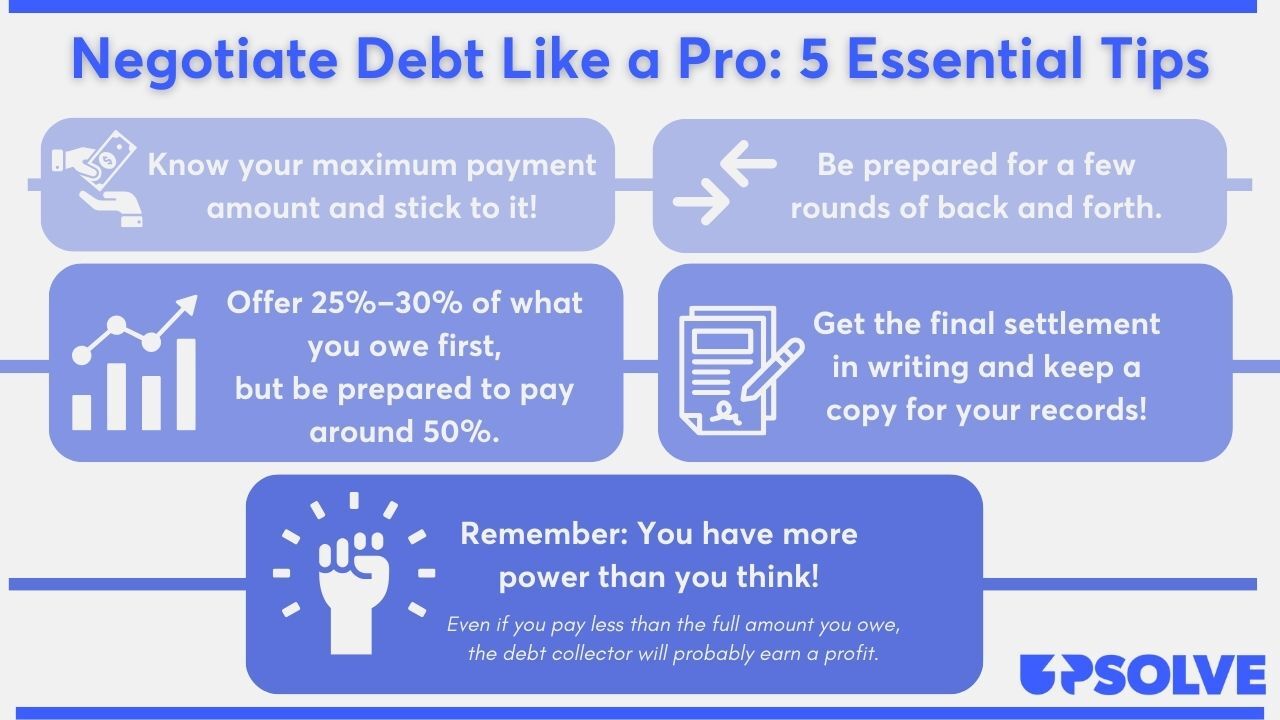

Tips for a Successful Debt Settlement

Here are our top tips on how to be a boss negotiator:

For more tips and info on negotiating, read 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat United Collection Bureau in a Debt Lawsuit

If you are sued by United Collection Bureau, you need to read your summons and complaint (two official court documents) and respond to the lawsuit with an answer form as soon as possible.

If you ignore a lawsuit, the debt collector may win the lawsuit by default. To prevent this from happening, respond to your lawsuit immediately after receiving your paperwork. Try not to worry — responding is simpler than you may think!

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped 234,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Step 1: Read the Summons and Complaint Carefully

A summons contains the important details of your lawsuit. Its main purpose is to alert you that you are involved in a lawsuit. Its format and contents can vary depending on your court, but typically a summons outlines:

The name and address of your court

The contact information for everyone involved in the case

The legal consequences you can face if you fail to respond

To understand why UCB filed a lawsuit, make sure to read your complaint document thoroughly. A complaint details the specific claims that UCB has against you, usually listed in numbered paragraphs. This is important to reference when filling out your answer form.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

Most courts provide an answer form template for you to fill out once you receive your summons and complaint. You can try Googling “[court name] + answer form” to see if your court has one of these templates. Some courts may require you to fill out additional paperwork along with your answer, so read your paperwork thoroughly.

Your responses should line up with each claim outlined in the complaint. This is your chance to bring up any affirmative defenses you may have. An affirmative defense is a legitimate reason why you do not have to pay the debt.

To see examples of affirmative defenses and learn more about the debt lawsuit process, read 3 Steps To Take if a Debt Collector Sues You.

If you have trouble finding your answer form or have questions about your court’s protocols, contact your court clerk. A court clerk is an official who works for the court and can help you with procedures and paperwork, but they cannot give legal advice.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

After filling out your answer form, submit it to the court noted on your summons document. Filing procedures are different for every court, so make sure to check out your court's website or contact the court clerk.

Most courts have an in-person filing option, while others allow you to file online. Some courts also have a mail-in option.

Regardless of how you file your answer form, most courts require you to also deliver a copy of your forms to the plaintiff (the debt collector). This is called serving the plaintiff. You can do this by mail, preferably through certified mail, so you have a receipt.

Let’s Summarize…

United Collection Bureau (UCB) is a legitimate debt collection agency. If they are contacting you, they believe you owe a debt that now belongs to them. After confirming that you do owe the debt, you can begin negotiations for a debt settlement. If UCB files a lawsuit against you, respond immediately and follow all procedures to protect yourself from future trouble.