How To Win Against Velocity Investments

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If Velocity Investments contacts you to collect a debt, it’s critical to first validate the details of the debt account. If they aren’t correct, send Velocity a verification letter to dispute the debt. If you know the information is accurate and agree that you owe the debt, you can use the information in this article to negotiate a settlement for less than the full amount. If Velocity Investments sues you, you can still try to negotiate a settlement, but you should also respond to the lawsuit.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated January 22, 2026

Table of Contents

If you got behind on payments for a personal loan, credit card bill, medical bill, or utility bill, Velocity Investments may be contacting you to try to collect the debt. Velocity is a debt collection company that primarily helps original creditors and debt buyers collect past-due consumer debts. They also purchase some debts themselves.

To learn more, check out our article, How To Deal With Velocity Investments.

Do I Have To Pay Velocity Investments?

Before you pay Velocity Investments, make sure they validate the debt and its details. If you agree that you owe the debt, the amount is correct, and Velocity Investments owns the debt, you probably do need to pay them at least a portion of the amount to resolve the issue.

If the debt is yours and you don’t pay it — or it’s not yours but you don’t dispute it — you could face serious consequences. Your credit score could suffer and your paychecks could be garnished. Even though it might feel scary, it’s in your best interest to respond to Velocity Investments if they reach out to you.

On the bright side, negotiating is routine for debt collectors. Many people successfully negotiate down their debt and pay less than the original amount owed. Debt settlement is a good way to get rid of the financial burden and emotional stress that looming debt can cause.

✨ If this is just one of many overwhelming debts, it might be time for a full fresh start with bankruptcy. Upsolve helps eligible individuals file Chapter 7 bankruptcy for free. It just takes two minutes to see if you're eligible.

How To Negotiate a Debt Settlement With Velocity Investments in 3 Steps

Unfortunately, debt collection is a lucrative business for companies like Velocity Investments. While it might not seem like it, this actually has benefits for you, the consumer.

When Velocity Investments handles debt on behalf of an original creditor, such as a credit card or personal loan company, they usually receive a percentage of the amount they successfully recover. If they purchased your debt from the original creditor, they probably bought it for a fraction of the outstanding balance.

In either case, this means they can make a healthy profit even if they don’t recoup the total amount owed. In other words, this is why they’re open to negotiating the debt.

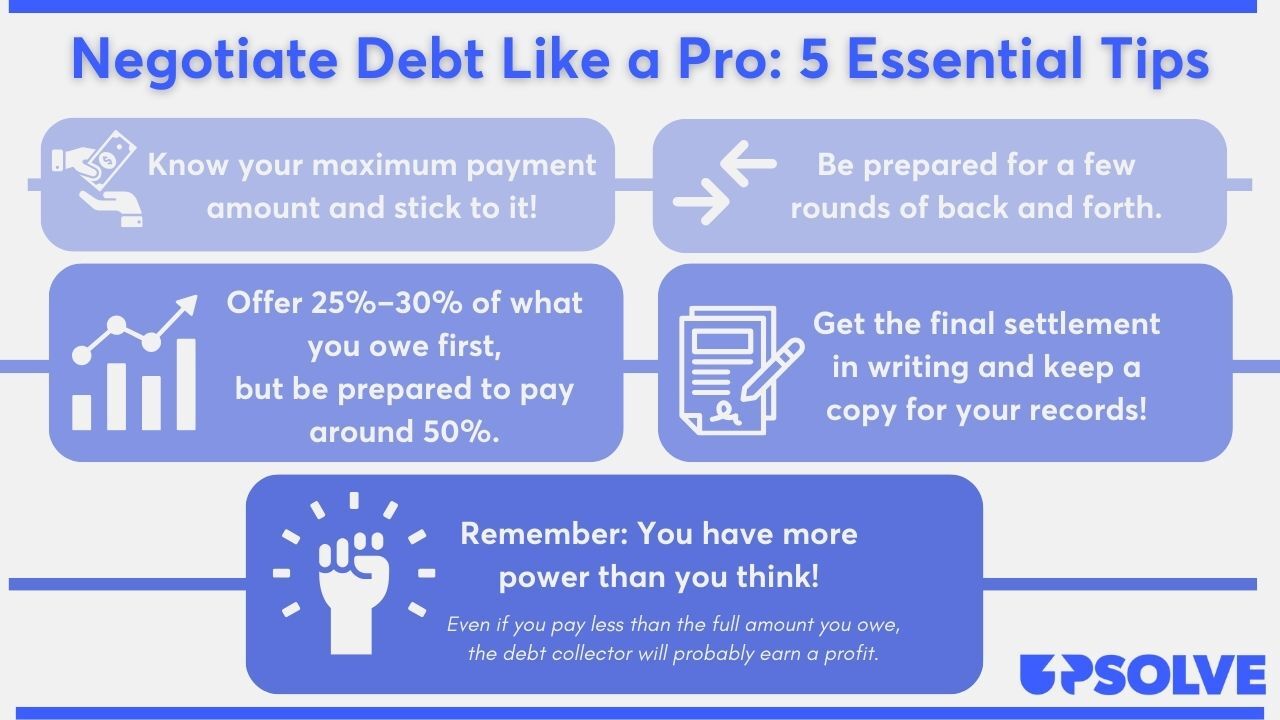

You can start by offering to a small portion of the amount you owe – say 25%. Velocity may not accept your first offer, so be prepared for a counteroffer. Many debt collectors settle for between 40% and 60% of the original amount.

Sometimes debt collectors will reach out to you with a settlement offer, but there’s no need to wait for them to start the conversation. Keep reading to understand this simple process.

Step 1: Make Sure the Debt Is Valid

The first and most important step to take when a debt collector contacts you is to validate the debt. You’ll want to confirm that:

The debt is actually yours (you weren’t misidentified as the account holder and no identity theft has occurred).

Velocity Investments owns the debt or has the legal right to collect it.

The debt amount is correct.

All of this information should be included in the debt validation letter that debt collection companies are required to send you. This notice should come before or within five days of making initial contact, according to a Consumer Financial Protection Bureau (CFPB) debt collection rule. If you haven’t received this letter already, ask for one!

If you received a validation letter but it didn’t have enough information about the debt, you can send Velocity Investments a debt verification letter to request additional details. You can also use a verification letter to dispute the debt if you don’t agree with it. There is a 30-day window (indicated on the validation letter) for you to do so, during which time Velocity Investments may take no further action.

Step 2: Figure Out What You Can Pay

If Velocity Investments validates the debt and you agree you owe it, the next step is to figure out what you can afford to pay. When you’re making this calculation, don’t sacrifice your essential needs, like food or housing.

Make some calculations to work out a doable payment by looking at your monthly take-home pay, expenses, and other debt payments. If this seems daunting, the CFPB offers a budget worksheet and debt worksheet to simplify the process. You could also consider getting a free consultation with an accredited nonprofit credit counselor. These financial professionals can also go over your other debt-relief options.

Figure Out How You Can Pay

You can negotiate how you repay your debt with Velocity — in a single payment (lump sum) or via a payment plan.

A lump-sum payment is usually preferable for debt collectors because there’s less risk of them not getting paid. If you can, consider putting a small windfall like a tax return or work bonus toward a one-time payment.

If a lump-sum payment isn’t possible, negotiate a payment plan. You can make your offer more compelling by suggesting direct withdrawal from your bank account. Above all else, make sure you are confident that you can pay the amount you suggest and that you offer a timeline you are comfortable with.

Step 3: Make a Settlement Offer to Velocity Investments

Once you’ve made your calculations and determined a payment you feel good about, it is time to make an offer. This is best done with a written letter so there’s a record of the exchange. You can use Upsolve’s debt settlement letter template to draft your letter. Be sure to ask for Velocity Investments’ reply in writing as well.

Don’t Just Negotiate the Amount… Negotiate Everything!

In addition to the settlement amount, you can also negotiate how you repay the debt (one payment vs. a payment plan) and how the account is reported on your credit report.

Velocity can report the account as paid in full, partial payment, or settled. As part of your settlement offer, ask that Velocity Investments report the debt as paid in full. This can help boost your credit score if you’re working to repair your credit.

Can You Still Negotiate a Settlement if There’s a Debt Lawsuit Against You?

You can usually still pursue a debt settlement even if you’ve been sued for the debt.

That said, it’s important to respond to the lawsuit, appear in court, and respond to court notices, even while negotiating a settlement. If you don’t, you could lose the case and face serious consequences like wage garnishment.

Treat the court case as valid until the judge dismisses or closes it. For additional information, read Can I Settle a Debt After a Lawsuit Has Been Filed?

Tips for a Successful Debt Settlement

Negotiating can be intimidating, but it’s easier to do than you might think.

For even more tips and info, read Upsolve’s article 5 Solid Steps for Negotiating With Debt Collectors

How To Beat Velocity Investments in a Debt Lawsuit

It’s not likely that Velocity Investments’ first tactic will be to sue you. However, they may eventually choose this route if they’re continually unsuccessful in their attempts to get paid.

If you’re being sued, you should receive official court documents called a summons and complaint. The most important thing you can do is to respond to the summons, which you can usually do on your own without hiring a lawyer.

If you ignore Velocity Investments, they will probably win the lawsuit. Then, they can get a court order to garnish your wages or freeze your bank account.

Responding to a lawsuit is mostly a matter of filling out paperwork. Keep reading to learn how.

If you're worried about responding on your own, but you can't afford a lawyer, you can draft a answer letter for free or a small fee using our partner SoloSuit. They've helped over 300,000 people respond to debt lawsuits and settle debts, and they have a 100% money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

Step 1: Read the Summons and Complaint Carefully

A summons is an official court document that informs you that you’re being sued or you’re required to appear in court. These forms vary by court, but they often include the key information such as:

The court’s name and address

The names and contact information of the parties involved

The case number

The nature of the lawsuit

The legal consequences of not responding to the lawsuit

The summons should also include a date or deadline for responding to the lawsuit. Pay special attention to this date!

You should also get a complaint document that outlines the claims against you, usually in numbered paragraphs.

Step 2: Fill Out an Answer Form (and Any Other Required Forms)

When you reply to the lawsuit by filling out an answer form, you get to explain your defenses or the reasons the debt collector shouldn't win. To learn about common defenses in debt collection lawsuits, read 3 Steps To Take if a Debt Collector Sues You.

Many courts provide answer forms that you can fill out to respond to the lawsuit. Sometimes they are included with the summons. If you didn’t receive one with the summons, the easiest way to find out if your court offers these is to Google the court name listed on the summons, plus “answer form” or “court forms.” If there are instructions included with the form, read them carefully and follow the steps outlined.

Some courts also require you to fill out additional forms, such as a certificate of service.

Each court has its own rules and processes. If you don’t understand these rules or processes, the court clerk is your go-to person for answers. They can’t give legal advice, but it’s their job to help you navigate the legal processes and paperwork. The court’s website is another resource for valuable information.

Step 3: File the Answer Form With the Court and Serve on the Plaintiff

When you’re finished filling out the answer form, you’ll need to file it. Again, this process varies by court, but you can almost always file in person at the courthouse or send it via certified mail.. Sometimes you can email or e-file the file as well. Check the summons or contact your court to find out your filing options.

In addition to filing the reply, you probably need to deliver a copy of your answer form to Velocity Investments or their lawyer. You can do so by mailing a copy of your answer form to the address listed on the summons.

Let’s Summarize…

If Velocity Investments contacts you about a debt, make sure it’s valid before you decide your next step. If the debt isn’t valid, dispute it. If it is valid and you agree that you owe it, prepare to negotiate a settlement by figuring out a payment you are comfortable with. If you get sued, respond to the lawsuit! Many processes vary by court, so check the court website and court clerk for specifics.