What Happens After You Attend the 341 Meeting?

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

After your 341 meeting, you’re in the final stages of your Chapter 7 bankruptcy case. The court will typically grant your discharge 60–90 days later, wiping out most or all of your eligible debts and giving you a fresh financial start. If the trustee determines your case is a no-asset case, it will likely be closed soon after the discharge is entered. However, if the trustee finds non-exempt assets, the process may take longer as they work to distribute funds to creditors, though your discharge won’t be affected.

Written by the Upsolve Team. Legally reviewed by Jonathan Petts

Updated May 6, 2025

Table of Contents

What To Expect After Your 341 Meeting of Creditors

First of all, congratulations 🎉! Completing your 341 meeting is a big milestone, and you’ve made it through the most stressful part of your bankruptcy case. Now, you’re in the home stretch!

Two important things happen after the 341 meeting:

The court will grant your bankruptcy discharge, which eliminates most or all of your eligible debts.

The bankruptcy trustee will finish their work on your case.

These two steps usually happen independently. In most cases, the trustee will determine that you don’t own any non-exempt property, meaning there’s nothing to sell to pay creditors. If that’s true for your case, the court will issue your discharge within 60–90 days, and your case will be closed shortly after.

If the trustee does find non-exempt property, the process can take longer as they’ll need time to sell the property and distribute the funds to creditors. Even in that situation, your discharge will still be granted and give you the fresh financial start you’ve been working toward.

Important: Make sure to let the court and your trustee know if you move or change your mailing address after you file your bankruptcy petition. The court and the trustee will continue to send you notices in the mail, and it’s important that you receive them.

What Happens During the 341 Meeting?

The 341 meeting, also called the meeting of creditors, is a routine step in every bankruptcy case. It’s an opportunity for the bankruptcy trustee to ask you questions about your financial situation, the information you included in your bankruptcy paperwork, and anything else relevant to your case. Creditors can attend the meeting, but they rarely do.

For most people, the meeting is short and straightforward, lasting about 10–15 minutes. As long as you bring the required documents, answer the trustee’s questions honestly, and provide any requested information, you’ve done everything you need to do. Once the meeting is officially concluded, you’re ready to move on to the next steps in your case.

What You Need To Know About Getting Your Bankruptcy Discharge

Getting your bankruptcy discharge is one of the most important steps in your Chapter 7 case because it officially wipes out your eligible debts. But understanding how and when it happens — and what happens afterward — can help you feel more confident as you move forward.

Here’s what you need to know about how a discharge works, when you can expect it, and how it’s different from your case being officially closed.

What Is a Bankruptcy Discharge?

A bankruptcy discharge is the court order that wipes out all your eligible debts, including credit card bills, medical debt, personal loans, and payday loans. It’s what ultimately helps you get the financial fresh start you are looking for.

If you meet certain requirements, your federal student loans can also be wiped out through bankruptcy, but this requires filing an adversary proceeding and typically takes longer than your regular bankruptcy discharge because it requires a court hearing.

When Will You Get Your Discharge?

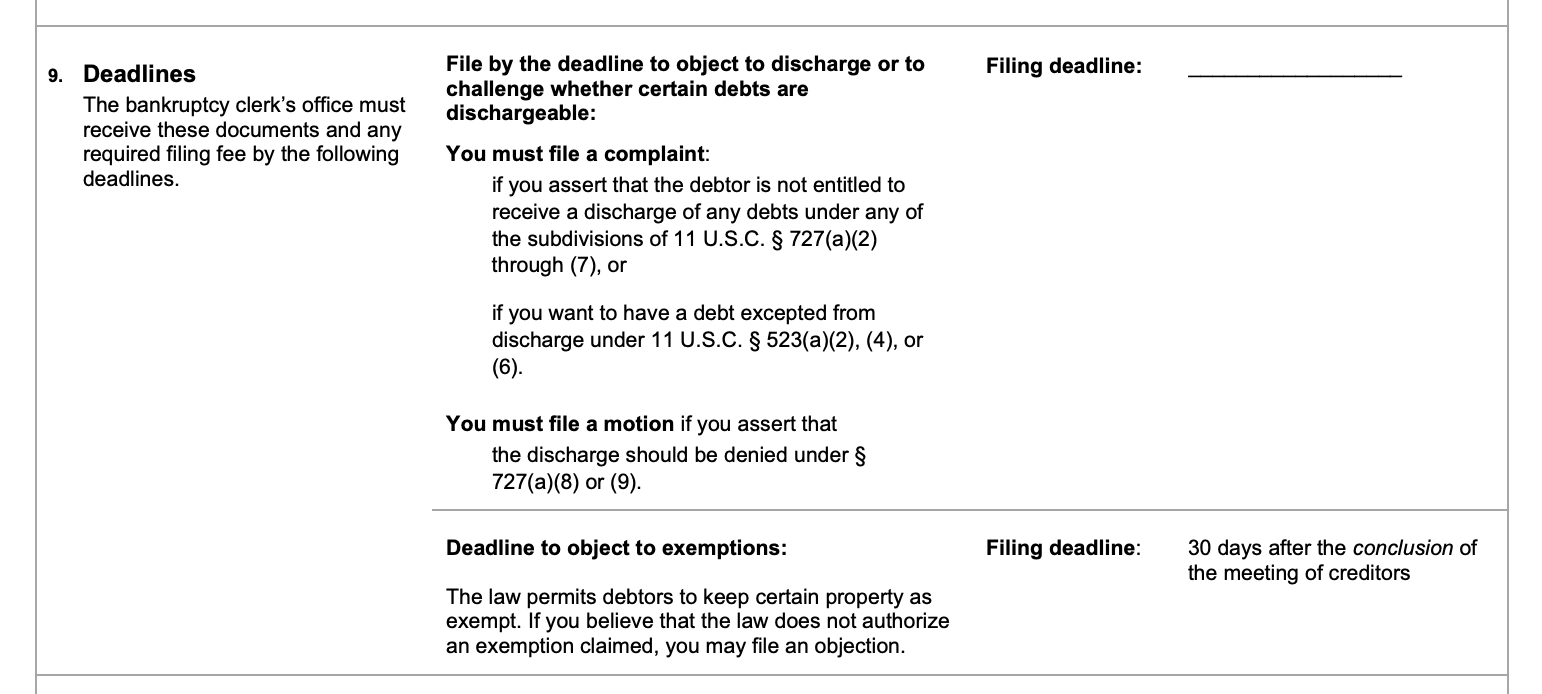

Most bankruptcy judges issue discharge orders 60–90 days after your 341 meeting of creditors. There’s always a waiting period because the Bankruptcy Code gives creditors time to object to your discharge or challenge any exemptions you’ve claimed.

The earliest your discharge can be entered is after the objection deadline has passed. You can find this deadline on page two of your Form 309A, under section nine, “Deadlines” (see example below).

If you’ve already completed the required second debtor education course (also called the financial management course) and submitted your certificate to the bankruptcy court, there’s nothing else you need to do — just sit back and wait for your discharge order to arrive in the mail.

If you haven’t taken the second course yet, don’t worry, but act fast. You must complete this course within 60 days after your 341 meeting or before the deadline to object to your discharge, whichever comes first. If you don’t submit your certificate of completion by the deadline, the court won’t grant your discharge.

What’s the Difference Between Discharge and Case Closure?

A discharge is what gives you a financial fresh start by wiping out most or all of your eligible debts. Once the discharge order is entered, you can start focusing on rebuilding your credit and moving forward.

However, a discharge is not the same as your case being officially closed. Case closure is the final step in the bankruptcy process, where the court formally ends your case after the trustee has completed all their required tasks. This includes filing any necessary reports, distributing non-exempt assets to creditors (if applicable), and confirming that there’s nothing more to administer in your case.

What Does the Trustee Do After the 341 Meeting?

The trustee’s next step after your 341 meeting depends on whether your case is a no-asset case or an asset case.

In no-asset cases, the trustee files a Report of No Distribution, and the court will usually close the case soon after your discharge is granted. In asset cases, the trustee may sell any non-exempt property and distribute the proceeds to creditors, a process that can take longer but doesn’t affect your discharge or eliminate your fresh start. Let’s dive into each scenario further.

No-Asset Cases: What Happens Next?

If your trustee told you that you have a no-asset case at the end of your 341 meeting, the only thing they have left to do is file their Report of No Distribution.

This report lets the court know that that trustee is done with your case. If the trustee files it before your discharge is entered, the court will close your case shortly after sending you the discharge order.

Unfortunately, the court doesn’t send out official notices when a case is closed. If you’re not sure if your case is still open after getting your discharge and the trustee’s report, you can call the court clerk’s office or check PACER to find out.

Asset Cases: What Happens Next?

In rare cases, the trustee may find that you own property or assets that aren’t protected by exemptions and can be sold to pay your unsecured creditors. This doesn’t happen often in Chapter 7 cases, but if it does, the process can take some time to complete.

If the trustee identifies non-exempt assets, they’ll send a notice to your creditors letting them know they can file a proof of claim. This is a legal form creditors must file to be eligible to receive a payment from the trustee. Creditors who file their claims before the deadline listed in the notice may receive part of the funds from the sale of your non-exempt assets.

It’s important to note that this doesn’t mean you owe these creditors any money or that your debts won’t be discharged. The trustee handles these payments as part of the case administration, and your discharge will still eliminate your personal obligation to repay these debts.

While your case is still open, you need to keep the court and trustee updated on any changes to your mailing address or contact information. You also need to cooperate with the trustee if they request additional documents or access to the non-exempt property they’re selling. In many cases, the trustee won’t need much (or anything) from you during this time, but it’s crucial to respond if they reach out.

What If the Trustee Isn’t Sure Yet?

Sometimes, the trustee won’t know at your 341 meeting whether your case will be treated as an asset or no-asset case. If the trustee asked you to provide more documents or scheduled a follow-up meeting, it’s important to provide what they’ve requested and attend any follow-up meetings.

Even if they don’t schedule a follow-up meeting, the trustee might need more time to review your case. They’ll still officially conclude the creditors’ meeting — you’ll hear them say something like, “this concludes the meeting” — but they won’t file the Report of No Distribution with the court right away. Instead, they’ll continue working on your case until they determine whether you have any unprotected property (non-exempt assets) that could be sold to pay creditors.

If, at any point after your 341 meeting, the trustee decides you don’t have any non-exempt property, they’ll file the Report of No Distribution with the court. If your discharge has already been granted by then, the court’s only remaining task will be to close your case.

Why Communicating With Your Trustee Is Important

If the trustee needs something from you and you ignore them or otherwise refuse to cooperate with them, you can lose your discharge.

So, while you’re out enjoying your fresh start, having left your debts in the rearview mirror, make sure to open and read all mail you receive from your trustee and, if you’re not sure if they’re asking you to do something, call their office.

What Happens if You Miss Your 341 Meeting?

If you miss your 341 meeting, reach out to your trustee as soon as possible to reschedule.

Your bankruptcy case could be dismissed if you miss your 341 meeting and don't communicate with the trustee. That means delays in getting a fresh start, possible extra fees, and less protection from creditors if you have to refile.

Whether you already missed the meeting or know you can’t make it, call and email your trustee right away to explain the situation and request a new date. If you’re not sure how to reach your trustee, the court can provide their contact information.

Let’s Summarize...

In most consumer bankruptcy cases under Chapter 7, not much happens after the 341 meeting is done. It’s actually a good thing not to hear anything from anyone (including your trustee) after the meeting.

The court will grant your bankruptcy discharge 60–90 days after the meeting. If the trustee filed a no-asset report, the case will be closed pretty soon after the discharge is entered. Until your case is closed, make sure to keep an eye on any mail from the court or the trustee so you don’t miss anything important.

Once the case is closed, you have reached the final peak of your bankruptcy journey!