Your Guide to Kentucky’s Debt Collection Laws

Upsolve is a nonprofit that helps you eliminate your debt with our free bankruptcy filing tool. Think TurboTax for bankruptcy. You could be debt-free in as little as 4 months. Featured in Forbes 4x and funded by institutions like Harvard University — so we’ll never ask you for a credit card. See if you qualify →

If you live in Kentucky, your main line of defense against debt collectors will be the Fair Debt Collection Practices Act (FDCPA). This federal law regulates third-party debt collectors and aims to prevent harassment, deception, and other unfair practices in the debt collection process. It also outlines certain things debt collectors are required to do, such as provide you with certain information about your debt.

Written by Attorney Tina Tran. Legally reviewed by Jonathan Petts

Updated October 17, 2025

Table of Contents

What Are the Debt Collection Laws in Kentucky?

Kentucky doesn’t have a specific law that regulates debt collection activity in the state. But Kentuckians still receive some important protections from the federal Fair Debt Collection Practices Act.

Here’s an overview of the FDCPA and who it applies to:

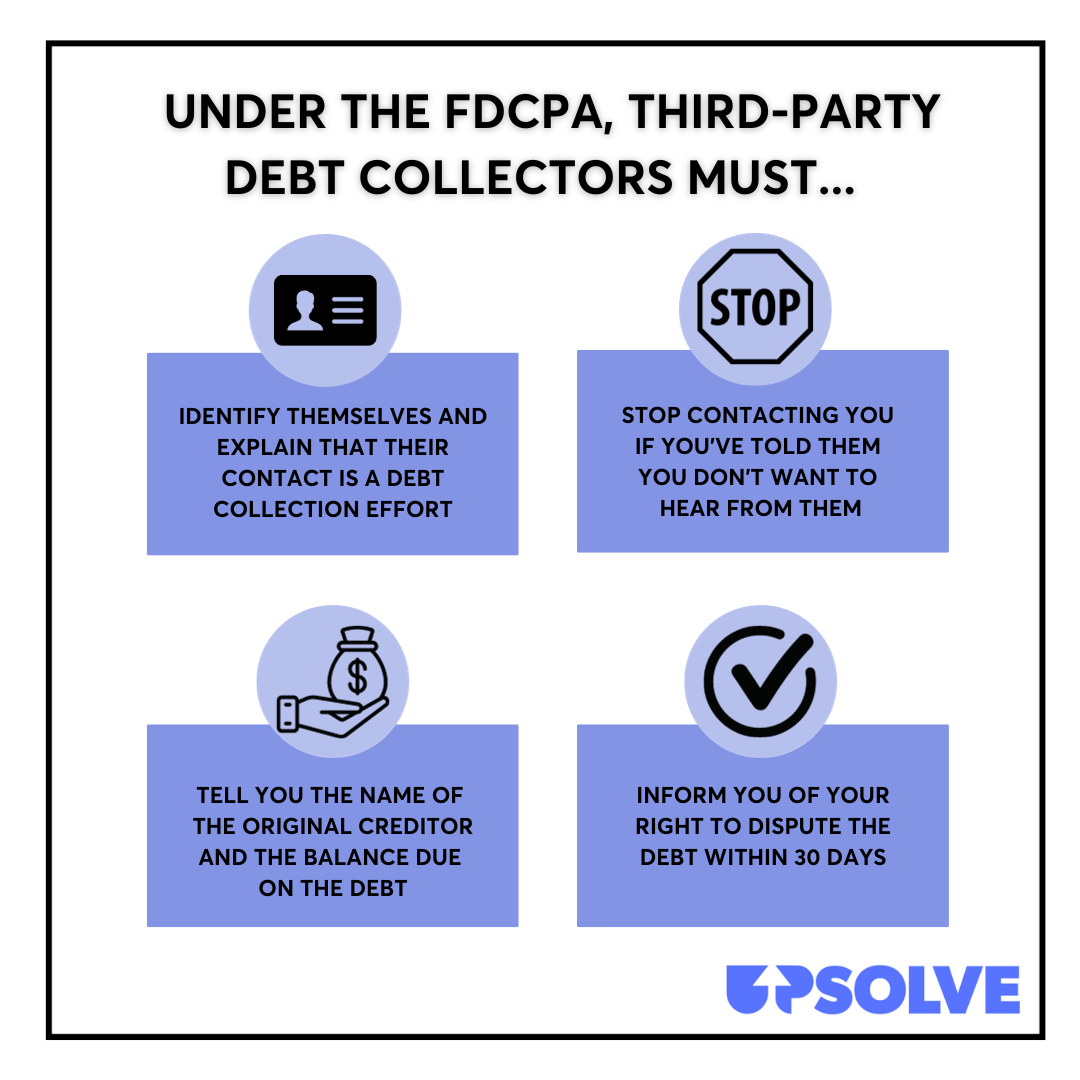

Under federal law, third-party debt collectors are required to do the following:

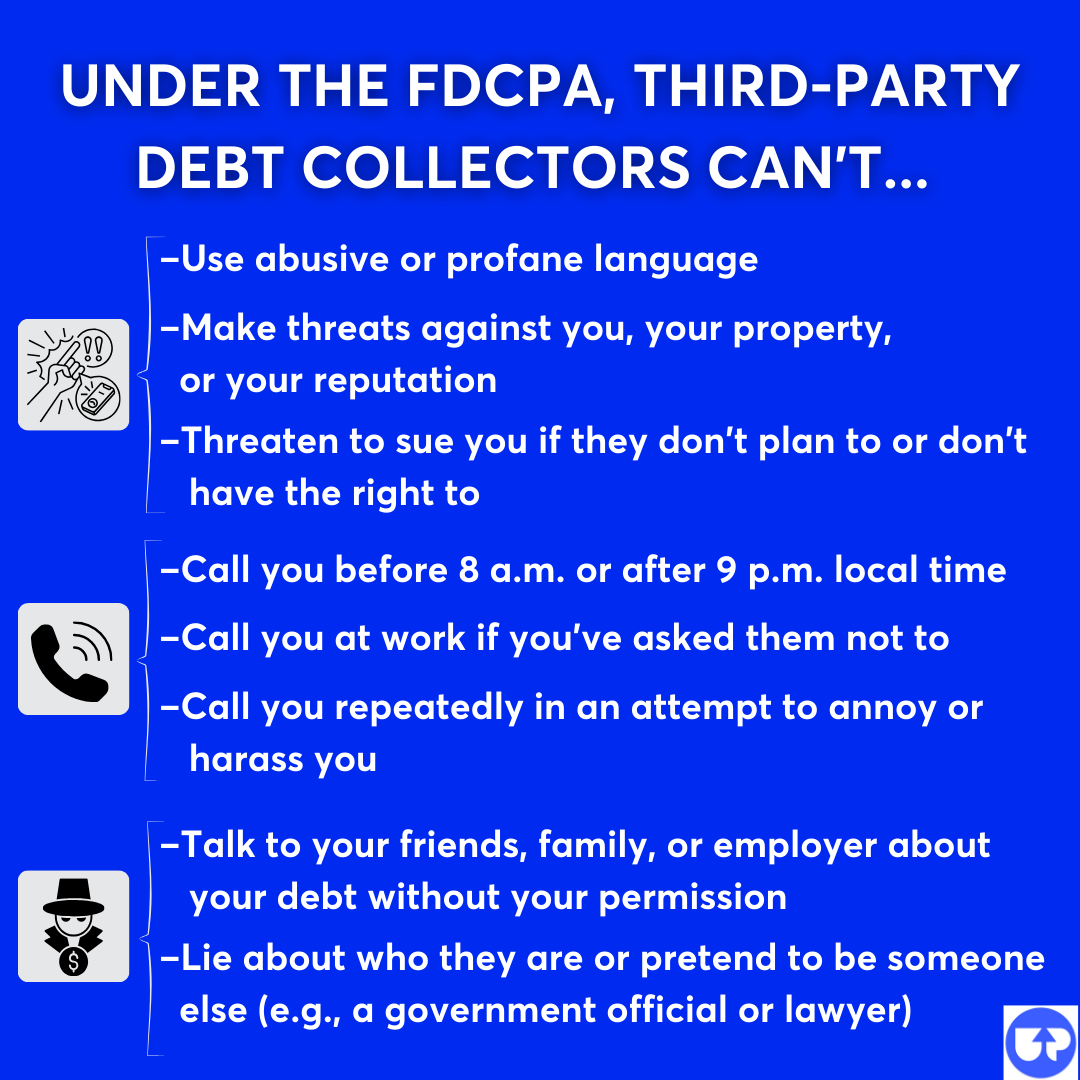

Third-party debt collectors are prohibited from the following under the FDCPA:

What Can You Do if a Debt Collector Breaks the Law in Kentucky?

If a third-party debt collector violates the FDCPA, you can report them or sue them.

To start, it’s a good idea to file a complaint. You can file a complaint with:

The Consumer Financial Protection Bureau (CFPB), the federal agency responsible for enforcing the FDCPA and punishing companies that violate it

The Kentucky Attorney General’s office, a state entity that helps enforce consumer protection laws and ensure fair business practices

You can also bring a lawsuit against third-party debt collectors who violate the FDCPA for compensation in a federal court. If you win the case, you may be awarded actual damages for any real financial loss or harm you suffered as well as up to $1,000 in statutory damages.

To learn more, read Yes, You Can Sue Debt Collectors Who Break the Law.

What Is the Statute of Limitations for Debt Collection in Kentucky?

The concept of the statute of limitations is simple: It’s the deadline debt collectors have to bring a lawsuit against you for an unpaid debt. But the implementation can get complicated since different debts have different deadlines, and the timelines are often based on the underlying debt contract or debt type.

Here’s how the statutes of limitations tend to break down for different types of debt in Kentucky:

| Debt Type | Statute of Limitations |

|---|---|

| Open-Ended Accounts (sometimes includes credit card debt) | 5 years |

| Written Contracts (often includes medical bills, sometimes includes credit cards and car loans) | 10 years (contracts after July 15, 2014) 15 years (contracts before July 15, 2014) |

| Oral Contracts | 5 years |

| Contract for Sale of Goods (including some auto loans) | 4 years |

| Promissory Notes | 15 years |

If you get contacted about an older debt and think it might be past the statute of limitations, it’s wise to proceed with caution. You can ask the debt collector to send you a written verification letter with the details of the debt.

While you can ask specifically for the date of the last payment and whether the statute of limitations has run out on the debt, the debt collector may not be legally obligated to answer your question. They will have to tell you certain other details about the debt though.

If you want legal help to better understand how the statute of limitations applies to your debt, you can usually get a free consultation with an attorney. You may also be able to get free or low-cost help from a local legal aid agency. You can also search online for legal clinics in your area.

What Can Debt Collectors Do To Collect Debt in Kentucky?

Though debt collectors face some legal limitations in the debt collection process, there’s a lot they can do to try to get money from you.

You may already be familiar with the most common debt collection methods — phone calls and written notices. If you don’t respond to the debt collector, they may escalate their efforts by taking you to court.

If this happens, it’s imperative that you respond to the lawsuit (here’s how to reply in Kentucky). If you're worried about responding on your own, consider using SoloSuit to help you draft and send your reply. SoloSuit has helped over 300,000 respond to debt lawsuits and settle debts. And they have a money-back guarantee.

SoloSuit is an affiliate partner, which means Upsolve may earn a small commission if you choose to use their paid service. This helps keep our services free.

If you don’t respond to the lawsuit, you are virtually guaranteed to lose by default. And if this happens, you open yourself up to even more serious collection measures like wage garnishment. This is the most popular method used by debt collectors with a court order to get your money. The good news is, the state limits how much they can take.

If you aren’t working or a wage garnishment isn’t possible, the debt collector can also try to get a bank levy or property lien once they have a court judgment in their favor.

If you’re behind on an auto loan, be aware that you’re at risk of repossession. Under Kentucky law, the lender doesn’t have to sue you or even warn you to repossess your car.

Need Help With Debt Relief? Here Are Some Options

One unexpected expense can really mess up your personal finances. If you find yourself starting to fall behind on multiple payments, it may be time to get some support and make a plan. Debt = stress, but you can relieve some of this stress by getting professional help… you can even do it for free through consumer credit counseling.

Credit counselors are professionals who will look at your personal financial situation alongside you and explain your debt relief options. They can tell you the pros and cons of a debt management plan, consolidation loan, and bankruptcy.

If you can’t see a light at the end of the tunnel, you may want to consider filing bankruptcy and getting a fresh start. Upsolve has a free filing tool to help people file Chapter 7 bankruptcy without a lawyer for free.