What Is Debt and How Should I Handle It?

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Debt is a result of borrowing money that has to be paid back over a period of time. Lending institutions, like banks, will lend you money so you can make a purchase. In turn they expect you to pay them back, with interest. Debt can be classified in two broad categories: corporate debt and personal debt, which is also called consumer debt. Corporate debt involves loans between businesses and, generally speaking, has little to no impact on personal debt. This article will explain the most common types of consumer (personal) debt and how to handle it.

Written by Attorney Andrea Wimmer.

Updated April 18, 2024

Table of Contents

What Is Debt?

Debt is a financial obligation that arises when someone borrows money from a financial institution (or another person) and agrees to repay it at a later date, usually with interest. The debtor is the person who borrows the money. The creditor is the person or company that lends the money. Creditors may also be called lenders.

Debt can take various forms. Some of the most common types of debt in the U.S. are personal loans, student loans, credit card balances, mortgages, and car loans.

When someone incurs debt, they are essentially borrowing money or using credit to fund their expenses or purchases. The debtor is legally obligated to repay the borrowed amount to the creditor according to the agreed-upon terms. The loan agreement usually outlines these terms which typically include the repayment amount, interest rate, and a specified repayment period.

Are There Different Kinds of Debt?

Yes. Generally speaking there are two different kinds of debt: secured debt — like a mortgage — and unsecured debt — like credit card debt.

What Is Secured Debt?

Secured debt is debt that is backed by collateral. Two of the most common kinds of secured debt are mortgage loans and car loans. If you take out a mortgage, the house itself is the collateral backing the loan. If you take out a car loan, the car acts as collateral for the loan.

Having collateral backing the loan reduces the lender's risk.(In technical terms, collateral is the loan company’s security interest.) It also means that if you don’t make your mortgage or car payments, you may lose your home or car. This process is called foreclosure for a home and repossession for a car.

Upsolve Member Experiences

1,904+ Members OnlineWhat Is Unsecured Debt?

Unsecured debt is debt that isn't backed by collateral. Most credit cards are unsecured. This is why they often have higher interest rates than secured debts like mortgages or cars. Since the lender doesn't have collateral it can take back if you fail to repay your debt, it charges a higher interest rate to try to off-set the risk of lending.

If you don't pay your credit card debt — or other unsecured debt — the lender can't usually take your home, car, or other possessions. That doesn't mean lenders/creditors don't have any way to deal with unpaid debt.

What Happens if You Don't Pay Your Unsecured Debt?

You'll probably get warnings first about your unpaid debt. If you default on your debt (defaulting will be defined in your loan agreement), the creditor or lender can sue you to try to recover the debt. They may also send your debt to collections.

What Is Student Loan Debt?

Student loan debt is debt incurred to attend a college or university. If you went to college, you probably filled out a FAFSA and got a loan to help pay your tuition. School loans for students can come from the government (federal loans and state loans) or private lenders like a bank or credit union.

Student loan debt is unique in some ways. It is an unsecured debt — your student loan lender can’t take away your diploma if you don’t repay your loans! But it’s treated differently than other debts, especially when it comes to bankruptcy. Most unsecured debt is eligible to be erased through bankruptcy. Student loan debt is too, but filers must take additional steps they don’t have to take to get rid of credit card debt and medical bills.

How Much Debt Is Too Much Debt?

The answer to the question of too much debt is highly individual. But here’s a good clue: You probably have too much debt if you won’t be able to repay it in your lifetime. That said, there are many paths to becoming debt-free or to get help managing your debt.

Lenders will also ask this question when they consider lending you money, whether it’s via a credit card, personal loan, line of credit, or other type of loan. Lenders usually look at your debt-to-income ratio when determining if you have “too much debt” and thus may be risky to loan to.

Debt-to-income (DTI) ratio may sound complicated but it’s just the measure of how much you owe versus how much credit you have (your credit limit). If you’ve maxed out your credit cards, your DTI will be high. This signals to lenders that you may not be able to take on more debt and repay it on time. Lenders will also look at your credit report to see if you’ve made timely payments in the past on your existing debts.

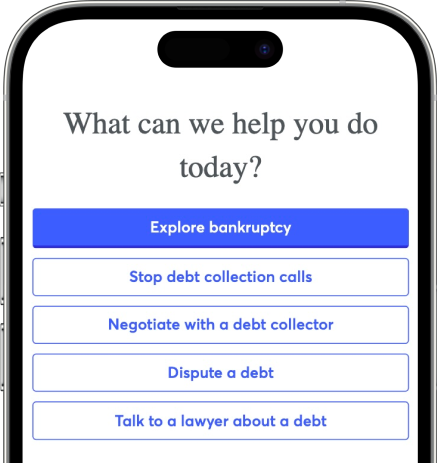

I Have Too Much Debt — What Should I Do?

Americans owe over $17 trillion in total household debt. Consumer debt comes from mortgages, student loans, credit cards, and auto loans. So, if you’re struggling with debt, know that you are not alone. Debt can become a vicious cycle that’s hard to break free from because high interest rates can make your debt balance snowball fast.

If you’re struggling to make your debt payments, or you can only make the minimum payment and you feel like you can’t get ahead, here are some options:

Try debt consolidation or a debt management plan

See if you can negotiate a debt settlement on some of your debt

File bankruptcy for a fresh start

What Is Debt Consolidation and When Is It a Good Idea?

Debt consolidation involves taking out a new loan to pay off your old debt. The goal is to get a new loan with a lower interest rate than your existing debt. One advantage of a debt consolidation loan is that you’ll only have to make one payment each month, instead of juggling several debt payments. You may also get a lower monthly payment. Beware though, if the lender offers you a long repayment period, your monthly payment may be lower, but you might end up paying more in interest over time. Still, if this makes your monthly payment affordable, it might be a good option.

To qualify for a consolidation loan, you’ll need to prove your creditworthiness. This means you’ll need to show the lender you have a clean credit history and a good credit score.

In addition to a personal debt consolidation loan, you may be able to do a credit card balance transfer, which acts in the same way. To do this successfully, you’ll want to get a card that offers a 0% interest. Many credit card companies do this as a promotion. You’ll also want to have a strong plan in place to repay your debt during that promotional period.

What Is a Debt Management Plan and When Is It a Good Idea?

If you don’t qualify for a debt consolidation loan, you can consider a debt management plan (DMP). This is another form of debt consolidation, but instead of getting a loan, you work with a certified credit counselor who manages the plan on your behalf. The counselor can contact your lenders to negotiate a payment arrangement. The credit counselor may be successful in getting a lower interest rate and getting late fees waived.

Once the debt management plan is in place, the person managing it will collect one monthly payment from you and send it to your creditors as outlined in the plan. Many people like a debt management plan because they only have to pay one person instead of juggling a handful of creditors. Of course, you can always try to negotiate with creditors on your own, but DMP agents tend to have connections and experience that results in lower rates.

A debt management plan can help with unsecured debt like credit cards and medical bills. It can’t help you with secured debt like mortgages and auto loans or with court-ordered payments like child support and alimony. You also can’t include student loans in a debt management plan, but if you have federal student loans, you can look into other repayment options through the U.S. Department of Education.

What Is Debt Settlement and When Is It a Good Idea?

Debt settlement isn’t always the easiest debt-relief option, but it’s worth bearing in mind, especially if you happen to have a lump-sum of money and you’ve been in default on your debt for a while. To settle a debt, you negotiate with the creditor or, if your debt has been sent to collections, the debt collector. You offer to make a single payment, in a lump sum, for less than what you owe. You may be able to pay as little as half of the total debt you owe. The amount of debt you have to pay will depend on if the creditor is willing to settle and how much they’re willing to settle for.

How is this possible? Debt collection agencies buy debts from creditors for pennies on the dollar. Then they try to get you to pay up. If you pay the original amount you owed, they profit.

The downsides to this are probably obvious: Most people who have debt don’t have a big pile of money sitting around somewhere. But if you come into a windfall, debt settlement may be worth a shot.

What Is Bankruptcy and When Is It a Good Idea?

Bankruptcy is a legal process that helps people (and companies) with overwhelming debt get a financial fresh start. There are two kinds of personal bankruptcy. The most common type is Chapter 7. This is what most people think of when they hear the word bankruptcy. Chapter 7 usually takes 3–4 months.

Though it’s less common, some people also file Chapter 13, especially if they make too much money to qualify for Chapter 7 or if they own a home or other real estate. Chapter 13 requires filers to adhere to a 3–5 year repayment plan. During this time, you’ll make some debt repayments, based on what the court thinks you can pay.

Many people think of bankruptcy as a last resort, but if you’ve been struggling to repay your debts for a while and you feel despair when you look at your bills and bank account, it’s worth at least looking into this option. The truth is, bankruptcy is a legal tool that helps hundreds of thousands of people get a fresh start each year. Upsolve is a non-profit that helps people file Chapter 7 for free. We’ve helped thousands of people get over $6 million in consumer debt discharged. Many of these people say they wish they’d looked into bankruptcy sooner.

Let’s Summarize…

Debt is money you borrow that’s meant to be paid back. There are two kinds of consumer debt: secured debt and unsecured debt. Home loans and car loans are the most common types of secured debt. Personal loans, payday loans, credit cards, and student loans are common types of unsecured debt.

Because consumer debt is usually accompanied by interest, one financial setback can cause debt to spiral fast. If this happens to you, explore your debt relief options.