How To Win Against Midland Funding LLC

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify

If Midland Funding is contacting you, they’re probably attempting to collect a debt. Before you do anything else, determine if the debt is valid. If it is but you can’t afford to pay it in full, you can try to negotiate a debt settlement. If Midland files a lawsuit against you, read the details thoroughly and respond quickly. Use this article as your guide to take on Midland Funding successfully.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated April 23, 2025

Table of Contents

- Why Is Midland Funding LLC Contacting Me?

- Do I Have To Pay Midland Funding LLC?

- How To Negotiate a Debt Settlement With Midland Funding LLC in 3 Steps

- Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

- Tips for a Successful Debt Settlement

- How To Beat Midland Funding LLC in a Debt Lawsuit

- Let’s Summarize…

Why Is Midland Funding LLC Contacting Me?

Midland Funding LLC is a debt collection agency that buys consumer debts, like credit card debt, from creditors. Midland Funding partners with Midland Credit Management to collect debts for their parent company, Encore Capital Group. Encore is a well-known debt buyer that purchases debt from credit unions, global banks, and utility providers.

If Midland is reaching out to you, they’re probably looking to collect a debt they believe you owe to a credit union, bank, or utility provider.

To learn more about Midland and what to do if they contact you, read How To Deal With Midland Funding LLC.

Do I Have To Pay Midland Funding LLC?

If Midland can prove the debt is real and you agree you owe it, you probably need to pay them or you’ll face some serious consequences.

Worst-case scenario, Midland could sue you for the debt and get a court order to garnish your paycheck or freeze your bank account and take your hard-earned income. To keep this from happening, speak with Midland to figure out how to address the debt. If you can’t afford to pay the full amount, see if you can negotiate a debt settlement to pay less than the original amount and close the account for good.

How To Negotiate a Debt Settlement With Midland Funding LLC in 3 Steps

Many debt collectors are willing to settle for 40%–60% of the original debt amount because they buy your debt account for significantly less than what you owe. This means that even if you pay only 50% of your debt as part of a settlement, they’ll probably still make a profit.

You can start negotiations on your own. It’s not as complicated as it may seem. Once you learn how to negotiate a debt settlement, you’ll have the confidence to deal with Midland Funding head on.

Step 1: Make Sure the Debt Is Valid

Debt collectors have to send you a debt validation letter and give you 30 days to dispute the debt. This is required under the Consumer Financial Protection Bureau’s debt collection rule. If they don’t send the validation letter within five days of first contacting you, ask them for one.

Use the letter to verify that:

The debt is yours

Midland truly owns the debt or has authorization to collect it

The account information and debt amount are correct

Compare the information you have about the debt with what Midland provides. Once all of the information about the debt is verified, you can figure out what you can pay.

If you need more information, you can create and send a debt verification letter.

Step 2: Figure Out What You Can Pay

Once you know the debt is valid, you can figure out how much of it you can afford to repay. To do this, make a list of your monthly income and expenses.

The Consumer Financial Protection Bureau has a budget worksheet that can help you figure out how much, if any, monthly disposable income you have. They also have a debt worksheet that can help you get a better understanding of your existing debt obligations.

If this feels overwhelming or you simply want some help, consider setting up a free consultation with a nonprofit credit counselor. These financial professionals can help you build a budget that works for you and understand all your debt-relief options.

Lump-Sum Payments vs. Payment Plans: Which Is Better?

Once you determine what you can afford to pay each month, you can decide how you want to pay it. You can choose between a one-time lump-sum payment or a monthly repayment plan.

Debt collectors are typically more likely to accept a settlement offer if it’s a lump sum. This is also how you can get the best deal. If you have some savings available or you’re expecting some extra money from a tax return or work bonus, you might want to consider this option. It’ll probably save you money in the long run.

That said, many people can’t scrap together a lump-sum payment, and that’s okay. You can negotiate a payment plan with Midland Funding, too. Use your budget information to figure out what an affordable monthly payment would be, and then use that to figure out the repayment timeline. You might be able to get a better deal or increase the chances of having the offer accepted if you agree to set up automatic withdrawals from your bank account.

Step 3: Make a Settlement Offer to Midland Funding LLC

Making a settlement offer is simpler than you think. You can speak with a representative at Midland on the phone to start negotiations. If you aren’t able to get the help you need, hang up and try again another time. If you come to an agreement, ask the representative to send it to you in writing.

You can also use Upsolve’s debt settlement letter template to make and send a debt settlement offer. This process can be slower than settling on the phone. On the upside, having your offer in writing gives you a record of your interaction.

Don’t Just Negotiate the Amount… Negotiate Everything!

You can negotiate more than the debt amount in a debt settlement. Negotiate how you repay and how Midland reports your account to the credit bureaus. Debt collectors can report your account as “paid in full,” “partial payment,” or “settled.”

Negotiate for Midland to report your debt as “paid in full” because this can help you repair your credit score.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

Usually, yes! Even if you’re in a debt lawsuit, it’s not too late to negotiate a settlement.

Keep in mind that you need to respond to the lawsuit and show up for all court appearances until the court acknowledges the settlement and your case is dismissed or closed.

Tips for a Successful Debt Settlement

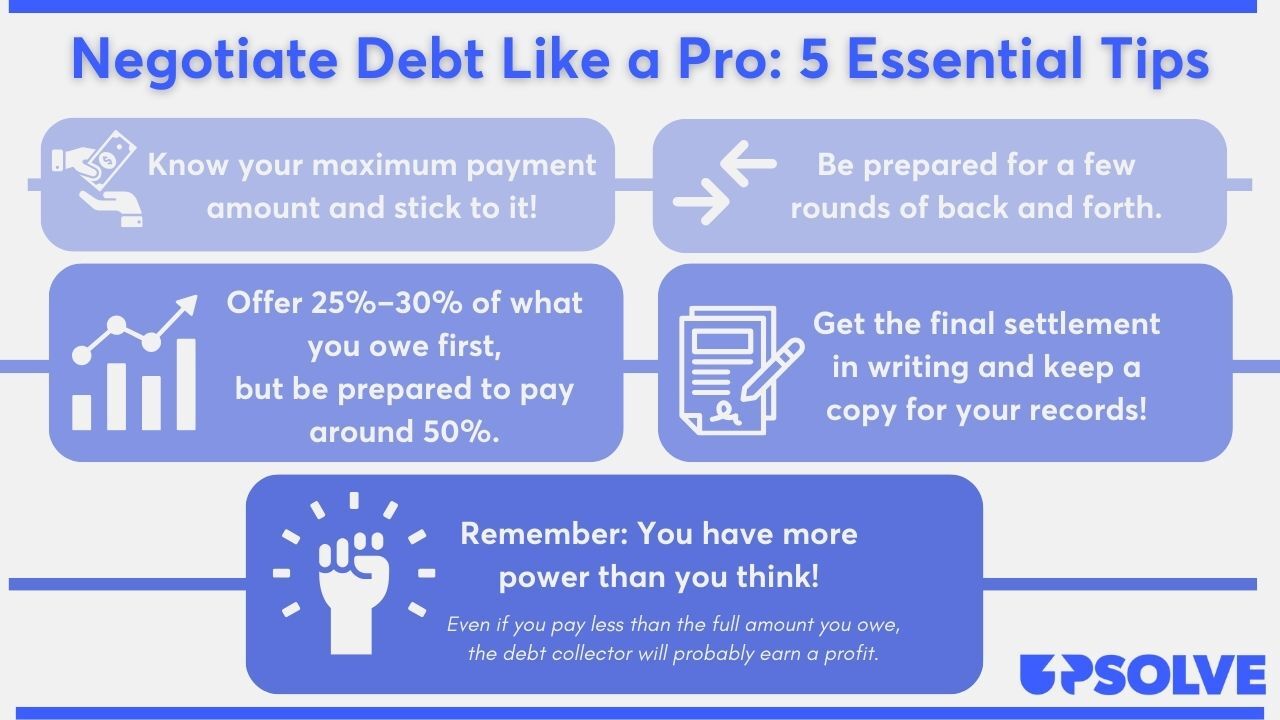

Negotiating with a debt collector can be intimidating, but you’ve got this! Here are five tips for negotiating like a pro:

For a deeper look into negotiating, read 5 Solid Steps for Negotiating With Debt Collectors.

How To Beat Midland Funding LLC in a Debt Lawsuit

If Midland contacts you about a debt you owe and you choose not to respond, they can file a lawsuit against you. If Midland sues you, you will receive a summons and a complaint.

When you get these court papers, the most important thing you can do is read them and respond to the lawsuit. If you ignore the lawsuit, you’ll probably give the debt collector an easy win. With this, they can get access to your money but garnishing your wages or freezing your bank account.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped over 280,000 people respond to debt lawsuits, and they have a 100% money-back guarantee.

Let’s take a look at what you can do if a debt collector sues you.

Step 1: Read the Summons and Complaint Carefully

A summon is the legal document notifying you of a lawsuit against you. The information included in a summons can vary by court, but most include:

The name and address of the court you report to

The details and contact info of all parties involved

The case number assigned to your lawsuit

The deadline to respond to the lawsuit

A complaint tells you who is suing you, how much they’re suing you for, and why they’re suing you. The reasons you’re being sued are laid out in numbered claims on the complaint. You’ll reference this information and respond to each claim when you fill out the paperwork to respond to the lawsuit.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

You respond to a debt lawsuit by filling out and submitting some paperwork — specifically, an answer form. The answer form is where you respond to the debt collector’s claims and where you tell the judge what defenses you have. You might also list affirmative defenses. These are reasons why the debt collector shouldn’t win the lawsuit based on information they left out of their complaint. To learn more about defenses and affirmative defenses, read 3 Steps To Take if a Debt Collector Sues You.

Most courts have blank answer forms you can download online or pick up from the court. Google your court’s name and “answer form” to see if you can find your court’s answer form online. If it’s easier for you, you can go in person to the courthouse and ask the clerk for a blank answer form.

Some courts will require you to complete additional forms, too. The most common is a certificate of service. Be sure to read about and follow all local requirements from the court hearing your case.

If you need help finding forms or understanding court processes and rules, contact the court clerk. Clerk’s can’t provide legal advice, but they can help guide you through court procedures like locating forms or understanding other local rules.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

Filing processes vary from court to court. You can usually file in person at the courthouse or send your answer form to the court via mail. Some courts also allow you to e-file or email your form. Check the summons or ask the court clerk to learn about your options.

You typically need to deliver a copy of your answer form to the plaintiff (the debt collector) as well. You can usually send the copy through the mail. When you mail court forms — whether to the court or the plaintiff — it’s advisable to use certified mail. This help proves the papers were sent and delivered by the deadline.

Let’s Summarize…

If Midland Funding contacts you about a debt, send a verification letter to make sure the debt is real and yours before you start any debt settlement negotiations. To negotiate a settlement, figure out how much of the debt you can pay and decide how you want to pay the debt. When you go to make your offer, make it in writing and ask for Midland’s reply in writing, too. If Midland sues you, respond to the lawsuit as soon as possible. You can still settle a debt even if you’re in the middle of a lawsuit.