How Student Loans Work: Your Complete Guide

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

There are two major categories of student loans: federal and private. Most students opt for federal student loans because they usually have lower interest rates and more generous repayment options. There are other differences between private and federal student loans as well, including payment terms, interest rates, and eligibility requirements. Student loans can be used to finance tuition, room and board, and living expenses.

Written by Elena Botella. Legally reviewed by Jonathan Petts

Updated June 9, 2025

Table of Contents

- How Do Student Loans Work?

- How To Get Federal Student Loans

- How To Get Private Student Loans

- Types of Federal Student Loans

- Types of Private Student Loans

- What Are the Key Differences Between Federal and Private Loans?

- How Does Interest Work on Student Loans?

- When Is Your First Student Loan Payment Due?

- How To Pay Back Your Student Loan

How Do Student Loans Work?

Getting a college education is expensive. This is why many college students take out student loans. They can help pay for the cost of attendance and other educational expenses.

There are many different student loan options. Each type has its own eligibility requirements, interest rates, and terms. That said, student loans can broadly be broken into two categories: federal student loans and private student loans.

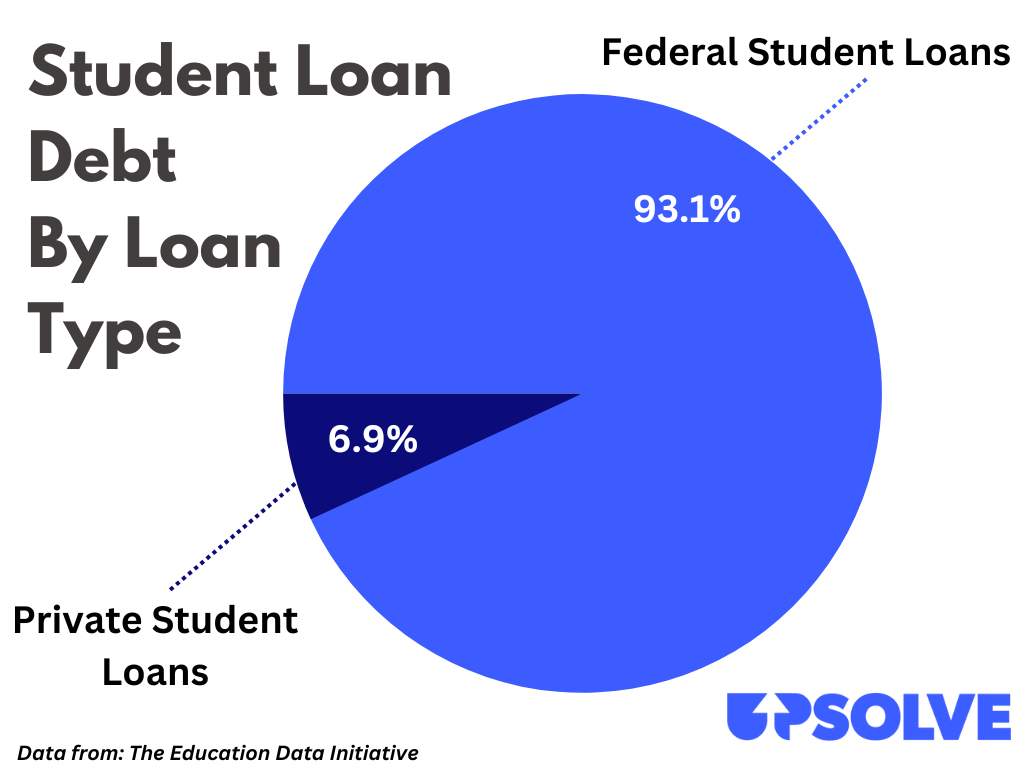

Over 90% of the current student loan debt in the U.S. is from federal student loans. Less than 10% comes from private student loans. So let’s look at how to get federal student loans first.

How To Get Federal Student Loans

The application process for federal student loans is pretty straightforward. It starts with filling out the Free Application for Federal Student Aid (FAFSA). The FAFSA helps financial aid offices at colleges and universities decide how much student aid to offer you each school year. This comes in two main forms:

Scholarships, grants, and work-study programs, which you don’t have to pay back

Student loans, which you do have to pay back, but usually not until you graduate

You’ll find out your aid options when you get an “award letter” from your school. It will detail what financial aid the school and the federal government (in the form of federal student loans) are offering you.

How To Get Private Student Loans

Because federal student loans tend to come with lower interest rates and more generous repayment options than private student loans, many people see what aid they can get from the federal government first. If you find that you weren’t offered enough in scholarships, grants, and loans to cover the cost of college, you may decide to apply for a private student loan. This process is similar to applying for a personal loan. You find a private lender, like a bank, online financial institution, or credit union, and apply from the lender of your choice.

Regardless of the type of loan you get — federal or private — you (the borrower) must sign a promissory note. This is a legal document outlining your agreement to repay the loan plus interest. The promissory note includes all the terms and conditions of the loan. This is where you can find things like your interest rate, repayment period, and other repayment terms.

Types of Federal Student Loans

Federal student loans are offered by the federal government, specifically the U.S. Department of Education. The borrower on these loans may be you as the student or your parents. Some loans are designed specifically for student loan borrowers and others for parents borrowing on behalf of their children.

There are three main types of federal student loans:

Direct Subsidized Loans

Direct Unsubsidized Loans

Direct PLUS Loans

What Are Direct Subsidized Loans?

After scholarships and grants, a Direct Subsidized Loan is probably the first place you want to look for financial aid. Only undergraduate students can take out Direct Subsidized Loans, and eligibility for these loans is based on financial need. The loans are called “subsidized” loans because they’re supposed to have a lower interest rate than borrowers would normally be able to get from a private lender. To get a subsidized loan, you have to fill out the Free Application for Federal Student Aid (FAFSA) Application.

A major benefit of Direct Subsidized Loans is that the interest on these loans doesn’t accrue while you’re in school at least half-time or during the six-month grace period after you leave school. This grace period is automatic, so it’s different from deferment or forbearance, which you must request from your loan servicer.

What Are Direct Unsubsidized Loans?

The biggest difference between subsidized and unsubsidized federal loans is that interest on Direct Unsubsidized Loans accumulates while you’re attending college. This makes the total cost higher in the long run than unsubsidized loans.

Direct Unsubsidized Loans are available to students regardless of their financial need. While only undergraduates can get subsidized loans, graduate students and professional students, along with undergraduate students, are eligible for federal Direct Unsubsidized Loans.

What Are Direct PLUS Loans?

Direct PLUS Loans are available to graduate or professional students or to the parents of undergraduate students. Direct PLUS Loans have a higher interest rate than Direct Subsidized and Direct Unsubsidized loans.

Direct PLUS Loans had an interest rate of 7.54%, compared to 4.99% for Direct Loans for undergraduates (both subsidized and unsubsidized) and 6.54% for Direct Unsubsidized Loans for grad students and professional students.

Taking out a student loan is always a big decision, but it’s especially important for students and their families to be careful before choosing to take out a Direct PLUS Loan. Unlike Direct Subsidized and Direct Unsubsidized loans, there is no loan limit for borrowers. Parents can borrow as much as they’re offered under the Direct PLUS Loan program. This means that it’s easy for parents to end up with more debt than they can repay. And the higher interest rates of these loans make them pricier than Direct Subsidized and Direct Unsubsidized loans.

Types of Private Student Loans

Private student loans are those offered by anyone other than the federal government. That can include banks, credit unions, colleges or universities, local or state governments, or other types of financial institutions (including online lenders).

While Direct Subsidized and Direct Unsubsidized loans are offered regardless of the student’s credit score, private lenders usually take a closer look at the borrower's credit history, credit score, and sometimes other factors like their GPA or college major.

What Are the Key Differences Between Federal and Private Loans?

Borrowers likely opt for federal student loans more often because they have a lot of advantages:

Federal student loans usually have a lower interest rate than private student loans (but not always).

Federal student loans usually come with more repayment options than private student loans. This includes the popular income-driven repayment plans, which limit your monthly payment by considering how much you make.

Federal loans also have more protections available if you lose your job or don’t make much money after you graduate. For example, you can put your loan in deferment or forbearance, which we’ll talk about more later.

Some federal student loans qualify for student loan forgiveness programs.

The federal government has borrowing limits for some types of federal student loans. In other words, there’s a maximum amount that each student can borrow from the federal government, which helps people not borrow more than they can repay.

Interest rates for federal student loans are set by the federal government. They aren’t based on your credit score, GPA, choice of profession, or other factors that private lenders may consider.

Federal student loans can be discharged if the borrower dies. That means if you have federal student loans and you die before your loan has been repaid, nobody else will be responsible for repaying your loan. Federal Parent PLUS loans are also discharged if the parent borrower passes away.

By comparison, private student loans aren’t always dischargeable upon death. If a friend or family member cosigned your private student loan, they may be on the hook to repay the loan if you die. If you didn't use a cosigner, private student lenders may try to collect from your spouse or estate.

How Does Interest Work on Student Loans?

The most important thing to know about student loans is that they aren’t free. Student loans are a type of debt, meaning if you take out a student loan, you’re on the hook to repay that loan, with interest. Over the life of the loan, interest can really add up.

For many college students, student loans are the first type of loan debt they’ve had. So let’s define the basic terms you’ll need to know:

Principal: This is the loan amount you originally borrowed — sometimes called the principal balance. For the average student loan borrower, this is around $40,000 in total.

Interest rate: This can be fixed (unchanging) or varied (changeable). This is essentially the amount (expressed as a percentage) that the loan costs you.

Interest rates on federal student loans are usually fixed rates between 4% and 8%. Private student loans can have a variable interest rate or fixed interest rate.

Loan repayment term: Your loan term is how long you have to pay off your loan. For federal student loans, this can range from 10–30 years. If you have a private loan, repayment terms vary and your loan term will be part of your loan agreement.

Loan balance: Your loan balance at any given time is your principal loan amount plus accrued interest. You can find out your loan balance from your loan servicer (the financial institution managing your student loan repayment) or by looking at the National Student Loan Data System.

Can You Lower Your Student Loan Interest Rate?

If you’re trying to get a lower interest rate, you can refinance your student loan. A word of caution, though: Refinancing your federal student loans turns them into private loans. This means you’ll lose access to things like deferment and forbearance and flexible repayment options like an income-based repayment plan.

To learn more about this process and decide if refinancing is right for you, read our article Can I Refinance My Student Loans?.

When Is Your First Student Loan Payment Due?

This varies based on whether you have a federal student loan or a private student loan.

You don’t have to make payments on your federal student loans so long as you’re in school at least half-time (this usually means six credit hours a semester, but can vary by school). That’s not always true with private student loans. Many private student loan companies require you to make payments while you’re still in school.

If you have federal student loans, you’ll also benefit from a six-month grace period. This means your first payment isn’t due until six months after you graduate, you leave school, or your enrollment falls below half-time. Remember, though, that federal Parent PLUS loans don’t have a grace period.

How To Pay Back Your Student Loan

If you have a federal student loan, that loan will be assigned to a student loan servicer. The federal government works with several different servicers, including Navient, MOHELA and FedLoan Servicing. If you’re not sure who your servicer is, check your Federal Student Aid account online.

You’ll make your loan payments directly to your servicer. You can usually do this online, over the phone, or by mail.

If you sign up for automatic payments from your checking account, some servicers will offer you a discount.

If you have a private loan, you’ll have to check with your lender about how to make payments. You may make your payments directly to the lender, or the lender may assign your loans to a servicer. In both cases, payments are generally due monthly.

Federal Student Loan Repayment Options

Federal student loans have several payment plan options. If you want to do a deep dive into understanding your options, check out our article: What’s the Best Student Loan Repayment Plan?

Standard Repayment Plan

Unless you choose otherwise, you’ll be enrolled in the standard repayment plan by default. This has a 10-year repayment term, which is much shorter than other types of federal repayment plans and can lead to a higher monthly payment than some borrowers can afford.

Income-Based Repayment Plans

Luckily, you can choose from several other plans that will lower your monthly payments. Some of these plans are based on a percentage of your income, which means if your income is very low, you may not have to make any payment at all during those months.

Here are the most common types of income-based repayment plans:

Income-Based Repayment (IBR) Plan

Income-Contingent Repayment (ICR) Plan

Pay-As-You-Earn (PAYE) Plan

Saving on a Valuable Education (SAVE) Plan

Formerly the Revised Pay As You Earn Repayment (REPAYE) Plan

Under these plans, your payment amount fluctuates based on how much money you’re earning. You’ll pay for 20–25 years on the plan. After that time, any outstanding balance will be forgiven.

Student Loan Forgiveness Programs

If you work for the government — including federal, state, local, and tribal governments — or for certain nonprofit organizations, you may be eligible to have your debt forgiven after 10 years of making qualifying payments under a policy called Public Service Loan Forgiveness (PSLF). To receive PSLF loan forgiveness, you generally need to make payments under an income-based repayment plan.

Private Student Loan Repayment Options

Private student loans don’t always come with payment plan options. This varies by lender. Some private lenders offer forbearance or hardship programs, but many do not. Contact your lender to ask about your options.

What if You Can’t Afford Your Student Loan Payment?

Before the student loan pause was instituted in March 2020, one-third of student loan borrowers showed signs of financial distress: 15% had defaulted on their student loans and another 15% had loans in deferment or forbearance. This is to say: If you can’t afford your monthly payments, you’re not alone.

It’s important to understand the consequences of not paying your student loans and to act as soon as you know you won’t be able to make a payment. Educate yourself about options if you can’t make your student loan payments. They include, but are not limited to:

Pausing loan payments temporarily through deferment or forbearance

Getting a consolidation loan to make your payments more manageable (especially if you have several different loans)

Seeing if you qualify for any student loan forgiveness programs

If you’ve been out of school for a while and have been struggling for years to make your student loan payments, you may also want to consider filing bankruptcy to erase your student loan debt.