How To Win Against Wakefield and Associates

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If Wakefield and Associates contacts you to collect a debt, make sure they’ve validated the debt before you decide what to do next. If they can prove the debt is valid but you disagree with the amount, you can dispute it. If you agree you owe that amount but can’t pay in full, try to negotiate a settlement to pay less. If Wakefield and Associates sues you, you must respond to their lawsuit even if you’re still negotiating the debt to avoid negative consequences.

Written by the Upsolve Team. Legally reviewed by Jonathan Petts

Updated April 23, 2025

Table of Contents

- Why Is Wakefield and Associates Contacting Me?

- Do I Have To Pay Wakefield and Associates?

- How To Negotiate a Debt Settlement With Wakefield and Associates in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Wakefield and Associates in a Debt Lawsuit

- Let’s Summarize…

Why Is Wakefield and Associates Contacting Me?

If Wakefield and Associates contacts you, it likely means they’re trying to collect a medical bill they believe you owe.

Wakefield and Associates is a debt collector that primarily collects past-due medical and healthcare bills. The company represents hospitals, clinics, and other medical providers and collects debts on their behalf. They also purchase unpaid medical debts. To learn more about the company, read Upsolve’s article Is Wakefield & Associates a Legit Debt Collector?

Do I Have To Pay Wakefield and Associates?

Maybe. It depends on whether the debt is yours and the amount is accurate.

If Wakefield and Associates can show the debt is valid, they are authorized to collect it, and you don’t dispute it, then you probably need to pay them.

If you don’t pay a legitimate debt, your credit score may dip and you might even find your paycheck or account with less money due to a garnishment. But the good news is you can try negotiating with Wakefield to settle the debt for less than the full amount.

How To Negotiate a Debt Settlement With Wakefield and Associates in 3 Steps

Companies like Wakefield usually get paid a percentage of what they collect from individuals, so the more accounts they close, the more they can make. This is why they might be willing to negotiate a debt settlement and allow you to pay just 40–60% of the original amount you owe.

Wakefield might start settlement negotiations, but you can initiate the process, too. And don’t worry! It’s not as difficult as you might think.

Step 1: Make Sure the Debt Is Valid

Before negotiating anything, you need to confirm that the debt is legitimate. The Consumer Financial Protection Bureau’s (CFPB) debt collection rule requires third-party debt collectors like Wakefield to send you a debt validation letter and give you 30 days to dispute the debt.

The debt validation can help you make sure:

The debt is yours and not someone else’s.

The amount is correct.

Wakefield owns the debt or has authorization to collect it.

Because third-party debt collectors get information second-hand, they sometimes make mistakes and ask people to pay a debt they’ve already paid or to pay a debt that doesn’t belong to them. This is why debt validation is so important.

You can also send Wakefield a debt verification letter to request more information about the debt, or to dispute the debt if you don’t believe you owe it.

Here’s the difference between these two letters:

Step 2: Figure Out What You Can Pay

Now that you know you have to pay the debt, it’s time to figure out how much you can offer in a negotiation.

First, add up your monthly take-home pay and any other sources of income. Then add up your expenses. Expenses should include anything you’re likely to pay each month, like utility bills, groceries, rent, and other debt payments. Subtract your expenses from your income. Do you have anything left over? If so, you can use this money in your settlement offer. Also, consider alternative sources of income, like a tax refund or work bonus, or get creative and see if you can sell personal belongings you no longer need.

If you want help with this process, you can use the CFPB’s budget worksheet and debt worksheet. You can also schedule a free consultation with a nonprofit credit counselor who can help you understand your debt-relief options.

Only Offer What You Can Afford To Pay

Don’t agree to pay anything you can’t realistically afford or that might lead you to miss future payments. It’ll land you back where you started, and the debt collector is less likely to be willing to work out a payment plan again.

Third-party collectors like Wakefield and Associates are also often more likely to accept lump-sum settlement offers than payment plans. If you do go the monthly payment plan route, you’ll most likely pay more in the long run.

If a monthly payment plan is your only realistic option, that’s okay. There’s no harm in offering a monthly amount you’re confident you can afford on a timeline you’re confident you can stick with.

Step 3: Make a Settlement Offer to Wakefield and Associates

Once you know your numbers, it’s time to negotiate. You can start the negotiation process by sending a letter to Wakefield and Associates. Ask them to reply in writing, too. This way you have a record of everything.

It’s not only best to negotiate in writing, but it’s also easier for many people than negotiating in real-time on the phone. If you do make an agreement on the phone, be sure to get it in writing as well.

Don’t Just Negotiate the Amount… Negotiate Everything!

You aren’t limited to just negotiating the settlement amount. As mentioned above, you can negotiate how you pay: via a lump sum or a monthly payment plan. And with a payment plan, you can negotiate how many months you pay as well as your monthly payment amount.

Here’s another powerful point of negotiation: how the account shows up on your credit report. Wakefield can choose to report a settled account in several ways: paid in pull, partial payment, and settled. Negotiating to have them report the account as “paid in full” can help improve your credit score, and will look better to future lenders than seeing an account listed as “partial payment” or “settled.”

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Even if you’re being sued, it’s probably still possible to settle the debt. Wakefield and Associates may not tell you this, but they may want to settle the case almost as much as you do. The sooner it settles, the sooner they get paid. Plus, they avoid the risk of losing in court.

If you’re in the process of negotiating with Wakefield after you’ve been sued, don’t stop responding to court notices and requests. You’ll also want to show up to court if there’s a hearing. Keep participating in the lawsuit until the case is officially closed or dismissed.

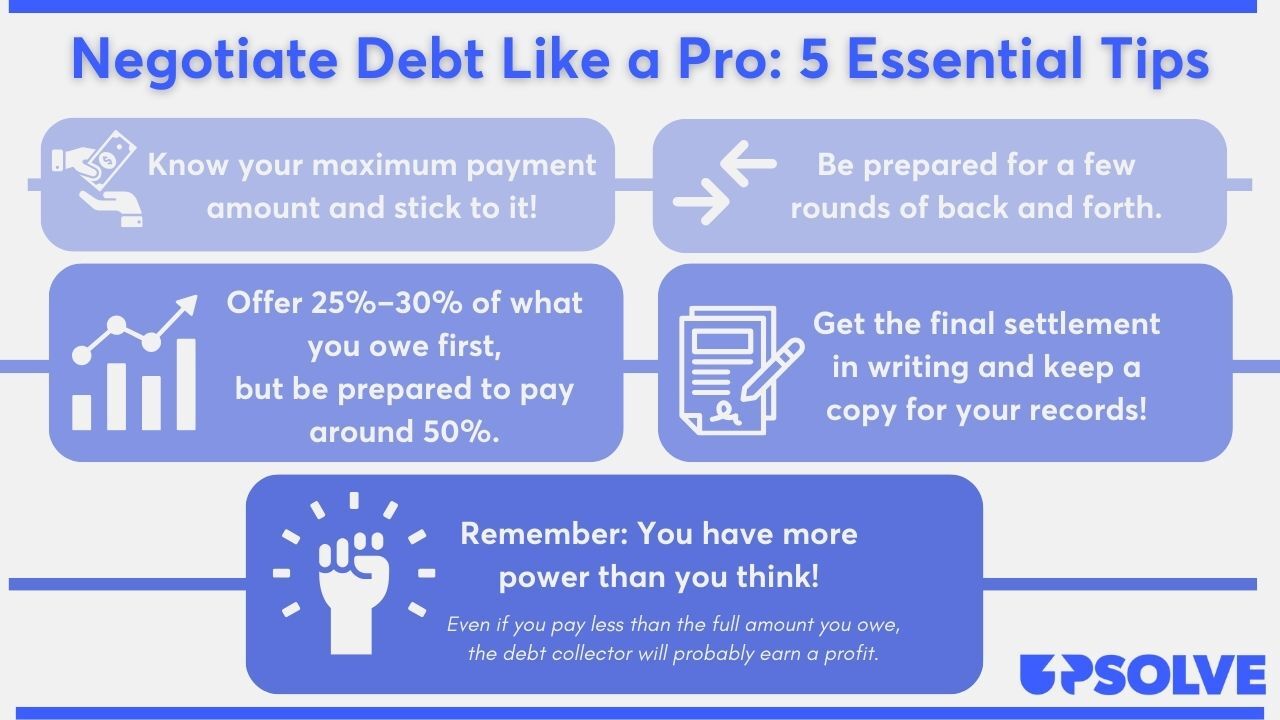

Tips for a Successful Debt Settlement

Debt negotiation feels like a scary or intimidating process, but here are some tips to increase your confidence and boost your chances of a successful settlement.

For additional tips and information, read Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Wakefield and Associates in a Debt Lawsuit

If Wakefield and Associates can’t get you to pay the outstanding debt they believe you owe, they may sue you. If they do, you’ll get two court documents: a summons and a complaint.

Whether you agree you need to pay the debt or you want to fight it in court, it’s best to respond to the lawsuit. If you don’t, the judge will likely rule in their favor. Then, they can get a court order to garnish your wages or bank account.

Getting sued may be intimidating, but responding to the lawsuit is fairly easy.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped over 280,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Step 1: Read the Summons and Complaint Carefully

A summons is a court document that informs you about the lawsuit and provides details about the case. The information in your summons will depend on which court issued it, but generally they contain:

The court’s name and address

The names and addresses of the people in the lawsuit

A case or docket number

The date the court issued the summons

A signature and seal of the court

A deadline to respond to the lawsuit (a specific date or a number of days may be given)

The summons may also include brief instructions on how to respond to the lawsuit as well as an explanation of the legal consequences of ignoring it.

A complaint is a court document that explains the claims against you. It’s written by the person suing you, or the plaintiff. (The person being sued is called the defendant.) Complaints are typically formatted with numbered paragraphs.

Once you’ve received and read these two forms, you can start filling out your response in an answer form.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

You respond to a debt collection lawsuit by filling out an answer form. Many courts provide blank answer forms for defendants to use as a template. These forms can be found at the courthouse or on the court’s website. If they’re online, you can normally find them by googling the court’s name along with “answer forms” or “court forms.”

Some answer forms come in a packet with instructions. If yours doesn’t or you don’t understand the instructions, contact the court clerk. Court clerks can’t offer legal advice, but they can answer questions about where to find forms, how to understand court processes, and where to get help if you don’t have a lawyer.

The answer form is sometimes your first and only chance to explain your defenses or affirmative defenses. To learn more about affirmative defenses in debt collection cases, read Upsolve’s article 3 Steps To Take if a Debt Collector Sues You.

In addition to the answer form, you might also need to complete and file additional forms, such as a certificate of service. The exact forms you need to file will depend on the court. Be sure to check the court’s website or ask the court clerk for more information.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

After you fill out the answer form and any other necessary forms, you need to file them with the court. You can do this in person, but many courthouses will also allow you to mail your forms in or file online through an e-filing system. Again, the exact process depends on which court your case was filed in. The court’s website or clerk can provide detailed information on how to file court papers.

You also need to deliver a copy of the forms you file with the court to the plaintiff (the person suing you as listed in the summons or complaint). This process is formally known as “service of process” or “service.” The rules for service also vary by court, but often you can mail the forms or deliver them in person. Some courts will allow you to email forms, but this isn’t common.

Let’s Summarize…

If Wakefield and Associates tries to collect a debt from you, make sure it’s valid before you do anything else. If you don’t believe the debt is valid, dispute it with a verification letter. If you know the debt is valid and you want to pay it, but you can’t afford the full amount, see if you can negotiate a debt settlement.

If Wakefield sues you, you can still try to settle the debt outside of court. But while you’re negotiating, it’s important to continue responding to court notices and documents until the case is officially closed or dismissed.